A week is a long time in the digital asset industry for an asset to jump between different price ranges.

Around 9 days ago, BTC‘s unexpected dip below $4000. From 19th March 10:00 UTC to 20th March 10:00 UTC, Bitcoin managed to scale back up by approx 25 percent, underlining its ability to undergo quick corrections. At press time, the price had fallen back by 8 percent.

As the market showed shades of green over the past few days, investors continued took a precarious approach in terms of investment.

Recent data suggested that despite Bitcoin‘s average 22 percent hike since March 15th, investors were still reluctant to dip their toes into the current market.

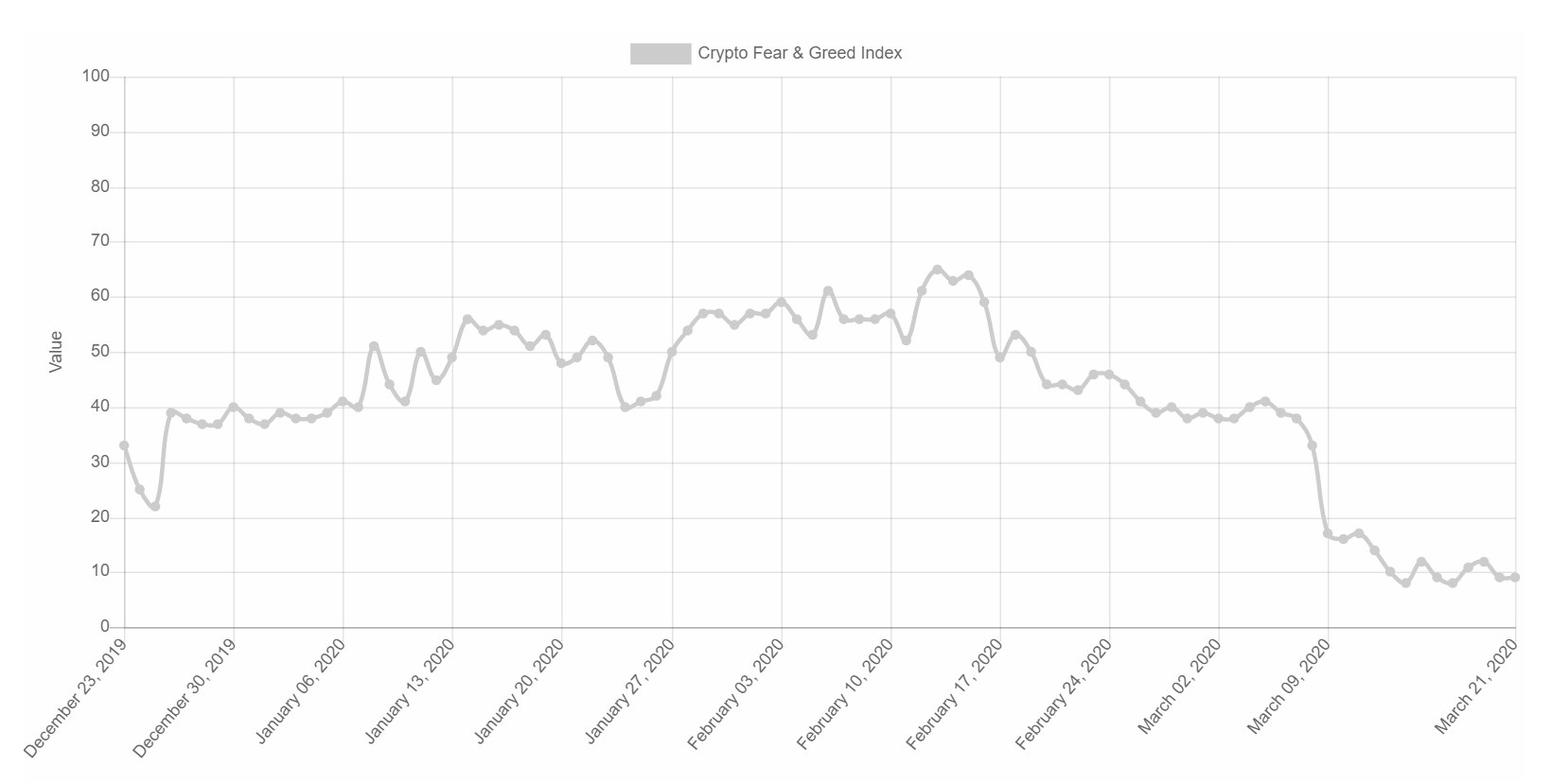

Source: alternative.me

