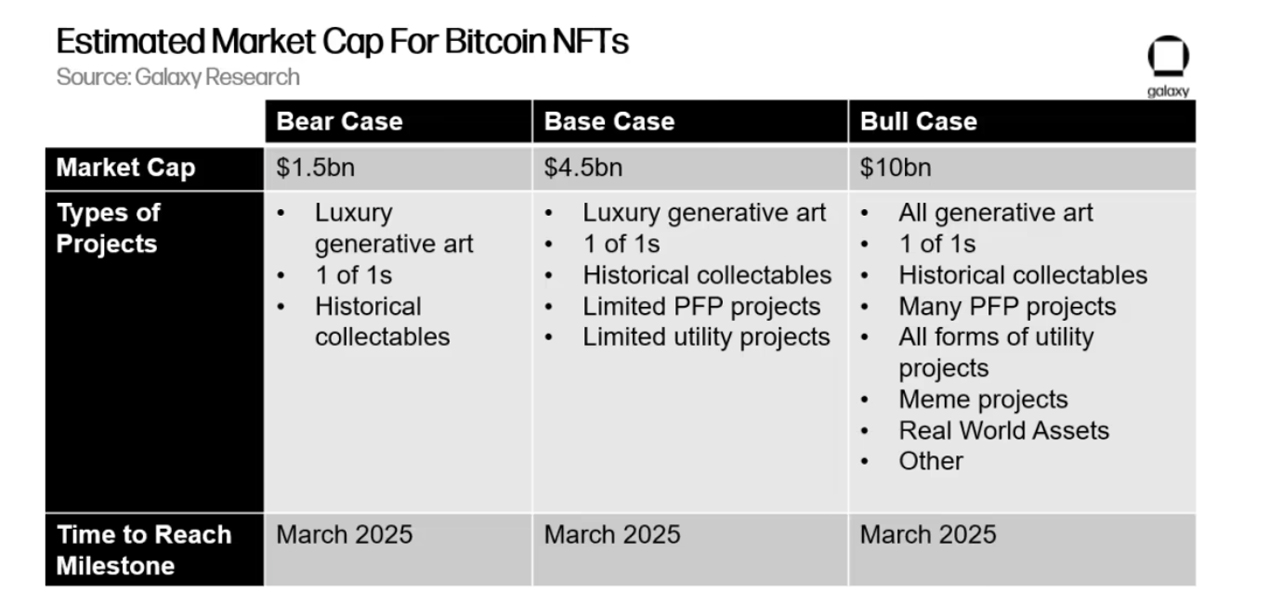

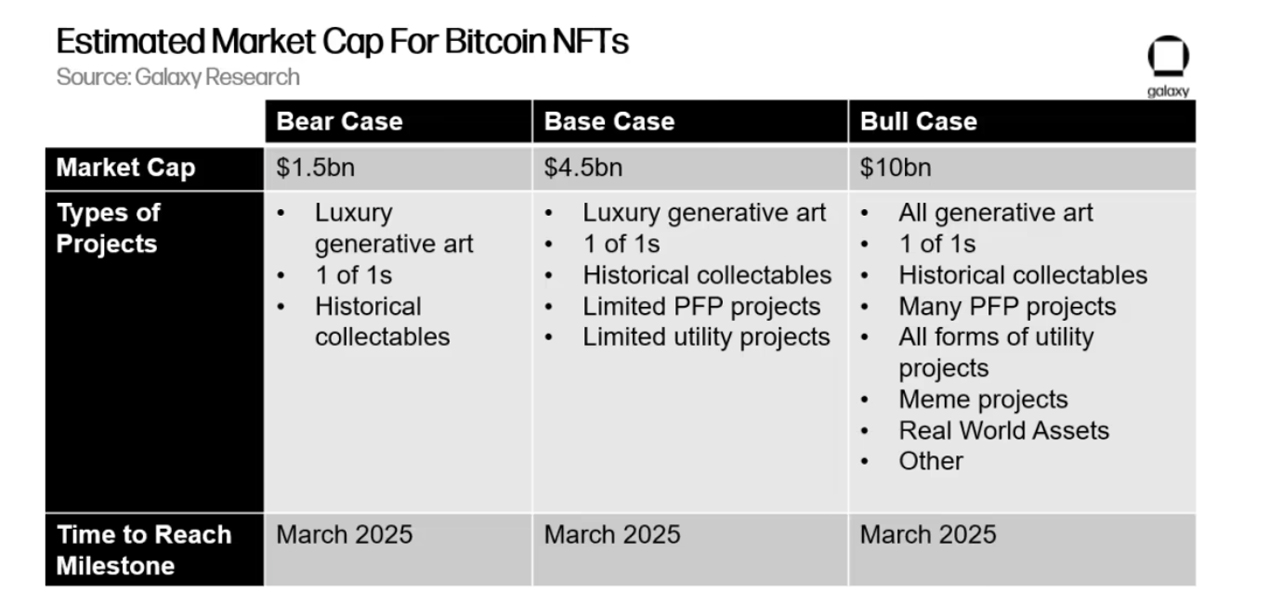

As the number of Bitcoin-based Ordinal inscriptions nears the 300,000 mark, Galaxy Digital’s research team published a report on the subject that says the market size of non-fungible tokens (NFTs) built on Bitcoin could reach $4.5 billion over the next two years. The researchers at Galaxy think that new use cases stemming from the inscription trend will “drive growing interest and adoption” for bitcoin.

At the time of writing, there are more than 288,000 Ordinal inscriptions hosted on the Bitcoin blockchain, as the trend has swelled greatly since the start of February 2023. Four days ago, the number of Ordinal inscriptions reached 200,000, and that same day, Yuga Labs, the creators of the Ethereum NFT collection Bored Ape Yacht Club (BAYC), revealed it had minted a collection of 300 inscriptions to auction the artwork. Six researchers and executives from Galaxy Digital published a report about the subject and assessed that it is possible that Bitcoin NFTs “built on inscriptions [and] Ordinals” could reach $4.5 billion by 2025.

“Inscriptions significantly expand the design space for Bitcoin,” Galaxy’s report says. “The addition of sizeable data storage with strong availability assurances opens up a variety of use-cases, many of which are only beginning to be explored, including things like new types of decentralized software or Bitcoin scaling techniques. Even the NFT use-case alone, though, has the potential to dramatically widen the scope of Bitcoin’s cultural impact.”

Galaxy researchers highlight that the ecosystem is still very young but note that “infrastructure is emerging quickly.” One of the key building blocks for the technology will be wallets, according to Galaxy’s paper on the inscription subject. Moreover, the study delves into the various collections minted in recent times, such as Taproot Wizards, Bitcoin Punks, and Ord Rocks. The paper mentions the marketplace Openordex, which leverages “partially-signed bitcoin transactions (PSBTs) to enable the trustless listing and purchasing of inscriptions.” Additionally, Galaxy researchers also discuss the controversy tied to the Ordinal inscriptions.

