Logium, an ambitious newcomer to the world of crypto betting, has recently undergone a noteworthy refresh to better serve its users.

What is Logium?

Logium is a peer-to-peer platform that allows traders to bet with each other on whether the price of an asset will go up or down in value. Every trade on Logium is executed in P2P, with up to 5x leverage. The platform has no access to users’ funds and only withholds a small (up to 5%) fee from the winning side of the bet, adhering to the core DeFi values of decentralization, democratization, and transparency. Importantly, Logium does not charge for bet maintenance. Regardless of the timeframe, leverage, or chosen position. If you are interested in a detailed outlook on Logium, follow them on Twitter.

What were the changes to Logium V1?

The most considerable change to Logium V1 is the much easier flow of taking bets. Instead of being overwhelmed by the variety of available options, users now start by picking a token, and the system automatically links them with a bet. Users can still adjust the leverage, bet timeframe, or switch between betting up or down, but the new design makes it easier to deal with all the rest.

One of the standout features is the new dark mode, which offers users better visibility and transparency. The dark mode interface is more comfortable for the eyes and adds to a sleek look that users are sure to appreciate. This feature is just one of many that Logium has introduced to make the platform more user-friendly and fun for all.

Additionally, the new version of Logium V1 has the list of available tokens limited down to BTC, ETH, and STC, with plans to extend the list in the future. This move ensures that users have a greater chance of winning and can focus on the tokens they know best. By limiting the number of tokens available, Logium has also reduced the complexity of the platform, making it more accessible to all users, regardless of their level of expertise in the crypto market.

How to take a bet on Logium?

/1 Firstly, visit Logium V1 dApp.

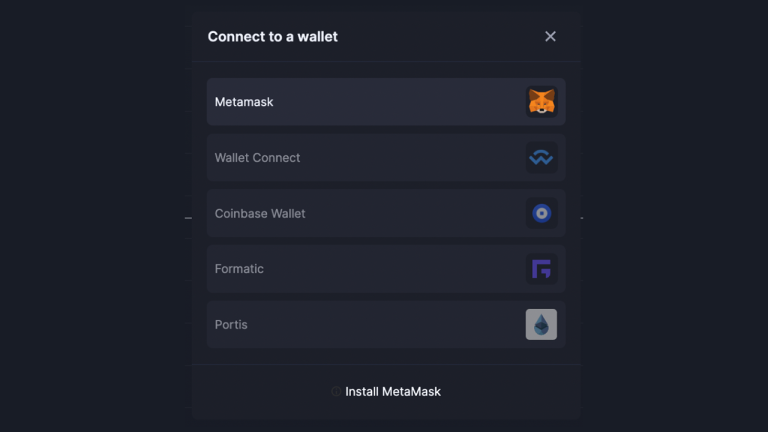

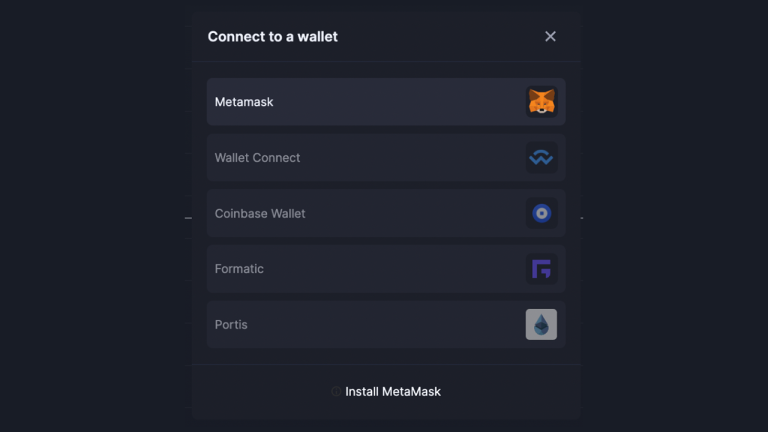

/2 You’ll need to connect a wallet by clicking the blue button in the right corner of the platform. Choose Metamask 🦊 and go back to the main panel.

