Bitcoin’s role as a store of value currency has been contested, debated, and supported in many instances. With the new crisis brought by the COVID 19 outbreak, will Bitcoin prevail over fiat currencies and confirm its superiority, or will it fail like the rest of the market?

Qiao Wang, head of product at Messari and angel investor, believes that an increasing number of traders would dump their altcoin funds and seek refuge in bitcoin during this deepening financial crisis.

Wang went on to tweet that he expects bitcoin’s dominance to see an increase of over 90 percent by the end of the current economic drop. ‘Bitcoin Dominance‘ refers to the price of Bitcoin compared to the rest of the cryptocurrency market, which currently has more than 5,000 coins and tokens.

Mr. Wang compared BTC to the US dollar, the latter serving as a global hedge for emerging economies when they are experiencing a worldwide financial crisis, pointing out that bitcoin could also provide traders with similar protection if they own highly volatile and illiquid crypto assets.

He tweeted:

“Bitcoin is to [alternative cryptos] as the USD is to EM currencies, except the Bitcoin Open Miners Committee can’t unilaterally inflate the supply enough to offset the relative increase in demand.”

coinivore.com

coinivore.comBitcoin vs Altcoins

During the second week of March, all crypto assets, regardless of their market cap ranking recorded losses against bitcoin. Ethereum, the second-largest crypto, lost 25 percent against bitcoin from this year’s highest value. Third place XRP also lost around 24 percent.

Around $58 billion left the altcoin market from February 15, with a part of it being transferred to the US dollar market for covering margin calls.

Rich Rosenblum, a former Goldman Sachs managing director, remarked that the huge self-off of bitcoin in early March was fuelled by “non-crypto-dedicated professionals moving risk off the table, starting with liquid assets and regardless of conviction level.”

The group mostly consisted of “traditional institutions” that quickly required cash to meet margin calls and quarterly redemptions, said Rosenblum.

“The record stimulus being deployed by central banks is a reminder of why bitcoin was created in the fallout of the last global market crisis. People are increasingly skeptical of conventional monetary systems. Bitcoin with its predictable inflationary scheme and 100% uptime offers some certainty in an environment that is otherwise very unpredictable,” – wrote Rosenblum.

The rest of the funds that went into USD markets was used to buy bitcoin, and this propelled market dominance from its YTD low of 61.98 percent to as high as 67.91 percent.

Bitcoin was created to work independently from banks, governments, or other systems used by fiat currencies. The blockchain on which Bitcoin runs relies on a network of nodes/computers that work independently from each other. Several countries are already using the coin in order to circumvent international economic sanctions.

Even with a 45% Drop, Is Bitcoin Still a Store-of-Value?

As bitcoin is highly volatile, many do not consider the coin as a store-of-value, but if the compare gold’s price movement during the 2008 financial crisis, based on this logic, gold isn’t a store of value as well.

Gold/USD daily chart 2007 – 2009. Source: TradingView

Gold/USD daily chart 2007 – 2009. Source: TradingViewAfter a 24% plunge in under 2 months, gold certainly doesn’t look like a financial refuge, and what’s more, the S&P 500 remained flat during that period. Thus, it does not seem correct to pinpoint a correlation during such a short period of time, as a drastic price movement does not invalidate gold’s resilience during economic unrest.

The same can be said about Bitcoin and its capacity to serve as a store of value during its first financial crisis. The current crisis is unprecedented, with the last similar event happening since the stock market crash of 1929.

The S&P 500 lost 20% in 3 weeks from its peak, and this did not happen even in 1929.

As Bitcoin presents no correlation to the stock markets, investors can shift from an entire class of assets, which is compromised to a cryptocurrency that is independent of their movements.

Bitcoin and S&P 500 60-day correlation chart. Source: TradingView

Bitcoin and S&P 500 60-day correlation chart. Source: TradingViewThe chart above showcases the price relationship between the S&P 500 and Bitcoin on a scale from -1, a perfect inverse relation to +1. The indicator has trends related to 0 most of the time, thereby showing there are no correlations between the two assets.

How will Bitcoin Fare Amid the Crisis?

