The last 12 months have been tough on digital currency investors as the crypto winter has caused a large sum of value to leave the once-bustling economy. The privacy coin economy, for instance, shed more than 55% against the U.S. dollar as it dropped from $11.7 billion in Jan. 2022 to the current $5.22 billion.

Privacy coins are not talked about like they used to be. These days, the hype and discussions surrounding decentralized finance (defi) and non-fungible tokens (NFTs) have eclipsed privacy coin conversations.

Furthermore, during the last 12 months, the privacy coin economy has dropped from $11.7 billion to today’s $5.22 billion. Last January, the top two privacy tokens included monero (XMR) and zcash (ZEC).

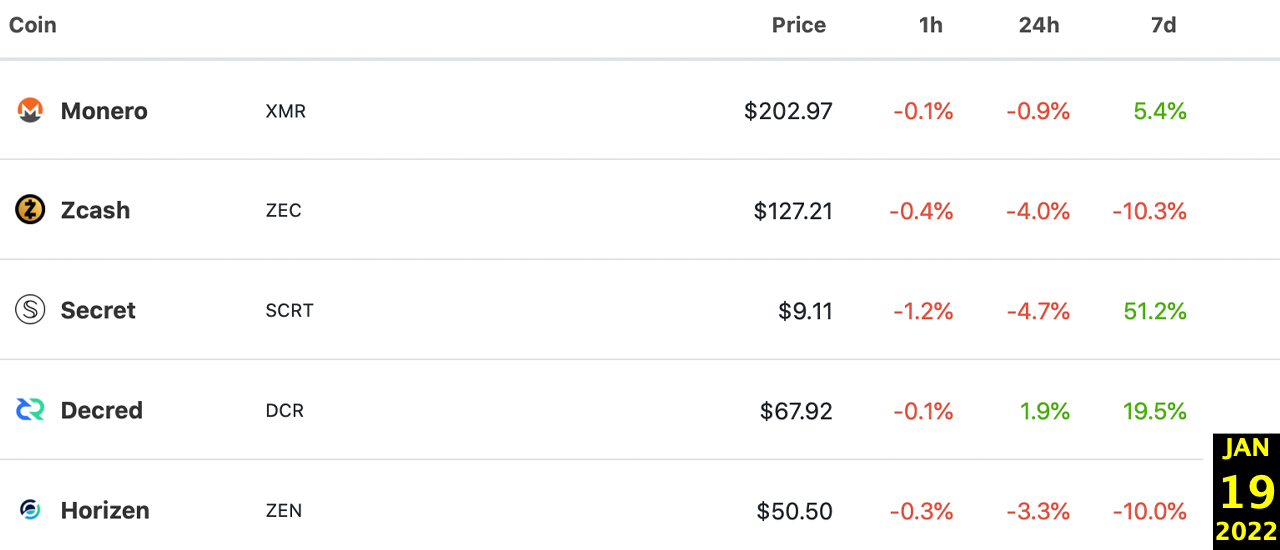

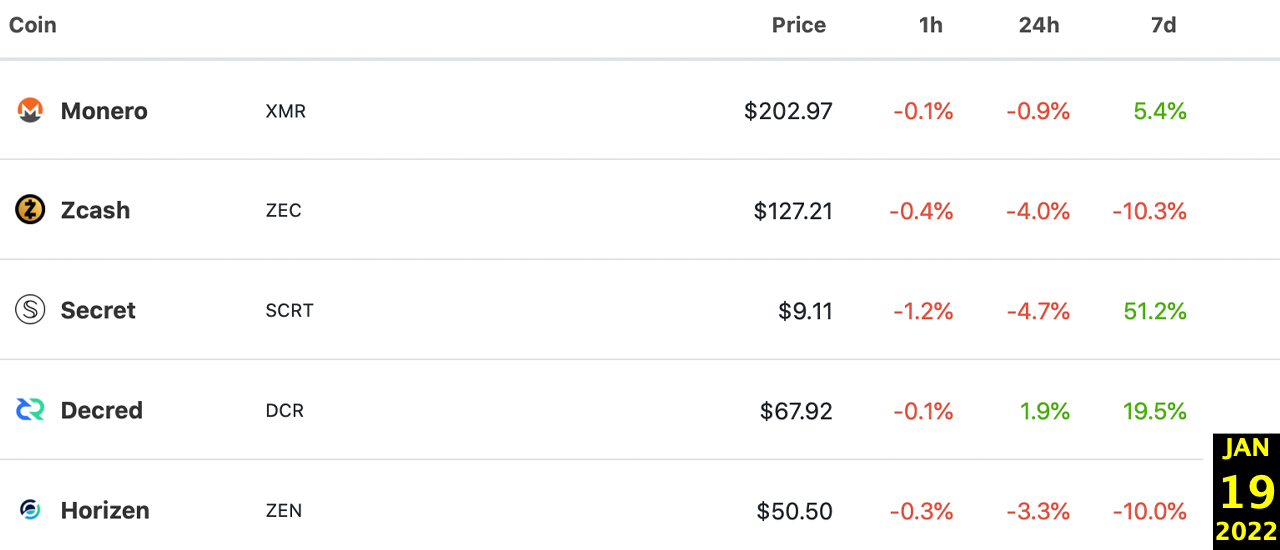

At the time, monero was the largest privacy coin by market cap and still is today. In Jan. 2022, XMR’s price was around $202.97 per unit and it had a market valuation of around $3.66 billion on Jan. 19, 2022.

