Gemini is one of the most well-known and respected US crypto exchanges on the market. Today, we will be analyzing in our review the fees, security, and features of the Gemini exchange.

Gemini Exchange Overview

Gemini was founded by the Winkelvoss twins in 2014 and officially started its operation in 2015.

Gemini was founded by the Winkelvoss twins in 2014 and officially started its operation in 2015.

The platform is based in New York, and it is one of the few crypto-to-fiat services that are licensed to operate in the US and in the state of NY.

Since its launch, it became one of the most respected and reputable crypto exchanges in the digital currency space. When it added support for Ether in 2016, it became the world’s first licensed Ether exchange.

Gemini currently has a 24-hour trading volume of $16,896,635, making it the 76th crypto exchange by daily liquidity.

Now we will go on to explore in-depth in our review more of the features provided by the Gemini.

Supported Currencies and Available Countries

The exchange only supports the trading of 5 cryptocurrencies (six counting their Stablecoin):

- Bitcoin (BTC);

- Ethereum (ETH);

- Bitcoin cash (BCH);

- Litecoin (LTC);

- Zcash (ZEC);

Gemini also launched its own stablecoin, the Gemini dollar (GUSD), which is 100% backed by USD. This ERC20 token is available for trading on various exchanges. The platform is the only entity that can issue GUSD and convert the token into US dollars. You just deposit your GUSD to Gemini, and these will be automatically converted into USD balances that can be withdrawn.

The only supported fiat currency is USD.

The supported cryptocurrency pairs are:

- BTC/USD;

- ETH/USD;

- ETH/BTC;

- ZEC/USD;

- ZEC/BTC;

- ZEC/ETH;

- ZEC/LTC;

- ZEC/BCH;

- BCH/USD;

- BCH/BTC;

- BCH/ETH;

- BCH/LTC;

- LTC/USD;

- LTC/BTC;

- LTC/ETH;

- LTC/BCH.

The platform operates in all US states and in a handful of other countries, such as Australia, Canada, Hong Kong, Singapore, South Korea, and the United Kingdom.

User Interface and Experience

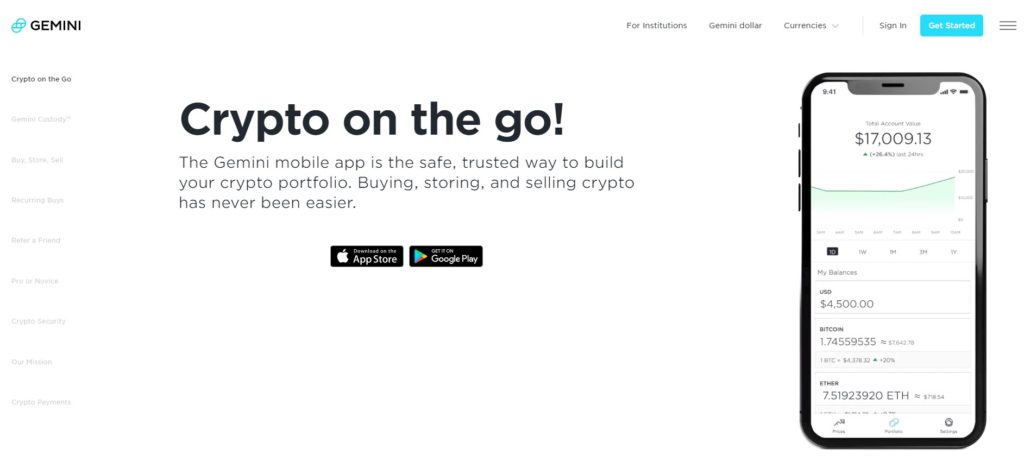

Gemini has an intuitively designed user platform that aims to be easy to use for all traders regardless of experience. The site’s interface is responsive, and it is reported to have a smooth functionality.

While it does not have a wide array of advanced features, it includes the basic ones: the exchange’s prices, balance, charts, and orders.

The exchange also launched a mobile app in December 2018, which is available for both iOS and Android users. The app has all of the functions featured on the web version and has been reported to work without any issues.

