Geneva, Switzerland / November 8, 2022 / – Messari, the leading provider of crypto market intelligence, released two quarterly analysis reports related to the TRON ecosystem – State of TRON Q3 2022 and State of USDD Q3 2022. Both reports indicated positive conclusions about the stable and secure strength of USDD and the TRON network as a whole.

The USDD report marked the first time Messari provided market intelligence in quarterly report form on the over-collateralized stablecoin issued by the TRON DAO Reserve (TDR), custodian of USDD, currently with nine whitelisted members. USDD is backed by select crypto assets, including BTC, USDT, USDC, and TRX. The State of USDD report includes insights on performance, issuance, deposits, reserve balance, user adoption, transactions, price analysis, and total value locked. Readers can also get qualitative analysis on subjects such as monetary policy and the peg stability module (PSM).

Key insights on the USDD Report include:

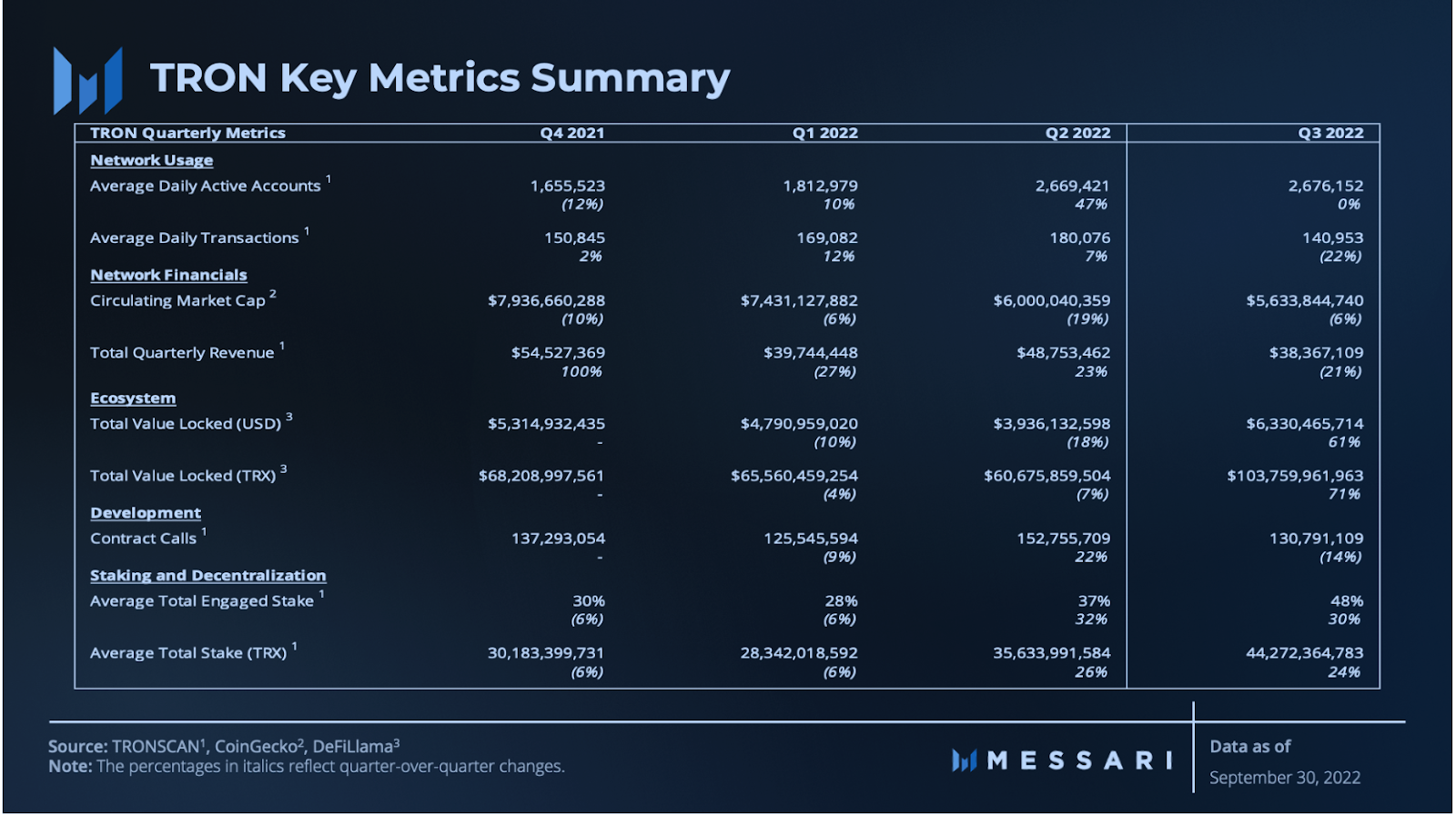

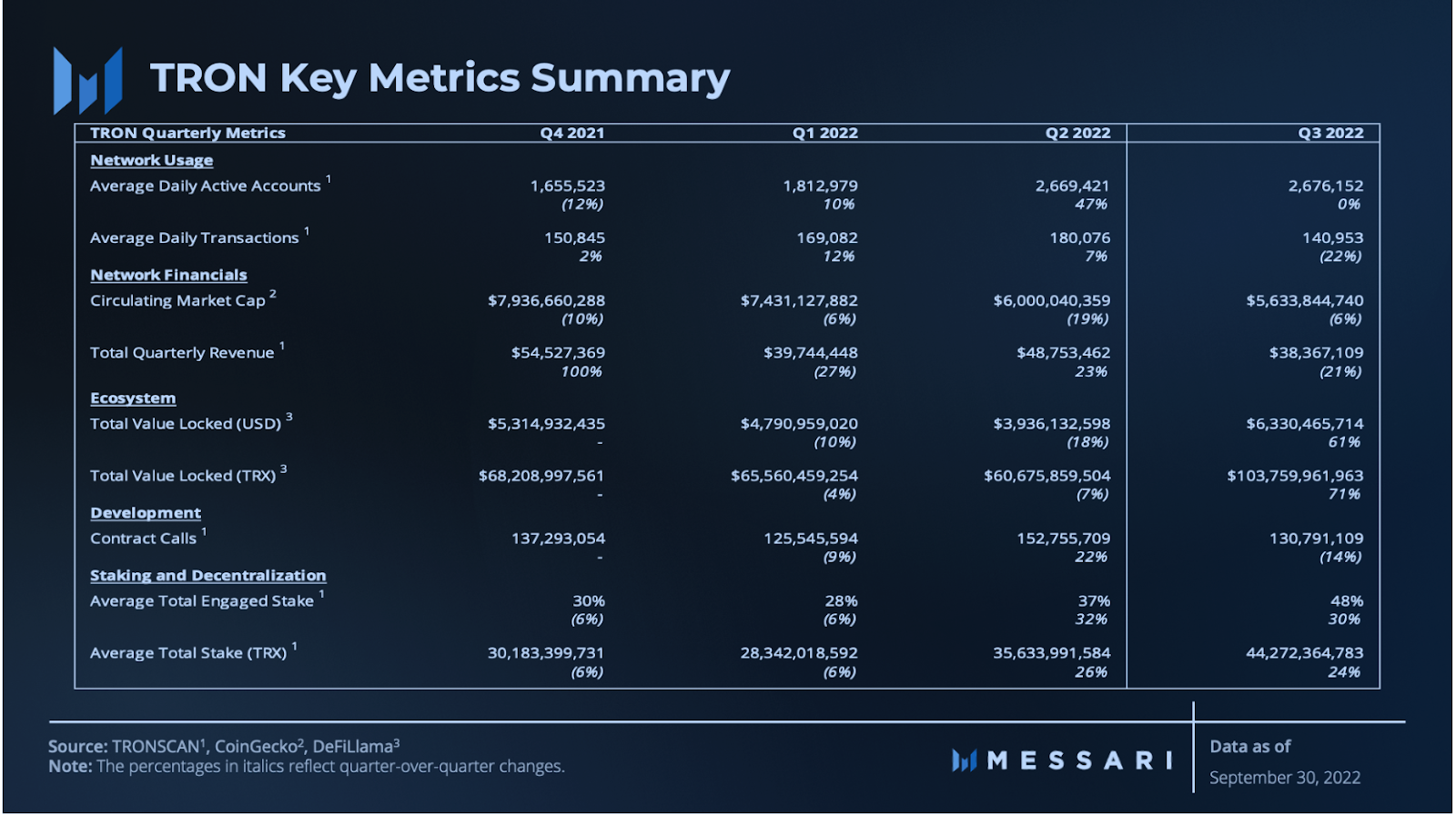

The State of TRON Report was also the first edition of quarterly coverage from Messari. This report highlights performance analysis, ecosystem development, and qualitative analysis. Readers can also get an overview of TRON’s TVL, Strategy and Challenges, and a forecast of the road ahead.

Key insights on the TRON Report include:

Both reports noted the stabilizing effect of USDD’s collateralization, adoption, and future use cases. The TRON DAO community is thrilled with the encouraging conclusions from the Messari research team.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Tony Hawk's Latest NFTs to Come With Signed Physical Skateboards

Last December, the renowned professional skateboarder Tony Hawk released his “Last Trick” non-fungible token (NFT) collection via the NFT marketplace Autograph. Next week, Hawk will be auctioning the skateboards he used during his last tricks, and each of the NFTs ... read more.

Geneva, Switzerland / November 8, 2022 / – Messari, the leading provider of crypto market intelligence, released two quarterly analysis reports related to the TRON ecosystem – State of TRON Q3 2022 and State of USDD Q3 2022. Both reports indicated positive conclusions about the stable and secure strength of USDD and the TRON network as a whole.

The USDD report marked the first time Messari provided market intelligence in quarterly report form on the over-collateralized stablecoin issued by the TRON DAO Reserve (TDR), custodian of USDD, currently with nine whitelisted members. USDD is backed by select crypto assets, including BTC, USDT, USDC, and TRX. The State of USDD report includes insights on performance, issuance, deposits, reserve balance, user adoption, transactions, price analysis, and total value locked. Readers can also get qualitative analysis on subjects such as monetary policy and the peg stability module (PSM).

Key insights on the USDD Report include:

The State of TRON Report was also the first edition of quarterly coverage from Messari. This report highlights performance analysis, ecosystem development, and qualitative analysis. Readers can also get an overview of TRON’s TVL, Strategy and Challenges, and a forecast of the road ahead.

Key insights on the TRON Report include:

Both reports noted the stabilizing effect of USDD’s collateralization, adoption, and future use cases. The TRON DAO community is thrilled with the encouraging conclusions from the Messari research team.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Tony Hawk's Latest NFTs to Come With Signed Physical Skateboards

Last December, the renowned professional skateboarder Tony Hawk released his “Last Trick” non-fungible token (NFT) collection via the NFT marketplace Autograph. Next week, Hawk will be auctioning the skateboards he used during his last tricks, and each of the NFTs ... read more.

After all the speculation surrounding the crypto exchanges Binance and FTX, Binance CEO Changpeng Zhao (CZ) revealed that his company is set to acquire FTX. CZ detailed that FTX asked for help and noted there is a “significant liquidity crunch.” FTX CEO Sam Bankman-Fried has confirmed the acquisition will take place.

On Nov. 8, 2022, Binance CEO Changpeng Zhao (CZ) revealed that his company would be taking over FTX. “This afternoon, FTX asked for our help,” CZ wrote. “There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire [FTX] and help cover the liquidity crunch. We will be conducting a full DD in the coming days.”