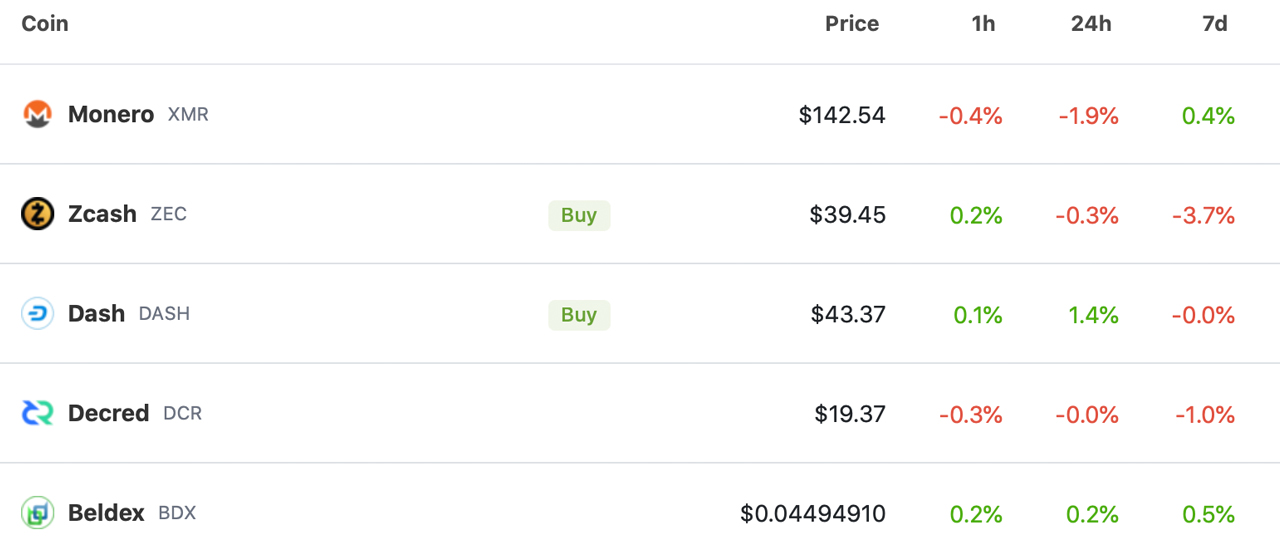

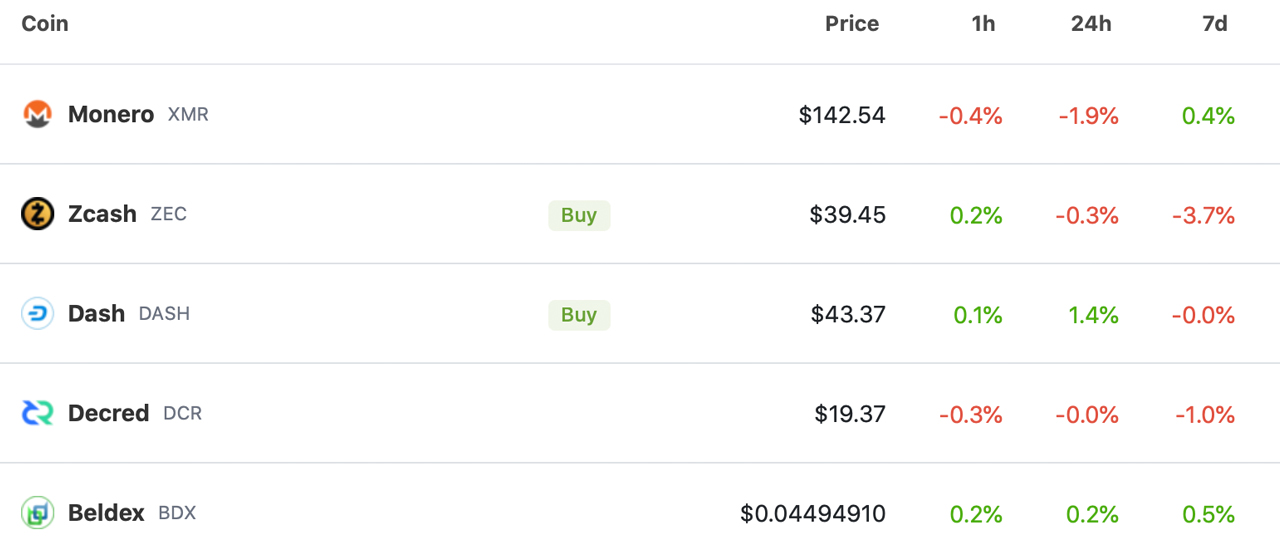

Today, XMR is exchanging hands for around $142.35 per coin and it has an overall market capitalization of around $2.58 billion. Zcash holds the second-largest privacy coin market valuation this year and in January it was around $1.53 billion.

At the end of Dec. 2022, ZEC’s market cap is down to $517 million. Jan. 2022’s top five privacy coins by market cap included monero (XMR), zcash (ZEC), secret (SCRT), decred (DCR), and horizen (ZEN).

December 2022 stats show the top five privacy coins include monero (XMR), zcash (ZEC), dash (DASH), decred (DCR), and beldex (BDX). XMR’s and ZEC’s market caps equate to roughly $3.1 billion which is 59.4% of the entire privacy coin economy.

In Jan. 2022, XMR and ZEC were valued at $5.19 billion and represented only 44.36% of the entire privacy coin economy. Today, the top two privacy coins by market cap have a lot more dominance.

Last month it was reported that leaked EU plans could ban privacy coins like XMR, ZEC, and DASH. “The European Union could ban banks and crypto providers from dealing in privacy-enhancing coins such as zcash, monero, and dash under a leaked draft of a money laundering bill obtained by Coindesk,” the publication noted on Nov. 15, 2022.

Government policy decisions and proposed guidelines have caused a number of crypto exchanges worldwide to stop listing privacy coins like XMR and ZEC. The lack of listings gives privacy coins a lot less liquidity which makes them more susceptible to price fluctuations.

What do you think about privacy coins this year and their market performances during the last 12 months? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

The last 12 months have been tough on digital currency investors as the crypto winter has caused a large sum of value to leave the once-bustling economy. The privacy coin economy, for instance, shed more than 55% against the U.S. dollar as it dropped from $11.7 billion in Jan. 2022 to the current $5.22 billion.

