In today’s Abra Wallet review, we will be looking into some of the features, pros, and cons of this crypto product to establish if this is the right wallet for you.

Abra Wallet Overview

Abra is a multi-crypto mobile wallet and exchange platform. Abra initially started as a Bitcoin-only wallet in 2014, developed by Bill Barhydt and Pete Kelly. The team’s main office is in Silicon Valley, USA, but they are also based in Manila, Philippines.

Since its launch, the project has attracted the interest and funds of a number of venture capital investors, raising approximately $35.5M. Some of the companies that backed Jungle Ventures, Arbor Ventures, and American Express.

Abra initially accepted cash and remittance payments via face-to-face meetings through a network of Tellers in points throughout the United States and the Philippines.

Later in 2017, the service started accepting the buying and selling of Bitcoins, in addition to supporting USD bank transfers and deposits through the American Express card. The Teller payment system was also limited to the Philippines residents during this time.

Abra now allows users to buy and trade cryptocurrencies, stocks, and ETFs, and it also supports credit card deposits (more on that later in our Abra Wallet review).

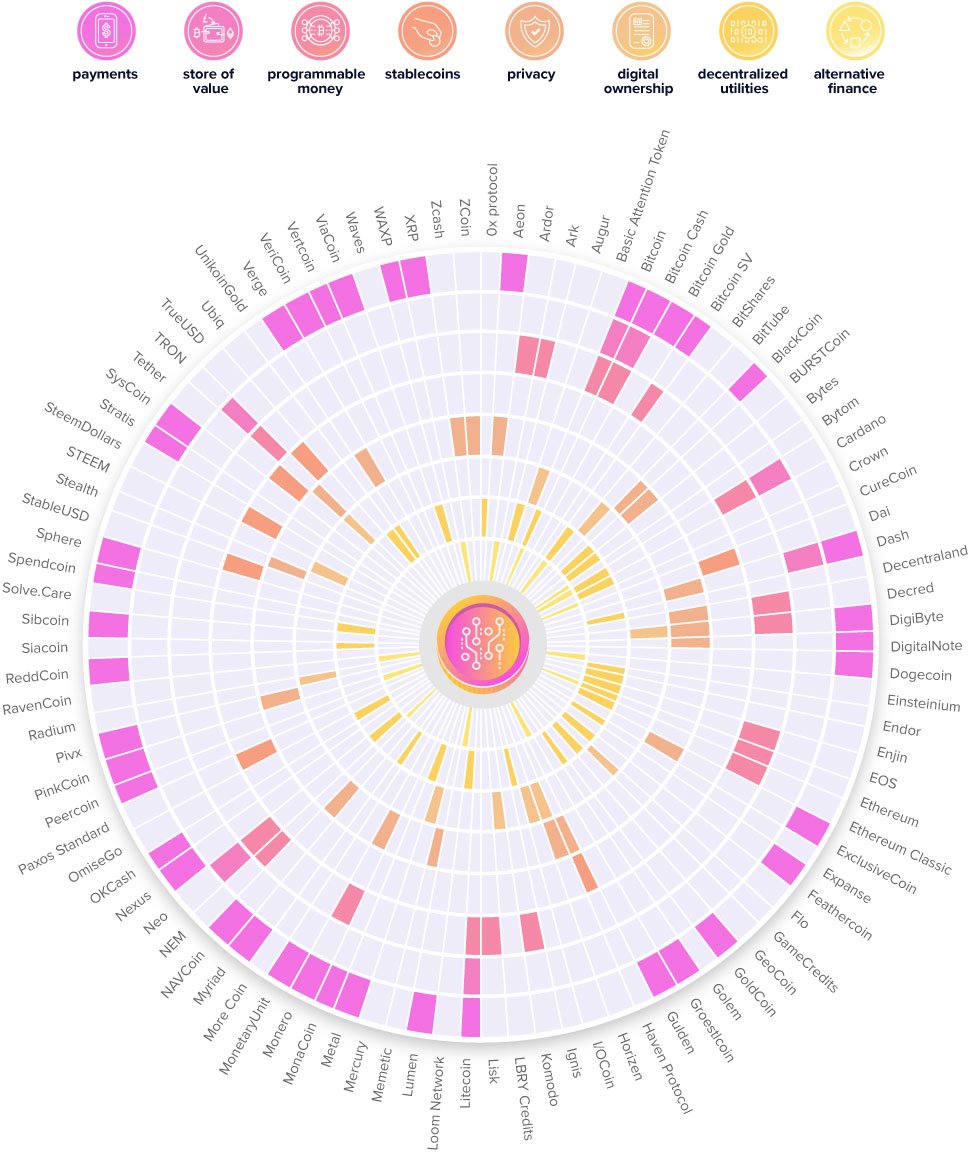

Supported Currencies and Available Countries

Depending on the country of residence, you will have access to certain cryptos, stocks, and ETFs.

