While the greenback has been rising higher, the Japanese yen tapped a 24-year low and Japan decided to intervene in foreign exchange markets (forex) for the first time since 1998. Reports say the Bank of Japan conducted the first forex intervention in 24 years, after the Japanese central bank kept its benchmark bank rate suppressed for quite some time. Following the intervention, the yen rallied as the U.S. dollar took a steep dive against the Japanese yen during Thursday’s trading sessions. However, the greenback has stepped back up to the plate and the yen’s recent gains are starting to waver.

The U.S. dollar has been a prominent force in the world of fiat currencies and just recently the Japanese yen tapped a 24-year low which pushed the Bank of Japan to intervene. Reuters detailed on Thursday that it was the first time the Japanese central bank stepped into forex markets since 1998 to revive the falling currency. It is the first buy-side intervention since 1998 as the Bank of Japan did sell yen using physical intervention methods in 2011.

Following the intervention, the Japanese yen rallied but the JPY/USD exchange rate still shows the yen is down a great deal against the greenback during the last six months. Speaking with marketwatch.com author Steve Goldstein, Michael Hewson, the chief markets analyst at CMC Markets U.K., is questioning the yen’s long-term decline.

“The big question is whether it will make a difference and change the long-term direction of the Japanese yen’s decline,” Hewson detailed on Thursday. “The 145/146 level does appear to be a level the Bank of Japan seems keen to defend at the moment given that last week’s rate check happened around similar levels.”

Chinese Yuan, EU’s Euro, and Many Other Fiat Currencies Take a Beating from the Robust Greenback — Yen’s Intervention Gains Start to Erode

The yen is not the only fiat currency struggling as the Chinese yuan has continued to depreciate against the greenback. After reaching parity with the U.S. dollar again this week, the European Union’s euro is now at $0.98 against the U.S. dollar at the time of writing.

Masato Kanda, Japan’s vice finance minister for international affairs, explained that the yen’s recent 24-year drop made it so officials “have taken decisive action in the exchange market.” At the time of writing, the U.S. dollar index chart (DXY) has skyrocketed to 111.448 and the yen’s gains during the morning trading sessions (ET) are slowly being erased. In addition to a large handful of fiat currencies, crypto assets, precious metals, and equities are taking a beating from the U.S. dollar as well on Thursday afternoon (ET).

What do you think about the Japanese yen sliding to a 24-year low and the Bank of Japan stepping in to fix the situation via forex markets? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

While the greenback has been rising higher, the Japanese yen tapped a 24-year low and Japan decided to intervene in foreign exchange markets (forex) for the first time since 1998. Reports say the Bank of Japan conducted the first forex intervention in 24 years, after the Japanese central bank kept its benchmark bank rate suppressed for quite some time. Following the intervention, the yen rallied as the U.S. dollar took a steep dive against the Japanese yen during Thursday’s trading sessions. However, the greenback has stepped back up to the plate and the yen’s recent gains are starting to waver.

The U.S. dollar has been a prominent force in the world of fiat currencies and just recently the Japanese yen tapped a 24-year low which pushed the Bank of Japan to intervene. Reuters detailed on Thursday that it was the first time the Japanese central bank stepped into forex markets since 1998 to revive the falling currency. It is the first buy-side intervention since 1998 as the Bank of Japan did sell yen using physical intervention methods in 2011.

Following the intervention, the Japanese yen rallied but the JPY/USD exchange rate still shows the yen is down a great deal against the greenback during the last six months. Speaking with marketwatch.com author Steve Goldstein, Michael Hewson, the chief markets analyst at CMC Markets U.K., is questioning the yen’s long-term decline.

“The big question is whether it will make a difference and change the long-term direction of the Japanese yen’s decline,” Hewson detailed on Thursday. “The 145/146 level does appear to be a level the Bank of Japan seems keen to defend at the moment given that last week’s rate check happened around similar levels.”

Chinese Yuan, EU’s Euro, and Many Other Fiat Currencies Take a Beating from the Robust Greenback — Yen’s Intervention Gains Start to Erode

The yen is not the only fiat currency struggling as the Chinese yuan has continued to depreciate against the greenback. After reaching parity with the U.S. dollar again this week, the European Union’s euro is now at $0.98 against the U.S. dollar at the time of writing.

