Today’s blustery global economy has everyone on edge as inflation has wreaked havoc on the wallets of ordinary people and energy prices continue to soar worldwide. According to Credit Suisse, “the worst is yet to come,” as the global investment bank’s analysts believe the European Union (EU) and the U.K. are already dealing with a recession. S&P Global has a similar hypothesis as a report published by the Manhattan corporation explains that the U.K. is currently contending with a full-year recession.

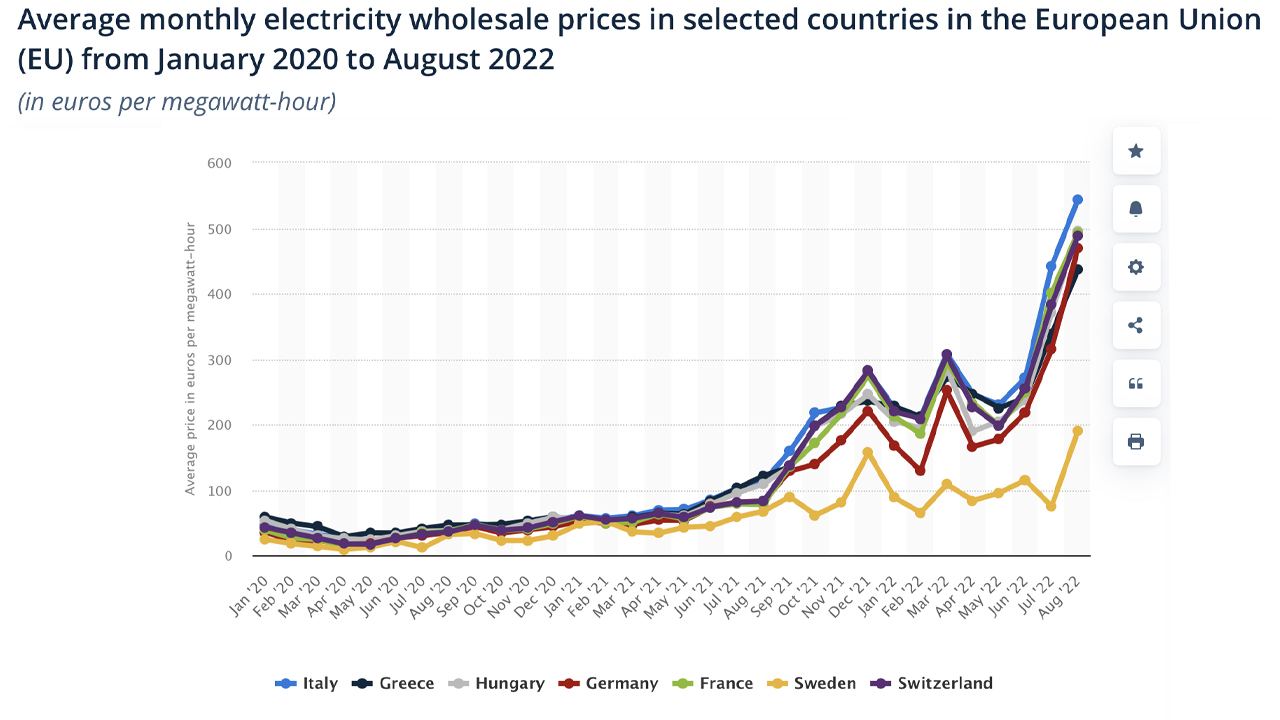

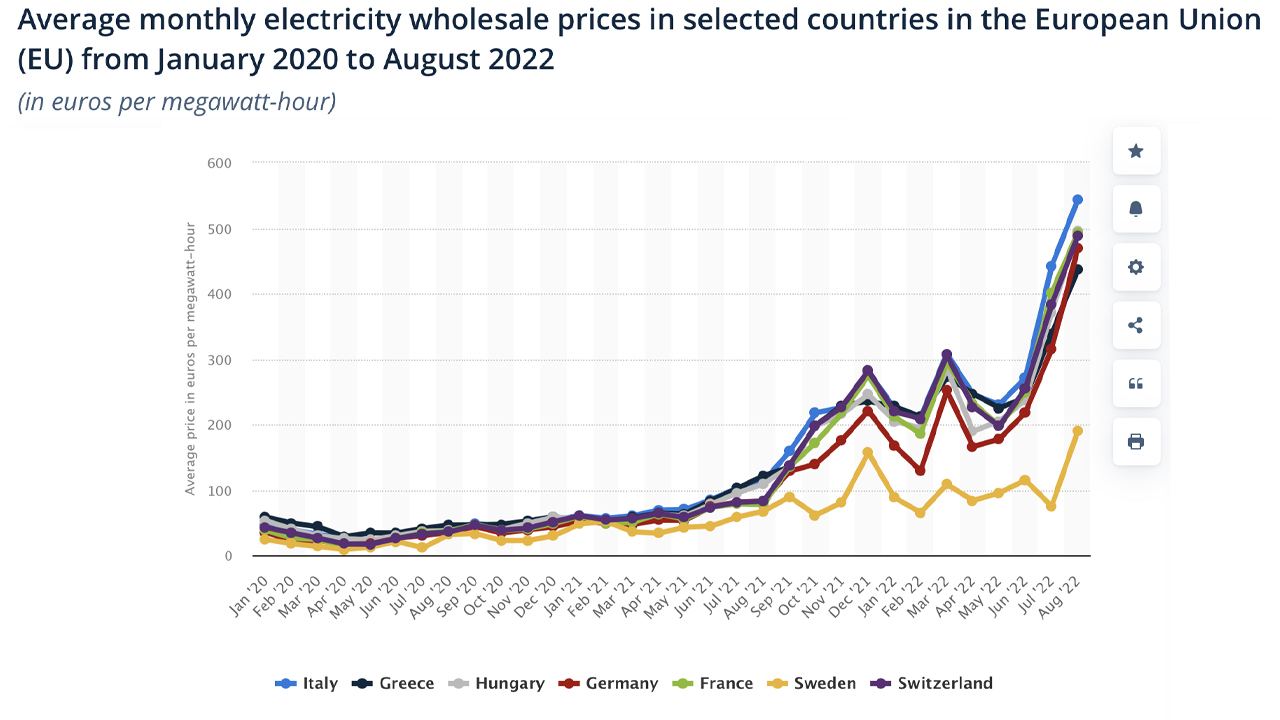

The world’s economy looks even worse following the Nord Stream pipeline rupture as many people believe the conflict between the West and Russia has heightened a great deal. The United Nations details that the destruction might have been the largest methane release ever recorded in history. Furthermore, the Nord Stream pipeline issue means Europe will have a tougher time accessing natural gas this winter. The price of natural gas in the EU has skyrocketed to a lifetime high alongside a myriad of European energy sources.

Moreover, both sides are blaming each other for the Nord Stream pipeline rupture as Vladimir Putin declared the act an “unprecedented sabotage” and an “act of international terrorism.” Meanwhile, U.S. president Joe Biden said the Nord Stream leak was a “deliberate act of sabotage” as well, and he further noted that the Kremlin blaming the U.S. for the rupture was simply untrue. Putin also noted during a recent speech that “the end of Western hegemony is inevitable.” The speech translated by Konstantin Kisin on September 30 explains that Putin thinks the West is greedy and seeks to enslave nations like Russia.

