Online communities that develop organically are the holy-grail of Web3 projects. Not only are they an indication of the strength of a virtual platform, but represent a cornerstone in the formation of social and economic immersion. While the web3 metaverse industry still relies heavily on token-incentives for user interaction, Upland is emerging as a unique platform where players form communities in a specific (virtual) geographic location.

This trend has been discussed theoretically by crypto’s modern-day political philosophers. In his 2022 groundbreaking book The Network State, Balaji Srinivasan describes the initial stages of Startup Societies as “online communities with aspirations of something greater”, and Network Unions as “groups capable of collective action with a purpose, coordinating its members for their mutual benefit”. It seems that some of the ‘nodes’ in the Upland metaverse may already fulfill this prerequisite.

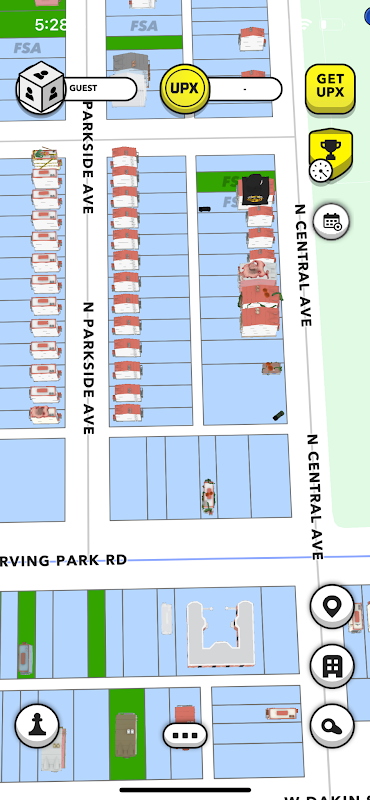

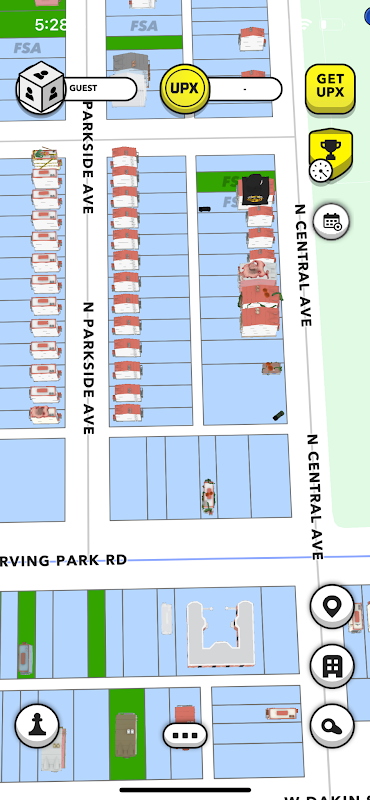

Upland is an open web3 metaverse platform mapped to the real world. The company’s mission is to “build the most dynamic maker-communities through a strong entrepreneur economy that allows players, creators, developers, and brands to manufacture goods and experiences, monetize assets, and provide utility and fun to other players.” Headquartered in Silicon Valley with hubs in Las Vegas, Ukraine, and Brazil, Upland was named among Fast Company’s “Next Big Things in Tech” in 2021 and one of “22 San Francisco Startups To Watch in 2022” by Built In SF. Like monopoly coming to life, Upland makes the familiar and relatable into virtual.

The Upland Community Directory shows how these initiatives manifest. One can see that UCN Broadcasters–players who create content–have initiated communities, with the Holliswood node in Queens, NY being one such example. Raddishhead, operating the popular YouTube channel Upland Analysis, has been working with channel followers to build the neighborhood in Queens and make it their own. Now about 30% built, as a community, they have pulled their spark (building resources) and UPX to develop the node and incentivise building participation.

