An analysis of the FTX and Alameda Research collapse has been published by the blockchain and crypto analytics firm Nansen and the report notes that the Terra stablecoin collapse, and the liquidity crunch that ensued, likely started the domino effect that led to the company’s implosion. The study from Nansen further details that “FTX and Alameda have had close ties since the very beginning.”

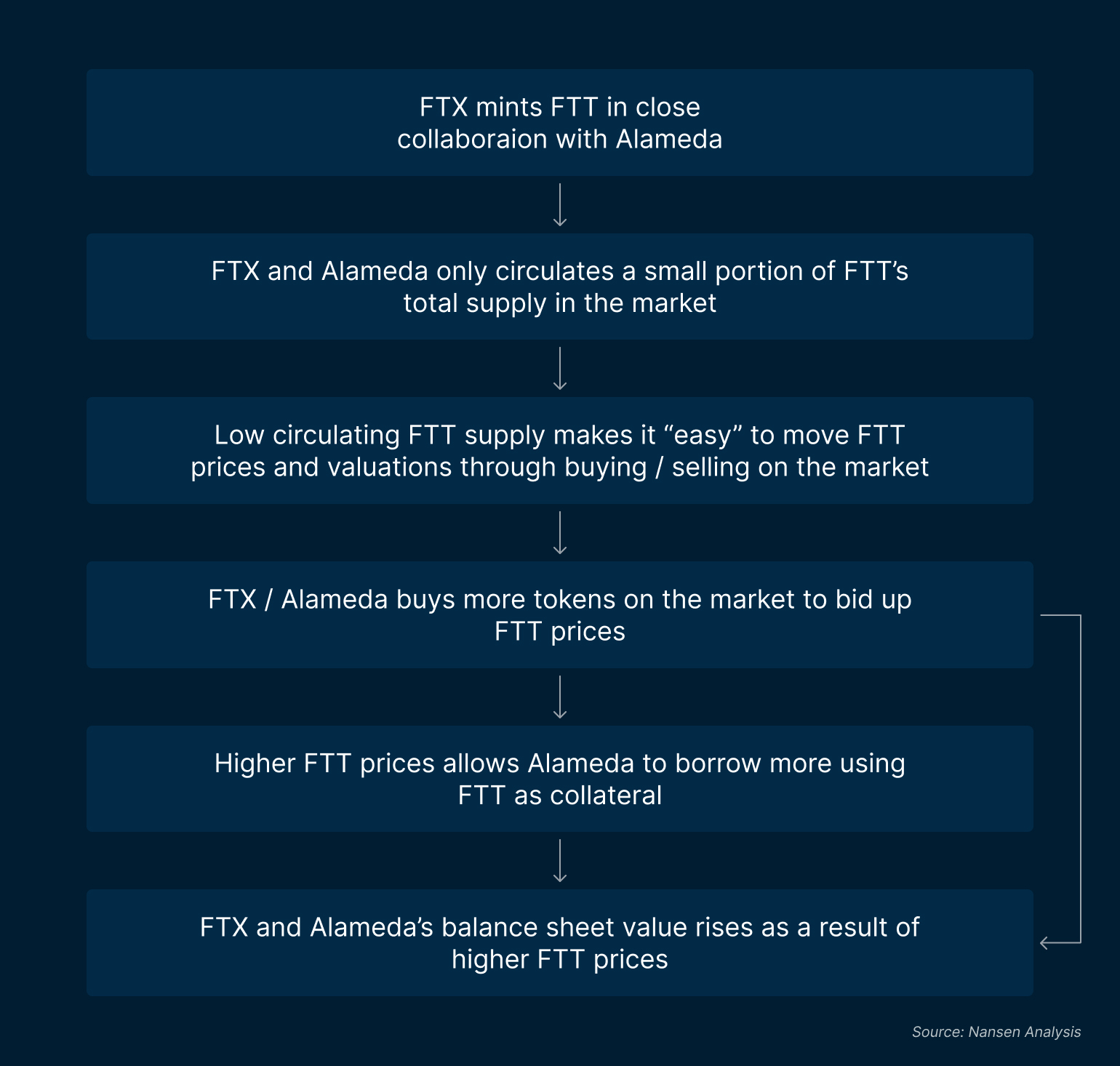

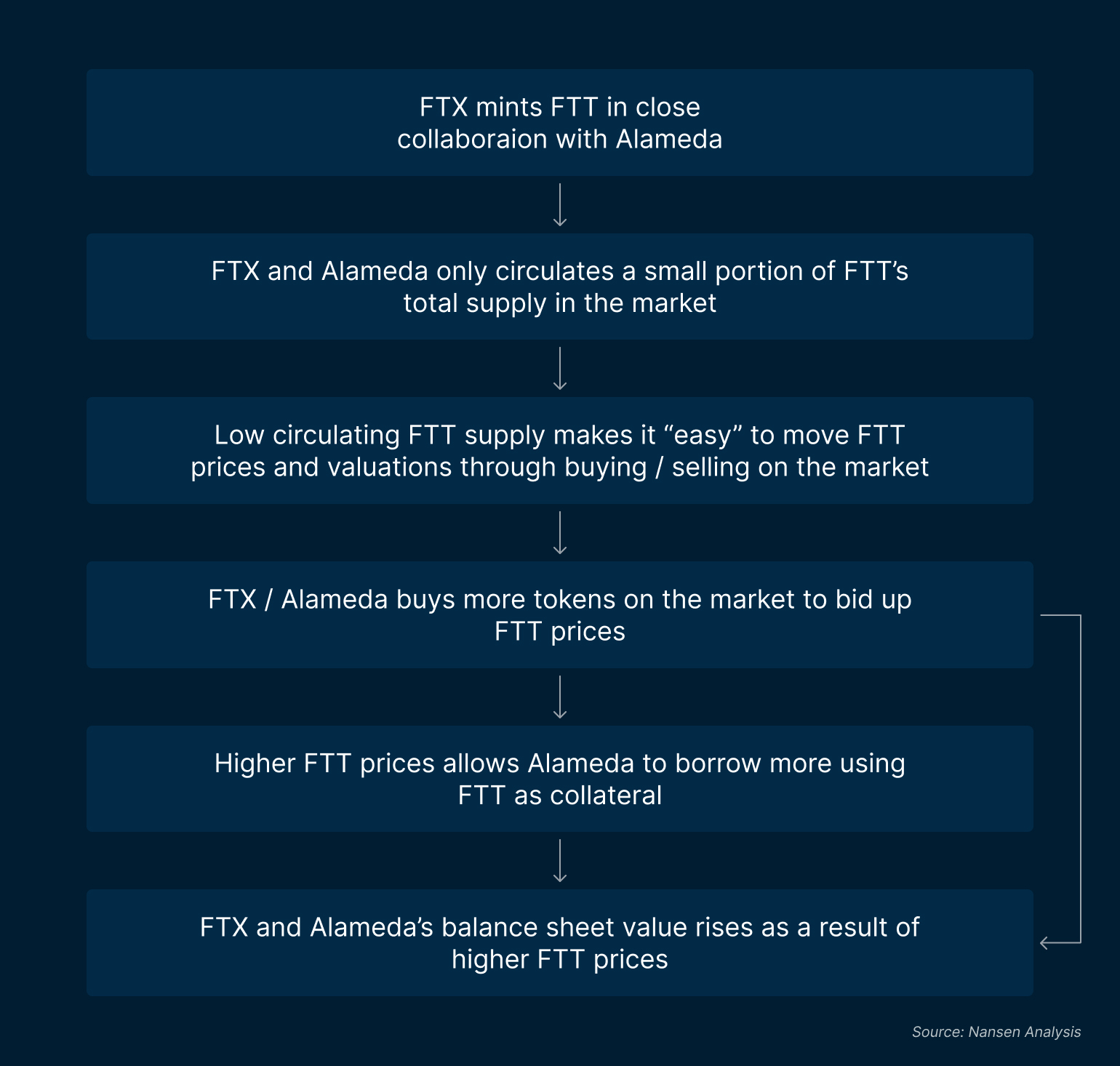

On Nov. 17, 2022, five researchers from the Nansen team published a blockchain analysis and comprehensive look at the “The Collapse of Alameda and FTX.” The report notes that FTX and Alameda had “close ties,” and blockchain records confirm this fact. FTX’s and Alameda’s rise to the top started with the FTT token launch and the “two of them shared the majority of the total FTT supply which did not really enter into circulation,” Nansen researchers detailed.

