According to statistics recorded this week on Tuesday and Wednesday, the layer two scaling project Arbitrum’s transaction count has surpassed Ethereum’s. On Wednesday, Arbitrum processed 1,090,510 transactions, compared to Ethereum’s 1,080,839 transfer count.

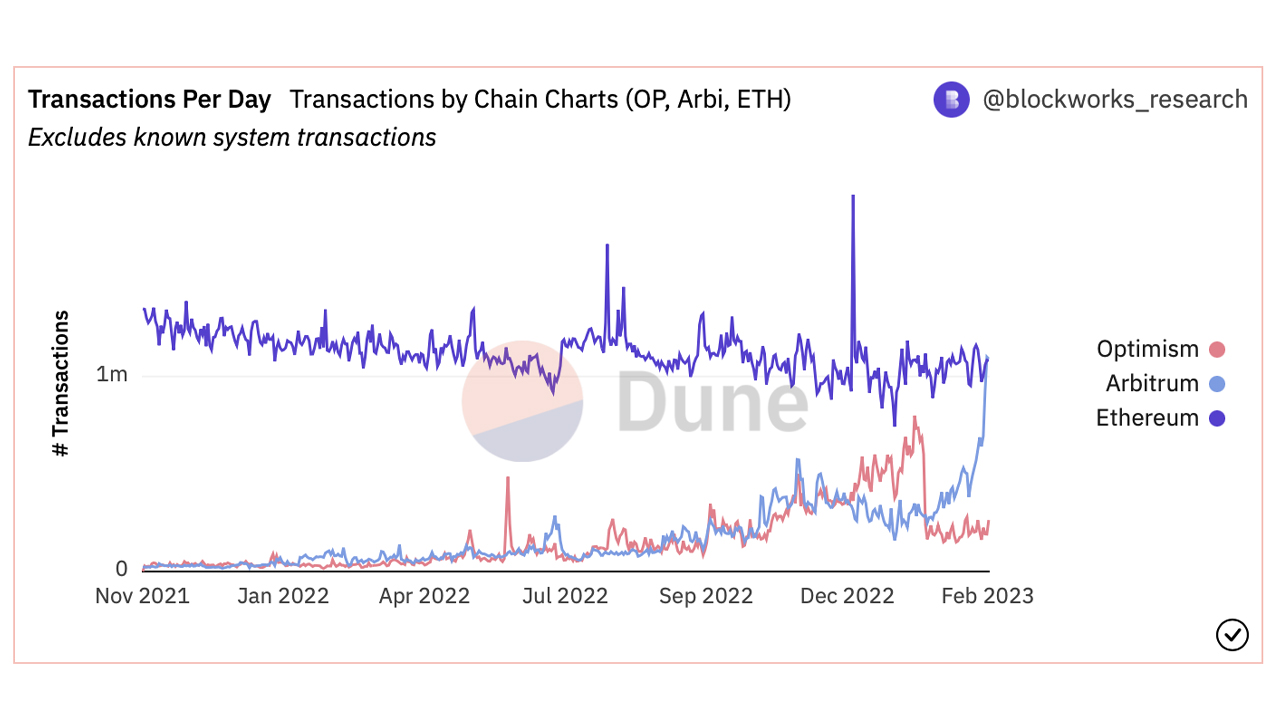

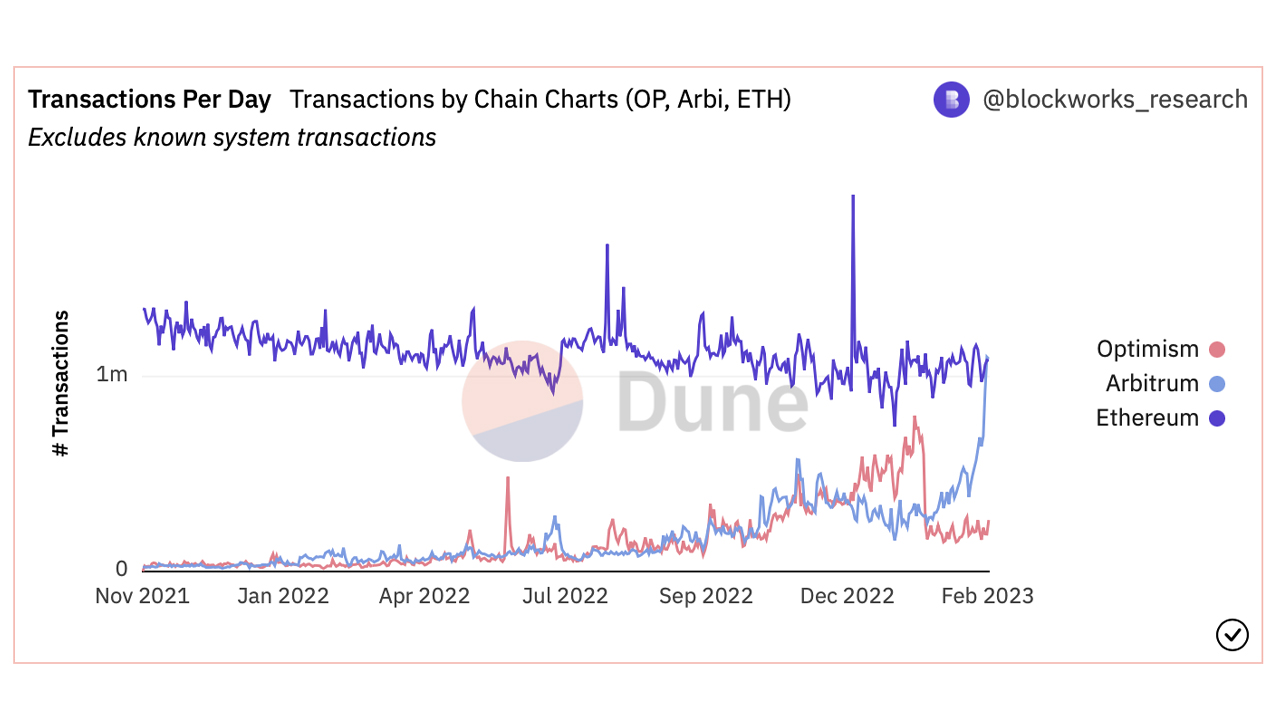

Layer two (L2) scaling networks have become popular over the last two years as secondary chains allow users to transact faster and pay fewer fees. Thirty-nine days ago, in mid-January 2023, the combined daily transaction count from L2 networks Optimism and Arbitrum surpassed Ethereum’s daily transaction count. However, the transaction count subsided and ETH’s transfer count exceeded both networks’ counts until Feb. 21, 2023.

Statistics show that Arbitrum’s daily transaction count has surged this week and surpassed Ethereum’s for the first time ever on Tuesday. On Feb. 21, 2023, Arbitrum processed 1.1 million transactions, compared to Ethereum’s 1.08 million. The next day, on Wednesday, Arbitrum beat Ethereum again by processing 1.09 million, while Ethereum processed 1.08 million.

Abitrum tweeted about the watershed moment on social media. “For the first time ever, Arbitrum One processed more transactions than Ethereum,” the official Abitrum Twitter account said. This is a huge milestone achieved by our team and Arbinauts. We’ve come a long way as a community and we’re grateful to have you along with us. Our mission to scale Ethereum continues.”

The increase in Arbitrum transactions comes at a time when Ethereum network transactions have risen significantly. Statistics show that on Thursday, the average fee to transact on Ethereum’s blockchain is 0.0041 ETH, or $6.87 per transaction, while the median fee is 0.0017 ETH, or $2.84 per transfer. On the same day, the average fee to transact on Arbitrum is $0.307 per transfer, while Optimism costs $0.3601 per transaction.

What do you think about Arbitrum’s daily transfer count rising above Ethereum’s? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

According to statistics recorded this week on Tuesday and Wednesday, the layer two scaling project Arbitrum’s transaction count has surpassed Ethereum’s. On Wednesday, Arbitrum processed 1,090,510 transactions, compared to Ethereum’s 1,080,839 transfer count.

Layer two (L2) scaling networks have become popular over the last two years as secondary chains allow users to transact faster and pay fewer fees. Thirty-nine days ago, in mid-January 2023, the combined daily transaction count from L2 networks Optimism and Arbitrum surpassed Ethereum’s daily transaction count. However, the transaction count subsided and ETH’s transfer count exceeded both networks’ counts until Feb. 21, 2023.