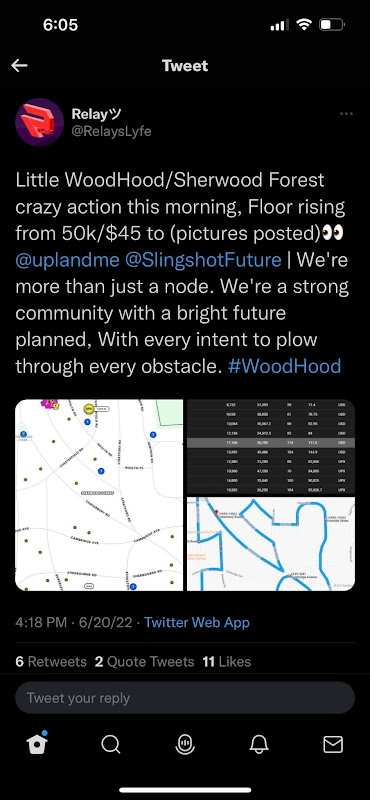

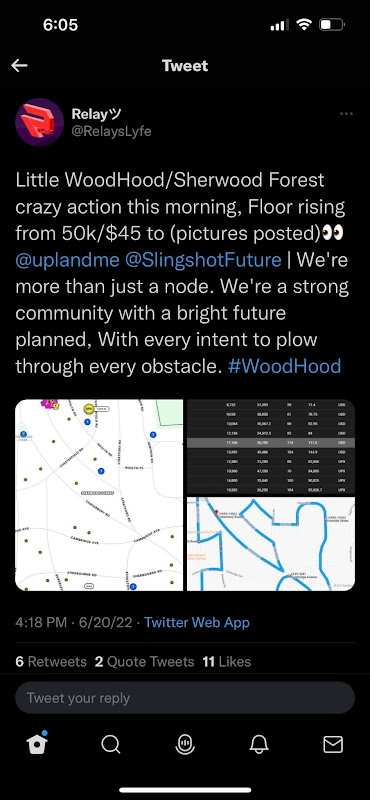

Interestingly, players from specific nationalities have created “expat” communities in the Upland metaverse. Whether it’s the Canadian Uplanders’ Group node in Maple Park, Kansas City, Japan Town in Bucktown Chicago, or the Israel “Kibbutz” in Granada Hills, LA. Upland players enthusiastically connect with their real life fellow-nationals in the virtual world. Take Fresh Meadows, Queens as an example. Led by Brazilian influencers Lucas Mucida (Upland Player of the Year), Bruno Clash, P2ECrew, Heitor Miguel and Rai Cripto, and together with Brazilian brand partners Flex Interativa and BeFly, over 50 players joined to buy properties in what is now known as “Little Brazil”. With over 300 properties minted in a “minting party,” players worked out the strategy, timing, and tried to bring a real sense of community to the process. In their Discord channel discussions, the node is already making future plans for Brazilian flags as outdoor decor and building a manufacturing plant and a showroom. They are working with their brand partners to host a Little Brazil Music Festival in the neighborhood, similar to the Brazilian Day that happens in real life in New York.