The researchers note that they believe technical arguments are already mostly avoided, and a social movement to stop Ordinal inscriptions probably won’t happen. “Ultimately, because witness data can be pruned and old data can be avoided in initial block download (IBD) by enabling assumevalid=1, we view the technical arguments against inscriptions to already be mostly mitigated,” the Galaxy researchers wrote. “On the narrative side, Ordinal inscription transactions are valid to all nodes on today’s Bitcoin network. A social movement to make changes to Bitcoin such that Ordinal inscriptions are no longer possible would need to emerge to change that, an outcome we view as unlikely.”

Galaxy’s study also notes that, unlike Ethereum, because of the lack of smart contract technology within Bitcoin, NFT royalties are also unlikely. The researchers think the criteria for blue-chip Ordinal inscriptions will be “dynamic,” and the market “could see significant secondary volume.” While the study mentioned a number of tools, Galaxy believes Ordinal inscription market infrastructure will be developed by the second quarter of this year. As a result of all these trends, layer two (L2) or other types of Bitcoin scaling solutions will be pushed to the forefront of development.

“The emergence of inscriptions, and the low-likelihood that the functionality is ever removed from the project, has the potential yet again evolve Bitcoin, driving new use cases, interest, and adoption,” Galaxy’s study concludes.

What do you think about the potential impact of Ordinal inscriptions on the future of Bitcoin and the wider adoption of NFTs? Share your thoughts in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Sergey Nivens, Galaxy Digital Report,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Bitcoin ATM Operator Indicted in New York Allegedly Running Illegal Business Attracting Criminals

A bitcoin ATM operator has been indicted in New York for running an illegal business "marketed towards individuals engaged in criminal activity." The district attorney in charge described: "Robert Taylor allegedly went to great lengths to keep his bitcoin kiosk ... read more.

As the number of Bitcoin-based Ordinal inscriptions nears the 300,000 mark, Galaxy Digital’s research team published a report on the subject that says the market size of non-fungible tokens (NFTs) built on Bitcoin could reach $4.5 billion over the next two years. The researchers at Galaxy think that new use cases stemming from the inscription trend will “drive growing interest and adoption” for bitcoin.

