Today, we will be taking an in-depth look at the features, advantages, and disadvantages of one of the most well-known brokers on the market in our eToro review.

eToro Review: Exchange Overview

eToro started operating in 2006 as a brokerage company, founded by Yoni Assia, Ronen Assia, and David Ring. The company quickly rose to have an international user base and has diversified its list of offerings.

eToro started operating in 2006 as a brokerage company, founded by Yoni Assia, Ronen Assia, and David Ring. The company quickly rose to have an international user base and has diversified its list of offerings.

The Assia brothers have experiences in tech fields, such as programming and project management side, and Ring previously worked as a software engineer in Israel.

Yoni Assia still activates as eToro’s CEO, working in the same position since the exchange first launched.

Supported Currencies and Available Countries

eToro supports a variety of financial instruments and assets that can be traded, such as forex, stocks, commodities, indices, ETFs, 47 currency pairs for spot trading, and 1,933 CFDs, including on cryptocurrencies.

The exchange currently offers 16 cryptocurrencies (BTC, ETH, BCH, XRP, DASH, LTC, ETC, ADA, EOS, NEO, IOTA, TRX, ZEC, BNB, XLM, XTZ), but you can only speculate on the price through CFD contracts, you can’t actually buy and trade with the coins (you can trade on eToroX, but more on that later on in our eToro review).

The platform also supports 19 fiat currencies: EUR, GBP, NZD, USD, AUD, CAD, HKD, SGD, CHF, NOK, ZAR, JPY, SEK, CNH, TRY, RUB, HUF, MXN, PLN.

eToro’s services can be accessed by residents of the following countries:

| Belgium | Brunei | Bulgaria | Canada | Chile |

| China | Colombia | Croatia | Cyprus | Czech Republic |

| Denmark | Egypt | Estonia | Finland | France |

| Germany | Gibraltar | Greece | Hungary | Iceland |

| India | Ireland | Italy | Jordan | Kuwait |

| Latvia | Liechtenstein | Lithuania | Luxembourg | Malaysia |

| Malta | Mexico | New Zealand | Nigeria | Norway |

| Oman | Paraguay | Peru | Poland | Portugal |

| Qatar | Romania | Russia | Saudi | Arabia |

| Singapore | Slovakia | Slovenia | South Africa | Spain |

| Sweden | Switzerland | Thailand | The Netherlands | Ukraine |

| UK | Argentina | Australia | Austria | Bahrain |

| United Arab Emirates | Uruguay | Venezuela. | | |

While eToro was unavailable for US investors for some time, but now there is a beta version for US residents from the following states:

| Arizona | Virginia | Washington | South Carolina | Georgia |

| District of Columbia | Florida | Kansas | Oregon | Vermont |

| Missouri | Maryland | Michigan | Colorado | N. Jersey |

| Ohio | Iowa | Mississippi | Alabama | Connecticut |

| Utah | Pennsylvania | Massachusetts | Indiana | Wisconsin |

eToro Compatibilities

eToro is available for web-browser and mobile use, as well. The interface can be used on all desktop operating systems, and the app is compatible with both Android and iOS.