Masato Kanda, Japan’s vice finance minister for international affairs, explained that the yen’s recent 24-year drop made it so officials “have taken decisive action in the exchange market.” At the time of writing, the U.S. dollar index chart (DXY) has skyrocketed to 111.448 and the yen’s gains during the morning trading sessions (ET) are slowly being erased. In addition to a large handful of fiat currencies, crypto assets, precious metals, and equities are taking a beating from the U.S. dollar as well on Thursday afternoon (ET).

What do you think about the Japanese yen sliding to a 24-year low and the Bank of Japan stepping in to fix the situation via forex markets? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

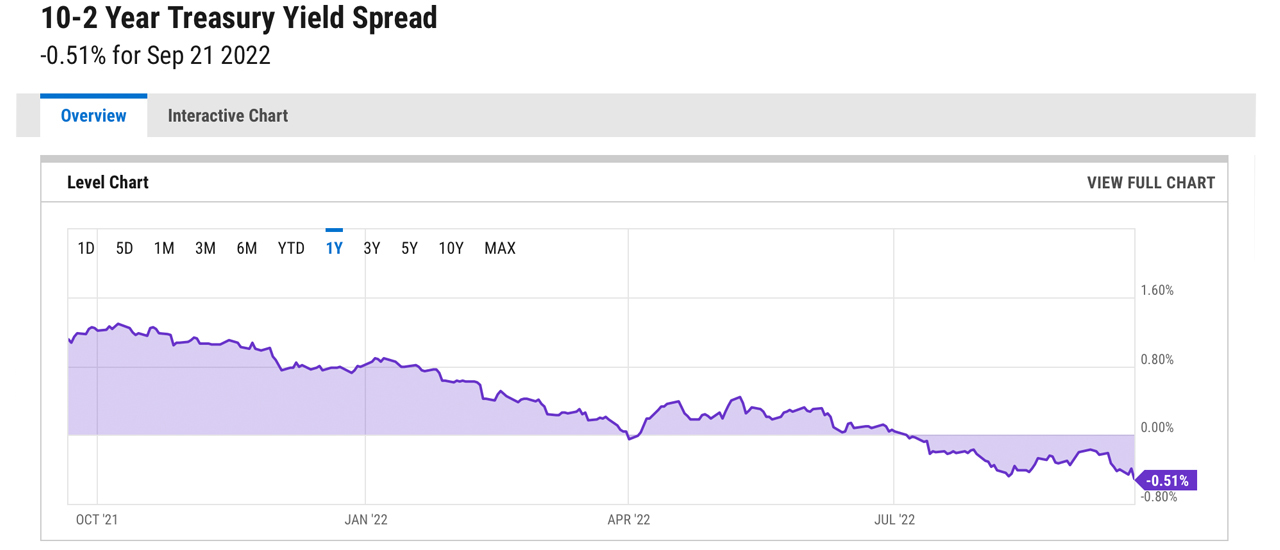

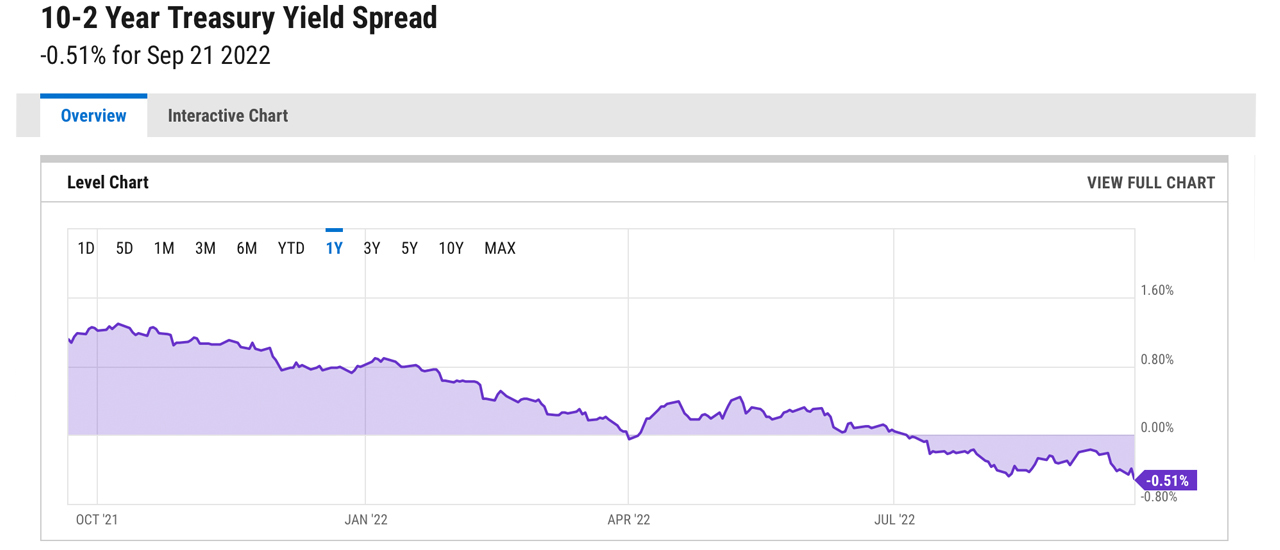

Yields on long-dated U.S. Treasuries have been erratic this year and this week, the 10-year Treasury yield crossed 3.5% for the first time in a decade. Following the Fed’s 75bps (basis points) rate hike, 10-year notes reached 3.642% and two-year Treasury notes jumped to a 15-year high at 4.090%. The curve between the two- and 10-year notes indicates the chances of a deep U.S. recession have grown stronger, and recent reports say bond traders have been “confronted with the wildest volatility of their careers.”

At the end of July, after the second consecutive quarter of negative gross domestic product (GDP), a number of economists and market strategists stressed that the U.S. is in a recession. However, the Biden administration disagreed and the White House published an article which defines the start of a recession from the National Bureau of Economic Research’s perspective. Additionally, red-hot inflation has been wreaking havoc on Americans, and market analysts believe that rising consumer prices also point to a recession in the United States.

One of the biggest signals, however, is the yield curve which measures long-term debt with short-term debt by monitoring two and 10-year Treasury note yields. Many analysts believe an inverted yield curve is one of the strongest signals that points to a recession. The inverted yield curve is unusual but not in 2022, as bond traders have been dealing with a crazy trading environment this year. This week, two- and 10-year Treasury note (T-note) yields broke records as the 10-year T-note surpassed 3.5% on September 19, for the first time since 2011. On the same day, the two-year T-note tapped a 15-year high reaching 3.97% for the first time since 2007.