FTX and FTT’s meteoric scaling led to Alameda’s swelling balance sheet which “was likely used as collateral by Alameda to borrow against.” Nansen researchers detail that if the borrowed funds were leveraged to make illiquid investments, then “FTT would become a central weakness for Alameda.” Nansen researchers say weaknesses began to show when Terra’s once-stable coin UST depegged and caused a massive liquidity crunch. This led to the collapse of crypto hedge fund Three Arrows Capital (3AC) and crypto lender Celsius.

While it’s not associated with Nansen’s report, 3AC co-founder Kyle Davies said in a recent interview that both FTX and Alameda Research “colluded to trade against clients.” Davies implied that FTX and Alameda were stop hunting his crypto hedge fund. After the contagion effect from Celsius and 3AC, Nansen’s report says “Alameda would have needed liquidity from a source that would still be willing to give out a loan against their existing collateral.”

Nansen details that Alameda transferred $3 billion worth of FTT on the FTX exchange and most of those funds remained on FTX until the collapse. “Evidence of the actual loan from FTX to Alameda is not directly visible on-chain, possibly due to the inherent nature of CEXs which may have obfuscated clear [onchain] traces,” Nansen researchers admit. However, outflows and a Bankman-Fried Reuters interview suggest to Nansen researchers that FTT collateral may have been used to secure loans.

“Based on the data, the total $4b FTT outflows from Alameda to FTX in June and July could possibly have been the provision of parts of the collateral that was used to secure the loans (worth at least $4b) in May / June that was revealed by several people close to Bankman-Fried in a Reuters interview,” Nansen’s study discloses. The report concludes that the Coindesk balance sheet report “exposed concerns regarding Alameda’s balance sheet” which finally led to the “back-and-forth battle between the CEOs of Binance and FTX.”

“[The incidents] caused a ripple effect on market participants, Binance owned a large FTT position,” Nansen researchers noted. “From this point on, the intermingled relationship between Alameda and FTX became more troubling, given that customer funds were also in the equation. Alameda was at the stage where survival was its chosen priority, and if one entity collapses, more trouble could start brewing for FTX.” The report concludes:

Given how intertwined these entities were set up to operate, along with the over-leverage of collateral, our post-mortem [onchain] analysis hints that the eventual collapse of Alameda (and the resulting impact on FTX) was, perhaps, inevitable.

You can read Nansen’s FTX and Alameda report in its entirety here.

What do you think about Nansen’s comprehensive report concerning the collapse of Alameda and FTX? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photo credit: Nansen Research, Maurice NORBERT / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

An analysis of the FTX and Alameda Research collapse has been published by the blockchain and crypto analytics firm Nansen and the report notes that the Terra stablecoin collapse, and the liquidity crunch that ensued, likely started the domino effect that led to the company’s implosion. The study from Nansen further details that “FTX and Alameda have had close ties since the very beginning.”

On Nov. 17, 2022, five researchers from the Nansen team published a blockchain analysis and comprehensive look at the “The Collapse of Alameda and FTX.” The report notes that FTX and Alameda had “close ties,” and blockchain records confirm this fact. FTX’s and Alameda’s rise to the top started with the FTT token launch and the “two of them shared the majority of the total FTT supply which did not really enter into circulation,” Nansen researchers detailed.

FTX and FTT’s meteoric scaling led to Alameda’s swelling balance sheet which “was likely used as collateral by Alameda to borrow against.” Nansen researchers detail that if the borrowed funds were leveraged to make illiquid investments, then “FTT would become a central weakness for Alameda.” Nansen researchers say weaknesses began to show when Terra’s once-stable coin UST depegged and caused a massive liquidity crunch. This led to the collapse of crypto hedge fund Three Arrows Capital (3AC) and crypto lender Celsius.

While it’s not associated with Nansen’s report, 3AC co-founder Kyle Davies said in a recent interview that both FTX and Alameda Research “colluded to trade against clients.” Davies implied that FTX and Alameda were stop hunting his crypto hedge fund. After the contagion effect from Celsius and 3AC, Nansen’s report says “Alameda would have needed liquidity from a source that would still be willing to give out a loan against their existing collateral.”