How to Use Gemini Exchange

Gemini Signup

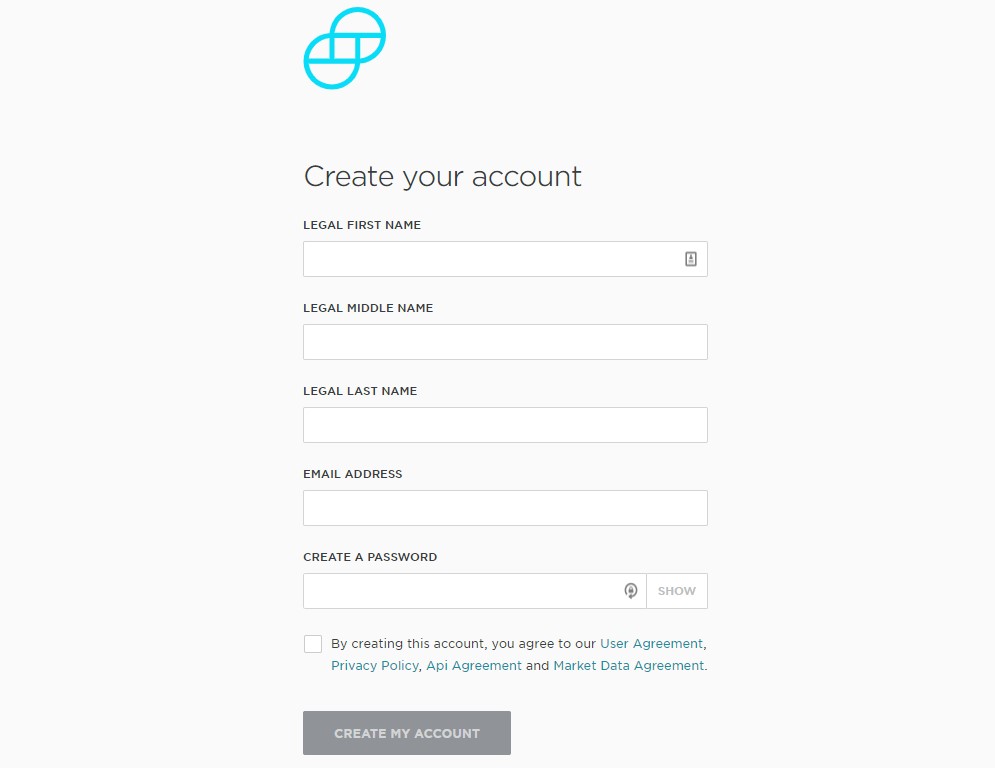

- Access the official website;

- Click on the “Register” button (on the page’s upper right-hand side. See the image below);

- Provide your name, password, and a valid email address;

- After receiving the confirmation code, enter the given code on the website;

- You will then have to go through the exchange’s verification process;

- Provide the required personal details, phone number, and enable Two-factor authentication. In the second stage, provide a bank account. The third verification stage will require you to submit photos of your ID card. The last stage asks for government-approved documents to confirm your identity.

Making a deposit

- Go to the menu and click on “Transfer Funds;”

- Go to “Deposit Into”→”Exchange”→”Bank Transfers;”

- Enter an amount that you want to deposit.

Buying Crypto

- Go to the menu and find the pair which you want to trade;

- Enter the amount and price of the buy order. You can also select market orders provided by other users, or you can set up an alert that sends you to push notifications when the price hits the level you are interested in;

- Click “Buy.”

Withdrawing crypto

- Click the “Transfer Funds” tab on the Gemini dashboard;

- From the dropdown menu, navigate to crypto you want to withdraw’

- Once you have selected your withdrawal options, you’ll be required to put in your “Destination Address” which is your external wallet;

- Click on the button to withdraw.

Gemini Exchange Fees

Gemini applies a fee when you place a buy or sell order through their website or mobile app in addition to a 0.5% “convenience fee.”

- Less than or equal to $10.00: $0.99;

- Greater than $10.00 but less than or equal to $25.00: $1.49;

- Greater than $25.00 but less than or equal to $50.00: $1.99;

- Greater than $50.00 but less than or equal to $200.00: $2.99;

- Greater than $200.00: 1.49% of your Web Order value.

Marketplace ActiveTrader fees

When buying or selling from the exchange continuous order books or the Gemini auction, through the ActiveTrader interface, you will have different fees that are charged on the maker/taker model based on a 30-day period.

When buying or selling from the exchange continuous order books or the Gemini auction, through the ActiveTrader interface, you will have different fees that are charged on the maker/taker model based on a 30-day period.

No fees are charged on USD withdrawals and deposits made through all payment methods, including ACH, Bank Wire, and Gemini Dollar conversions.

