Solana surged by as much as 22% on Monday, as bullish sentiment returned to cryptocurrency markets. The move saw the token climb to its highest point since November, when it was embroiled in the FTX collapse. Cardano also moved higher to start the week, climbing by nearly 13%.

Solana (SOL) was one of Monday’s big movers, as prices of the token rose by as much as 22%.

SOL/USD surged to an intraday high of $16.62 to start the week, which comes less than 24 hours after trading at a low of $13.47.

Today’s rise in price pushed SOL to its strongest point since November 12, days after the token plummeted, after being exposed to the FTX/Alameda scandal.

From the chart, Monday’s rally came following a breakout of a key resistance level at the $15.00 mark.

As a result of this, the 14-day relative strength index (RSI) has risen to 73.26, which is its strongest point since April.

Due to prices now being relatively overbought, there is a strong possibility that there could be a reversal in momentum in the coming days.

Cardano (ADA) was another notable gainer to start the week, with the token climbing for a second straight day.

Following a low of $0.2865 on Sunday, ADA/USD hit a high of $0.3409 earlier in today’s session.

Like with solana, this move saw cardano hit its highest mark since November, and came after a breakout of a ceiling at $0.3250.

Looking at the chart, as a result of today’s rally, the 14-day RSI rose to a level not seen since September 2021.

Due to this, earlier gains have somewhat eased, and as of writing, ADA/USD is trading at $0.3247.

Register your email here to get weekly price analysis updates sent to your inbox:

Could cardano rally back beyond this resistance level in the coming days? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Solana surged by as much as 22% on Monday, as bullish sentiment returned to cryptocurrency markets. The move saw the token climb to its highest point since November, when it was embroiled in the FTX collapse. Cardano also moved higher to start the week, climbing by nearly 13%.

Solana (SOL) was one of Monday’s big movers, as prices of the token rose by as much as 22%.

SOL/USD surged to an intraday high of $16.62 to start the week, which comes less than 24 hours after trading at a low of $13.47.

Today’s rise in price pushed SOL to its strongest point since November 12, days after the token plummeted, after being exposed to the FTX/Alameda scandal.

From the chart, Monday’s rally came following a breakout of a key resistance level at the $15.00 mark.

As a result of this, the 14-day relative strength index (RSI) has risen to 73.26, which is its strongest point since April.

Due to prices now being relatively overbought, there is a strong possibility that there could be a reversal in momentum in the coming days.

Cardano (ADA) was another notable gainer to start the week, with the token climbing for a second straight day.

Following a low of $0.2865 on Sunday, ADA/USD hit a high of $0.3409 earlier in today’s session.

Like with solana, this move saw cardano hit its highest mark since November, and came after a breakout of a ceiling at $0.3250.

Looking at the chart, as a result of today’s rally, the 14-day RSI rose to a level not seen since September 2021.

Due to this, earlier gains have somewhat eased, and as of writing, ADA/USD is trading at $0.3247.

Register your email here to get weekly price analysis updates sent to your inbox:

Could cardano rally back beyond this resistance level in the coming days? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

The U.S. Federal Reserve has raised the benchmark bank rate seven times during the course of 2022, leading many to question when the central bank will cease or change course. The Fed has stated that it aims to bring inflation down to the 2% target, and the increases to the federal funds rate are intended to move toward this goal. However, Zoltan Pozsar, a U.S. macroeconomist and observer of the Fed, predicts that the central bank will start quantitative easing (QE) again by summer. Bill Baruch, an executive at Blue Line Futures, a futures and commodities brokerage firm, anticipates that the Fed will halt rate hikes by February.

Inflation in the U.S. saw a significant increase last year, but has since slowed. After seven rate hikes from the central bank, investors and analysts anticipate that the Fed will change course this year. In an interview with Kitco News, Bill Baruch, president of Blue Line Futures, told Kitco’s anchor and producer David Lin that the U.S. Federal Reserve is likely to halt monetary tightening in February. Baruch pointed to the decrease in inflation and cited manufacturing data as one factor in his prediction.