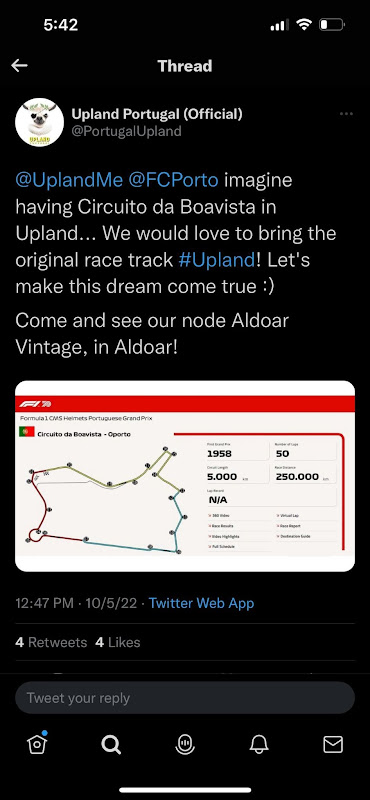

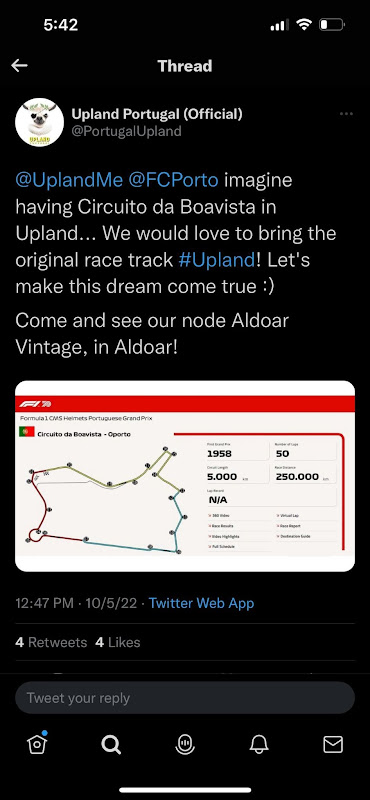

Some communities are forming around specific interests, rather than geographies. The Upland Racing League (URL) is a community built around cars and racing in Upland. The founders DAK & MASSCHEF organized seasons of racing throughout Upland with Race Commissioners – players who are putting together Teams; Planners – players who are designing the different racetracks; and Drivers who race. The 700 Discord members, the community is building tracks, manufacturing outdoor decor for the tracks, and collectively decides on rules. Developing this further as a Layer2 overlay of Upland, the URL is building a 3rd party racing in Unity as a skill-based race.

Other nodes are organically joining forces with this initiative. Boystown node in Chicago for example, is louding the development of their neighborhood’s Circuit Race Track “sanctioned by URL”. This is a good example of Balaji Srinivasan’s description of Web3 community vs Web2 communities. Balaji’s notion being that in web3 “we are all in this together” while web2 games are a one-way player interaction with project operators. Facilitating the Web3 approach, Upland’s roadmap is indicative of a strategy of building tools for players to develop prosperous communities and economies on their own, like the URL.

Many of the Upland nodes also develop independent initiatives and Governance. An example of one such community is Portage Park. Winners of the 2021 Halloween decoration challenge, the node takes pride in their community activities. Russellenvy, the newly elected first mayor of the Portage Park node in Upland’s Chicago described some of the community plans they are pursuing: “We are attracting more Metaventures to Portage Park; Block explorer shops, NFLPA legit shops, outdoor decor and more. We also look forward to dev shops and expanding into layer two applications”. Describing the Governance mechanism the community has created, the Mayor said they have “Formed a Council that is made up of three elected individuals (DongDingBat, CrownHandler, Outsomniac), four moderators (CityRunner, COOP, MRFR, Hanzilla206) and the Mayor. Any member of the Portage Park community can suggest an idea for a contest/giveaway. The council then gathers and discusses which ideas they would like to pursue further.” The Council, he mentioned, communicates directly with the individuals about the proposal and picks which to present to the community. Initiatives aim to better the community, build more structures or help bring in new players. A great example of this process is the Portage Park Building Guidelines. The community decided to limit the structure color scheme to while and red, but to make everyone happy, guidelines were amended to allow a different accent or details color. While property prices naturally rose with the popularity of the node, OG players sell to new ones below market value to maintain accessibility and incentivize community growth. “It’s truly a great community.” Russellenvy said with pride.

Examples of Nodes in Upland:

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Following a Brief Fee Spike, Gas Prices to Move Ethereum Drop 76% in 12 Days

Transaction fees on the Ethereum network are dropping again after average fees saw a brief spike on April 5 jumping to $43 per transfer. 12 days later, average ether fees are close to dropping below $10 per transaction and median-sized ... read more.

Online communities that develop organically are the holy-grail of Web3 projects. Not only are they an indication of the strength of a virtual platform, but represent a cornerstone in the formation of social and economic immersion. While the web3 metaverse industry still relies heavily on token-incentives for user interaction, Upland is emerging as a unique platform where players form communities in a specific (virtual) geographic location.

This trend has been discussed theoretically by crypto’s modern-day political philosophers. In his 2022 groundbreaking book The Network State, Balaji Srinivasan describes the initial stages of Startup Societies as “online communities with aspirations of something greater”, and Network Unions as “groups capable of collective action with a purpose, coordinating its members for their mutual benefit”. It seems that some of the ‘nodes’ in the Upland metaverse may already fulfill this prerequisite.

Upland is an open web3 metaverse platform mapped to the real world. The company’s mission is to “build the most dynamic maker-communities through a strong entrepreneur economy that allows players, creators, developers, and brands to manufacture goods and experiences, monetize assets, and provide utility and fun to other players.” Headquartered in Silicon Valley with hubs in Las Vegas, Ukraine, and Brazil, Upland was named among Fast Company’s “Next Big Things in Tech” in 2021 and one of “22 San Francisco Startups To Watch in 2022” by Built In SF. Like monopoly coming to life, Upland makes the familiar and relatable into virtual.