The current economic instability caused by the Coronavirus might bring the downfall of many leading companies, physical retail businesses, and credit lenders. This GDP setback could be the factor that might remove confidence in the current financial system.

While Bitcoin and cryptocurrencies are not expected to be the prime option for most investors, this sector is considered a viable solution for a small percentage of the population, as pointed out in a Charles Schwab report released in November 2019. People from countries affected by hyperinflated fiat currencies, such as Venezuela, Turkey, and Iran, have already turned to crypto and indicated that the financial crisis could favor an increase in Bitcoin adoption.

Opinions from Experts

According to John Waz, academician of the Australian Monash College, the problems with fiat and the issues of financial authorities to deal with the crisis will attract more people to consider cryptocurrencies as an alternative.

“The capabilities of digital property presently rely upon the effectiveness of the measures taken by the authorities to fight the crisis. The extra errors on the half of regulators, the increased the possibilities of digital property to succeed, ” affirmed Waz.

John Waz associated bitcoin’s price drop with a complete liquidity crisis in the fiat market, noting that very few assets managed to secure their positions, such as gold.

“The unusual factor is that during this era, some see the greenback as a software to protect worth. That is in all probability the most poorly managed asset. On this facet, cryptocurrencies are extra engaging, since there are not any banks or governments above them that steal losses and privatize earnings. ” – stated the economist.

John Waz compared the use of cigarettes to bitcoin in the context of prisons:

“Traditionally, the worth of cash stems from the reality that folks use it. Nobody thinks of cigarettes as cash, however in prisons they’re as helpful as gold. The success of cryptocurrencies is determined by what number of prisoners are keen to take cigarettes.”

chinadailyhk.com

chinadailyhk.comBitwise Asset Management also mentioned in an April update how the current situation had impacted the diversification of crypto portfolios:

“We are in unprecedented times, seeing anomalous and unexpected developments in financial markets, including gold, and witnessing extraordinary fiscal and monetary responses to the coronavirus pandemic. In such an environment, a small allocation to crypto in a diversified portfolio seems increasingly prudent. We are hearing this from clients, and seeing it in our inflows. If considering a small allocation to crypto has been on your to-do list, now may be one of the best possible times to prioritize figuring out your stance.”

Bitcoin has been regularly experiencing a trend in which it outperforms. During the course of 2019, bitcoin saw an increase of 94 percent. That surge represented triple the amount S&P 500 accrued during a banner year for the stock index.

Michael Novogratz, CEO of the cryptocurrency investment firm Galaxy Digital, stated that he was receiving more inquiries from investors that never heard of bitcoin before. He stated that they all asked the same question: “Tell me about this bitcoin.”

Blockforce Capital, a San Diego-based cryptocurrency investment firm, mentioned in its Multi-Strategy Master Fund report that it lost 14 percent in March, while also remarking that overall performance was basically flat for the year. As the company noted that “cryptocurrencies will remain volatile and widespread institutional adoption will take a very long time.”

“We believe that we can achieve superior risk-adjusted returns that are uncorrelated to the other investments that so many of our clients already own.”

What’s more interesting is that respected Wall Street analysts that do not necessarily follow bitcoin’s movement are also predicting a rise in inflation.

Former Bank of America chief U.S. equity strategist, Rich Bernstein, said on April 3 that he foresees stagnation for the economy, otherwise “stagflation” – where low or flat growth occurs when consumer prices and unemployment sharply rise.

“When you think about the amount of stimulus that is being put in the system worldwide, it seems to me that’s a reasonable proposition that you can have more inflation than people think,” stated Bernstein.

Michael Wilson, a Morgan Stanley equity strategist, also wrote in an April 5th report that “there are literally no governors on the amount of monetary or fiscal stimulus that will be used in this fight.” He went on to say:

“Not only are we likely to get the largest peacetime fiscal deficit in history, but the stimulus targets the parts of the economy with a higher propensity to spend. Such a dramatic shift in U.S. fiscal and monetary policy relative to other regions should lead to a materially weaker dollar.”

In light of such declarations, there is no surprise that investors are looking to cryptos.

