As far as the Bitcoin market is concerned, a pump or a dump is more often than not, unconfirmed. Several movements have no source, no ground-zero, but many have far-reaching consequences including massive million-dollar liquidations, an incessant attack on the store of value of the cryptocurrency, and the gloat train led by Nouriel Roubini and Peter Schiff.

While these are not the most looked-forward things in the market, the price rise or fall, at times, does come with a source, or rather a consequence. On 2 April, Bitcoin, as other macroeconomic markets were enjoying domestic artificial stimulus, jumped from $6,500 and broke the $7,000 mark briefly, with mostly untoward trades, a level it fell below three weeks ago with its biggest collapse in seven years.

Did anyone predict this move, or is there a notable consequence? Well, there might just be; if you look at the Bitcoin derivatives market, you’re sure to find something.

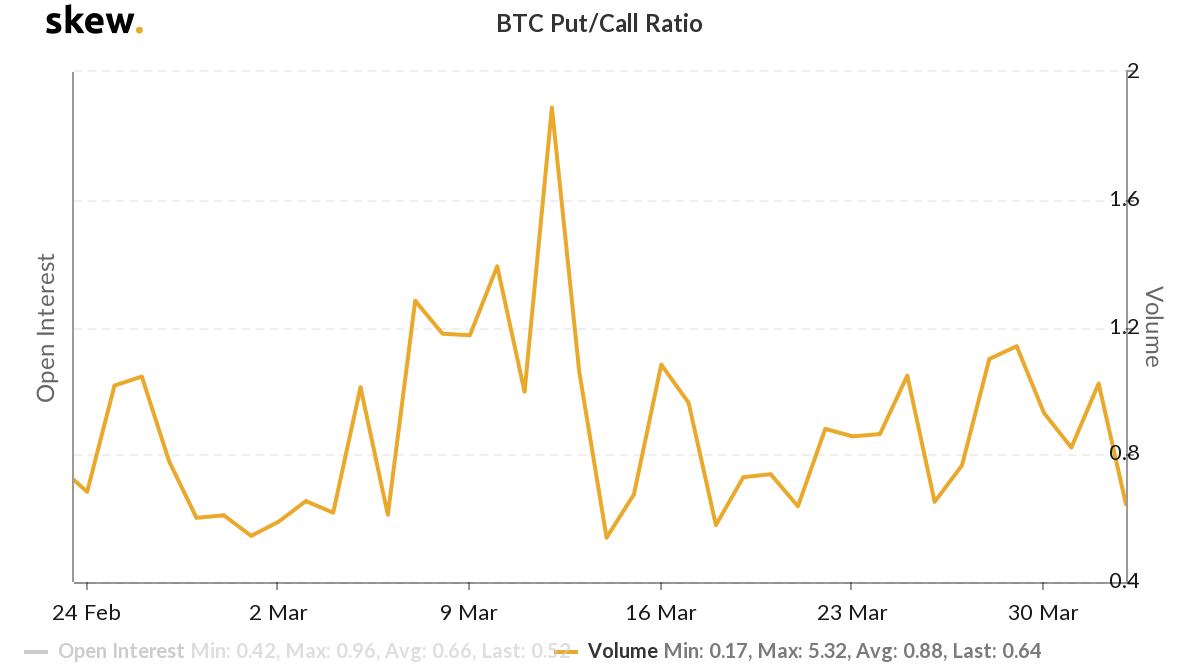

Bitcoin Options Put/Call ratio | Source: skew

According to data from Skew markets, on the Options front, the Put/Call ratio nosedived, dropping from 1.02 to 0.64, a drop of 37 percent in the past 24-hours alone. This suggests, either, that traders are buying more call options, or right to buy options, compared to put options, or right to sell Options. Either way, this has surmounted high buying pressure on the cryptocurrency’s spot market as well, resulting in the price increase.

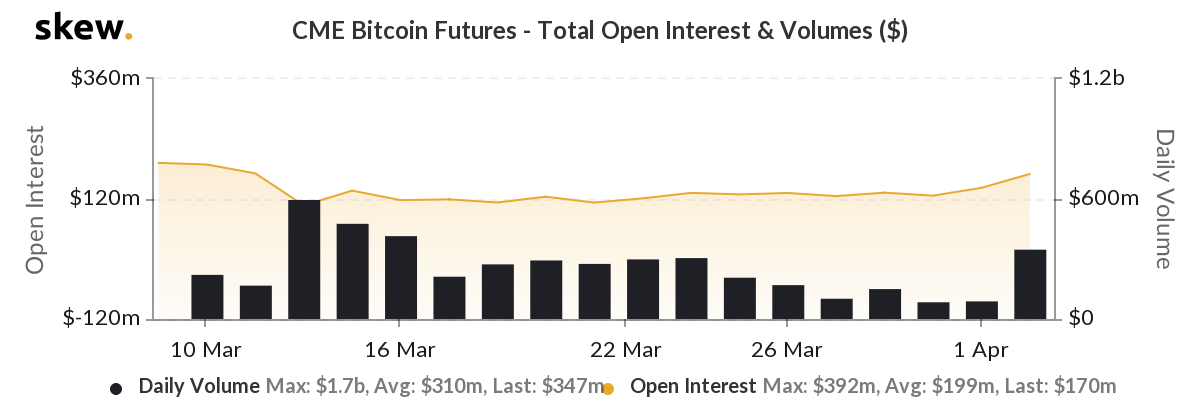

On the other hand, the Futures market has some compelling evidence. This evidence, however, was not common across all exchanges, but rather only for institutional-grade, U.S investors-concentrated Chicago Mercantile Exchange [CME].

The CME saw a relative uptick in its Open Interest [OI], or open and active positions, current on its coffers. This OI increase was accompanied by an increase in volume from $88 million on 1 April to $347 million a day later, a massive 294 percent increase. Increasing volume, however, is something common with unregulated exchanges.

CME Bitcoin Futures volume and OI | Source: skew

On the other hand, exchanges like BitMEX, OKEx, and Binance while also seeing surging volumes, have not seen the same level of rising Open Interest. CME’s OI increased from $127 million to $177 million, a 39 percent increase in the past 24 hours, while the OI across the three main unregulated exchanges fell over the same time period.

Bitcoin’s move up to $7,000, while having no organic source, could be traced back to the derivatives market. While Bitcoin Options mounted the buying pressure, Bitcoin Futures fueled liquidity.

Source From : Ambcrypto