The acquisition news follows CZ explaining earlier this week his exchange would be dumping its FTT holdings. A significant amount of speculation followed and the crypto community began to monitor FTX-associated crypto addresses. Following CZ’s announcement on Tuesday, Bankman-Fried confirmed that Binance would be taking over the company. The FTX CEO said:

Things have come full circle, and [FTX’s] first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for [FTX] (pending DD etc.).

Bankman-Fried added that FTX and Binance teams were working on clearing a backlog of withdrawals. “This will clear out liquidity crunches; all assets will be covered 1:1. This is one of the main reasons we’ve asked Binance to come in. It may take a bit to settle etc. — we apologize for that,” Bankman-Fried detailed.

What do you think about Binance acquiring FTX after the last few days of speculation? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

After all the speculation surrounding the crypto exchanges Binance and FTX, Binance CEO Changpeng Zhao (CZ) revealed that his company is set to acquire FTX. CZ detailed that FTX asked for help and noted there is a “significant liquidity crunch.” FTX CEO Sam Bankman-Fried has confirmed the acquisition will take place.

On Nov. 8, 2022, Binance CEO Changpeng Zhao (CZ) revealed that his company would be taking over FTX. “This afternoon, FTX asked for our help,” CZ wrote. “There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire [FTX] and help cover the liquidity crunch. We will be conducting a full DD in the coming days.”

The acquisition news follows CZ explaining earlier this week his exchange would be dumping its FTT holdings. A significant amount of speculation followed and the crypto community began to monitor FTX-associated crypto addresses. Following CZ’s announcement on Tuesday, Bankman-Fried confirmed that Binance would be taking over the company. The FTX CEO said:

Things have come full circle, and [FTX’s] first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for [FTX] (pending DD etc.).

Bankman-Fried added that FTX and Binance teams were working on clearing a backlog of withdrawals. “This will clear out liquidity crunches; all assets will be covered 1:1. This is one of the main reasons we’ve asked Binance to come in. It may take a bit to settle etc. — we apologize for that,” Bankman-Fried detailed.

What do you think about Binance acquiring FTX after the last few days of speculation? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

PRESS RELEASE. KLAB is a new green cryptocurrency from KLABRATE WORLD that will offer its native digital token via a presale campaign.

The KLAB token offers the opportunity to buy into an innovative and exciting project at the best price possible. In fact, as of writing, the first tranche of KLAB tokens will be available to buy at $0.0125

Once that allocation sells, the crypto presale price will rise to $0.0175.

KLABRATE WORLD is the first eco metaverse tied to carbon offsetting for individuals and socially minded businesses.

Climate change is one of the biggest challenges facing humanity. Research shows that the best way to attract support for green projects is to make it easy, fun and financially rewarding for everyone to participate.

Those who buy KLAB tokens during the presale can choose to convert them to plots of land in Klabrate World as well as gaining exposure to the fast-growing $1.2 billion carbon credit market. This enables buyers to list their land or carbon credits in the Klabrate marketplace, with valuations depending on supply and demand from other landowners and the price of carbon credits in this fast-growing global market.

It is also important to note that the KLAB token is not aimed solely at individuals who wish to gain exposure to a green crypto. On the contrary, KLABRATE WORLD will be utilized by tens of thousands of businesses, brands and social organizations worldwide. As such, the KLAB token offer a great alternative to other green projects, not least because it is designed to be the most sustainable cryptocurrency in the space.

Learn More Here:

Join Presale: https://klabrateworld.com

Telegram: https://t.me/klabrateworld

Discord: https://discord.gg/PFMtt8Yyvc

Twitter:https://twitter.com/klabrateworld

Media Enquiries: tim@klabrate.com

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

PRESS RELEASE. KLAB is a new green cryptocurrency from KLABRATE WORLD that will offer its native digital token via a presale campaign.

The KLAB token offers the opportunity to buy into an innovative and exciting project at the best price possible. In fact, as of writing, the first tranche of KLAB tokens will be available to buy at $0.0125

Once that allocation sells, the crypto presale price will rise to $0.0175.