Kisin’s translation further says that Putin remarked that the West leverages finance and technology to bring other nations to submission. The West collects a “hegemon’s tax,” according to the Russian president. “They do not want us to be free, they want Russians to be a mob of soulless slaves,” Putin told the attendees at the event.

There was a strong reaction from the attendees and one individual says:

We’ll beat them all, we’ll kill them all, we’ll plunder all their stuff. It’s going to be what we love to do.

Amid the heightened tension, a Credit Suisse report says the U.K. and Europe are already in a recession and the U.S. is “flirting” with one. The global investment bank’s analyst explained that some of the weight stemmed from central banks raising interest rates. “Higher rates combined with ongoing shocks lead us to cut GDP forecasts,” the Credit Suisse report details. “The euro area and the U.K. are in recession, China is in a growth recession, and the U.S. is flirting with recession.”

The Credit Suisse report adds:

Crucially, the rising share of price categories above central bank inflation target levels shows inflation is broadening out from a limited group of supply shock related drivers to more general inflation. This broadening requires tighter policy and weaker economies because it increasingly reflects tight labor markets.

The report from Credit Suisse follows the recent statements Citadel CEO Ken Griffin made last Wednesday at a conference. Griffin explained that Citadel is “very focused on the possibility of a recession.” Further, analysts in a report published by S&P Global explain that the U.K. and Europe are already in a recession and the Ukraine-Russia war is exacerbating the region’s gloomy economy. S&P Global’s regional credit conditions chairman, Paul Watters, says the EU has a tough winter ahead, and the European economy faces heightened credit risks.