Statistics show that Arbitrum’s daily transaction count has surged this week and surpassed Ethereum’s for the first time ever on Tuesday. On Feb. 21, 2023, Arbitrum processed 1.1 million transactions, compared to Ethereum’s 1.08 million. The next day, on Wednesday, Arbitrum beat Ethereum again by processing 1.09 million, while Ethereum processed 1.08 million.

Abitrum tweeted about the watershed moment on social media. “For the first time ever, Arbitrum One processed more transactions than Ethereum,” the official Abitrum Twitter account said. This is a huge milestone achieved by our team and Arbinauts. We’ve come a long way as a community and we’re grateful to have you along with us. Our mission to scale Ethereum continues.”

The increase in Arbitrum transactions comes at a time when Ethereum network transactions have risen significantly. Statistics show that on Thursday, the average fee to transact on Ethereum’s blockchain is 0.0041 ETH, or $6.87 per transaction, while the median fee is 0.0017 ETH, or $2.84 per transfer. On the same day, the average fee to transact on Arbitrum is $0.307 per transfer, while Optimism costs $0.3601 per transaction.

What do you think about Arbitrum’s daily transfer count rising above Ethereum’s? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Sam Bankman-Fried (SBF), the disgraced co-founder of FTX, faces four more charges after a new indictment was unsealed on Wednesday. The charges include operating an unlicensed money transfer business and conspiring to commit bank fraud.

The former CEO of FTX was originally indicted 72 days ago by a federal grand jury in Manhattan, and prosecutors charged the crypto exchange co-founder with eight different offenses. The charges include conspiracy to commit wire fraud, wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, and conspiracy to commit money laundering.

A new indictment was unsealed by the court on February 22, 2023, adding four new charges to SBF’s case. The charges include operating an unlicensed money transmitter and conspiracy to commit bank fraud. “Exploiting the trust that FTX customers placed in him and his exchange, Bankman-Fried stole FTX customer deposits and used billions of dollars in stolen funds for a variety of purposes,” the new indictment reads.

The newly revised indictment did not name any other defendants, and it alleges that SBF “corrupted the operations of the cryptocurrency companies he founded and controlled—including FTX.com and Alameda Research.” The revised indictment further adds that SBF “perpetrated this multibillion-dollar fraud through a series of systems and schemes that allowed him, through Alameda, to access and steal FTX customer deposits without detection.”

In addition to operating an unlicensed money transfer business and bank fraud, SBF is accused of defrauding customers in connection with the purchase and sale of derivatives. Furthermore, SBF faces a charge of making unlawful political contributions and defrauding the Federal Election Commission.

What impact do you think these new charges will have on SBF’s case? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

Sam Bankman-Fried (SBF), the disgraced co-founder of FTX, faces four more charges after a new indictment was unsealed on Wednesday. The charges include operating an unlicensed money transfer business and conspiring to commit bank fraud.

The former CEO of FTX was originally indicted 72 days ago by a federal grand jury in Manhattan, and prosecutors charged the crypto exchange co-founder with eight different offenses. The charges include conspiracy to commit wire fraud, wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, and conspiracy to commit money laundering.

A new indictment was unsealed by the court on February 22, 2023, adding four new charges to SBF’s case. The charges include operating an unlicensed money transmitter and conspiracy to commit bank fraud. “Exploiting the trust that FTX customers placed in him and his exchange, Bankman-Fried stole FTX customer deposits and used billions of dollars in stolen funds for a variety of purposes,” the new indictment reads.

The newly revised indictment did not name any other defendants, and it alleges that SBF “corrupted the operations of the cryptocurrency companies he founded and controlled—including FTX.com and Alameda Research.” The revised indictment further adds that SBF “perpetrated this multibillion-dollar fraud through a series of systems and schemes that allowed him, through Alameda, to access and steal FTX customer deposits without detection.”

In addition to operating an unlicensed money transfer business and bank fraud, SBF is accused of defrauding customers in connection with the purchase and sale of derivatives. Furthermore, SBF faces a charge of making unlawful political contributions and defrauding the Federal Election Commission.

What impact do you think these new charges will have on SBF’s case? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

PRESS RELEASE. Dubai, Feb 23: The layer-1 for data, Flare, just completed a live demonstration of new interoperability functionality now available in beta on the network. Using two core interoperability protocols, State Connector and Flare Time Series Oracle (FTSO), an NFT was trustlessly purchased with the transaction taking place on a different chain using a different token. The demo was performed on Flare’s canary network, Songbird, with the purchase made using DOGE and XRP tokens.