The Upland Community Directory shows how these initiatives manifest. One can see that UCN Broadcasters–players who create content–have initiated communities, with the Holliswood node in Queens, NY being one such example. Raddishhead, operating the popular YouTube channel Upland Analysis, has been working with channel followers to build the neighborhood in Queens and make it their own. Now about 30% built, as a community, they have pulled their spark (building resources) and UPX to develop the node and incentivise building participation.

Interestingly, players from specific nationalities have created “expat” communities in the Upland metaverse. Whether it’s the Canadian Uplanders’ Group node in Maple Park, Kansas City, Japan Town in Bucktown Chicago, or the Israel “Kibbutz” in Granada Hills, LA. Upland players enthusiastically connect with their real life fellow-nationals in the virtual world. Take Fresh Meadows, Queens as an example. Led by Brazilian influencers Lucas Mucida (Upland Player of the Year), Bruno Clash, P2ECrew, Heitor Miguel and Rai Cripto, and together with Brazilian brand partners Flex Interativa and BeFly, over 50 players joined to buy properties in what is now known as “Little Brazil”. With over 300 properties minted in a “minting party,” players worked out the strategy, timing, and tried to bring a real sense of community to the process. In their Discord channel discussions, the node is already making future plans for Brazilian flags as outdoor decor and building a manufacturing plant and a showroom. They are working with their brand partners to host a Little Brazil Music Festival in the neighborhood, similar to the Brazilian Day that happens in real life in New York.

Some communities are forming around specific interests, rather than geographies. The Upland Racing League (URL) is a community built around cars and racing in Upland. The founders DAK & MASSCHEF organized seasons of racing throughout Upland with Race Commissioners – players who are putting together Teams; Planners – players who are designing the different racetracks; and Drivers who race. The 700 Discord members, the community is building tracks, manufacturing outdoor decor for the tracks, and collectively decides on rules. Developing this further as a Layer2 overlay of Upland, the URL is building a 3rd party racing in Unity as a skill-based race.

Other nodes are organically joining forces with this initiative. Boystown node in Chicago for example, is louding the development of their neighborhood’s Circuit Race Track “sanctioned by URL”. This is a good example of Balaji Srinivasan’s description of Web3 community vs Web2 communities. Balaji’s notion being that in web3 “we are all in this together” while web2 games are a one-way player interaction with project operators. Facilitating the Web3 approach, Upland’s roadmap is indicative of a strategy of building tools for players to develop prosperous communities and economies on their own, like the URL.

Many of the Upland nodes also develop independent initiatives and Governance. An example of one such community is Portage Park. Winners of the 2021 Halloween decoration challenge, the node takes pride in their community activities. Russellenvy, the newly elected first mayor of the Portage Park node in Upland’s Chicago described some of the community plans they are pursuing: “We are attracting more Metaventures to Portage Park; Block explorer shops, NFLPA legit shops, outdoor decor and more. We also look forward to dev shops and expanding into layer two applications”. Describing the Governance mechanism the community has created, the Mayor said they have “Formed a Council that is made up of three elected individuals (DongDingBat, CrownHandler, Outsomniac), four moderators (CityRunner, COOP, MRFR, Hanzilla206) and the Mayor. Any member of the Portage Park community can suggest an idea for a contest/giveaway. The council then gathers and discusses which ideas they would like to pursue further.” The Council, he mentioned, communicates directly with the individuals about the proposal and picks which to present to the community. Initiatives aim to better the community, build more structures or help bring in new players. A great example of this process is the Portage Park Building Guidelines. The community decided to limit the structure color scheme to while and red, but to make everyone happy, guidelines were amended to allow a different accent or details color. While property prices naturally rose with the popularity of the node, OG players sell to new ones below market value to maintain accessibility and incentivize community growth. “It’s truly a great community.” Russellenvy said with pride.

Examples of Nodes in Upland:

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Following a Brief Fee Spike, Gas Prices to Move Ethereum Drop 76% in 12 Days

Transaction fees on the Ethereum network are dropping again after average fees saw a brief spike on April 5 jumping to $43 per transfer. 12 days later, average ether fees are close to dropping below $10 per transaction and median-sized ... read more.

According to recent reports close to central bank officials, the U.S. Federal Reserve will likely deliver another interest rate hike by roughly 75 basis points (bps) next month. Moreover, markets are predicting another rise by three-quarters of a point, and CME’s Fedwatch Tool indicates there’s a near-certain (98%) chance the central bank will choose a 75bps raise. Despite the market expecting an aggressive Fed, an analyst from investors.com believes the Fed will pivot by December depending “on how financial markets act between now and then.”