Nansen details that Alameda transferred $3 billion worth of FTT on the FTX exchange and most of those funds remained on FTX until the collapse. “Evidence of the actual loan from FTX to Alameda is not directly visible on-chain, possibly due to the inherent nature of CEXs which may have obfuscated clear [onchain] traces,” Nansen researchers admit. However, outflows and a Bankman-Fried Reuters interview suggest to Nansen researchers that FTT collateral may have been used to secure loans.

“Based on the data, the total $4b FTT outflows from Alameda to FTX in June and July could possibly have been the provision of parts of the collateral that was used to secure the loans (worth at least $4b) in May / June that was revealed by several people close to Bankman-Fried in a Reuters interview,” Nansen’s study discloses. The report concludes that the Coindesk balance sheet report “exposed concerns regarding Alameda’s balance sheet” which finally led to the “back-and-forth battle between the CEOs of Binance and FTX.”

“[The incidents] caused a ripple effect on market participants, Binance owned a large FTT position,” Nansen researchers noted. “From this point on, the intermingled relationship between Alameda and FTX became more troubling, given that customer funds were also in the equation. Alameda was at the stage where survival was its chosen priority, and if one entity collapses, more trouble could start brewing for FTX.” The report concludes:

Given how intertwined these entities were set up to operate, along with the over-leverage of collateral, our post-mortem [onchain] analysis hints that the eventual collapse of Alameda (and the resulting impact on FTX) was, perhaps, inevitable.

You can read Nansen’s FTX and Alameda report in its entirety here.

What do you think about Nansen’s comprehensive report concerning the collapse of Alameda and FTX? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photo credit: Nansen Research, Maurice NORBERT / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

Litecoin rallied to a one-week high on Friday, as the token rose for a second consecutive session. The move saw prices climb by close to 8% earlier in the day, and comes as crypto markets mostly traded higher. Uniswap also gained, rebounding from recent losses.

Litecoin (LTC) was a notable gainer on Friday, as the token surged by as much as 8% in today’s session.

Following a low of $60.29 on Thursday, LTC/USD raced to an intraday high of $63.61 earlier in the day.

As a result of today’s rally, litecoin moved close to a key resistance level, hitting its highest point since last Friday in the process.

Looking at the chart, prices did not yet collide with the aforementioned ceiling of $64.00, which was last broken ten days ago.

This comes as the 14-day relative strength index (RSI) hit a key resistance level of 57.00, leading earlier bulls to abandon their positions.

As of writing, LTC is now tracking at $62.77.

Uniswap (UNI) rebounded in today’s session, snapping a two-day downtrend in the process.

UNI/USD hit a peak of $6.03 earlier in the day, which comes less than 24 hours after hitting a low of $5.74.

This surge comes as bulls rejected a breakout of a floor at $5.70 on Thursday, with the target now seemingly a resistance of $6.50.

In order to recapture this point, UNI traders will first need to overcome an upcoming ceiling on the RSI indicator.

As of writing, the index is tracking at 45.16, which is under its aforementioned resistance of 48.90.

Bulls will likely need to be cautious, as the momentum of the 10-day (red) moving average appears to still be bearish.

Register your email here to get weekly price analysis updates sent to your inbox:

Could we see a shift in momentum for uniswap this weekend? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

Litecoin rallied to a one-week high on Friday, as the token rose for a second consecutive session. The move saw prices climb by close to 8% earlier in the day, and comes as crypto markets mostly traded higher. Uniswap also gained, rebounding from recent losses.

Litecoin (LTC) was a notable gainer on Friday, as the token surged by as much as 8% in today’s session.

Following a low of $60.29 on Thursday, LTC/USD raced to an intraday high of $63.61 earlier in the day.

As a result of today’s rally, litecoin moved close to a key resistance level, hitting its highest point since last Friday in the process.

Looking at the chart, prices did not yet collide with the aforementioned ceiling of $64.00, which was last broken ten days ago.

This comes as the 14-day relative strength index (RSI) hit a key resistance level of 57.00, leading earlier bulls to abandon their positions.

As of writing, LTC is now tracking at $62.77.

Uniswap (UNI) rebounded in today’s session, snapping a two-day downtrend in the process.