At the time of writing, there are more than 288,000 Ordinal inscriptions hosted on the Bitcoin blockchain, as the trend has swelled greatly since the start of February 2023. Four days ago, the number of Ordinal inscriptions reached 200,000, and that same day, Yuga Labs, the creators of the Ethereum NFT collection Bored Ape Yacht Club (BAYC), revealed it had minted a collection of 300 inscriptions to auction the artwork. Six researchers and executives from Galaxy Digital published a report about the subject and assessed that it is possible that Bitcoin NFTs “built on inscriptions [and] Ordinals” could reach $4.5 billion by 2025.

“Inscriptions significantly expand the design space for Bitcoin,” Galaxy’s report says. “The addition of sizeable data storage with strong availability assurances opens up a variety of use-cases, many of which are only beginning to be explored, including things like new types of decentralized software or Bitcoin scaling techniques. Even the NFT use-case alone, though, has the potential to dramatically widen the scope of Bitcoin’s cultural impact.”

Galaxy researchers highlight that the ecosystem is still very young but note that “infrastructure is emerging quickly.” One of the key building blocks for the technology will be wallets, according to Galaxy’s paper on the inscription subject. Moreover, the study delves into the various collections minted in recent times, such as Taproot Wizards, Bitcoin Punks, and Ord Rocks. The paper mentions the marketplace Openordex, which leverages “partially-signed bitcoin transactions (PSBTs) to enable the trustless listing and purchasing of inscriptions.” Additionally, Galaxy researchers also discuss the controversy tied to the Ordinal inscriptions.

The researchers note that they believe technical arguments are already mostly avoided, and a social movement to stop Ordinal inscriptions probably won’t happen. “Ultimately, because witness data can be pruned and old data can be avoided in initial block download (IBD) by enabling assumevalid=1, we view the technical arguments against inscriptions to already be mostly mitigated,” the Galaxy researchers wrote. “On the narrative side, Ordinal inscription transactions are valid to all nodes on today’s Bitcoin network. A social movement to make changes to Bitcoin such that Ordinal inscriptions are no longer possible would need to emerge to change that, an outcome we view as unlikely.”

Galaxy’s study also notes that, unlike Ethereum, because of the lack of smart contract technology within Bitcoin, NFT royalties are also unlikely. The researchers think the criteria for blue-chip Ordinal inscriptions will be “dynamic,” and the market “could see significant secondary volume.” While the study mentioned a number of tools, Galaxy believes Ordinal inscription market infrastructure will be developed by the second quarter of this year. As a result of all these trends, layer two (L2) or other types of Bitcoin scaling solutions will be pushed to the forefront of development.

“The emergence of inscriptions, and the low-likelihood that the functionality is ever removed from the project, has the potential yet again evolve Bitcoin, driving new use cases, interest, and adoption,” Galaxy’s study concludes.

What do you think about the potential impact of Ordinal inscriptions on the future of Bitcoin and the wider adoption of NFTs? Share your thoughts in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Sergey Nivens, Galaxy Digital Report,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Following a Brief Fee Spike, Gas Prices to Move Ethereum Drop 76% in 12 Days

Transaction fees on the Ethereum network are dropping again after average fees saw a brief spike on April 5 jumping to $43 per transfer. 12 days later, average ether fees are close to dropping below $10 per transaction and median-sized ... read more.

Xrp rebounded from a two-month low to start the weekend, as prices moved back above a key support point. The token, which fell to its lowest point since January on Friday, rose by as much as 2% on Saturday. Cardano also recovered yesterday’s losses.

XRP rose higher to start the weekend, as the token formerly known as ripple rebounded from a two-month low.

XRP/USD jumped to an intraday high of $0.3795 earlier in the day, which comes after bottoming out at $0.3664 on Friday.

Yesterday’s drop saw XRP fall to its weakest point since January 11, when prices were at a low of $0.3477.

Looking at the chart, Saturday’s recovery has sent the token back above a long-term floor at $0.3720, which was broken yesterday.

Overall, the rebound appears to have taken place as the relative strength index (RSI) bounced from a floor at 43.00

At the time of writing, the index is tracking at 43.48, with the next visible ceiling at the 45.00 mark.

In addition to XRP, cardano (ADA) was another token to rebound from a multi-month low on Saturday.

Following a low of $0.3367 on Friday, ADA/USD moved to a peak of $0.3443 to start the weekend.

Similar to xrp above, yesterday’s move saw cardano fall to its lowest level since January 11.

Overall, ADA is now trading over 1.3% higher than this bottom, climbing back above a recent support point in the process.

Cardano is now trading at $0.3418, which is higher than the aforementioned floor at $0.3400.