Flare’s State Connector protocols enable information, both from other blockchains and the internet to be used securely, scalably and trustlessly with EVM-based smart contracts on Flare chains. In this case, it has been used to prove that a transaction has been confirmed on a non-Flare chain and simultaneously verify the correct payment reference was included.

The Flare Time Series Oracle delivers highly decentralized price and data feeds to dapps on Flare, without relying on a centralized provider to bring the data on-chain. For the demonstration, it provides the live updating price of the NFT in the currency of the other chain.

As Flare is an EVM-based blockchain, everything that can be achieved on Ethereum and other EVM chains can also be performed on Flare. The NFTs minted in the demo are therefore standard ERC721 contracts written in Solidity and deployed on the network. The only changes required were the addition of methods to integrate with the FTSO and State Connector.

Hugo Philion, Flare CEO & Co-founder, said, “This demo highlights Flare’s ability to provide more types of secure, decentralized data on-chain in order to power new functionality and potential use cases for the industry. The NFT demo is one example of the web3 utility Flare can unlock for legacy tokens, enabling them to be used trustlessly in dapps on the network. We are excited to see what other applications engineers can develop, harnessing the capabilities of Flare’s native interoperability protocols.”

Demo Video: https://www.youtube.com/watch?v=g0qxxm2EZjw

About Flare

Flare is an EVM-based Layer 1 blockchain that gives developers decentralized access to high-integrity data from other chains and the internet. This enables new use cases and monetization models, while allowing apps to serve multiple chains through a single deployment.

Flare’s State Connector protocols enable information, both from other blockchains and the internet to be used securely, scalably and trustlessly with smart contracts on Flare.

The Flare Time Series Oracle delivers highly-decentralized price and data feeds to dapps on Flare, without relying on centralized providers.

Build on Flare with more data than ever before or build with Flare to serve multiple ecosystems.

Website | Twitter | Telegram | Discord

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

PRESS RELEASE. Dubai, Feb 23: The layer-1 for data, Flare, just completed a live demonstration of new interoperability functionality now available in beta on the network. Using two core interoperability protocols, State Connector and Flare Time Series Oracle (FTSO), an NFT was trustlessly purchased with the transaction taking place on a different chain using a different token. The demo was performed on Flare’s canary network, Songbird, with the purchase made using DOGE and XRP tokens.

Flare’s State Connector protocols enable information, both from other blockchains and the internet to be used securely, scalably and trustlessly with EVM-based smart contracts on Flare chains. In this case, it has been used to prove that a transaction has been confirmed on a non-Flare chain and simultaneously verify the correct payment reference was included.

The Flare Time Series Oracle delivers highly decentralized price and data feeds to dapps on Flare, without relying on a centralized provider to bring the data on-chain. For the demonstration, it provides the live updating price of the NFT in the currency of the other chain.

As Flare is an EVM-based blockchain, everything that can be achieved on Ethereum and other EVM chains can also be performed on Flare. The NFTs minted in the demo are therefore standard ERC721 contracts written in Solidity and deployed on the network. The only changes required were the addition of methods to integrate with the FTSO and State Connector.

Hugo Philion, Flare CEO & Co-founder, said, “This demo highlights Flare’s ability to provide more types of secure, decentralized data on-chain in order to power new functionality and potential use cases for the industry. The NFT demo is one example of the web3 utility Flare can unlock for legacy tokens, enabling them to be used trustlessly in dapps on the network. We are excited to see what other applications engineers can develop, harnessing the capabilities of Flare’s native interoperability protocols.”

Demo Video: https://www.youtube.com/watch?v=g0qxxm2EZjw

About Flare

Flare is an EVM-based Layer 1 blockchain that gives developers decentralized access to high-integrity data from other chains and the internet. This enables new use cases and monetization models, while allowing apps to serve multiple chains through a single deployment.

Flare’s State Connector protocols enable information, both from other blockchains and the internet to be used securely, scalably and trustlessly with smart contracts on Flare.

The Flare Time Series Oracle delivers highly-decentralized price and data feeds to dapps on Flare, without relying on centralized providers.

Build on Flare with more data than ever before or build with Flare to serve multiple ecosystems.

