According to countdown statistics based on the average block generation time of around ten minutes, progress toward the next Bitcoin block reward halving has surpassed 60%. However, while most halving countdown clocks leverage the ten-minute average, the countdown leveraging the most current block intervals of around 7:65 minutes shows the halving could occur in 2023.

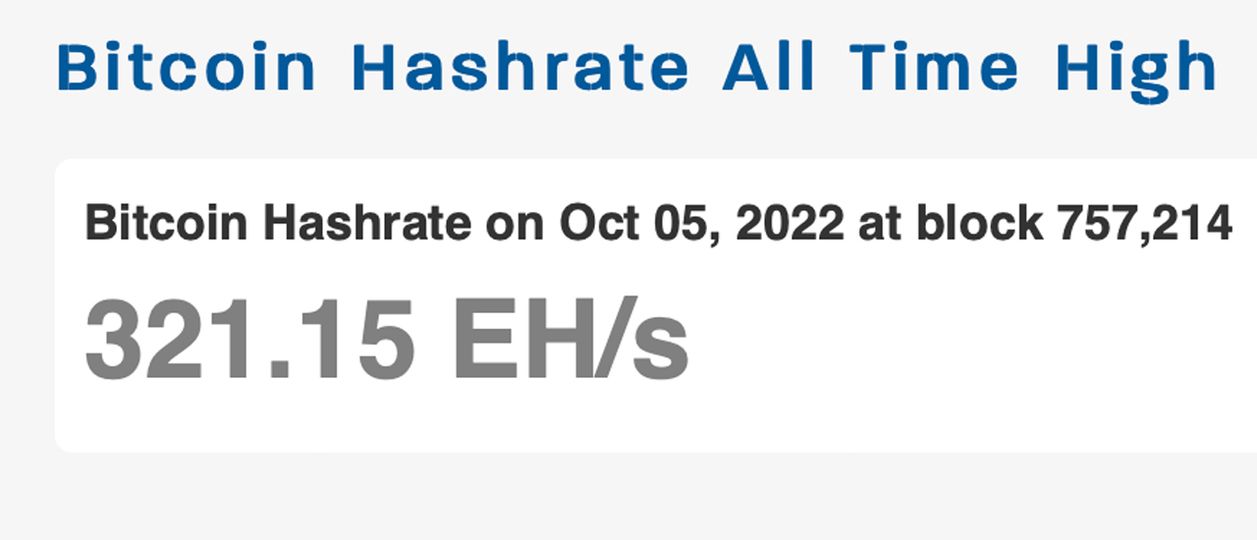

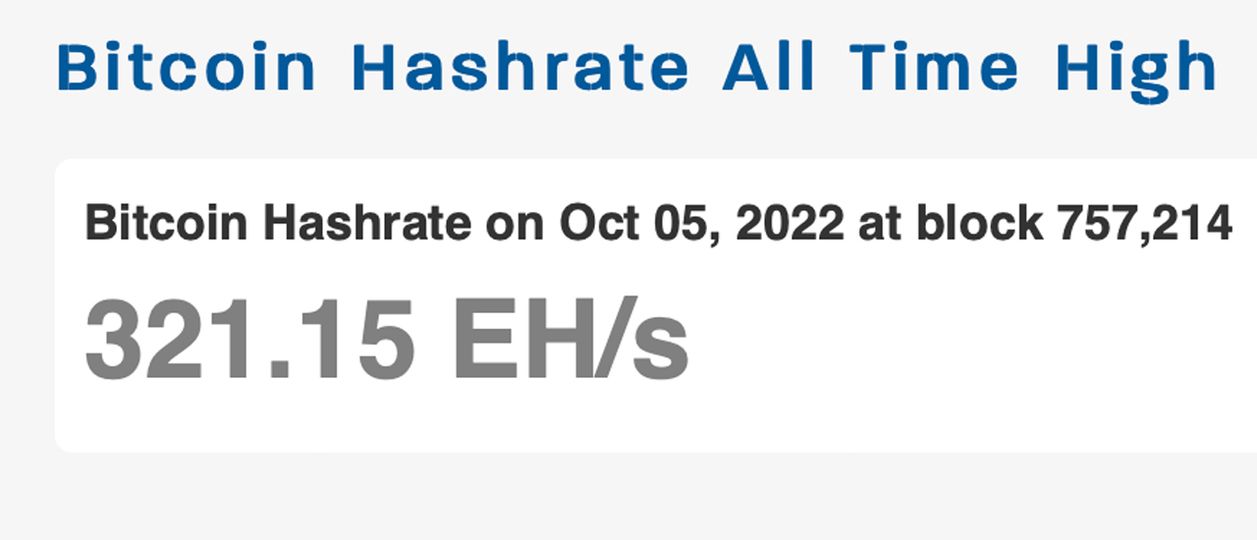

Just recently, at block height 757,214, mined on October 5, 2022, Bitcoin’s total hashrate tapped an all-time high (ATH) at 321.15 exahash per second (EH/s). Lately, block intervals have been faster than usual and well under the ten-minute average.