It seems pretty certain that the U.S. Federal Reserve will raise the federal funds rate (FFR) by roughly 75bps, according to various reports and CME’s Fedwatch Tool. That’s despite the fact that politicians and a recent United Nations Conference on Trade and Development (UNCTAD) report have urged the Fed to slow down. Analysts from the investment bank Barclays explained this week that the central bank may have to slow down or stop monetary tightening by eliminating balance sheet reductions.

CME’s Fedwatch Tool indicates the chance of a 75bps jump is around 98% today and a report from the New York Times (NYT) published on October 18, says “Federal Reserve officials have coalesced around a plan to raise interest rates by three-quarters of a point next month.” The NYT report further explains that the “conversation about whether to scale back is now more likely to happen in December.” Other reports indicate that futures markets investors have fully priced in a number of FFR increases that will reach 5% by May 2023.

The president of the Philadelphia Fed, Patrick Harker, explained on Thursday that he envisions the FFR well above 4% by 2022’s end. “After that, if we have to, we can tighten further, based on the data,” FT reports. “But we should let the system work itself out. And we also need to recognise that this will take time: Inflation is known to shoot up like a rocket and then come down like a feather,” Harker added. FT’s report further quotes Neel Kashkari, president of the Minneapolis Fed, speaking at a panel about the rate rising past 5%.

Kashkari said:

If we don’t see progress in underlying inflation or core inflation, I don’t see why I would advocate stopping at 4.5%, or 4.75% or something like that. We need to see actual progress in core inflation and services inflation and we are not seeing it yet.

The analyst and author at investors.com, Jed Graham, says that while a 75bps hike is in the cards for November, a “Federal Reserve pivot is coming in December,” according to his premise. Graham’s report surmises that the Fed “won’t pivot until the labor market shows signs of cracking — But once the job market appears to be rolling over, everything will change.” Graham insists that while an overheated job market gives the Fed leverage to be more aggressive, “jumbo rate hikes won’t fly when the job market has already lost steam.”

Graham’s FFR outlook report adds:

However, the outlook also depends on how financial markets act between now and then. If the fledgling stock market rally continues and global bond and currency markets step back from the brink, that would tend to give the Federal Reserve more flexibility to keep hiking. The combination of market distress and a fading labor market could hold the Fed to a quarter-point hike in December, and that might be the last one.

Since the onslaught of interest rate hikes from the Fed, interest rates on various loans in America have followed suit. For example, a 30-year fixed rate for a mortgage in the United States is currently 7.896%, according to bankrate.com. The Federal Reserve will meet on Wednesday, November 2, to address the FFR and share the central bank’s economic plans.

What do you think about the upcoming Fed rate hike in November? Do you expect another 75bps increase? Let us know your thoughts about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

According to recent reports close to central bank officials, the U.S. Federal Reserve will likely deliver another interest rate hike by roughly 75 basis points (bps) next month. Moreover, markets are predicting another rise by three-quarters of a point, and CME’s Fedwatch Tool indicates there’s a near-certain (98%) chance the central bank will choose a 75bps raise. Despite the market expecting an aggressive Fed, an analyst from investors.com believes the Fed will pivot by December depending “on how financial markets act between now and then.”

It seems pretty certain that the U.S. Federal Reserve will raise the federal funds rate (FFR) by roughly 75bps, according to various reports and CME’s Fedwatch Tool. That’s despite the fact that politicians and a recent United Nations Conference on Trade and Development (UNCTAD) report have urged the Fed to slow down. Analysts from the investment bank Barclays explained this week that the central bank may have to slow down or stop monetary tightening by eliminating balance sheet reductions.

CME’s Fedwatch Tool indicates the chance of a 75bps jump is around 98% today and a report from the New York Times (NYT) published on October 18, says “Federal Reserve officials have coalesced around a plan to raise interest rates by three-quarters of a point next month.” The NYT report further explains that the “conversation about whether to scale back is now more likely to happen in December.” Other reports indicate that futures markets investors have fully priced in a number of FFR increases that will reach 5% by May 2023.