UNI/USD hit a peak of $6.03 earlier in the day, which comes less than 24 hours after hitting a low of $5.74.

This surge comes as bulls rejected a breakout of a floor at $5.70 on Thursday, with the target now seemingly a resistance of $6.50.

In order to recapture this point, UNI traders will first need to overcome an upcoming ceiling on the RSI indicator.

As of writing, the index is tracking at 45.16, which is under its aforementioned resistance of 48.90.

Bulls will likely need to be cautious, as the momentum of the 10-day (red) moving average appears to still be bearish.

Register your email here to get weekly price analysis updates sent to your inbox:

Could we see a shift in momentum for uniswap this weekend? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

PRESS RELEASE. As if the cryptoverse needed more reasons for people to be fearful, both FTX and BlockFi rocked cryptocurrency blockchains and investors alike, sending prices spiraling, blockchains congesting, and investors hunkering down for more ‘crypto-winter’.

But amidst this uncertainty, crypto investors now risk missing out on opportunities while becoming stuck in fear, uncertainty and doubt (FUD).

The EverEarn coin ($EARN) launched on the Binance Smart Chain (BNB) blockchain platform in January 2022 with a simple goal; to show that a new startup cryptocurrency can be run like a business from the beginning, without any false hype or empty promises, while providing increased passive stablecoin (BUSD) payouts, and continue to grow, evolve and expand.

EverEarn Growth While Others are Fearful

Despite recent events, and the global downtrend for the past 8 months, EverEarn has paid out over $2 million in BUSD stablecoin back to holders. The team has maintained daily community voice chats since launch, and a monthly community address. The EverEarn team is now bringing this ‘stick to it’ community mentality and commitment to the Ethereum blockchain and is doing so in a big way.

Ethereum With a Bang

The EverEarn team has amassed almost 60 social media influencers with over 2 million followers along with forming marketing arrangements and development partnerships with EY Studios, Brave Browser, Bitcoin.com, ‘Rug Free Coins’, ‘Mike Tha Investor’, ‘What Coin Talk’, and ‘Crypto Atlas’. Marketing and advertising is being pushed out to millions ahead of the EverEarn Public Presale starting on Nov. 18, 2022 @ 8am EST / 1pm UTC on well reputed UniCrypt Launchpad. https://app.unicrypt.network/amm/uni-v2/ilo/0xB41f93AAF46901d4A6b67791D4723c1388Dcbf3E

But the team hasn’t stopped there; they’ve already obtained two separate audits from ‘Rug Free Coins’ and ‘Solid Proof’, as well as completing two separate identity confirmations (Veriff and iDenfy), along with a FULL TEAM identity confirmation through Veriff.

Multiple Blockchains + Stablecoin Rewards

With the launch to Ethereum (and expected launch to Polygon in December 2022), EverEarn will be providing holders with high ratio stablecoin rewards across multiple blockchains;

All project wallets are blacklisted within the solidity contract, and all future-use tokens are locked within trusted 3rd party launchpad platforms.

During the first 4 weeks of the $EARN ETH launch, ‘diamond hand holders’ (those who do not sell), will earn a chance to split all the stablecoin (BUSD/USDC) amassed within promotion wallets specifically meant to reward those who hold long term.

Public Whitelist Presale Registration: https://www.everearn.academy/whitelist-promotion

Social Media Handles:

Twitter: https://twitter.com/theEverEarn

Telegram: https://t.me/EverEarnOfficial

Website: https://everearn.net

Academy: https://www.everearn.academy

RugFreeCoins Audit: https://github.com/Rugfreecoins/Smart-Contract-Audits/blob/main/ETH%20-%20EverEarn%20Token%20Audit.pdf

SolidProof Audit & Team KYC: https://github.com/solidproof/projects/tree/main/EverEarn

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Tony Hawk's Latest NFTs to Come With Signed Physical Skateboards

Last December, the renowned professional skateboarder Tony Hawk released his “Last Trick” non-fungible token (NFT) collection via the NFT marketplace Autograph. Next week, Hawk will be auctioning the skateboards he used during his last tricks, and each of the NFTs ... read more.

PRESS RELEASE. As if the cryptoverse needed more reasons for people to be fearful, both FTX and BlockFi rocked cryptocurrency blockchains and investors alike, sending prices spiraling, blockchains congesting, and investors hunkering down for more ‘crypto-winter’.