/3 Then, choose a coin from a drop bar in the upper left corner of the interface.

Select bet direction (higher ⬆️/lower ⬇️) and bet size (the amount of money you’re willing to spend 💰). The platform will automatically match a bet for you 🎯

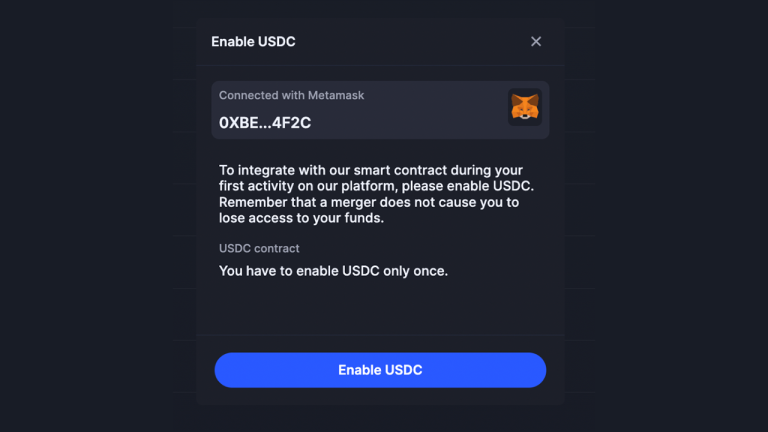

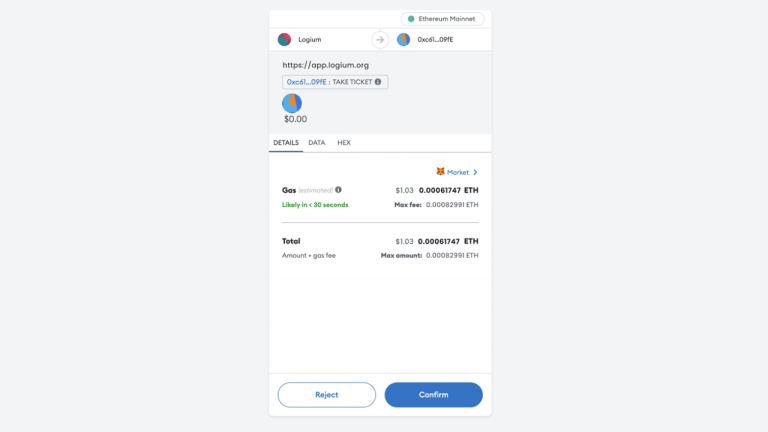

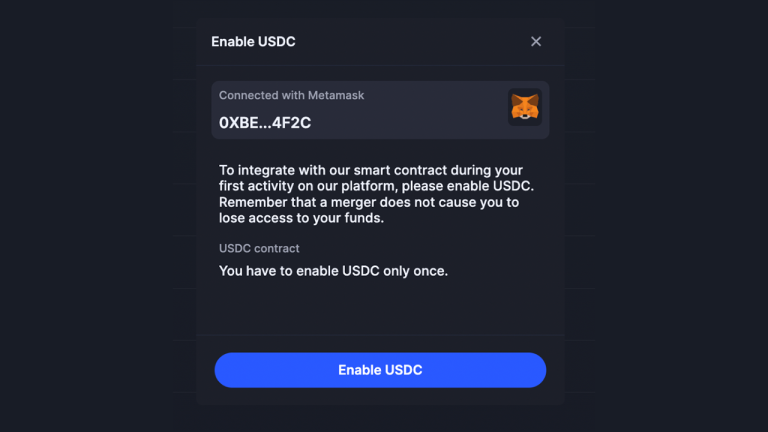

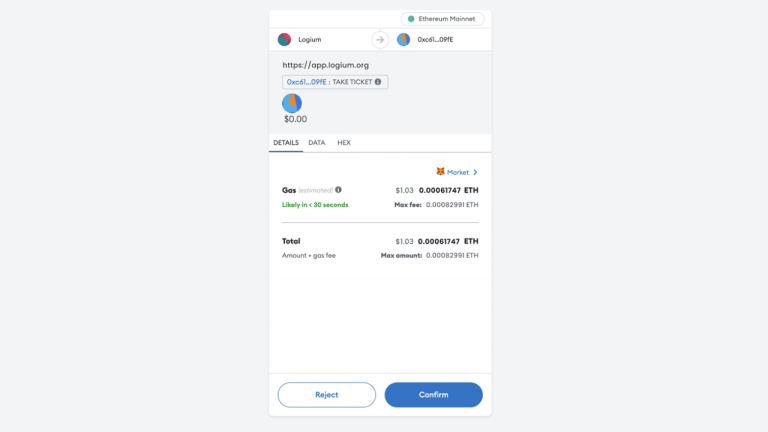

/4 Having connected a wallet, you may click the “Take a bet” button in the lower right corner. After you decide to do so, you’ll be asked to enable USDC to use Logium’s smart contract 🤝

/6 And that’s it! You made it here – now try making it on a platform 😎

What are the benefits of decentralized crypto betting platforms?

First of all, decentralization itself. Logium doesn’t hold users’ assets, period. All trades are p2p via smart contracts, which are thoroughly audited for safety and transparency. This means that users have complete control over their money and can make bets directly from their self-custody wallets without having to trust their funds with an intermediary.

What’s more, decentralized crypto betting platforms allow you to earn money in the crypto market, even during the bear cycles. By betting on the direction of the market, users can profit from their investments, regardless of whether prices are going up or down. This is a significant advantage in a market that is as volatile and unpredictable as ever.

Logium V1 is a perfect platform for anyone looking to get started with crypto betting or for those who want to take their investments to the next (decentralized) level. With its transparent interface, streamlined logic, and limited list of tokens, Logium offers a straightforward and intuitive way to have fun and go green in the crypto winter. The platform is designed to be accessible to all, regardless of experience level, which makes it a superior choice for anyone looking to diversify their investments and take advantage of the crypto market’s potential.

If you want to conquer the bear market, Logium is the platform to choose.

Take your first bet now!