User Interface and Experience

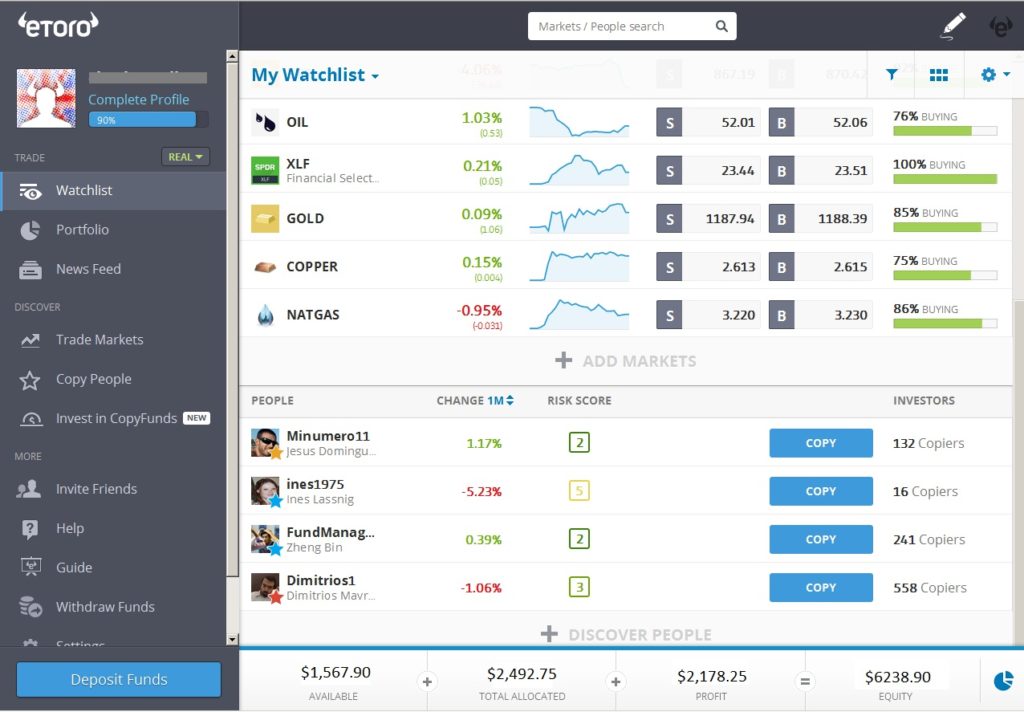

The eToro social trading platform web browser interface is focused on simplicity and ease of use. Experienced traders can also make use of the platform, as the charting features 66 indicators and numerous drawing tools. Even if it does not include backtest functionality, the charting provides performance data from CopyTraders and CopyPortfolios.

The News section actually redirects you to a social forum, where users post the latest events in the crypto news, but it’s not like a regular news aggregator.

forex-showdown.com

forex-showdown.comWatchlists show the buying and selling percentages in real-time, and they can also be easily customized.

This part of the eToro review will be focusing on their mobile apps for iOS and Android, that can easily be synced, having well-ordered, but with fewer advanced features and limited customization. The indicator list features only five basic types, while the order entry is just like the web version.

Unlike the web version, the watchlist does not have any client positioning data, but custom price alerts and push notifications about market events and account issues can be set.

Sorce: Brokernotes

Sorce: BrokernotesHow to Get eToro

- Go to the official eToro website.

- Click on “Sign up.”

- You can register for an account by creating one, or by using your Facebook or Google+ account.

- Supply the required information if you sign up by completing the form.

- In order to make deposits with real money, you will have to verify your identity and residency by uploading the following documents:

- copy of passport or personal ID;

- copy of your utility bill or bank statement.

How to Use eToro

eToro enables you to copy the trades of other users or invest in a CopyPortfolio.

CopyPortfolio is a portfolio management product that will automatically copy multiple markets or traders based on a fixed investment strategy.

There are currently two types of CopyPortfolios:

- Partner Portfolios – an investment vehicle created by eToro partners;

- Market Portfolios – top performing assets from a specific market.

A cryptocurrency has to meet several requirements to be included in the CryptoPortfolio:

- Minimum market cap of $1 billion;

- Minimum average monthly trading volume of $20 million.

The proportion of the crypto in the portfolio will be determined by the size of its market cap (the minimum is 5%). Should the coin drop below the minimum requirements, the portfolio’s system automatically removes it.

The CryptoPortfolio goes through analysis and rebalancing on the first trading day of each month.

Our eToro review will now briefly explain how to trade with crypto on eToroX:

- Click the “Trade Markets” link on the left of the screen;

- Click on “Crypto;”

- To place a CFD order:

- Select a currency pair

- Or buy with leverage

- Or take out a short position

- Enter the details of your transaction.

- Open the trade or set the order.

eToro’s Cryptocurrency Wallet

eToro has also developed a crypto wallet for Android but is not actually a truce crypto wallet; instead, it is more like an interface to eToro’s existing platform.

The wallet currently supports Bitcoin, Litecoin, Ethereum, and Bitcoin Cash.

eToroX

On April 26, 2019, eToro launched eToroX, a fully regulated cryptocurrency exchange, where you can actually trade and withdrawal crypto.

linkedin.com

linkedin.comeToro Exchange Fees

In our eToro review, we noticed that there are many types of fees when dealing with the exchange.

The account opening requires $200 for international users, while U.S. and Australian users pay $50.

eToro applies fees to a fixed spread of three pips on the EUR/USD, having some of the highest prices when compared to the rest of the brokerage platforms.

Minimum forex, commodity and index spreads are high, with EUR/USD at 3.0 pips and S&P 500 at 75.00 pips. Spreads can also get larger depending on market conditions.