But amidst this uncertainty, crypto investors now risk missing out on opportunities while becoming stuck in fear, uncertainty and doubt (FUD).

The EverEarn coin ($EARN) launched on the Binance Smart Chain (BNB) blockchain platform in January 2022 with a simple goal; to show that a new startup cryptocurrency can be run like a business from the beginning, without any false hype or empty promises, while providing increased passive stablecoin (BUSD) payouts, and continue to grow, evolve and expand.

EverEarn Growth While Others are Fearful

Despite recent events, and the global downtrend for the past 8 months, EverEarn has paid out over $2 million in BUSD stablecoin back to holders. The team has maintained daily community voice chats since launch, and a monthly community address. The EverEarn team is now bringing this ‘stick to it’ community mentality and commitment to the Ethereum blockchain and is doing so in a big way.

Ethereum With a Bang

The EverEarn team has amassed almost 60 social media influencers with over 2 million followers along with forming marketing arrangements and development partnerships with EY Studios, Brave Browser, Bitcoin.com, ‘Rug Free Coins’, ‘Mike Tha Investor’, ‘What Coin Talk’, and ‘Crypto Atlas’. Marketing and advertising is being pushed out to millions ahead of the EverEarn Public Presale starting on Nov. 18, 2022 @ 8am EST / 1pm UTC on well reputed UniCrypt Launchpad. https://app.unicrypt.network/amm/uni-v2/ilo/0xB41f93AAF46901d4A6b67791D4723c1388Dcbf3E

But the team hasn’t stopped there; they’ve already obtained two separate audits from ‘Rug Free Coins’ and ‘Solid Proof’, as well as completing two separate identity confirmations (Veriff and iDenfy), along with a FULL TEAM identity confirmation through Veriff.

Multiple Blockchains + Stablecoin Rewards

With the launch to Ethereum (and expected launch to Polygon in December 2022), EverEarn will be providing holders with high ratio stablecoin rewards across multiple blockchains;

All project wallets are blacklisted within the solidity contract, and all future-use tokens are locked within trusted 3rd party launchpad platforms.

During the first 4 weeks of the $EARN ETH launch, ‘diamond hand holders’ (those who do not sell), will earn a chance to split all the stablecoin (BUSD/USDC) amassed within promotion wallets specifically meant to reward those who hold long term.

Public Whitelist Presale Registration: https://www.everearn.academy/whitelist-promotion

Social Media Handles:

Twitter: https://twitter.com/theEverEarn

Telegram: https://t.me/EverEarnOfficial

Website: https://everearn.net

Academy: https://www.everearn.academy

RugFreeCoins Audit: https://github.com/Rugfreecoins/Smart-Contract-Audits/blob/main/ETH%20-%20EverEarn%20Token%20Audit.pdf

SolidProof Audit & Team KYC: https://github.com/solidproof/projects/tree/main/EverEarn

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

PRESS RELEASE. Seychelles, November 18, 2022 – Bitflex Ltd. (“Bitflex,” “we” or “our”), a blockchain technology company in the global market, today has just announced the official launch of its cryptocurrency exchange. The launch follows an extremely successful beta period, which saw its user base grow by over 1,000%.

The Bitflex platform offers an aesthetically pleasing interface built-in with news, notifications, and charting tools to create a superior environment for users to make the most educated trades. The trading platform versions are immediately available for Windows, iOS, and Android.

Ee Wui Yang, CEO of Bitflex, said:

“This is an exciting period for both Bitflex and the crypto community. Our cryptocurrency exchange platform has gone through multiple rounds of rigorous testing and we’re confident that it is ready to be used by a wider audience.”

Bitflex meets the need for a user-friendly and accessible crypto derivatives trading platform. The Bitflex platform features new branding and an improved user interface on the platform in addition to improved liquidity, rigorous security, and 18 of the most popular linear perpetual swap trading pairs.

Leveraging an intimate familiarity with crypto users’ pain points, Bitflex makes buying and selling crypto derivatives simple and enjoyable for both amateur and experienced crypto users who find traditional crypto trading platforms intimidating.