Website | Twitter | Telegram | Discord

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

PRESS RELEASE. The new partnership between SIMBA Chain and Alitheon brings real-time tracking of digitized physical goods across their entire life cycle.

SIMBA Chain, the builder of Blocks, an enterprise-grade platform that abstracts the complexities of blockchain development to make the innovative technology more accessible across multiple blockchains and services, today announces the integration of Alitheon, the provider of FeaturePrint®, the machine-vision based solution for authentication and traceability of physical goods.

The go-to-market partnering agreement enables Alitheon to provide its customers with the ability to certify the authenticity and take ownership of digitized physical items using the blockchain-based FeaturePrint® system. SIMBA will extend Alitheon’s FeaturePrint to its own customer base, allowing them to first authenticate, and then trace, physical products through the entirety of their commercial lifecycle.

FeaturePrint® allows for immediate authentication of an item using a smartphone using an advanced optical AI technology that digitizes items. SIMBA provides the infrastructure to enable the omnipresent tracking of real-world items through the blockchain by tying each physical item issued by a manufacturer to a unique NFT which acts as the item’s digital twin. From here, both the NFT and the item can be tracked from warehouse to customer to second-hand buyer and beyond, eliminating the possibility of replication, fraud or counterfeiting.

Bryan Ritchie, CEO of SIMBA Chain, said: “The global gray and black market and counterfeiting industry has proven to be highly resistant to modern day technical solutions designed to curb the problem, while physical policing simply cannot match the scope and scale of the issue. By registering and digitizing physical items on the blockchain we can create an immutable public record of each item, and then follow its path from retailer to customer and beyond.”

Using NFTs to represent physical items on the blockchain enables industrial materials like aircraft and automotive parts to be tracked in real-time through the supply chain, effectively eliminating risks associated with counterfeit parts or inadequate maintenance. Blockchain technology can also be used by diamond producers to confirm the quality and ethical sourcing of their precious stones using immutable data which proves the origin of the gemstones.

SIMBA Chain provides governments and enterprises with interconnective blockchain-based solutions to address a number of areas, including supply chain management, financial accountability, medical data processing, and manufacturing lines. SIMBA recently ported the parts supply chain for Boeing’s F/A-18 combat aircraft onto its blockchain-based system, cutting time consuming paperwork costs by 40%, and reducing parts waste by 15%.

In industries spanning aviation, automotive manufacturing, pharmaceuticals, luxury goods, and collectibles, counterfeiting and gray market activity poses an estimated $4.5 trillion annual challenge to brands and manufacturers. These activities have negative impacts on revenue, brand integrity, and, in some cases, the security and well-being of customers.

The Alitheon SIMBA offering presents undeniable authentication of the physical item, coupled with an immutable ledger for storing ownership and other essential data. This ensures that any sales, upgrades, and maintenance activities are safely recorded for the entire lifespan of the item’s usage. The transparency and immutability provided by this solution surpasses current solutions, including certificates of authenticity, guaranteeing end-to-end verification and security for both the physical and digital aspects of the product that can’t be altered by anyone on the network.

###

About SIMBA Chain

Incubated at the University of Notre Dame in 2017, SIMBA Chain (short for Simple Blockchain Applications) provides a scalable enterprise platform that simplifies blockchain development. With fewer barriers to entry, companies can build secure, scalable, enterprise-grade solutions that integrate seamlessly with existing data systems. SIMBA implementations generate value for major government organizations, enterprises, and blockchain companies as a production-grade platform that enables public, private, or hybrid deployments. Visit simbachain.com to learn more.

Media contact:

press@simbachain.com

About Alitheon

Alitheon® is a Bellevue, Washington-based leader in advanced optical AI and creator of FeaturePrint®, a patented system connecting the physical and digital worlds via a secure and immutable link. FeaturePrint digitizes for items and products, what fingerprints are for people – a one of a kind, unique identifier that does not require you to mark, modify or add anything to the item. Using just a camera, FeaturePrinting enables authentication, identification, and traceability of individual items out of millions of similar objects. With FeaturePrint, counterfeits are avoided, misidentification of parts is eliminated, and the use of wrong products is minimized. FeaturePrint is currently used for numerous track, trace, and authentication purposes across automotive, pharmaceuticals, aerospace & defense, medical equipment, precious metals, and luxury goods & collectibles.

Media Contact:

alitheon@missionc2.com

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

Source From : News