The rebound in price comes despite the 14-day RSI continuing to track near an eight-week low of its own at 38.76.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect cardano to move higher in the coming days? Let us know your thoughts in the comments.

Eliman was previously a director of a London-based brokerage, whilst also an online trading educator. Currently, he commentates on various asset classes, including Crypto, Stocks and FX, whilst also a startup founder.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

NFT Sales Volume Saw a Small Uptick This Week — Moonbirds, Mutant Apes Take Top Sales

Non-fungible token (NFT) sales saw a small uptick over the last week as $658.4 million in NFT sales were recorded, up 3.35% in seven days. Out of 15 blockchains, Polygon-based NFT sales saw the largest increase in volume, jumping 106.68% ... read more.

Xrp rebounded from a two-month low to start the weekend, as prices moved back above a key support point. The token, which fell to its lowest point since January on Friday, rose by as much as 2% on Saturday. Cardano also recovered yesterday’s losses.

XRP rose higher to start the weekend, as the token formerly known as ripple rebounded from a two-month low.

XRP/USD jumped to an intraday high of $0.3795 earlier in the day, which comes after bottoming out at $0.3664 on Friday.

Yesterday’s drop saw XRP fall to its weakest point since January 11, when prices were at a low of $0.3477.

Looking at the chart, Saturday’s recovery has sent the token back above a long-term floor at $0.3720, which was broken yesterday.

Overall, the rebound appears to have taken place as the relative strength index (RSI) bounced from a floor at 43.00

At the time of writing, the index is tracking at 43.48, with the next visible ceiling at the 45.00 mark.

In addition to XRP, cardano (ADA) was another token to rebound from a multi-month low on Saturday.

Following a low of $0.3367 on Friday, ADA/USD moved to a peak of $0.3443 to start the weekend.

Similar to xrp above, yesterday’s move saw cardano fall to its lowest level since January 11.

Overall, ADA is now trading over 1.3% higher than this bottom, climbing back above a recent support point in the process.

Cardano is now trading at $0.3418, which is higher than the aforementioned floor at $0.3400.

The rebound in price comes despite the 14-day RSI continuing to track near an eight-week low of its own at 38.76.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect cardano to move higher in the coming days? Let us know your thoughts in the comments.

Eliman was previously a director of a London-based brokerage, whilst also an online trading educator. Currently, he commentates on various asset classes, including Crypto, Stocks and FX, whilst also a startup founder.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

PRESS RELEASE. B2BinPay has unveiled that they are now an official sponsor of Athletic Club, one of Spain’s most renowned football teams! This momentous collaboration will begin on February 14th and continue until the 2023/2024 La Liga season.

On top of the B2BinPay logo featuring prominently in all official jerseys, several joint marketing initiatives have been planned for execution as well. Through our partnership with Athletic Club, B2BinPay hopes to bring cryptocurrency payments closer than ever before to enthusiastic football fans around the world.

With enthusiasm, Arthur Azizov – the CEO of B2BinPay’s parent company, B2Broker – expressed his delight at the news: “I am a passionate football fan myself, and we have our own corporate football team here in B2BinPay. That’s why I am so proud to announce that our company will now sponsor the great Athletic Club. We do not doubt that the Athletic team will triumph in La Liga during the upcoming 22/23 and 23/24 seasons, potentially playing their way into the UEFA Europa League finals! Also, we hope our sponsorship of Athletic Bilbao will be an opportunity to promote cryptocurrency payments adoption among football fans and in Europe in general.”

“We are very happy to have reached this agreement with a leading company such as B2BinPay and we are certain that it will be a great travel companion to achieve the objectives that we have set for ourselves,” declared Jon Uriarte, President of Athletic Club.

About B2BinPay

For companies seeking secure and effortless crypto transactions, B2BinPay stands head-and-shoulders above the rest. Their unbeatable fees, lightning-fast integration process, and top-notch efficiency make them perfect for businesses of any size — allowing companies to easily accept payments in an array of coins, tokens, and stablecoins!

Closing Remarks

Athletic Club & B2BinPay’s partnership is a milestone for both companies, offering immense potential and lucrative rewards. This marks the beginning of a promising journey connecting two powerhouses in their industries. With a mutual dedication to advancing cryptocurrency payments, this groundbreaking venture will surely make its presence felt!

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

SEC Risks Violating Admin Procedure Act by Rejecting Spot Bitcoin ETFs, Says Grayscale

Grayscale Investments' CEO explains that the U.S. Securities and Exchange Commission (SEC) could potentially violate the Administrative Procedure Act by not approving a spot bitcoin exchange-traded fund (ETF). SEC Approving Spot Bitcoin ETF Is 'a Matter of When and Not ... read more.

Source From : News