Watters believes the EU’s measures to put price caps on energy will protect Europeans this winter from the inflationary pressures. “Fiscal support measures deployed by the government, notably the upper limit set on typical household energy bills, will significantly protect household budgets from an even greater inflation squeeze over the winter,” Watters claims. “This, along with ongoing resilience of the labor market, are the main reasons we do not expect the U.K. economy to perform worse.”

S&P Global’s report continues:

Europe faces a difficult and uncertain geopolitical and economic outlook as Russia’s political risk appetite appears to increase after losses of territory in Ukraine, and exorbitant energy prices fuel inflation, triggering interventions to support consumers and businesses, with central banks recalibrating interest levels in quick order.

Meanwhile, the U.S. Dollar Index (DXY) has dropped from the recent highs recorded nine days ago, and a myriad of fiat currencies worldwide have rebounded against the greenback. The euro has managed to rebound by 2.15% during the past seven days against the U.S. dollar, and the U.K.’s pound has increased 3.95% this week. However, the pound is down 14.98% during the last six months, and the euro has shed 11.25% against the greenback. Russia’s ruble, on the other hand, has increased 42.44% against the U.S. dollar during the last six months.

What do you think about the reports that say Europe and the U.K. are already in a recession? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Today’s blustery global economy has everyone on edge as inflation has wreaked havoc on the wallets of ordinary people and energy prices continue to soar worldwide. According to Credit Suisse, “the worst is yet to come,” as the global investment bank’s analysts believe the European Union (EU) and the U.K. are already dealing with a recession. S&P Global has a similar hypothesis as a report published by the Manhattan corporation explains that the U.K. is currently contending with a full-year recession.

The world’s economy looks even worse following the Nord Stream pipeline rupture as many people believe the conflict between the West and Russia has heightened a great deal. The United Nations details that the destruction might have been the largest methane release ever recorded in history. Furthermore, the Nord Stream pipeline issue means Europe will have a tougher time accessing natural gas this winter. The price of natural gas in the EU has skyrocketed to a lifetime high alongside a myriad of European energy sources.

Moreover, both sides are blaming each other for the Nord Stream pipeline rupture as Vladimir Putin declared the act an “unprecedented sabotage” and an “act of international terrorism.” Meanwhile, U.S. president Joe Biden said the Nord Stream leak was a “deliberate act of sabotage” as well, and he further noted that the Kremlin blaming the U.S. for the rupture was simply untrue. Putin also noted during a recent speech that “the end of Western hegemony is inevitable.” The speech translated by Konstantin Kisin on September 30 explains that Putin thinks the West is greedy and seeks to enslave nations like Russia.

Kisin’s translation further says that Putin remarked that the West leverages finance and technology to bring other nations to submission. The West collects a “hegemon’s tax,” according to the Russian president. “They do not want us to be free, they want Russians to be a mob of soulless slaves,” Putin told the attendees at the event.

There was a strong reaction from the attendees and one individual says:

We’ll beat them all, we’ll kill them all, we’ll plunder all their stuff. It’s going to be what we love to do.

Amid the heightened tension, a Credit Suisse report says the U.K. and Europe are already in a recession and the U.S. is “flirting” with one. The global investment bank’s analyst explained that some of the weight stemmed from central banks raising interest rates. “Higher rates combined with ongoing shocks lead us to cut GDP forecasts,” the Credit Suisse report details. “The euro area and the U.K. are in recession, China is in a growth recession, and the U.S. is flirting with recession.”

The Credit Suisse report adds:

Crucially, the rising share of price categories above central bank inflation target levels shows inflation is broadening out from a limited group of supply shock related drivers to more general inflation. This broadening requires tighter policy and weaker economies because it increasingly reflects tight labor markets.

The report from Credit Suisse follows the recent statements Citadel CEO Ken Griffin made last Wednesday at a conference. Griffin explained that Citadel is “very focused on the possibility of a recession.” Further, analysts in a report published by S&P Global explain that the U.K. and Europe are already in a recession and the Ukraine-Russia war is exacerbating the region’s gloomy economy. S&P Global’s regional credit conditions chairman, Paul Watters, says the EU has a tough winter ahead, and the European economy faces heightened credit risks.