KLABRATE WORLD is the first eco metaverse tied to carbon offsetting for individuals and socially minded businesses.

Climate change is one of the biggest challenges facing humanity. Research shows that the best way to attract support for green projects is to make it easy, fun and financially rewarding for everyone to participate.

Those who buy KLAB tokens during the presale can choose to convert them to plots of land in Klabrate World as well as gaining exposure to the fast-growing $1.2 billion carbon credit market. This enables buyers to list their land or carbon credits in the Klabrate marketplace, with valuations depending on supply and demand from other landowners and the price of carbon credits in this fast-growing global market.

It is also important to note that the KLAB token is not aimed solely at individuals who wish to gain exposure to a green crypto. On the contrary, KLABRATE WORLD will be utilized by tens of thousands of businesses, brands and social organizations worldwide. As such, the KLAB token offer a great alternative to other green projects, not least because it is designed to be the most sustainable cryptocurrency in the space.

Learn More Here:

Join Presale: https://klabrateworld.com

Telegram: https://t.me/klabrateworld

Discord: https://discord.gg/PFMtt8Yyvc

Twitter:https://twitter.com/klabrateworld

Media Enquiries: tim@klabrate.com

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

PRESS RELEASE. The global cryptocurrency wealth management platform, Flynt Finance based in Singapore has unveiled a strategy to earn a high yield of up to 25% capitalizing on the inefficiencies in Ethereum options markets. The ETH product is similar to their previous hit strategy, the Bitcoin Covered Call x5 strategy, consistently generating approximately 50% APY.

Options Market Inefficiency

As the crypto bear market continues, price uncertainties have made it difficult for traders to predict price direction. Especially seeing recent bitcoin volatilities hitting its 27-month-lows, many institutional and retail traders are diversifying their trade strategies through cryptocurrency options to capture profits in the choppy environment. Furthermore, options trading volume has increased significantly as Decentralized Option Vaults (DOVs) came into play. At peak, a single platform was selling $300M in call options each week.

Under current conditions, due to the repetitive nature of the concentrated sell-side pressure from DOV products, the price of options falls sharply around the time of expiry.

Recent research by OrBit Markets, an exotic derivatives desk, which analyzed the implied volatility (IV) of a 1-week timeframe for ETH-USD illustrated extremely low levels of IV between 6 am to 3 pm UTC. The IV accounts as an important factor in pricing options. Lower IV means lower option prices and as for DOVs which sell options, they need higher IV to attain higher APYs. This hints at an inefficiency in the market due to the emergence of large DOVs writing covered call options each week at the same time.

Flynt Finance Takes Advantage of the Market Inefficiency

The general procedure for the covered calls strategy is selling covered calls that expire in 7 days. However, as this is a rolling strategy, the trade can only be made once the settlement takes place – usually at 8 am UTC Friday. Flynt Finance is introducing a unique strategy that not only systematically sells far out-of-the-money weekly call options and auto-compounds the premium every week, but also produces additional premiums by monitoring option prices and taking shorter-term positions when options are considered overpriced.

Flynt Finance’s Head of Quant Research, 0xTinkerer says “the call option writing for digital assets has increased significantly over the last year and the options market is still in its infancy. There are multiple opportunities in the market as it matures and Flynt will be focusing on taking advantage of this gap.”

The transparency of Flynt’s strategies has taken the industry’s standards to the next level to the point where clients can see every single trade detail of the product. This has also enhanced trust in the financial service resulting in weekly transacted volumes of $2M in just two months from launch.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

PRESS RELEASE. The global cryptocurrency wealth management platform, Flynt Finance based in Singapore has unveiled a strategy to earn a high yield of up to 25% capitalizing on the inefficiencies in Ethereum options markets. The ETH product is similar to their previous hit strategy, the Bitcoin Covered Call x5 strategy, consistently generating approximately 50% APY.