Despite the fact that such bond market volatility is usually a sign of a weakening economy in the U.S., professional traders claim bond markets have been exciting and “fun.” Bloomberg authors Michael MacKenzie and Liz Capo McCormick say bond markets are “characterized by sudden and sweeping daily swings that are typically a favorable environment for traders and dealers.” Paul Hamill, the head of global fixed income, currencies, and commodities distribution at Citadel Securities agrees with the Bloomberg reporters.

“We are right in the sweet spot of rates really being an interesting market, with clients being excited to trade,” Hamill explained on Wednesday. “Everyone is spending all day talking to clients and talking to each other. It’s been fun.”

However, not everyone thinks the equity and bond market volatility is all fun and games. The chief strategist at bubbatrading.com, Todd ‘Bubba’ Horwitz, recently said that he expects to see “a 50 to 60 percent haircut” in equity markets. The recent U.S. Treasury yield fluctuations have given market strategists reasons to be concerned about looming economic issues. During the first week of September, Lead-Lag Report publisher and portfolio manager, Michael Gayed, warned that the erratic bond market could spark a sovereign debt crisis and “several black swans.”

Studies and empirical evidence show a volatile U.S. Treasury note market is not good for foreign countries holding U.S. T-notes and dealing with significant debt issues. That’s because when U.S. T-notes are leveraged for restructuring purposes and a resolution tool, “sudden and sweeping daily swings” can punish countries trying to use these financial vehicles for debt restructuring. Additionally, since the Covid-19 pandemic, the massive U.S. stimulus programs, and the Ukraine-Russia war, sovereign risk has elevated across the board, in a myriad of countries worldwide.

