Bitcoin’s recent foray under $4000 created a bearish ripple effect that was felt across the digital market industry.

The world’s largest cryptocurrency dipped under the aforementioned range for the first time since early-2019 and assets such as Ethereum, XRP, and Litecoin also followed suit. Although Bitcoin‘s valuation had risen above $5700 at press time, a key fundamental metric indicated a significant difference.

Source: Coinmetrics

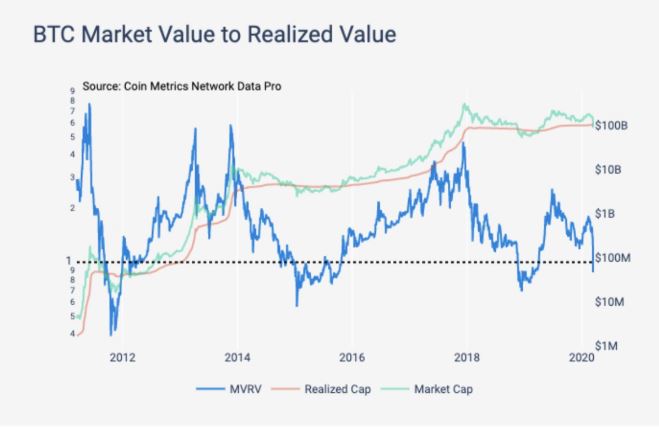

According to Coinmetrics’ recent analysis, following Bitcoin’s 45 percent dip, the asset’s MVRV index dropped below 1 for the fourth time in history. The MVRV ratio is a comparison between Market Value (Market Cap) and Realized Value, where the realized value establishes an adjustment between the lost BTC coins and the assets used for hodling.

Source: Coinmetrics

Although the drop below 1 underlined a major bearish scenario, the analytics platform indicated that it could open the floodgates for accumulating a higher amount of Bitcoins at a reduced price.

However, a large drop in MVRV was not reciprocated by the realized cap that only dropped by 3 percent.

It was suggested that the small drop in realized cap indicated that long-term hodlers are currently unaffected by the recent decline and the price action is now, being driven by new investors in the market.

Along with the MVRV ratio, Bitcoin’s SOPR index dived below 1 as well, something that suggested that the overall profitability of the market is more on the negative side, at press time.

The Spent Output Profit Ratio falling under 1 suggested that traders, on an average, would be incurring a loss, while selling their Bitcoins.

In hindsight, historically, it has been observed that the market usually corrects the SOPR value under 1 during a bull market, which likely improves the confidence of the traders during a rally.

The movement for SOPR and MVRV ratio should undergo a trend reversal as the market credentials were improving, at the time of writing. However, these indicators are still increasingly bearish and BTC’s valuation could consolidate at a lower range over the next few weeks.

Source From : Ambcrypto