Privacy coins are not talked about like they used to be. These days, the hype and discussions surrounding decentralized finance (defi) and non-fungible tokens (NFTs) have eclipsed privacy coin conversations.

Furthermore, during the last 12 months, the privacy coin economy has dropped from $11.7 billion to today’s $5.22 billion. Last January, the top two privacy tokens included monero (XMR) and zcash (ZEC).

At the time, monero was the largest privacy coin by market cap and still is today. In Jan. 2022, XMR’s price was around $202.97 per unit and it had a market valuation of around $3.66 billion on Jan. 19, 2022.

Today, XMR is exchanging hands for around $142.35 per coin and it has an overall market capitalization of around $2.58 billion. Zcash holds the second-largest privacy coin market valuation this year and in January it was around $1.53 billion.

At the end of Dec. 2022, ZEC’s market cap is down to $517 million. Jan. 2022’s top five privacy coins by market cap included monero (XMR), zcash (ZEC), secret (SCRT), decred (DCR), and horizen (ZEN).

December 2022 stats show the top five privacy coins include monero (XMR), zcash (ZEC), dash (DASH), decred (DCR), and beldex (BDX). XMR’s and ZEC’s market caps equate to roughly $3.1 billion which is 59.4% of the entire privacy coin economy.

In Jan. 2022, XMR and ZEC were valued at $5.19 billion and represented only 44.36% of the entire privacy coin economy. Today, the top two privacy coins by market cap have a lot more dominance.

Last month it was reported that leaked EU plans could ban privacy coins like XMR, ZEC, and DASH. “The European Union could ban banks and crypto providers from dealing in privacy-enhancing coins such as zcash, monero, and dash under a leaked draft of a money laundering bill obtained by Coindesk,” the publication noted on Nov. 15, 2022.

Government policy decisions and proposed guidelines have caused a number of crypto exchanges worldwide to stop listing privacy coins like XMR and ZEC. The lack of listings gives privacy coins a lot less liquidity which makes them more susceptible to price fluctuations.

What do you think about privacy coins this year and their market performances during the last 12 months? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Solana fell to a one-month low to start the weekend, as cryptocurrency markets moved lower ahead of Christmas Day. Today’s drop saw the token fall for a fourth straight session, as market sentiment shifted bearish. Uniswap was also in the red on Saturday, with price falling for a second consecutive day.

Solana (SOL) was in the red on Saturday, as prices moved lower for a fourth straight session.

SOL/USD slipped to a low of $11.24 in today’s session, which comes less than a day after the token was trading at $11.95.

Today’s drop saw solana fall to its lowest point since November 22, when price hit a low of $10.94.

As can be seen from the chart, Saturday’s decline came as the 14-day relative strength index (RSI) broke out of a floor at 34.00.

The index is currently tracking at 31.79, with the next visible point of support at the 29.90 level.

Should the RSI continue to head to this point, it is likely that solana will fall below the $10.94 level, which was last seen four weeks ago.

Uniswap (UNI) also moved lower to start the weekend, as the token extended a recent bear run.

Following a high of $5.32 on Friday, UNI/USD fell to an intraday low of $5.20 on Christmas Eve.

The move led to uniswap landing on its long-term point of support, with bears likely to force a breakout as the weekend matures.

As of writing, the token remains marginally above its $5.20 floor, and is currently trading at $5.22.

Should this floor be broken, a possible target for sellers will possibly be a floor at $4.95, which was last hit in late November.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect uniswap to fall below $5.00 this weekend? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Vladimka production / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

NFT Sales Volume Saw a Small Uptick This Week — Moonbirds, Mutant Apes Take Top Sales

Non-fungible token (NFT) sales saw a small uptick over the last week as $658.4 million in NFT sales were recorded, up 3.35% in seven days. Out of 15 blockchains, Polygon-based NFT sales saw the largest increase in volume, jumping 106.68% ... read more.

Solana fell to a one-month low to start the weekend, as cryptocurrency markets moved lower ahead of Christmas Day. Today’s drop saw the token fall for a fourth straight session, as market sentiment shifted bearish. Uniswap was also in the red on Saturday, with price falling for a second consecutive day.