On Wednesday, Bloomberg authors MacKenzie and McCormick also quoted Ian Lyngen, the head of U.S. rates strategy at BMO Capital Markets, and the analyst noted that the existence of so-called financial safe havens is waning. “This will be a defining week for Fed rate expectations between now and the end of the year,” Lyngen said just before the Fed raised the federal funds rate by 75 basis points. Lyngen remarked that there’s a “[sense of investors] not wanting to be long the market. As we shift to a truly aggressive monetary policy stance, investors are running out of havens.”

On Thursday, the yield curve between the two- and 10-year T-notes slipped to 58bps, a low not seen since the deep lows in August and then 40 years ago, back in 1982. At the time of writing, the yield curve between the two- and 10-year T-notes is down 0.51%. The crypto economy is down 0.85% during the last 24 hours and is coasting along at $918.12 billion. Gold’s price per ounce is down 0.14% and silver is down 0.28%. Equity markets opened lower on Thursday morning as all four major indexes (Dow, S&P500, Nasdaq, NYSE) have printed losses.

What do you think about the erratic bond markets in 2022 and the signals that show the economy and safe havens are unreliable these days? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

Yields on long-dated U.S. Treasuries have been erratic this year and this week, the 10-year Treasury yield crossed 3.5% for the first time in a decade. Following the Fed’s 75bps (basis points) rate hike, 10-year notes reached 3.642% and two-year Treasury notes jumped to a 15-year high at 4.090%. The curve between the two- and 10-year notes indicates the chances of a deep U.S. recession have grown stronger, and recent reports say bond traders have been “confronted with the wildest volatility of their careers.”

At the end of July, after the second consecutive quarter of negative gross domestic product (GDP), a number of economists and market strategists stressed that the U.S. is in a recession. However, the Biden administration disagreed and the White House published an article which defines the start of a recession from the National Bureau of Economic Research’s perspective. Additionally, red-hot inflation has been wreaking havoc on Americans, and market analysts believe that rising consumer prices also point to a recession in the United States.

One of the biggest signals, however, is the yield curve which measures long-term debt with short-term debt by monitoring two and 10-year Treasury note yields. Many analysts believe an inverted yield curve is one of the strongest signals that points to a recession. The inverted yield curve is unusual but not in 2022, as bond traders have been dealing with a crazy trading environment this year. This week, two- and 10-year Treasury note (T-note) yields broke records as the 10-year T-note surpassed 3.5% on September 19, for the first time since 2011. On the same day, the two-year T-note tapped a 15-year high reaching 3.97% for the first time since 2007.

Despite the fact that such bond market volatility is usually a sign of a weakening economy in the U.S., professional traders claim bond markets have been exciting and “fun.” Bloomberg authors Michael MacKenzie and Liz Capo McCormick say bond markets are “characterized by sudden and sweeping daily swings that are typically a favorable environment for traders and dealers.” Paul Hamill, the head of global fixed income, currencies, and commodities distribution at Citadel Securities agrees with the Bloomberg reporters.

“We are right in the sweet spot of rates really being an interesting market, with clients being excited to trade,” Hamill explained on Wednesday. “Everyone is spending all day talking to clients and talking to each other. It’s been fun.”

However, not everyone thinks the equity and bond market volatility is all fun and games. The chief strategist at bubbatrading.com, Todd ‘Bubba’ Horwitz, recently said that he expects to see “a 50 to 60 percent haircut” in equity markets. The recent U.S. Treasury yield fluctuations have given market strategists reasons to be concerned about looming economic issues. During the first week of September, Lead-Lag Report publisher and portfolio manager, Michael Gayed, warned that the erratic bond market could spark a sovereign debt crisis and “several black swans.”

Studies and empirical evidence show a volatile U.S. Treasury note market is not good for foreign countries holding U.S. T-notes and dealing with significant debt issues. That’s because when U.S. T-notes are leveraged for restructuring purposes and a resolution tool, “sudden and sweeping daily swings” can punish countries trying to use these financial vehicles for debt restructuring. Additionally, since the Covid-19 pandemic, the massive U.S. stimulus programs, and the Ukraine-Russia war, sovereign risk has elevated across the board, in a myriad of countries worldwide.

On Wednesday, Bloomberg authors MacKenzie and McCormick also quoted Ian Lyngen, the head of U.S. rates strategy at BMO Capital Markets, and the analyst noted that the existence of so-called financial safe havens is waning. “This will be a defining week for Fed rate expectations between now and the end of the year,” Lyngen said just before the Fed raised the federal funds rate by 75 basis points. Lyngen remarked that there’s a “[sense of investors] not wanting to be long the market. As we shift to a truly aggressive monetary policy stance, investors are running out of havens.”