Wui Yang added:

“The Bitflex platform has arrived to empower every type of crypto user, no matter how new or old they are to the crypto world. With the launch of our easy-to-use exchange platform, we are standing strongly behind our vision that crypto is for everyone. And as cryptocurrency traders ourselves, we want to create a platform that is designed specifically for crypto traders.”

“Due to the recent collapse of the world’s second-largest crypto exchange, crypto worldwide has taken a huge reputational hit. We acknowledge the challenges that our industry will face in the next few years in combating scams and fraudulent behaviors and that is why we are going back to the basics by incorporating DeFi functionalities into our platform such as our upcoming HEX feature that combines the benefits of both centralized and decentralized offerings and on-chain data analysis to assist traders to make better decisions in their positions.”

“We will be launching this feature on our platform in early 2023 and we believe it will be a game-changer in the cryptocurrency exchange industry. We want to be a pioneer of the HEX exchange to help the crypto industry regain its allure in the investment world.”

In addition, Bitflex adopted the brand slogan of “Leveraging your future”, which indicates that the platform’s growth strategy moving forward is to motivate and assist users on their platform to build a promising future and make their dreams come true.

Media Information

Start trading now: https://www.bitflex.com

Email: hello@bitflex.com

Twitter: https://twitter.com/bitflex

LinkedIn: https://www.linkedin.com/company/bitflex

Instagram: https://www.instagram.com/bitflex/

Telegram: https://t.me/Bitflex_Global

About Bitflex

Bitflex, consisting of a team of veterans in the Web3 arena, is a cryptocurrency derivatives exchange aiming to disrupt the crypto exchange space by being the first standout HEX Exchange combining the advantages of a CEX and DEX. Bitflex’s modular, hybrid design centralizes reliability while distributing control, putting power back into the hands of traders while giving them a platform they can always depend on.

Media Queries:

Nicholas Jack, Social Media and Communications Lead

Mobile: +6017-2880051

E-mail: n.jack@bitflex.com

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

PRESS RELEASE. Seychelles, November 18, 2022 – Bitflex Ltd. (“Bitflex,” “we” or “our”), a blockchain technology company in the global market, today has just announced the official launch of its cryptocurrency exchange. The launch follows an extremely successful beta period, which saw its user base grow by over 1,000%.

The Bitflex platform offers an aesthetically pleasing interface built-in with news, notifications, and charting tools to create a superior environment for users to make the most educated trades. The trading platform versions are immediately available for Windows, iOS, and Android.

Ee Wui Yang, CEO of Bitflex, said:

“This is an exciting period for both Bitflex and the crypto community. Our cryptocurrency exchange platform has gone through multiple rounds of rigorous testing and we’re confident that it is ready to be used by a wider audience.”

Bitflex meets the need for a user-friendly and accessible crypto derivatives trading platform. The Bitflex platform features new branding and an improved user interface on the platform in addition to improved liquidity, rigorous security, and 18 of the most popular linear perpetual swap trading pairs.

Leveraging an intimate familiarity with crypto users’ pain points, Bitflex makes buying and selling crypto derivatives simple and enjoyable for both amateur and experienced crypto users who find traditional crypto trading platforms intimidating.

Wui Yang added:

“The Bitflex platform has arrived to empower every type of crypto user, no matter how new or old they are to the crypto world. With the launch of our easy-to-use exchange platform, we are standing strongly behind our vision that crypto is for everyone. And as cryptocurrency traders ourselves, we want to create a platform that is designed specifically for crypto traders.”

“Due to the recent collapse of the world’s second-largest crypto exchange, crypto worldwide has taken a huge reputational hit. We acknowledge the challenges that our industry will face in the next few years in combating scams and fraudulent behaviors and that is why we are going back to the basics by incorporating DeFi functionalities into our platform such as our upcoming HEX feature that combines the benefits of both centralized and decentralized offerings and on-chain data analysis to assist traders to make better decisions in their positions.”

“We will be launching this feature on our platform in early 2023 and we believe it will be a game-changer in the cryptocurrency exchange industry. We want to be a pioneer of the HEX exchange to help the crypto industry regain its allure in the investment world.”

In addition, Bitflex adopted the brand slogan of “Leveraging your future”, which indicates that the platform’s growth strategy moving forward is to motivate and assist users on their platform to build a promising future and make their dreams come true.