Solana (SOL) was in the red on Saturday, as prices moved lower for a fourth straight session.

SOL/USD slipped to a low of $11.24 in today’s session, which comes less than a day after the token was trading at $11.95.

Today’s drop saw solana fall to its lowest point since November 22, when price hit a low of $10.94.

As can be seen from the chart, Saturday’s decline came as the 14-day relative strength index (RSI) broke out of a floor at 34.00.

The index is currently tracking at 31.79, with the next visible point of support at the 29.90 level.

Should the RSI continue to head to this point, it is likely that solana will fall below the $10.94 level, which was last seen four weeks ago.

Uniswap (UNI) also moved lower to start the weekend, as the token extended a recent bear run.

Following a high of $5.32 on Friday, UNI/USD fell to an intraday low of $5.20 on Christmas Eve.

The move led to uniswap landing on its long-term point of support, with bears likely to force a breakout as the weekend matures.

As of writing, the token remains marginally above its $5.20 floor, and is currently trading at $5.22.

Should this floor be broken, a possible target for sellers will possibly be a floor at $4.95, which was last hit in late November.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect uniswap to fall below $5.00 this weekend? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Vladimka production / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

PRESS RELEASE. Locker Token & Ice Hockey extraordinaires Rögle BK have officially announced an In-Real-Life (IRL) NFT, event set to take place at the Catena Arena – the home of the European champions. The event is designed to showcase the innovative asset class that is NFTs, while also educating Rögle fans on how to utilize the blockchain and purchase their favourite player trading cards.

The event, due to take place on December 30th, will feature educational content, a free mint for the first 500 fans, and in-person interaction with cryptocurrency experts – The Nordic Whales.

About The Event

Rögle BK fans were the first fanbase able to mint their favourite players and in-game moments via the Locker sports NFT marketplace. The team have been equipped with the technology to mint any NFTs that would potentially be sought-after by fans, with NFTs created with ease through the Locker Token app. In line with the partnership, the event has been planned to help fans make their first steps into blockchain.

The event will be hosted and supported by local natives the Nordic Whales, who are located a mere 20 minutes from the stadium. The AMA enthusiasts are able to provide educational content in both English and Swedish due to their close proximity to the team.

The first 500 fans are in for a treat upon arrival after scanning the event QR code. This will provide them with a free mint, with a further 6500 being minted on the day that will be made available for purchase. The first 500 will be randomized in terms of rarity.

What is Locker Token?

Locker Token is an ecosystem for sports teams and athletes that allows them to futureproof and monetize their respective offerings through blockchain, while connecting fans and the athletes themselves via a unique asset class. Locker is known by its ticker – $LKT – and was recently listed on CoinMarketCap after a successful contract migration.

Despite being a relatively new project, the ecosystem features a number of the worlds best Ice Hockey teams and players including; Rögle BK, Manchester Storm, and HC Bolzano. More teams across both Ice Hockey and other sports are in the process of being onboarded, with the end goal being to onboard each respective team’s fan base to Locker as engaged fans and buyers.

From a token perspective, the Ethereum price decline of late has dragged the price of $LKT with it due to the closely-connected nature of Locker as an ERC20 token. However, the team has continued to build and create new partnerships despite the market-wide downturn.

500 lucky fans will receive a free mint upon scanning a QR code.

About Rögle BK

Rögle BK (Rögle Bandyklubb) is a Swedish professional ice hockey club from Ängelholm. The club has featured in the SHL most-recently since the 2015–16 season. Rögle has previously played in the SHL in 1992–1996, 2008–2010, and briefly in 2012–13.

The team are currently enduring a mixed season, placed 9th in the league standings at the time of writing. They are however on a two-game winning streak, with Adam Tambellini playing a big part in the team’s offensive play with 12 league goals to date.

Mint Rögle BK NFTs today via the Locker Token app for iOS and Android.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

Source From : News