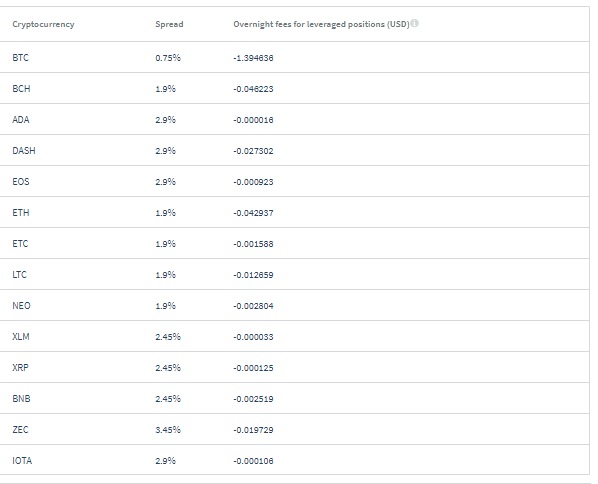

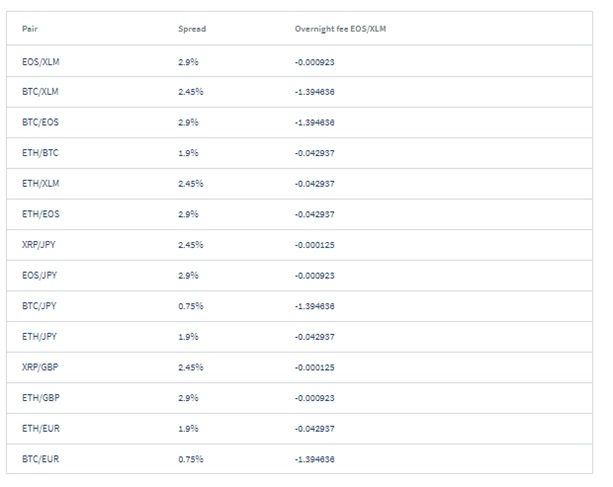

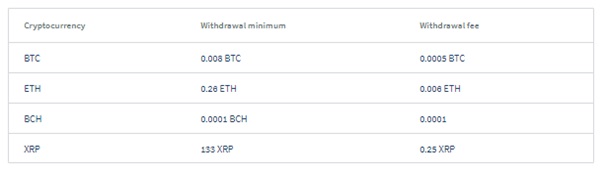

The CFD prices for cryptos are:

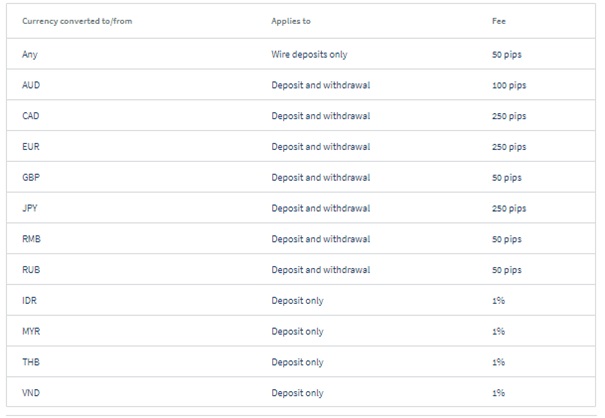

The deposit fees are based on the currency you select to make the conversion:

eToro’s non-trading fees are also high. Even if there is an inactivity fee, there are no fees for the account, deposit, and custody.

Payment Methods

eToro allows users to deposit and withdrawal fund through a variety of payment methods :

- Credit/debit card;

- Wire transfer;

- PayPal;

- Skrill;

- Neteller;

- WebMoney;

- Giropay;

- China UnionPay;

- Yandex;

- Local Online Banking.

Transaction Times

If you search online for an eToro review from actual users, the depositing times will vary greatly. Deposits can be instant or can take up to 5 business days. Cryptocurrency transfers in and out of eToro vary on the traffic of the network at that time.

Withdrawals can take from 2 to 8 business days and vary according to the payment method used, with wire transfers being the longest.

Transaction Limits

There is a $500 minimum when you first make a deposit, which has to be made via wire transfer. There are also limits to how much you can withdraw:

Security Features

The exchnage is regulated an operates under various licenses that allow it to function in various countries:

The exchnage is regulated an operates under various licenses that allow it to function in various countries:

- the Cyprus Securities Exchange Commission (CySEC) under the license # 109/10;

- the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139;

- the Financial Conduct Authority (FCA) under the license FRN 583263.

The platform features a two-step login system, although enabling it is optional.

eToro client funds are stored in segregated accounts, and deposits are encrypted through SSL technology.

There are no investor protections if you lose your cryptocurrency funds, except if eToro goes bankrupt, and you have a claim.

There are some protections for users that have experienced loses related to cryptocurrency CFDs if the exchange is not able to pay your earnings. Non-professional investor customers that are protected by the Cypriot Investors Fund with insurance of up to €20,000.

Customer Support

eToro offers customer support on a 24/7 basis, where customers can submit a support ticket to ask help for account problems. The site also features an FAQ section with answers to the most common questions. The only listed phone number is available only for the Australian branch.

eToro offers customer support on a 24/7 basis, where customers can submit a support ticket to ask help for account problems. The site also features an FAQ section with answers to the most common questions. The only listed phone number is available only for the Australian branch.

There is a live online chat feature available to clients who have registered on the platform.

eToro Exchange Reputation

The exchange also features an eToro review section on their page, where users can post their evaluation on their service. On this page, they have a rating of 4.86 out of 5 based on 1946 reviews.

On Trustpilot, they have a rating of 2,5 out of 5 stars rating. Complaints vary from lack of support response to opening and closing instruments at times when it is most suited for the exchange.

eToro Review: Verdict

eToro is a completely trustworthy trading platform that also offers crypto derivatives, but the prices are considerably higher, and you do not actually trade with crypto, in fact, you speculate on their price.

The Review

eToro Exchange Review

PROS

- Easy to use

- Has a variety of trading instruments

- Completely regulated

CONS

- High fees

- Too many fees

- Withdrawals not functional all cryptocurrencies

Review Breakdown

- Supported Currencies

- Rates and Fees

- Security

- Transaction Speed

- Ease of Use

- Customer Support