US-based users are able to buy, sell, and trade with Bitcoin, Ether, Litecoin, and Bitcoin Cash. Currently, international users have access to 90 cryptocurrencies, such as BTC, BCH, ETH ZRX, AEON, ARDR, ARK, REP, BAT, BSV, BTS, and DASH, but starting with December 2019, they will be able to trade, buy, and sell 200 new cryptocurrencies.

Deposits with stablecoins such as Tether, Paxos, TrueUSD, and DAI has been implemented since November 12, 2019.

The app accepts a total of 54 fiat currencies, including AUD, USD, GBP, EUR, JPY, SGD, and HKD.

All residents that are based outside of the United States are able to invest in stocks, such as Apple, Amazon, Alibaba, Facebook, Netflix, and Tesla, as well as the following ETFs: SPDR Gold Trust, SPDR S&P 500, United States Oil Fund, and the Vanguard FTSE Europe.

The app’s service can be used in over 150 countries, including those from the following regions: North America, South Africa, South America, Australia, Europe, South East Asia.

Abra Wallet Compatibilities

The Abra wallet can only be downloaded and used for iOS or Android devices.

User Interface and Experience

Both iOS and Android users have been praised for its ease of use and intuitive interface, with the menu system and tab layout make it simple to find any feature you are looking for. The app has been reported to have good functionality, even though there have been a few bugs over the years.

How to Get Abra Wallet

We will now show you in our Abra wallet review how to install and use the app:

- Go to the Abra wallet site or the App Store or Google Play;

- Select the app for your system; download and install it;

- Provide your name, email address, and mobile phone number;

- You will receive a text with a verification code;

- Create and confirm a four-digit pin;

- Confirm if you are a resident of the United States of America;