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Logium, an ambitious newcomer to the world of crypto betting, has recently undergone a noteworthy refresh to better serve its users.

What is Logium?

Logium is a peer-to-peer platform that allows traders to bet with each other on whether the price of an asset will go up or down in value. Every trade on Logium is executed in P2P, with up to 5x leverage. The platform has no access to users’ funds and only withholds a small (up to 5%) fee from the winning side of the bet, adhering to the core DeFi values of decentralization, democratization, and transparency. Importantly, Logium does not charge for bet maintenance. Regardless of the timeframe, leverage, or chosen position. If you are interested in a detailed outlook on Logium, follow them on Twitter.

What were the changes to Logium V1?

The most considerable change to Logium V1 is the much easier flow of taking bets. Instead of being overwhelmed by the variety of available options, users now start by picking a token, and the system automatically links them with a bet. Users can still adjust the leverage, bet timeframe, or switch between betting up or down, but the new design makes it easier to deal with all the rest.

One of the standout features is the new dark mode, which offers users better visibility and transparency. The dark mode interface is more comfortable for the eyes and adds to a sleek look that users are sure to appreciate. This feature is just one of many that Logium has introduced to make the platform more user-friendly and fun for all.

Additionally, the new version of Logium V1 has the list of available tokens limited down to BTC, ETH, and STC, with plans to extend the list in the future. This move ensures that users have a greater chance of winning and can focus on the tokens they know best. By limiting the number of tokens available, Logium has also reduced the complexity of the platform, making it more accessible to all users, regardless of their level of expertise in the crypto market.

How to take a bet on Logium?

/1 Firstly, visit Logium V1 dApp.