The speed at which the 2,016 blocks are found in between difficulty adjustments determines the difficulty and current block intervals suggest a large difficulty jump is in the cards. Now, prior to the next difficulty rise, the hashrate has continued to remain strong and block times at the time of writing are around 7:65 minutes.

The next mining difficulty retarget is scheduled to happen on or around October 10, 2022. If block times remain faster than usual even after the retarget, the protocol’s block reward halving could very well happen in 2023. Statistics from bitcoinsensus.com indicate that at 7:65 minutes per block interval, the halving could take place on or around December 19, 2023.

Bitcoinsensus.com further shows the halving time based on the average ten-minute rule which shows the halving will occur on May 1, 2024. Most countdown calculators apply the average ten-minute rule, and other data points suggest the halving could occur on April 20, 2024.

Either way, the progress toward the next halving is still more than 60% complete, and when it occurs, bitcoin miner rewards will be reduced from 6.25 BTC to 3.125 BTC post halving. Despite the high speed now, miners could easily slow down after the meaningful difficulty increase on October 10 is recorded and if BTC prices remain low.

This, in turn, would push the halving date back to the 2024 range and after all, there’s still well over a year’s worth of BTC block subsidies to mine. A lot can change. According to a recent blog post from Blocksbridge Consulting, the difficulty change and low price range could give bitcoin miners a headache from loss of profits.

“Bitcoin’s daily mining revenue per PH/s is currently around $80. If the difficulty rises 13% on Monday and bitcoin’s price stays at $19.5K, the daily revenue would decrease to $70 per (petahash) PH/s,” Blocksbridge Consulting’s Miner Weekly issue #17 notes. “That would cause mining companies to mine at all-time low revenues on a daily basis, even lower than what we saw during the summer following the May 2020 halving.”

The blog post adds:

Unless bitcoin’s price breaks the $20,000 barrier, those who employ older-generation machines or have bloated mining operations will face an even tougher time ahead.

Viabtc’s Viawallet halving metrics show that eight blockchains are expected to see reward halvings or what’s known as “reward reductions.” Dash expects a reward reduction on June 20, 2023, as rewards will shrink from 2.76 DASH to 2.56 DASH. Other reduction events and reward halvings will stem from blockchains that include BCH, BSV, LTC, ETC, ZEC, and ZEN.

What do you think about the Bitcoin network’s progress toward the next halving exceeding 60%? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

According to countdown statistics based on the average block generation time of around ten minutes, progress toward the next Bitcoin block reward halving has surpassed 60%. However, while most halving countdown clocks leverage the ten-minute average, the countdown leveraging the most current block intervals of around 7:65 minutes shows the halving could occur in 2023.

Just recently, at block height 757,214, mined on October 5, 2022, Bitcoin’s total hashrate tapped an all-time high (ATH) at 321.15 exahash per second (EH/s). Lately, block intervals have been faster than usual and well under the ten-minute average.

The speed at which the 2,016 blocks are found in between difficulty adjustments determines the difficulty and current block intervals suggest a large difficulty jump is in the cards. Now, prior to the next difficulty rise, the hashrate has continued to remain strong and block times at the time of writing are around 7:65 minutes.

The next mining difficulty retarget is scheduled to happen on or around October 10, 2022. If block times remain faster than usual even after the retarget, the protocol’s block reward halving could very well happen in 2023. Statistics from bitcoinsensus.com indicate that at 7:65 minutes per block interval, the halving could take place on or around December 19, 2023.

Bitcoinsensus.com further shows the halving time based on the average ten-minute rule which shows the halving will occur on May 1, 2024. Most countdown calculators apply the average ten-minute rule, and other data points suggest the halving could occur on April 20, 2024.

Either way, the progress toward the next halving is still more than 60% complete, and when it occurs, bitcoin miner rewards will be reduced from 6.25 BTC to 3.125 BTC post halving. Despite the high speed now, miners could easily slow down after the meaningful difficulty increase on October 10 is recorded and if BTC prices remain low.

