In times like these, we often forget that Bitcoin is more volatile than its contemporaries.

After an oil oversupply sell-off, an equity regain failure, and a treasury bond plummet, it’s hard to pay attention to a Bitcoin drop. One would even think that the cryptocurrency, known for being erratic, is not as volatile as its past. The charts beg to differ.

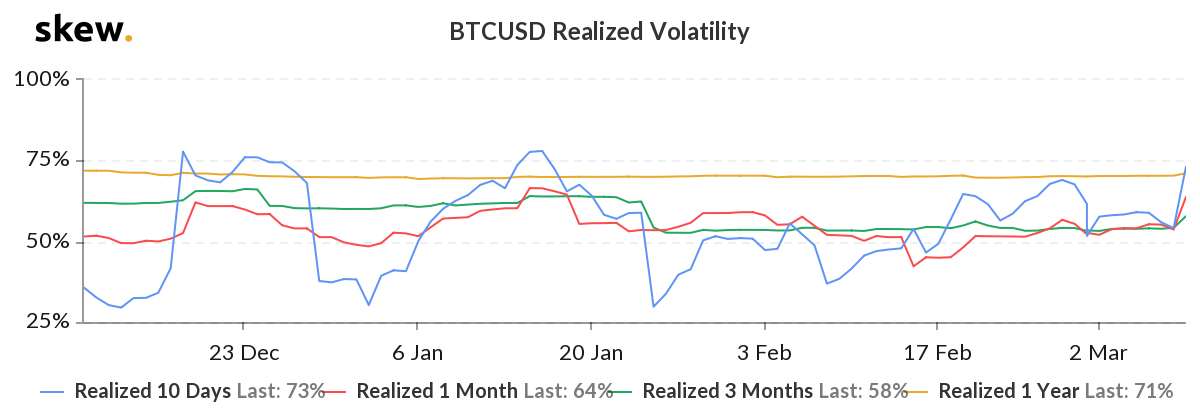

Following the 9 March drop which took Bitcoin below $8,000 for the first time since the beginning of January, the realized volatility of the cryptocurrency, in the short-term, jumped up. According to data from Skew markets, the 10-day realized volatility reached a high of 73 percent.

BTCUSD 10-days, 1-month, 3-months, and 1-year Realized Volatility | Source: skew

Extending the time-frame, the volatility was relatively smaller, but growing. The 1-month realized volatility was at 64 percent, increasing by over 10 percent following the $8,000 decline, while the 3-month and 1-year volatility was at 58 percent and 71 percent, respectively.

The last time the 10-day realized volatility was over the long-term measures was between 14 January and 17 January. During this run, Bitcoin jumped up by over 10 percent, fueled by an unlikely “safe-haven” narrative.

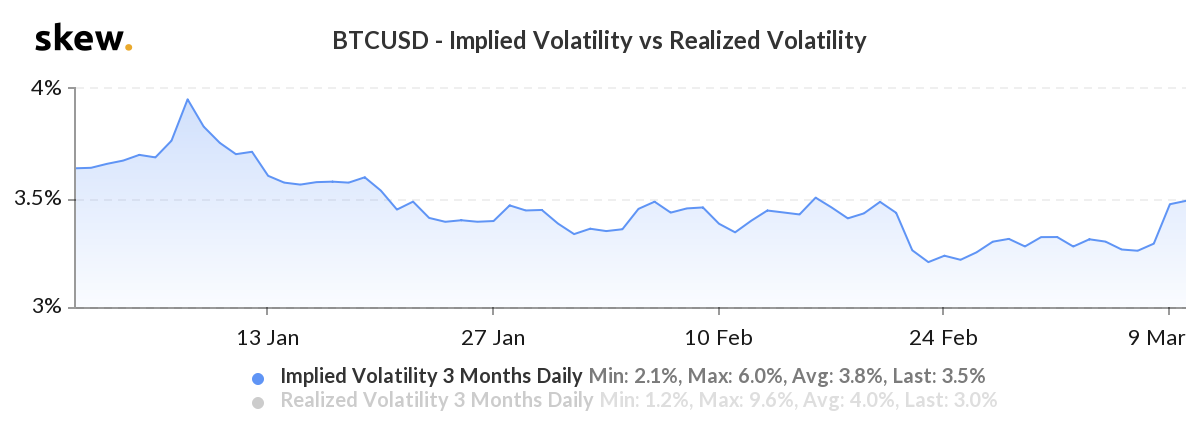

Looking ahead, the implied volatility [IV], based on the pricing of Bitcoin Options contracts has also risen, although marginally, as far as the larger trend is concerned. The 3-month Implied volatility for Bitcoin is at 3.5 percent, its highest point in the past three weeks.

BTCUSD Implied Volatility | Source: skew

The movement upwards in the IV of Bitcoin is underscored by yesterday’s fall, in both price and sentiment. The majority of the Bitcoin Options contracts traded on 9 March had a strike price below the current trading price of Bitcoin in the range of $6,000 to $7,500. Further, in the top-5 contracts by volume, only one set was call options, indicating a ‘right to buy.’ 605 contracts and 291 Put options contracts on Deribit with expiry dates of 26 June and 27 March.

With the price leveling at $7,800 and not falling further, the sentiment shifted. The Options contracts traded on 10 March had more optimism. In the top-5 by volume on Deribit, the top contract was a $7,250 strike price Put, expiring on 20 March, but two Call contracts with volumes of 275 BTC and 207 BTC traded with strike prices of $10,000 and $11,000 and a common 24 April expiry.

Bitcoin’s volatility is unfettered, and the coming months will prove so.

Source From : Ambcrypto