Watters believes the EU’s measures to put price caps on energy will protect Europeans this winter from the inflationary pressures. “Fiscal support measures deployed by the government, notably the upper limit set on typical household energy bills, will significantly protect household budgets from an even greater inflation squeeze over the winter,” Watters claims. “This, along with ongoing resilience of the labor market, are the main reasons we do not expect the U.K. economy to perform worse.”

S&P Global’s report continues:

Europe faces a difficult and uncertain geopolitical and economic outlook as Russia’s political risk appetite appears to increase after losses of territory in Ukraine, and exorbitant energy prices fuel inflation, triggering interventions to support consumers and businesses, with central banks recalibrating interest levels in quick order.

Meanwhile, the U.S. Dollar Index (DXY) has dropped from the recent highs recorded nine days ago, and a myriad of fiat currencies worldwide have rebounded against the greenback. The euro has managed to rebound by 2.15% during the past seven days against the U.S. dollar, and the U.K.’s pound has increased 3.95% this week. However, the pound is down 14.98% during the last six months, and the euro has shed 11.25% against the greenback. Russia’s ruble, on the other hand, has increased 42.44% against the U.S. dollar during the last six months.

What do you think about the reports that say Europe and the U.K. are already in a recession? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

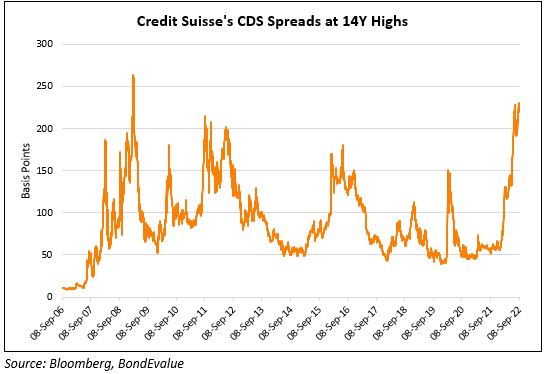

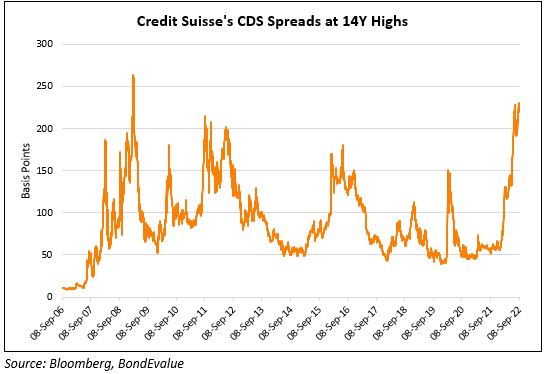

It’s been more than a decade since the financial crisis in 2007-2008 when Lehman Brothers, the fourth largest investment bank in the U.S., collapsed and filed bankruptcy. Close to 14 years later, Credit Suisse and Deutsche Bank, two of the world’s largest banks, are suffering from distressed valuations and the banks’ credit default insurance levels are approaching degrees not seen since 2008.

During the first week of October, the world economy continues to look bleak as energy and gas prices have reached record highs, inflation in many countries is the highest in 40 years, supply chains are fractured, equity markets have shed significant value, and the tensions between the West and Russia has elevated.

Amid this nasty economy, two of the largest investment banks are floundering from distressed valuations. Market data shows that Credit Suisse Group AG (NYSE: CS) and Deutsche Bank AG (NYSE: DB) are trading at extremely low values not seen since the 2008 financial crisis.

At the end of August, Deutsche Bank analyzed the issues tethered to Credit Suisse, and the bank’s analysts noted that there was a $4.1 billion gap that needs to be filled in order to combat the financial institution’s financial well-being. Furthermore, Credit Suisse’s credit default insurance (CDS) levels resemble the same CDS levels Lehman Brothers had just before the bank’s bankruptcy.

Credit Suisse CEO Ulrich Koerner recently explained that his company is facing a “critical moment” and he stressed that the Swiss-based financial institution has a “strong capital base and liquidity position.”

Not everyone agrees with Koerner as a report from investing.com details that a “large investor that deals with Credit Suisse says the investment bank is a disaster, [and] CDS is trading like a ‘Lehman moment’ [is] about to hit.” The managing partner at Compcircle Gurmeet Chadha, however, doesnt think a major market anomaly will reveal itself.