International wire transfers could have Swift routing fees, which are charged by your own bank.

There are also no fees for crypto deposits, and the exchange will not charge you any fees if you make below ten crypto withdrawals a month. Of course, there will be mining fees applied.

Limits

Users are allowed to deposit up to USD 500 daily through bank transfers, with a monthly limit of USD 15,000. Wire transfers and crypto deposits have no limit.

The Bank transfer has a daily withdrawal limit of USD 100,000, while the Bank wire and crypto withdrawals have no limit.

The minimum amount you can purchase for Bitcoin is 0.00001 BTC, and for Ether, the minimum amount is 0 .001 ETH.

Payment Methods

Users can fund their accounts either with cryptocurrency, Wire transfer, or Bank transfer (the USA only).

Security Features

Gemini is regarded as one of the most secure exchanges in the crypto industry.

Most of its crypto funds are kept in cold storage, with the keys to these wallets being stored on multiple different devices and locations. The wallets are secured by multi-signature technology, meaning that the cooperation of several people is required to open the wallets. Gemini’s “Hot Wallet” is hosted on AWS, a secure infrastructure, and these Hot Wallet keys are stored in Hardware Security Modules (HSMs) which are considered to be top-notch hardware.

For account protection, the exchange also requires two-factor authentication in order to operate an account, a feature that also keeps accounts protected from phishing attempts. Other security standards which have been implemented include strong passwords, account rate limiting, and address whitelisting.

medium.com

medium.comGemini also provides FDIC insurance for their users’ USD account balances of up to $250k, with USD funds stored in segregated accounts.

This means that user funds are kept separately from any of the company funds. Their coin reserves from all their account balances are also backed up fully by crypto or USD.

The platform also supports hardware wallet security keys, as well as Web Authentication that allows users to gain access to their accounts via hardware wallet instead of their phone.

At the company level, the exchange also applies some operational security measures, such as conducting background checks on all their employees and storing keys outside of their offices. Also, none of the managers or founders can transfer any funds individually.

Their web platform is protected from Dedicated Denial of Service (DDoS) attacks and uses only the internal section of their website which has no external access.

Gemini was also reviewed by Deloitte & Touché LLP for their SOC 2 implementation, making it one of the few cryptocurrency exchanges that have completed this review.

The company is totally compliant with stringent US regulations, as being a New York Trust Company, it holds a BitLicense – meaning that they are a regulated crypto company operating under the authority of the New York Department of Financial Services (NYDFS).

The exchange is also a member of the Virtual Commodities Association (VCA), a self-regulatory organization that oversees the crypto industry.

Customer Support

The exchange features an FAQ section that has answers to most questions in relation to crypto trading and account funding.

The exchange features an FAQ section that has answers to most questions in relation to crypto trading and account funding.

For specific inquires, you can contact the support team of Gemini through an email ticket.

There is also a live chat function, but it does not seem to be working.

Users can also reach the support team if their problems are still unresolved on their social media accounts, either Twitter or Facebook, by showing your ticket number.

There have been several complaints regarding the responsiveness of the exchange, with some users complaining that it took hours for them to receive an answer or some got no response at all.

Gemini Exchange Reputation

Like any crypto exchange, you will find online many bad and good reviews. Most of the complaints that we have noticed are with regards to a lack of customer support responsiveness, or fund and account freezing.

Like any crypto exchange, you will find online many bad and good reviews. Most of the complaints that we have noticed are with regards to a lack of customer support responsiveness, or fund and account freezing.

But, overall, it is highly rated for its security and legitimacy, and there have been no reported hacks, factors that make Gemini a trusted exchange.

Gemini Exchange Review: Verdict

We can’t tell you if Gemini is a good or bad exchange, but from our review, you can determine for yourself if it is the best trading platform for you and your specific trading needs.

The Review

Gemini Exchange Review

PROS

- Intuitive interface

- No deposit/withdrawal fees

- Available to US-based traders

- Tightly regulated

- Highly secure

- Various trade types

- High liquidity

CONS

- Long registration process due to tedious verification requirements

- Available in a limited number of countries

- High trading fees

- Limited coin selection

- Limited fiat deposit options

- Slow customer support

- No chat function or phone number

- Hold the private keys of users

Review Breakdown

- Supported Currencies

- Rates and Fees

- Security

- Transaction Speed

- Ease of Use

- Customer Support