“I think there is a good chance that we don’t see the Fed hike at all in February,” Baruch told Lin. “We could see something from them that would surprise the markets in the first week of February.” However, Baruch emphasized that markets will be “volatile,” but also will see a strong rally. Baruch stated that the rate hikes “were aggressive,” and he noted that “there were signs in 2021 that the economy was ready to slow.” Baruch added:

But with the Fed hiking those rates right through, that’s what slam-dunked this market down.

There is some uncertainty among analysts as to whether the Federal Reserve will choose to raise the federal funds rate or pivot in its course of action. Bill English, a finance professor at the Yale School of Management, explained to bankrate.com that it is difficult to be certain about the Federal Reserve’s plans for rate hikes in 2023.

“It’s not hard to imagine scenarios where they end up raising rates a fair amount next year,” English said. “It’s also possible they end up cutting rates more if the economy really slows and inflation comes down a lot. It’s hard to be confident about your outlook. The best you can do is balance the risks.”

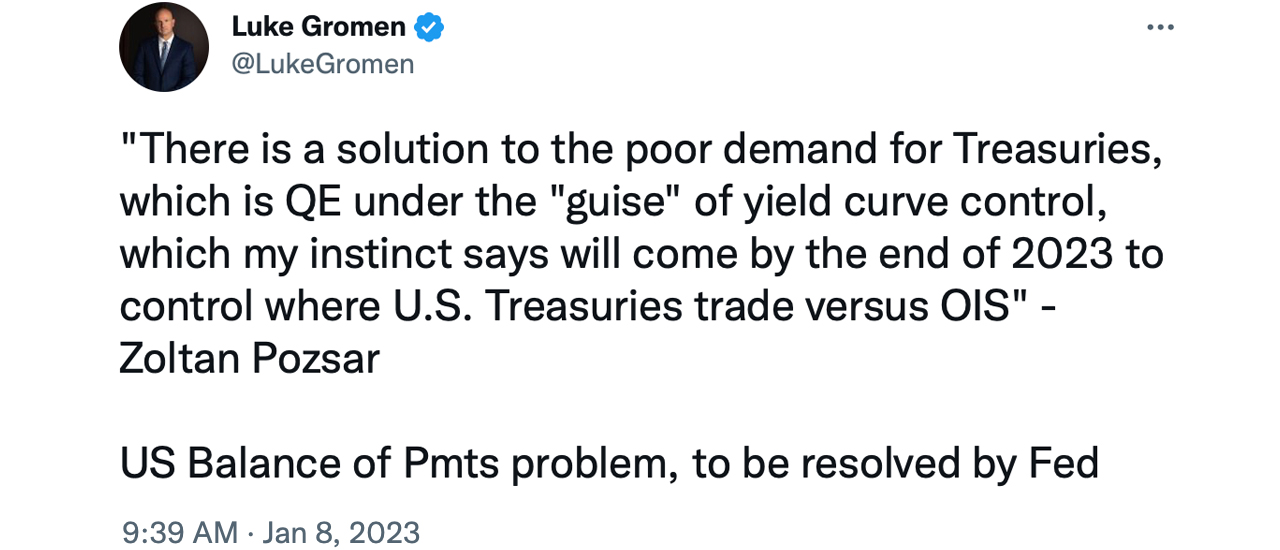

U.S. macroeconomist and Fed watcher Zoltan Pozsar, for his part, thinks the Fed will restart quantitative easing (QE) again by the summer. According to Pozsar, the Fed won’t pivot for a while and Treasuries will go under duress. In a recent zerohedge.com article, the macroeconomist insists the Fed’s ‘QE summer’ will be under the “guise” of yield curve controls.

Pozsar believes that this will happen by the “end of 2023 to control where U.S. Treasuries trade versus OIS.” Citing Pozsar’s prediction, zerohedge.com’s Tyler Durden explains it will be like a “‘checkmate-like’ situation” and the impending implementation of QE will occur within the framework of dysfunction in the Treasury market.

What do you think about the Fed’s moves in 2023? Do you expect more rate hikes or do you expect the Fed to pivot? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Fidelity Investments Launches Crypto, Metaverse ETFs — Says 'We Continue to See Demand'

Fidelity Investments, one of the largest financial services firms with more than $11 trillion under administration, is launching exchange-traded funds (ETFs) focusing on the crypto ecosystem and the metaverse. "We continue to see demand, particularly from young investors, for access ... read more.

Source From : News