According to Bitcoin’s Fear and Greed Index, the asset continued to a rating below 10, suggesting an ‘Extreme Fear’ market sentiment. Surprisingly, the index appeared to have declined further over the week, as the index showed a rating of 12 on 14th March.

The current ratings implied that investors lacked confidence with Bitcoin’s price and needed more time to evaluate the situation. Although an ‘Extreme Fear’ usually opens a buying opportunity, the market remained inactive over the week.

The above sentiment can be verified from the following skew charts.

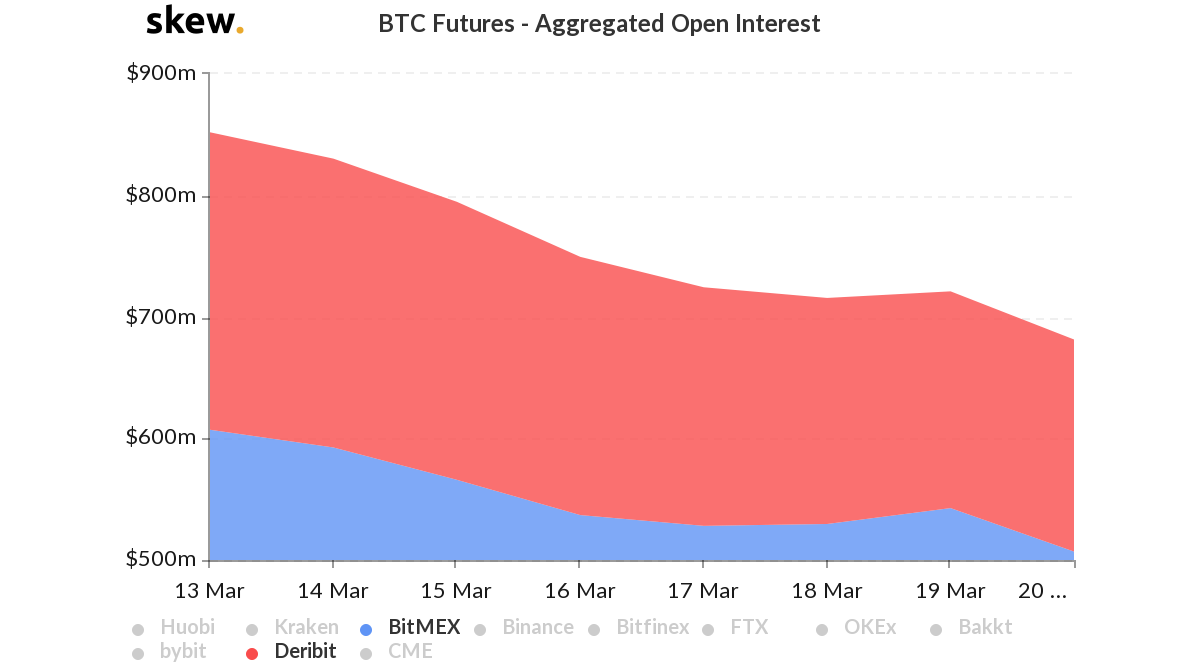

Source: skew

BitMEX and Deribit, two of the major derivatives exchanges continued to indicate a decline in Open Interest as OI for both the platforms dropped from $607 and $245 million to $507 and $175 million, respectively.