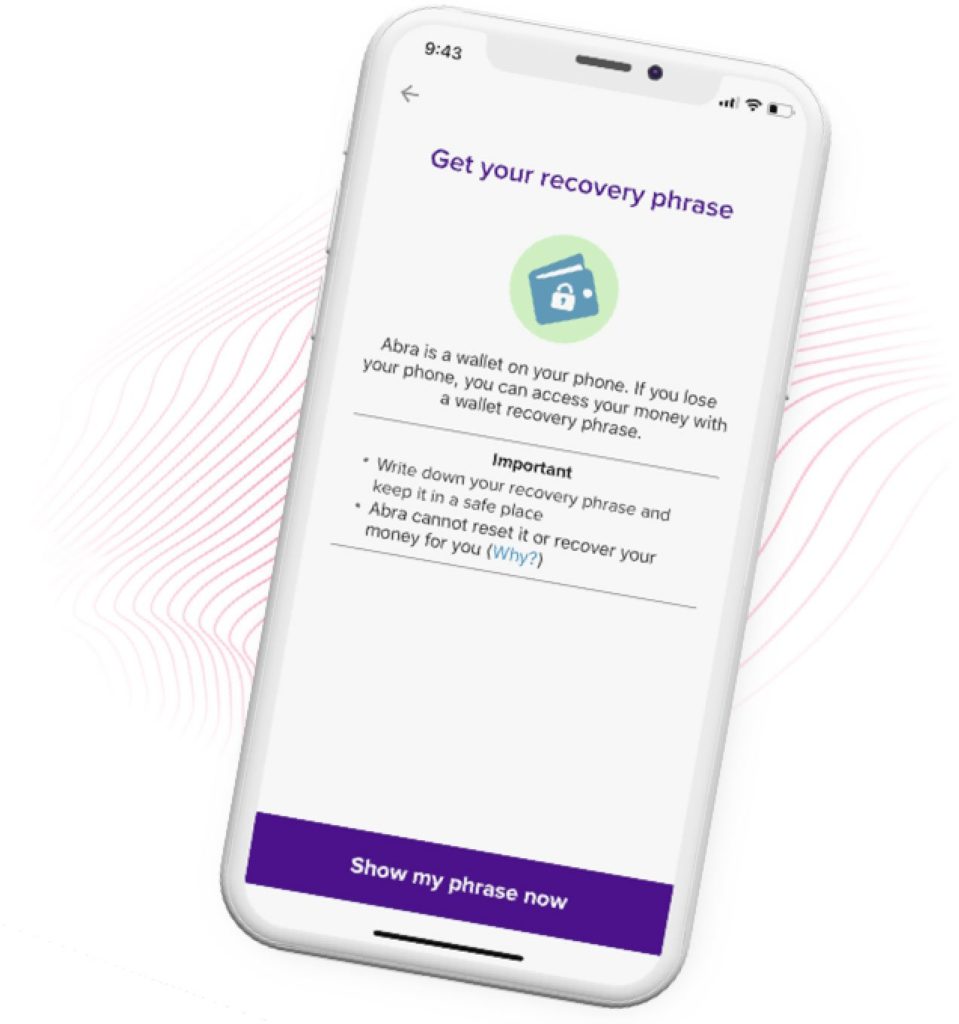

- Generate recovery seed phrase and write it down.

You will have to go through ID verification if you want to link your bank account. You will have to provide a photo of your ID, selfie with the ID, bank statement, and other documentation if the service deems it necessary.

How to Use Abra Wallet

Depositing crypto

- Open the app and go to the portfolio screen.

- Tap “+Add Money” and select which crypto you want to deposit.

- Scan the QR code presented or copy and paste the cryptocurrency address.

Sending funds

- Go to the main portfolio screen.

- Select the main menu on the top left corner.

- Tap on “send to Abra user”.

- Select a user from the list of contacts.

- Select which currency you want to send by choosing in which type of wallet the recipient will have the funds deposited into.

- You can convert crypto to fiat when sending by tapping the blue-highlighted “change” option.

Withdrawing crypto

- Go to the portfolio view and select “withdraw.”

- Select which cryptocurrency you would like to send.

- Tap the QR code symbol to send the QR address of the recipient or paste the address in the address field.

- Enter the amount you wish to send.

- Tap “confirm.”

Abra Wallet Fees

Through its Simplex integration, Abra is able to support credit card deposits. The payment methods and respective fees are included below in the Abra wallet review.

The wallet applies different fees according to the method of funding you have chosen:

- ACH bank transfer: free;

- Bank wires (US only): no Abra fee, but your bank may charge one;

- SEPA transfer (EU): 0.25%;

- AMEX card (US only): 4%;

- VISA or Mastercard: $10 Flat fee or 4%;

- Via teller (Philippines): 1 to 2.5%;

- Crypto deposits: no Abra fee, network fee may apply.

The withdrawal fees will also vary according to the method you have selected:

- Via US and PH bank: no Abra fee, but your bank may apply a charge;

- Via teller (Philippines): up to 2%;

- Cryptocurrency: network fees;

- Abra wire program (US): varies.

US users: Altcoin withdrawals come with a network fee in addition to the Bittrex withdrawal fee.

International users: Altcoin withdrawals come with a bitcoin network fee plus a Bittrex withdrawal fee. This is because the app does not natively support altcoins for international users, as they are synthetic within the Abra app, meaning the underlying currency is still bitcoin. Abra thus uses Bittrex to exchange BTC for altcoin when making the withdrawal.

When exchanging currencies within the Abra app, this generates a small spread. This means you will buy a currency at a higher price than the one it has on the market rates, or you will sell a currency that is below the current rates.

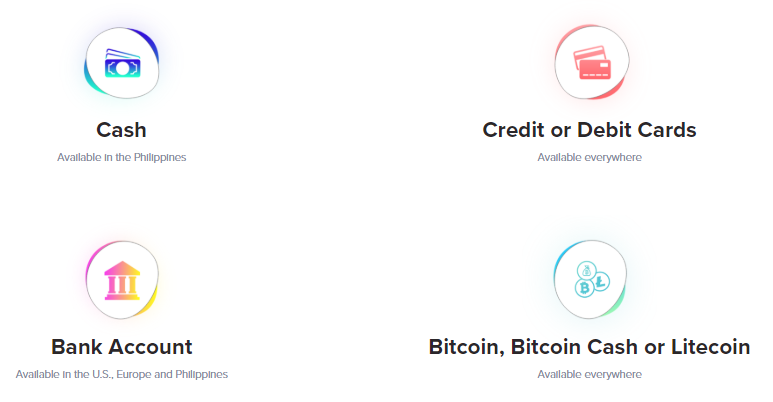

Payment Methods

Our Abra wallet review will list the payment methods supported by the app for account funding:

- Cryptocurrency: Bitcoin, Ethereum, Litecoin, etc;

- Credit card: MasterCard, Visa, or American Express (US only);

- Local Bank Transfer: US (ACH), EU (SEPA), Philippines;

- Wire Transfer: US bank wires, and the International wires expected to be added in the future.