The president of the Philadelphia Fed, Patrick Harker, explained on Thursday that he envisions the FFR well above 4% by 2022’s end. “After that, if we have to, we can tighten further, based on the data,” FT reports. “But we should let the system work itself out. And we also need to recognise that this will take time: Inflation is known to shoot up like a rocket and then come down like a feather,” Harker added. FT’s report further quotes Neel Kashkari, president of the Minneapolis Fed, speaking at a panel about the rate rising past 5%.

Kashkari said:

If we don’t see progress in underlying inflation or core inflation, I don’t see why I would advocate stopping at 4.5%, or 4.75% or something like that. We need to see actual progress in core inflation and services inflation and we are not seeing it yet.

The analyst and author at investors.com, Jed Graham, says that while a 75bps hike is in the cards for November, a “Federal Reserve pivot is coming in December,” according to his premise. Graham’s report surmises that the Fed “won’t pivot until the labor market shows signs of cracking — But once the job market appears to be rolling over, everything will change.” Graham insists that while an overheated job market gives the Fed leverage to be more aggressive, “jumbo rate hikes won’t fly when the job market has already lost steam.”

Graham’s FFR outlook report adds:

However, the outlook also depends on how financial markets act between now and then. If the fledgling stock market rally continues and global bond and currency markets step back from the brink, that would tend to give the Federal Reserve more flexibility to keep hiking. The combination of market distress and a fading labor market could hold the Fed to a quarter-point hike in December, and that might be the last one.

Since the onslaught of interest rate hikes from the Fed, interest rates on various loans in America have followed suit. For example, a 30-year fixed rate for a mortgage in the United States is currently 7.896%, according to bankrate.com. The Federal Reserve will meet on Wednesday, November 2, to address the FFR and share the central bank’s economic plans.

What do you think about the upcoming Fed rate hike in November? Do you expect another 75bps increase? Let us know your thoughts about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

PRESS RELEASE. WhiteBIT continues to be the center of discussions in crypto communities worldwide, and there are solid reasons for it. Being the biggest crypto exchange in Europe, WhiteBIT has been pleasing its users with excellent functionality for five years of its existence. Spot and futures trading with up to 20x leverage, efficient passive income tools, and the lowest trading fees are definitely worth the attention. Recently, the exchange released its own WhiteBIT Token, which has organically complemented the Olympus of modern cryptocurrencies, providing its owners with multiple benefits within the exchange.

WBT holders can receive a 100% discount on their maker fee and a 90% discount on their taker fee. They can withdraw their ETH and ERC20 tokens without paying fees. The users can also receive additional perks within the frames of their referral program. These include a 50% share of their referrals’ trading fees. Top it with free AML checks, and you can get a complete package for convenient exchange usage.

The total supply of tokens is 400 000 000 WBT. 200 million of these are treasury tokens that are distributed to the various funds within the ecosystem; they will be unlocked within the next three years.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Bitcoin ATM Operator Indicted in New York Allegedly Running Illegal Business Attracting Criminals

A bitcoin ATM operator has been indicted in New York for running an illegal business "marketed towards individuals engaged in criminal activity." The district attorney in charge described: "Robert Taylor allegedly went to great lengths to keep his bitcoin kiosk ... read more.

PRESS RELEASE. WhiteBIT continues to be the center of discussions in crypto communities worldwide, and there are solid reasons for it. Being the biggest crypto exchange in Europe, WhiteBIT has been pleasing its users with excellent functionality for five years of its existence. Spot and futures trading with up to 20x leverage, efficient passive income tools, and the lowest trading fees are definitely worth the attention. Recently, the exchange released its own WhiteBIT Token, which has organically complemented the Olympus of modern cryptocurrencies, providing its owners with multiple benefits within the exchange.

WBT holders can receive a 100% discount on their maker fee and a 90% discount on their taker fee. They can withdraw their ETH and ERC20 tokens without paying fees. The users can also receive additional perks within the frames of their referral program. These include a 50% share of their referrals’ trading fees. Top it with free AML checks, and you can get a complete package for convenient exchange usage.

The total supply of tokens is 400 000 000 WBT. 200 million of these are treasury tokens that are distributed to the various funds within the ecosystem; they will be unlocked within the next three years.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Bitcoin ATM Operator Indicted in New York Allegedly Running Illegal Business Attracting Criminals

A bitcoin ATM operator has been indicted in New York for running an illegal business "marketed towards individuals engaged in criminal activity." The district attorney in charge described: "Robert Taylor allegedly went to great lengths to keep his bitcoin kiosk ... read more.