Options Market Inefficiency

As the crypto bear market continues, price uncertainties have made it difficult for traders to predict price direction. Especially seeing recent bitcoin volatilities hitting its 27-month-lows, many institutional and retail traders are diversifying their trade strategies through cryptocurrency options to capture profits in the choppy environment. Furthermore, options trading volume has increased significantly as Decentralized Option Vaults (DOVs) came into play. At peak, a single platform was selling $300M in call options each week.

Under current conditions, due to the repetitive nature of the concentrated sell-side pressure from DOV products, the price of options falls sharply around the time of expiry.

Recent research by OrBit Markets, an exotic derivatives desk, which analyzed the implied volatility (IV) of a 1-week timeframe for ETH-USD illustrated extremely low levels of IV between 6 am to 3 pm UTC. The IV accounts as an important factor in pricing options. Lower IV means lower option prices and as for DOVs which sell options, they need higher IV to attain higher APYs. This hints at an inefficiency in the market due to the emergence of large DOVs writing covered call options each week at the same time.

Flynt Finance Takes Advantage of the Market Inefficiency

The general procedure for the covered calls strategy is selling covered calls that expire in 7 days. However, as this is a rolling strategy, the trade can only be made once the settlement takes place – usually at 8 am UTC Friday. Flynt Finance is introducing a unique strategy that not only systematically sells far out-of-the-money weekly call options and auto-compounds the premium every week, but also produces additional premiums by monitoring option prices and taking shorter-term positions when options are considered overpriced.

Flynt Finance’s Head of Quant Research, 0xTinkerer says “the call option writing for digital assets has increased significantly over the last year and the options market is still in its infancy. There are multiple opportunities in the market as it matures and Flynt will be focusing on taking advantage of this gap.”

The transparency of Flynt’s strategies has taken the industry’s standards to the next level to the point where clients can see every single trade detail of the product. This has also enhanced trust in the financial service resulting in weekly transacted volumes of $2M in just two months from launch.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

Bitcoin.com, a digital ecosystem and secure self-custody platform where users can safely and easily interact with cryptocurrencies and digital assets, has launched support for Ethereum in its decentralized exchange, Verse DEX, with ~$2 million in liquidity initially distributed across six trading pairs.

The full-featured decentralized exchange will work seamlessly with the self-custodial multichain Bitcoin.com Wallet, providing millions of people with a simple but secure way to permissionlessly swap cryptocurrencies without having to rely on third-party custodians.

“Bitcoin.com is a gateway for millions of newcomers to decentralized finance. In line with our mission to create economic freedom in the world, we are committed to providing the tools these people to need to trade and invest without counter-party risk,” said Bitcoin.com CEO Dennis Jarvis. “Verse DEX is just such a tool, and we are excited at the prospect of it enabling permissionless trading for people around the world.”

Support for Ethereum in the Verse DEX comes ahead of the launch of Bitcoin.com’s VERSE, the utility and rewards token for the Bitcoin.com ecosystem. VERSE, like the Verse DEX, will start out on the Ethereum network but soon expand into low-fee alternative layer-one chains.

Strategic buyers purchased $33.6 million in a private sale of VERSE tokens in May. The Verse public token sale is currently underway at getverse.com, where 2% of the token supply is up for grabs in a dynamically priced sale that could see public sale buyers pay a lower price per token than those who purchased in the first round.

Currently anyone can add liquidity to trading pairs on the Verse DEX and earn a share of the trading fees generated. Applications for token listings are being accepted here. Once the VERSE token has launched following the conclusion of the public token sale, liquidity providers to the Verse DEX will also receive liquidity pool tokens which will be redeemable for VERSE and other cryptocurrencies.

Since 2015, Bitcoin.com has been a global leader in introducing newcomers to crypto. Featuring accessible educational materials, timely and objective news, and intuitive self-custodial products, we make it easy for anyone to buy, spend, trade, invest, earn, and stay up-to-date on cryptocurrency and the future of finance.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Source From : News