/2 You’ll need to connect a wallet by clicking the blue button in the right corner of the platform. Choose Metamask 🦊 and go back to the main panel.

/3 Then, choose a coin from a drop bar in the upper left corner of the interface.

Select bet direction (higher ⬆️/lower ⬇️) and bet size (the amount of money you’re willing to spend 💰). The platform will automatically match a bet for you 🎯

/4 Having connected a wallet, you may click the “Take a bet” button in the lower right corner. After you decide to do so, you’ll be asked to enable USDC to use Logium’s smart contract 🤝

/6 And that’s it! You made it here – now try making it on a platform 😎

What are the benefits of decentralized crypto betting platforms?

First of all, decentralization itself. Logium doesn’t hold users’ assets, period. All trades are p2p via smart contracts, which are thoroughly audited for safety and transparency. This means that users have complete control over their money and can make bets directly from their self-custody wallets without having to trust their funds with an intermediary.

What’s more, decentralized crypto betting platforms allow you to earn money in the crypto market, even during the bear cycles. By betting on the direction of the market, users can profit from their investments, regardless of whether prices are going up or down. This is a significant advantage in a market that is as volatile and unpredictable as ever.

Logium V1 is a perfect platform for anyone looking to get started with crypto betting or for those who want to take their investments to the next (decentralized) level. With its transparent interface, streamlined logic, and limited list of tokens, Logium offers a straightforward and intuitive way to have fun and go green in the crypto winter. The platform is designed to be accessible to all, regardless of experience level, which makes it a superior choice for anyone looking to diversify their investments and take advantage of the crypto market’s potential.

If you want to conquer the bear market, Logium is the platform to choose.

Take your first bet now!

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Bill ‘On Digital Currency’ Caps Crypto Investments for Russians, Opens Door for Payments

Russia’s recently revised bill “On Digital Currency” limits crypto purchases for non-qualified investors while providing legal ground for some cryptocurrency payments, according to local media. The draft law, proposed by the Russian finance ministry, also introduces strict requirements for platforms ... read more.

Litecoin surged to a nine-day high to start the month, breaking out of a recent resistance point in the process. The token climbed past the $95.00 level, as bulls made a run for the $100.00 mark. Polygon also snapped a recent losing streak, by bouncing from a key support point.

Litecoin (LTC) climbed to its highest point in over a week on Wednesday, following a breakout of a recent resistance level.

Following a low of $93.52 on Tuesday, LTC/USD started the month of March by climbing to a high of $97.93.

This surge sent litecoin to its strongest point since February and came as prices moved past a ceiling at $95.00.

Looking at the chart, one of the catalysts for the move was a breakout on the relative strength index (RSI).

Price strength moved above a ceiling at 53.00, and as of writing is tracking at the 55.61 level.

The next visible point of support seems to be near the 58.00 mark, and should this be hit, there is a strong chance that LTC will move beyond $100.00.

Additionally, polygon (MATIC) also snapped a recent losing streak, as bulls rejected a breakout of a key price floor.

MATIC/USD moved to a peak of $1.26 on Wednesday, after falling to a bottom of $1.19 the day prior.

The jump in price comes after an attempt to move below support at $1.18, following recent downward pressure.

Currently, the 10-day (red) moving average is a stone’s throw away from a potential cross with its 25-day (blue) counterpart, which has been delayed by today’s rally.

In order to further delay this action, there will likely need to be another jump in price, with bulls likely to target the $1.30 ceiling.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect polygon to hit $1.30 in the coming days? Let us know your thoughts in the comments.

Eliman was previously a director of a London-based brokerage, whilst also an online trading educator. Currently, he commentates on various asset classes, including Crypto, Stocks and FX, whilst also a startup founder.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

Litecoin surged to a nine-day high to start the month, breaking out of a recent resistance point in the process. The token climbed past the $95.00 level, as bulls made a run for the $100.00 mark. Polygon also snapped a recent losing streak, by bouncing from a key support point.

Litecoin (LTC) climbed to its highest point in over a week on Wednesday, following a breakout of a recent resistance level.