Economic Measures Amid Crisis

Larry Kudlow, President Donald Trump’s top economic adviser, has expressed that he is in favor of selling government bonds to “raise money for the war effort,” and noted that there is a necessity to “have fiscal policy working with monetary policy.” The short story is that authorities are responding to the outbreak’s effects and that the U.S. central bank can be requested to offer financing in the government’s chosen spending programs. The Federal Reserve generally acts independently of the government.

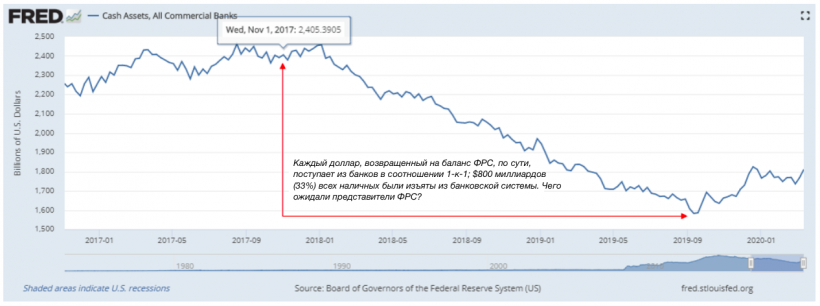

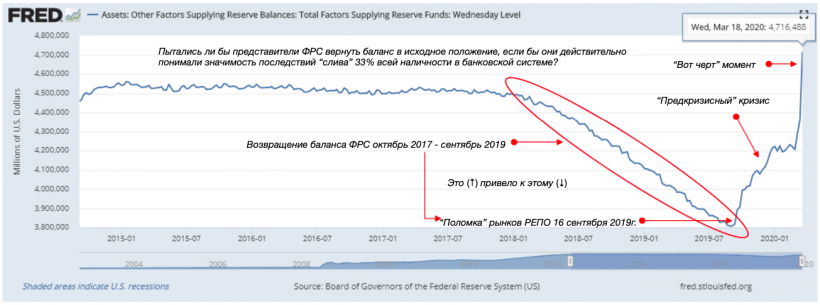

Even prior to the market crash, the Federal reserve already allocated approximately $500 billion in urgent financing of repo markets. “Now the central bank is pouring oil directly into the fire. But not only the scale is striking, but also the sheer loss of control due to incrementalism,”- wrote Parker Lewis’s article on how the monetary crisis confirms the superiority of bitcoin.

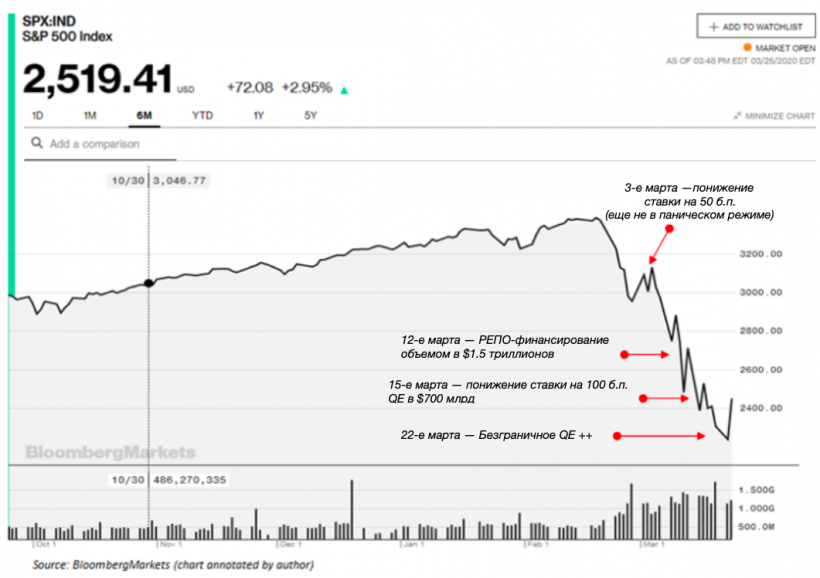

After the stock market crashed, an emergency interest rate cut of 50 basis points was implemented by the Fed. The market once again dropped, and the Fed put in another $1.5 trillion for repo markets. The same thing happened; the market collapsed, and three days later, the central bank revealed a $700 billion quantitative easing program and reduced the interest rate to almost zero. Once again, the market crashed, and the Fed applied for an unlimited quantitative easing program, vowing to secure the markets at no matter the costs.