Media Information

Start trading now: https://www.bitflex.com

Email: hello@bitflex.com

Twitter: https://twitter.com/bitflex

LinkedIn: https://www.linkedin.com/company/bitflex

Instagram: https://www.instagram.com/bitflex/

Telegram: https://t.me/Bitflex_Global

About Bitflex

Bitflex, consisting of a team of veterans in the Web3 arena, is a cryptocurrency derivatives exchange aiming to disrupt the crypto exchange space by being the first standout HEX Exchange combining the advantages of a CEX and DEX. Bitflex’s modular, hybrid design centralizes reliability while distributing control, putting power back into the hands of traders while giving them a platform they can always depend on.

Media Queries:

Nicholas Jack, Social Media and Communications Lead

Mobile: +6017-2880051

E-mail: n.jack@bitflex.com

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Fidelity Investments Launches Crypto, Metaverse ETFs — Says 'We Continue to See Demand'

Fidelity Investments, one of the largest financial services firms with more than $11 trillion under administration, is launching exchange-traded funds (ETFs) focusing on the crypto ecosystem and the metaverse. "We continue to see demand, particularly from young investors, for access ... read more.

PRESS RELEASE. As of September 2022, MEXC has finally reached a respectable milestone of 10 million users! To celebrate this unique achievement, starting November 18th of this year, MEXC will introduce a major brand color change to its global userbase to spread awareness for which it stands for. After surveying customers directly during a limited roll-out in South Korea, the color has transitioned from MEXC’s original ‘Forest Green’ color-scheme, to a new, beautiful ‘Ocean Blue’ pallet.

At MEXC, our #1 priority is adhering to the principle of ‘Users Come First’. Upon further surveying additional global markets, the response has been overwhelmingly positive for ‘Ocean Blue’ – the change is now permanent. Vice President of MEXC, Andrew Weiner states that users in Korea advocated strongly for the rebrand to ‘Ocean Blue’. “Following our evaluation, we tested the requested color upgrade with our passionate users from MEXC Korea. It was great to see the change so well-received, and MEXC is truly grateful for the customer insight that directly influences our views and image.”

Now, why ‘Ocean Blue’? Our blue oceans cover 71.35% of Earth’s surface, whereas the forest area accounts for just 7.27%. Forests are fragile, and restricted to the land – but the sea is immense and limitless. ‘Ocean Blue’ incorporates ‘every river that flows into the sea.’ According to Weiner, ‘Ocean Blue’ is also a more accurate reflection of MEXC’s brand identity. “We are calm and professional, open and inclusive, and powerful and innovative – inviting every user to dive deep and explore what treasures MEXC has to offer!”

MEXC was founded in April 2018. It is the world’s leading one-stop crypto shop and fastest growing exchange. They offer futures, spot, ETF, and NFT Index trades, as well as staking, MX DeFi, and many other services for our special users.

“When we look back at MEXC’s history, ‘Users Come First’ has always been more than a motto – it is the recipe to our success,” Weiner said. Which the improvement of the brand color can not exemplify.

MEXC significantly upgraded its Futures trading system and product functions in their June 2020 release. Before the upgrade, the operations, product, and technical teams spent months doing thorough consumer research, gathering feedback, and performing rigorous product testing. The improvements range from minute details to extravagant enhancements to customer journeys, including such examples as “Lightning Close,” and “Leverage Multiples Adjustment”. All these upgrades came directly from MEXC’s skilled team and loyal customer feedback.

‘Users Come First’ has been the heart of the crypto industry’s essential values of decentralization and community spirit and MEXC bleeds this mantra. “It is because we put our users in the forefront and present them with our professional goods and services that we are able to have reached the accolades of reaching the highest liquidity in futures, spot, and ETFs in the second half of this year with constant efforts,” Andrew explained. “Please enjoy our rebrand and take comfort that you are in safe hands.”

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

NFT Sales Volume Saw a Small Uptick This Week — Moonbirds, Mutant Apes Take Top Sales

Non-fungible token (NFT) sales saw a small uptick over the last week as $658.4 million in NFT sales were recorded, up 3.35% in seven days. Out of 15 blockchains, Polygon-based NFT sales saw the largest increase in volume, jumping 106.68% ... read more.

Source From : News