PRESS RELEASE. The global leader in providing liquidity and technology for a wide variety of financial markets, B2Broker, is pleased to announce updated pricing policies for its three flagship products – B2Core, MarksMan, and B2Trader. All package prices have been lowered to give more businesses access to the best products on the market. This step represents the company’s commitment to providing only the best services and products that can satisfy the greatest needs of traders and brokerage firms. Thank you for being with us!

Changes in Fees

B2Trader, MarksMan, and B2Core customers are no longer subject to setup fees as any set-up fees for these three products have been removed. Customers will be able to save significant amounts of money by switching to B2Trader and MarksMan since they will not have to pay $25,000 and $2000, respectively, for installation. Aside from that, the elimination of setup fees will facilitate customers’ ability to scale their use of these products as their requirements change. Customer and product providers both benefit from this change.

Due to the fact that B2Broker does not charge set-up fees, we have amended our service agreement in order to offer such incredible savings to our customers. All new clients of B2Trader, Marksman Liquidity Hub, or B2Core are now required to make an upfront payment of three months. We anticipate that this change will simplify our billing process while providing significant cost savings for our clients and innovative solutions for them at the same time.

Customers of B2Trader are no longer required to pay separately for AWS Invoice. B2Broker will continue to provide the service free of charge to our customers, covering the costs ourselves. All our clients have to do is make a monthly payment. Hopefully, this change will facilitate our customers’ financial management and provide them with a greater level of savings.

Changes in the Product

Our packaging system for B2Trader has been redesigned to provide a more user-friendly and straightforward trading experience for our clients. As a result, now all packages offer full functionality, and the differences between them can be boiled down to two factors: the number of instruments available to trade and the depth of the order book. For those who require only a few pairs and a simple order book, you may want to consider the Standard package. The Enterprise package, which includes 100 pairs and an order book of 100×100, is the best option if you are planning to list many coins and tokens.

Moreover, the MarksMan Liquidity Hub Advanced package no longer limits the number of external liquidity providers that can be supported. The change will simplify the process for all clients, allowing them to choose from a wider range of options. All clients will be able to connect to an unlimited number of external liquidity providers as a result of this update. This will help clients provide trading services confidently since they will have access to the best prices available.

Additionally, B2Core has introduced Customer Queues! In order to provide our customers with the best service possible, we have established a regular Customer Queue for Standard and Advanced packages, as well as a dedicated Customer Queue for Enterprise packages. We have already informed all teams, and we are in the process of analyzing requests. Upon approval, however, all tasks related to Enterprise packages will take precedence. In our opinion, this new system will considerably improve the level of service we are able to provide for our clients.

Moreover, all “coming soon” package features have been removed for greater transparency and clarity on what we do. In other words, if a feature is not a part of a package, it will not be available until a later update makes it available. Providing our customers with honest information about which package is best for them will help them make informed decisions.

In order to accurately represent the products, we have updated all integrations and incorporated more modern features. With these updates, we hope to improve your experience and make it more enjoyable for you.

The Prices

As part of our efforts to improve transparency and clarity, we have also revised our pricing structure. Three main products are available from us: B2Trader, MarksMan, and B2Core. In view of the fact that there are no longer any additional charges for services or set-up fees but only a monthly payment, the following prices will apply:

There is a great deal you should know about if you are considering signing up for an annual subscription. The price for committing to a full year of service is reduced by three months free if you sign up for a full year. As a result, instead of making a payment for 12 months, you will only have to make a payment for 9 months.

Conclusion

B2Broker is thrilled to be able to provide even more value to its customers through the new pricing. By offering updated pricing options for B2Core, MarksMan, and B2Trader, a wider range of businesses can benefit from these products. The changes made by B2Broker reflect the company’s commitment to providing its clients with the finest possible service. So, why not get started now? Become a member now and take advantage of these great products at a lower price than ever before! In the coming months, you can expect even more updates and features. Should you have any questions or suggestions, please do not hesitate to contact us.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Tony Hawk's Latest NFTs to Come With Signed Physical Skateboards

Last December, the renowned professional skateboarder Tony Hawk released his “Last Trick” non-fungible token (NFT) collection via the NFT marketplace Autograph. Next week, Hawk will be auctioning the skateboards he used during his last tricks, and each of the NFTs ... read more.

Source From : News