The Fed applied the most aggressive steps in history over the course of just 10 days. The central bank revealed that it plans to buy corporate bonds in the secondary market, take part in corporate debts, and buy commercial mortgage-backed securities. The Fed also developed a system for issuing securities backed by student loans, car loans, etc.

Parker Lewis then asks in his article:

“If the Fed understood the scale of the problem initially, then why did she change her plans so dramatically in such a short period of time? This suggests that the central bank has lost control. Why announce a $ 700 billion program if you already know that it will not work? This is a classic guessing game, and the economy is at stake.”

“The Federal Reserve has an unlimited amount of cash,” stated Neil Kashkari, Fed President of Minneapolis – March 22, 2020 (60 minutes)

“To lend to a bank, we simply use a computer to increase the size of the account that they have with the Fed […], it is much more like printing money than borrowing it,” stated Ben Bernanke, former Fed Chairman – March 15, 2009 (60 minutes).

It has been estimated that the Fed will dedicate to market financing at least a sum of $4 trillion. As noticed, short-term financing will not have an effect, and the regulator will be forced to monetize a large portion of the credit system. This was the same approach taken in 2008, and the crisis we are facing today is much worse.

The Congress also announced that $2 trillion worth of incentives will be allocated to alleviate the impact of the COVID-19 outbreak. The liquidity crisis is already noticeable as banks lack the funds to cover the gaping deficit of the federal government. This would force the Fed to back up any fiscal measures for a continuous quantitative easing program. This represents the only option through which banks can secure the finance needed for these fiscal incentives.

crypto-news-flash.com

crypto-news-flash.com“This is a sign of misunderstanding of the underlying problem. This is an erroneous assessment of the consequences of the pandemic and a distorted assumption that the only hope is that central banks and governments will create money from the air. It is predictably irrational.”

“There is no reason to believe that the stop economic activity for several months should put the world on the brink of global depression. The latter is the fruit of an inherently fragile financial system, which depends on continuous credit expansion to support livelihoods. I mean, a failure was inevitable without a pandemic. If it were not for the unstable dependence on borrowed funds, trading in the S&P 500 would not have stopped at such a frequency due to sharp collapses.

Dependence on borrowed funds is not a natural property of capitalism or the free market. This is the installation of central banks. Instability is in the market structure.

In response to every economic downturn (or crisis) over the past 40 years, central banks have responded by increasing the money supply and lowering interest rates. Each time the system tried to relieve the debt burden, central banks prevented this by monetary stimulation, thereby postponing the problem and allowing the imbalance to accumulate in the credit system for decades. This is the main reason for the fragility of the financial system. That is why every time a sinking economy needs a lifebuoy greater than the previous one.”

From Lewis’s observations, quantitative easing forces cash savings to lose their value, distorting all pricing mechanisms in the economy, with the final goal of prolonging debt.

This is why bitcoin is a proper asset in which savings can be converted, as the currency is not subjected to manipulation.

While the price of Bitcoin cannot be predicted for the long-term, it might provide more stability due to its immutable nature. The coin itself is not a safe financial heave in the traditional sense, as its use is not widely adopted at this point. While still in its early stages, during times of global economic instability, it is expected that any liquid asset will be sold-off.

Unlike the other assets on the stock exchange, Bitcoin trading cannot be suspended, and there are no bailouts involved.

The total supply of BTC is capped at 21 million. Once that limit is reached, no more BTC can be created. All further financial incentives of central banks will contribute to making bitcoin appear more reasonable, as, in spite of its price volatility, Bitcoin provides a monetary system that is more stable.

Bitcoin issuing is handled solely by its source code, thus basing a credit system on it will not feature unevenness. Its immutable nature will prevent systemic risks which are now plaguing the traditional system.

“The next storm will pass, and it will become clear: that which does not kill bitcoin makes it stronger. He lives and thrives without central coordination. Bitcoin is not for the faint of heart, it is for the free and brave,”- concluded Lewis.

Featured image: bitcoinist.com

Source From : Coindoo News