“Since 2008, once a year Credit Suisse [and] once in [two] years Deutsche bank is about to default,” Chadha tweeted. “In Every correction – this speculation starts coming. In my little experience- A black swan event never announces itself.”

Credit Suisse analysts downgrading their own stock to a sell rating pic.twitter.com/SghqtoFnhS

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) October 2, 2022

Chadha’s commentary has not put a cork on the speculation surrounding the two banks and many believe a disaster is imminent. “Credit Suisse is probably going bankrupt,” the Twitter account ‘Wall Street Silver’ told its 320,000 followers.

“The collapse in Credit Suisse’s share price is of great concern,” Wall Street Silver said. “From $14.90 in Feb 2021, to $3.90 currently. And with P/B=0.22, markets are saying it’s insolvent and probably bust.”

Credit Suisse, the 4 key numbers:

160b Cash

400b at call Liabilities

900b Leveraged exposure

40b Equity

— Charlie Munger Fans (@CharlieMunger00) October 1, 2022

An analysis of the situation published on Seeking Alpha also notes that both Credit Suisse and Deutsche Bank are trading at distressed valuations and further says that Credit Suisse “will have to go through a painful restructure.” The Seeking Alpha author writes that “[Credit Suisse] is trading at 0.23x tangible book [and] Deutsche Bank is trading at 0.3x tangible book value.” However, the Seeking Alpha author says that Deutsche Bank is working through the storm via benefits from interest rates. The author adds

Investors should avoid [Credit Suisse] and buy [Deutsche Bank].

Investors believe that the two financial giants are facing a significant crisis and they don’t believe the statements made by the Credit Suisse CEO. Some have criticized the banks’ auditing process as they believe Credit Suisse and Deutsche Bank are up to their necks in debt and bad loans.

“Tell me the real number amount of bad loans outstanding that Credit Suisse has to these hedge funds and family offices like Archegos,” the CEO of Wallstformainst Jason Burack tweeted in August. “Because anyone who fully trusts their accounting also believes in unicorns and the tooth fairy.” At the time of writing, the term “Credit Suisse” is a very popular vertical trend on Twitter on Sunday morning (ET) with 46,000 tweets.

What do you think about the financial issues surrounding Deutsche Bank and Credit Suisse? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photo credit: Nataly Reinch and Rostislav Ageev

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Tony Hawk's Latest NFTs to Come With Signed Physical Skateboards

Last December, the renowned professional skateboarder Tony Hawk released his “Last Trick” non-fungible token (NFT) collection via the NFT marketplace Autograph. Next week, Hawk will be auctioning the skateboards he used during his last tricks, and each of the NFTs ... read more.

It’s been more than a decade since the financial crisis in 2007-2008 when Lehman Brothers, the fourth largest investment bank in the U.S., collapsed and filed bankruptcy. Close to 14 years later, Credit Suisse and Deutsche Bank, two of the world’s largest banks, are suffering from distressed valuations and the banks’ credit default insurance levels are approaching degrees not seen since 2008.

During the first week of October, the world economy continues to look bleak as energy and gas prices have reached record highs, inflation in many countries is the highest in 40 years, supply chains are fractured, equity markets have shed significant value, and the tensions between the West and Russia has elevated.

Amid this nasty economy, two of the largest investment banks are floundering from distressed valuations. Market data shows that Credit Suisse Group AG (NYSE: CS) and Deutsche Bank AG (NYSE: DB) are trading at extremely low values not seen since the 2008 financial crisis.

At the end of August, Deutsche Bank analyzed the issues tethered to Credit Suisse, and the bank’s analysts noted that there was a $4.1 billion gap that needs to be filled in order to combat the financial institution’s financial well-being. Furthermore, Credit Suisse’s credit default insurance (CDS) levels resemble the same CDS levels Lehman Brothers had just before the bank’s bankruptcy.

Credit Suisse CEO Ulrich Koerner recently explained that his company is facing a “critical moment” and he stressed that the Swiss-based financial institution has a “strong capital base and liquidity position.”

Not everyone agrees with Koerner as a report from investing.com details that a “large investor that deals with Credit Suisse says the investment bank is a disaster, [and] CDS is trading like a ‘Lehman moment’ [is] about to hit.” The managing partner at Compcircle Gurmeet Chadha, however, doesnt think a major market anomaly will reveal itself.

“Since 2008, once a year Credit Suisse [and] once in [two] years Deutsche bank is about to default,” Chadha tweeted. “In Every correction – this speculation starts coming. In my little experience- A black swan event never announces itself.”