This, in turn, would push the halving date back to the 2024 range and after all, there’s still well over a year’s worth of BTC block subsidies to mine. A lot can change. According to a recent blog post from Blocksbridge Consulting, the difficulty change and low price range could give bitcoin miners a headache from loss of profits.

“Bitcoin’s daily mining revenue per PH/s is currently around $80. If the difficulty rises 13% on Monday and bitcoin’s price stays at $19.5K, the daily revenue would decrease to $70 per (petahash) PH/s,” Blocksbridge Consulting’s Miner Weekly issue #17 notes. “That would cause mining companies to mine at all-time low revenues on a daily basis, even lower than what we saw during the summer following the May 2020 halving.”

The blog post adds:

Unless bitcoin’s price breaks the $20,000 barrier, those who employ older-generation machines or have bloated mining operations will face an even tougher time ahead.

Viabtc’s Viawallet halving metrics show that eight blockchains are expected to see reward halvings or what’s known as “reward reductions.” Dash expects a reward reduction on June 20, 2023, as rewards will shrink from 2.76 DASH to 2.56 DASH. Other reduction events and reward halvings will stem from blockchains that include BCH, BSV, LTC, ETC, ZEC, and ZEN.

What do you think about the Bitcoin network’s progress toward the next halving exceeding 60%? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

At the end of January 2022, non-fungible token (NFT) sales raked in $4.77 billion and NFT sales have slipped month after month since then. Last month, $549.82 million in NFT sales took place in September which shows monthly NFT sales are more than 88% lower than they were in January. Furthermore, after the search term “NFT” reached the highest score on Google Trends last January, tapping a score of 100, the last week of September’s score was 12, which is also 88% lower in terms of interest.

Non-fungible token (NFT) technology was very popular at the end of 2021 and during the first month of 2022. In fact, in terms of Google Trends data (GT), worldwide the term “NFT” scored the highest score a search query can get on the GT database, which is 100.

In fact, it was the first time the search term tapped this region according to the GT database, but today the score is 88% lower with a score of 12 during the week of September 25 through October 1, 2022. Today, China is the most active region according to GT metrics and the country is followed by Hong Kong, Singapore, Nigeria, and Taiwan.

Sales have slid since January as well, as records show that NFT sales were just above the half-billion mark or approximately $549.82 million. The number is approximately 88.49% lower than the $4.77 billion in NFT sales recorded eight months ago.

May was the last month that NFT sales printed above the $1 billion mark and that month $3.18 billion in NFT sales were recorded. The following month was a significant slide down to $879 million and in July, NFT sales saw $682 million. August sales slid lower after $633 million in NFT sales were recorded that month, and September’s sales are 13.27% lower.

So far, the first week of October 2022 has seen $105.22 million in NFT sales via 191,175 unique buyers. 30-day metrics indicate that the top NFT collection in terms of sales was Bored Ape Yacht Club (BAYC) as the collection printed $30,964,305 in sales last month.

However, that’s 37.49% lower than the sales BAYC recorded the month prior. Statistics aggregated by cryptoslam.io show the project QQL Mint Pass has seen $27.80 million in sales this month and Cryptopunks captured $23.49 million.

The generative art NFT project with artwork by Tyler Hobbs and Dandelion Wist Mané is a new collection with no prior market data, but Cryptopunks’ $23.49 million in NFT sales are up 12.27% higher than the 30 days prior.

Four specific projects saw three-digit gains this past month compared to last month’s NFT sales data which include Renga, Gods Unchained, Ethereum Name Service (ENS), and NFL All Day, respectively. During the past month, most of the sales volume derived from the Ethereum blockchain as it recorded $345,633,653 in sales.

Ethereum’s sales were followed by Solana’s $114.32 million, Flow’s $20.61 million, and the $18.95 million from Immutable X NFT sales. While Ethereum-based NFT sales dominated, month-over-month stats show ETH sales are down 21.26%. 30-day metrics indicate Solana-based NFT sales are up 109.23% and Flow NFT sales are up 40.58%. NFT sales that derive from the Immutable X network saw a month-over-month increase of around 125.30%.

Coincidently, the top five most expensive NFTs sold during the last 30 days stem from Yuga Labs’ associated NFT collections like the Bored Ape Yacht Club and Otherdeeds. The most expensive NFT sold within the past 30 days was Bored Ape #8585 for $1.03 million and the second most expensive NFT sold was Bored Ape #441 which sold for $350,991 19 days ago.

What do you think about monthly NFT sales being down 88% lower than the sales recorded last January? What do you think about the NFT sales action during the last 30 days? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Google Trends, Cryptoslam.io,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

Source From : News