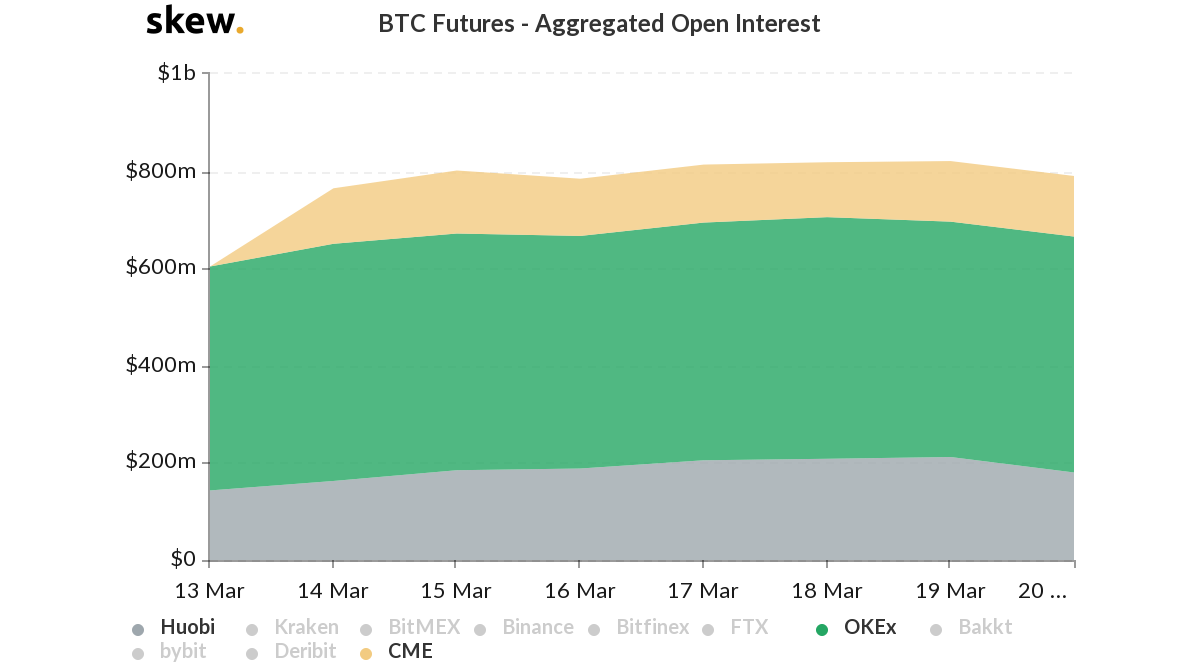

Source: skew

OI remained fairly stable on OKEx, Huobi, and CME, without experiencing a significant hike or drop. With various futures contracts expiring on 27th March, OI may pick up over the next week, if Bitcoin is able to maintain consolidation at a higher range.

Are the Macro returns clouding investors’ judgment?

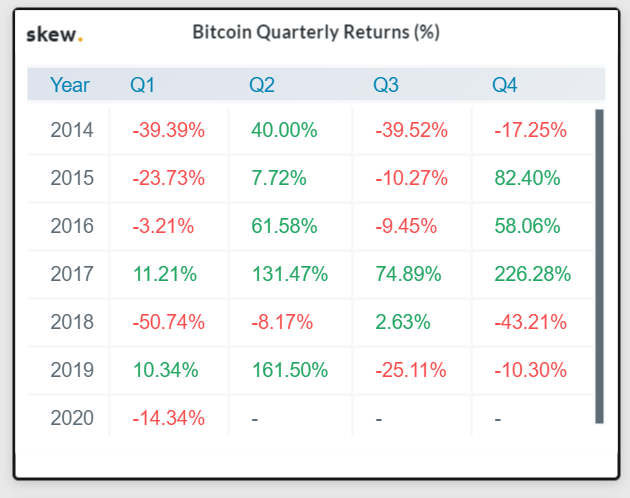

Bitcoin may have scaled closed to 20-25 percent over the past few days but according to skew, the quarterly returns for Q1 2020, remain relatively negative at press time.

Source: Skew

The macro returns in Q1 2019 were around 10 percent, while at press time, BTC registered -14.34 percent for the past three months. With only a few days to go before Q1 concludes for 2020, it is likely to end on a negative and investors could be looking at this metric closely while analyzing future investments.

Source From : Ambcrypto