Credit Suisse analysts downgrading their own stock to a sell rating pic.twitter.com/SghqtoFnhS

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) October 2, 2022

Chadha’s commentary has not put a cork on the speculation surrounding the two banks and many believe a disaster is imminent. “Credit Suisse is probably going bankrupt,” the Twitter account ‘Wall Street Silver’ told its 320,000 followers.

“The collapse in Credit Suisse’s share price is of great concern,” Wall Street Silver said. “From $14.90 in Feb 2021, to $3.90 currently. And with P/B=0.22, markets are saying it’s insolvent and probably bust.”

Credit Suisse, the 4 key numbers:

160b Cash

400b at call Liabilities

900b Leveraged exposure

40b Equity

— Charlie Munger Fans (@CharlieMunger00) October 1, 2022

An analysis of the situation published on Seeking Alpha also notes that both Credit Suisse and Deutsche Bank are trading at distressed valuations and further says that Credit Suisse “will have to go through a painful restructure.” The Seeking Alpha author writes that “[Credit Suisse] is trading at 0.23x tangible book [and] Deutsche Bank is trading at 0.3x tangible book value.” However, the Seeking Alpha author says that Deutsche Bank is working through the storm via benefits from interest rates. The author adds

Investors should avoid [Credit Suisse] and buy [Deutsche Bank].

Investors believe that the two financial giants are facing a significant crisis and they don’t believe the statements made by the Credit Suisse CEO. Some have criticized the banks’ auditing process as they believe Credit Suisse and Deutsche Bank are up to their necks in debt and bad loans.

“Tell me the real number amount of bad loans outstanding that Credit Suisse has to these hedge funds and family offices like Archegos,” the CEO of Wallstformainst Jason Burack tweeted in August. “Because anyone who fully trusts their accounting also believes in unicorns and the tooth fairy.” At the time of writing, the term “Credit Suisse” is a very popular vertical trend on Twitter on Sunday morning (ET) with 46,000 tweets.

What do you think about the financial issues surrounding Deutsche Bank and Credit Suisse? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photo credit: Nataly Reinch and Rostislav Ageev

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Tony Hawk's Latest NFTs to Come With Signed Physical Skateboards

Last December, the renowned professional skateboarder Tony Hawk released his “Last Trick” non-fungible token (NFT) collection via the NFT marketplace Autograph. Next week, Hawk will be auctioning the skateboards he used during his last tricks, and each of the NFTs ... read more.

PRESS RELEASE. On 15 October, England men will face the Samoa men at St James Park in the opening match of the Rugby League World Cup (RLWC) 2021, which will conclude in Manchester on 18 November with the wheelchair final and a spectacular doubleheader at Old Trafford on 19 November for the men’s and women’s finals.

For the first time in tournament history, the men’s, women’s, and wheelchair competitions will take place simultaneously, with the BBC broadcasting all 61 matches live. More than 600 players and 32 teams will compete across 17 host cities and 21 stadiums, including London, Manchester, Newcastle, York, Leeds, Coventry, and Sheffield.

Having been postponed from 2021 to 2022 due to the Covid-19 pandemic, this year’s Rugby League World Cup will be the 16th edition, and CoinEx, the leading cryptocurrency exchange, will be cheering all teams on as the tournament’s exclusive cryptocurrency trading platform partner.

Cryptocurrencies are becoming more prevalent in the sports industry. By providing easy-to-use crypto products and pleasant, convenient crypto trading experiences, CoinEx is committed to making crypto trading easier for all crypto users.

Currently available in 16 languages, including Chinese, English, Spanish, French, and Portuguese, CoinEx offers products and services, including spot trading, futures contracts, margin trading, mining, AMM, CoinEx Dock, Pledging, etc. With over 3 million users across more than 200 countries and regions, the exchange provides an easy-to-use, secure, and reliable crypto trading service. Furthermore, it offers trading sections for Bitcoin, Bitcoin Cash, and stablecoins, as well as 600+ excellent, innovative cryptos, giving crypto users a wider variety of trading options.

In the past year, CoinEx has won the recognition of users because of the ease of use of its products, the speed of its service, the stability of its performance, and the smoothness of its deposits/withdrawals.

It is now CoinEx’s pleasure to be part of the biggest, most exciting, and most inclusive Rugby League World Cup in history and to witness the extraordinary performances of the participants at RLWC2021.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

Source From : News