Following a low of $93.52 on Tuesday, LTC/USD started the month of March by climbing to a high of $97.93.

This surge sent litecoin to its strongest point since February and came as prices moved past a ceiling at $95.00.

Looking at the chart, one of the catalysts for the move was a breakout on the relative strength index (RSI).

Price strength moved above a ceiling at 53.00, and as of writing is tracking at the 55.61 level.

The next visible point of support seems to be near the 58.00 mark, and should this be hit, there is a strong chance that LTC will move beyond $100.00.

Additionally, polygon (MATIC) also snapped a recent losing streak, as bulls rejected a breakout of a key price floor.

MATIC/USD moved to a peak of $1.26 on Wednesday, after falling to a bottom of $1.19 the day prior.

The jump in price comes after an attempt to move below support at $1.18, following recent downward pressure.

Currently, the 10-day (red) moving average is a stone’s throw away from a potential cross with its 25-day (blue) counterpart, which has been delayed by today’s rally.

In order to further delay this action, there will likely need to be another jump in price, with bulls likely to target the $1.30 ceiling.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect polygon to hit $1.30 in the coming days? Let us know your thoughts in the comments.

Eliman was previously a director of a London-based brokerage, whilst also an online trading educator. Currently, he commentates on various asset classes, including Crypto, Stocks and FX, whilst also a startup founder.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

PRESS RELEASE. LBank; a leading token-to-token crypto exchange, has partnered with Encryptus Europe UAB; a licensed crypto and fiat infrastructure company, to streamline their crypto to payouts in 100+ countries.

After this integration, LBank will be able to offer to their users off ramps in the form of bank wires, gift cards, mobile top-ups and data plans without having to invest significant time and resources into product development, market research and regulatory compliance. Instead, they can focus on other areas of their business, such as user acquisition and retention, while still offering a use case for stable coins to their users in the form of off-ramps.

LBank’s 9 million users across Africa, Asia and Europe will be able to access Encryptus’ sophisticated payout network, enabling them to make payouts in a compliant and secure manner. In Phase 1 of the launch, users from Vietnam, India, Indonesia, Philippines, Kenya, Tanzania, Mexico, Brazil and 30 other countries will be able to receive bank wires. In 100+ countries, users will be able to get gift cards, airtime top-up and internet data plans against USD Coin (USDC) and Tether (USDT). Sanctioned countries, Japan and the US will be excluded for bank wires.

Remittance is a vital source of income for many developing countries and has been steadily increasing in recent years, with low and middle income countries (LMICs) growing an estimated 5% to $626 billion, according to the World Bank. Remittance is expected to expand at a compound annual growth rate (CAGR) of 15.6% from 2023 to 2030.

“We are excited to partner with LBank to provide a more dependable payout infrastructure for stablecoins,” said Shantnoo Saxsena, Founder and CEO of Encryptus. “We consider this agreement to be an important step in the B2B2C space in bringing a use case for crypto assets. Encryptus will continue to build a solid and scalable infrastructure to support crypto companies in the background.”

Kaia Wong, CMO of LBank, sounded excited about the partnership and commented, “LBank is thrilled to be working with Encryptus to offer payout to our users. Bank wires, gift cards, mobile data plans and mobile minutes is just the start. Through this partnership, LBank will be able to offer additional services to our users. We are an ecosystem company and this partnership proves that.”

Kristina Vanacova, Product and Operations Manager for Encryptus, commented, “We are committed to deliver innovative yet compliant solutions to assist the crypto community with use cases. We will be rolling out additional payout options for our partners to scale up.”

A significant element of the partnership is the One-API-Connects-All feature, which integrates compliance, onboarding, dashboards and payouts in one place. This means that LBank’s users can complete their transactions more efficiently without worrying about navigating different systems or dealing with multiple providers. The simplicity and convenience of this system will undoubtedly make it more attractive to clients, especially those new to cryptocurrency.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Source From : News