Transaction Times

Bank account transfers depend on your country of residence, as in Europe and the US, you can expect the funds to be credited within 1-2 days, and in the Philippines between 2-4 days.

Cash, credit/debit card, and crypto deposits are instantly available. Deposits and withdrawals made through the Abra wire program are credited between 3 to 5 days.

Withdrawals made through US and Philippines banks usually take up to 2-3 business days. Cash withdrawals are available immediately, while crypto withdrawals vary according to network traffic.

Transaction Limits

The limits imposed by Abra will vary according to the method of payment used:

- US bank wires: $30,000 per wire, daily;

- Bank deposits and withdrawals: $2,000 daily, $4,000 weekly, $8,000 monthly;

- Credit card deposits (AMEX): $200 daily and $1,000 monthly;

- Teller deposits and withdrawals: proprietary limits;

- Buy/sell non-BTC/LTC cryptocurrencies: 5 BTC per day; no limit for BTC and LTC;

- BTC, LTC, BCH deposits and withdrawals: no limit;

- Peer-to-peer transactions: no limit.

Security Features

The Abra company operates from California, but it is registered with the SEC Philippines and other relevant entities as Plutus Technologies Philippines Corporation.

The code of the app is not open source, and there have no publications that reveal any of the technical details behind the app.

Abra is a non-custodial wallet, meaning that it does not hold any of the users’ private keys. Abra provides mobile number verification, pin numbers, and seed recovery phrases during the registration process. In our Abra wallet review, we were not able to find which types of security standards are used within the wallet and exchange.

The wallet encrypts personal user information and does not reveal sensitive data to the recipient when making transactions. Abra implements the Synapse Fi banking software provider and is connected to the FDIC-insured Evolve Bank to enable it to access the ACH clearing system. This allows the app’s system to treat bank transactions made by US users as electronic deposits and withdrawals.

Customer Support

Abra’s website features guides, research, Bitcoin 101, and the FAQ section which offers information regarding their services and functionalities. However, it is not that easy to find something if you are looking for one particular information, and the site loads extremely slow.

Customers are able to contact the Abra support team through live chat, app, email, or social channels. The live chat can be accessed on their website between 9:30 AM to 4 PM PST M-F, and by accessing the “Contact Us” tab in the app you can send your email to [email protected]

The team can also be reached at their official Telegram group, Twitter account, and Facebook page.

Abra Wallet Reputation

An overwhelming number of users complained that their account was blocked or restricted when they tried adding their bank account to their app, even though they respected the identification procedure. Other issues included funds disappearing from their account and indifference from the support team when the customers solicited help with such issues.

The appgrooves.com website has over 60% negative reviews about the Abra app, and there is only one review and a person that rated the app on TrustPilot, and that review was also poor and complained about the same restriction issue.

The app has a rating of 3.6 out of 5 on Google Play from 5,900 reviews, while on iOS, the app is rated 4.6 out of 5 stars from 9.8k users. The ratings are not that bad, but there are many one-star reviews that have complained about the poor service of the app.

Abra Wallet Review: Verdict

Abra is a wallet and exchange service for mobile users that allows fiat and crypto deposits. However, the fees are pretty steep, and it seems that there is a common problem encountered by those who tried to use their bank account.

Featured image: Coinfomania

The Review

Abra Wallet Review

PROS

- Supports many cryptos for international users

- Supports fiat, stocks, and ETFs

- Payment methods include credit card and cash transfer

CONS

- US users have limited access to crypto

- US users have no access to stocks and ETFs

- High fees

- Added conversion fees from Bittrex

- Does not support altcoins natively

- Many user complaints regarding bank account linking

- Registered in Philippines

Review Breakdown

- Supported Currencies

- Rates and Fees

- Security

- Transaction Speed

- Ease of Use

- Customer Support