On Thursday, the yield curve between the two- and 10-year T-notes slipped to 58bps, a low not seen since the deep lows in August and then 40 years ago, back in 1982. At the time of writing, the yield curve between the two- and 10-year T-notes is down 0.51%. The crypto economy is down 0.85% during the last 24 hours and is coasting along at $918.12 billion. Gold’s price per ounce is down 0.14% and silver is down 0.28%. Equity markets opened lower on Thursday morning as all four major indexes (Dow, S&P500, Nasdaq, NYSE) have printed losses.

What do you think about the erratic bond markets in 2022 and the signals that show the economy and safe havens are unreliable these days? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

PRESS RELEASE. Stockholm, September 22nd: As the world moves into more digital environments, Swedish beauty-tech giant FOREO has taken the initiative to bring a whole new product to audiences everywhere – the beauty NFT. Blockchain technology has allowed FOREO to challenge traditional skincare protocol and unobtainable beauty standards by bringing its renowned beauty range LUNA into the 21st century with NFTs of its leading products before traditional launch.

Brands have the opportunity to bring their products to a whole new market, connecting younger generations with tailored, innovative skincare that promotes a better ethos for industry standards. This beauty-tech disruptor, led by Boris Trupcevic, FOREO CEO, is paving the way for both mental health and great skin by building a trusting, inclusive community. LUNA NFTs are promoting a healthy relationship between beauty, technology and overall well-being to highlight how their products are made and the benefits of great skincare routines for a more socially-conscious approach to audiences worldwide.

To further support their efforts, FOREO is donating the entire proceeds from NFT sales and trades to three deserving charities: Tjejzonen, Hope Givers and Scleroderma Research Foundation. These charities work to help people struggling with mental health issues and skin conditions to foster self-love and a happier, healthier mindset.

Those interested will be able to buy digital versions of their chosen LUNA 4 products before release – and there are 5 different NFTs to choose from. Each has 50 variations, so there are 250 limited edition NFTs to be enjoyed. Furthermore, there will be an exclusive launch of just one special edition NFT which will be sold at auction; FOREO worked with stand-out female designer Miriam to bring her own brand of stunning, stylistic artful concepts to the launch. Click here for more info.

Mental health can be impacted by how an individual’s skin looks and feels and that’s why the beauty industry has a responsibility to not only design and create products that cater to the needs of various skin types, but also to promote an accessible, safe, inclusive environment for audiences everywhere.

There has been a focus on unrealistic beauty standards for far too long and now is the time to change the direction of the industry and bring skincare to those who really need it. With this in mind, FOREO is forging forward with innovations in tech, their products and their business model to better connect with the ever-changing needs of consumers in the digital environment. Sitting firmly at the intersection of beauty and mental health, the brand is redefining how skincare is accessed, using NFTs, and bringing the spotlight on what it really means to feel happy in one’s own skin.

It’s these fundamental concepts driving FOREOs latest skin cleansing range LUNA 4.

The LUNA cleansing brush is the world’s most-sold facial brush – and the LUNA 4 has taken an already great design and made it even better. Users can now expect an even gentler feel with softer silicone touchpoints, alongside a deeper spa-like facial cleansing experience with five different massage modes for improved circulation and collagen production. The LUNA 4 is the first digital body brush to incorporate NIR LED light for heating and microcurrent capabilities that can tackle cellulite. All of these fantastic features combine for instant, visible results in three simple steps. First, start with the LUNA 3 and begin the 1 minute cleansing routine. Next, use the UFO 2 supercharged 2-minute facial to allow treatments to penetrate the deepest layers of skin. Finally, finish with the BEAR facial toning device – and that’s it!

FOREO is a beauty tech pioneer that’s bringing groundbreaking devices to the beauty industry and revolutionising the way users think about premium skincare. For an affordable way to promote skin health and a new approach to beauty treatments, fans can enjoy LED light therapy, T-Sonic pulsations, Thermotherapy, Cryotherapy, Microcurrents and more.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Today's Top Ethereum and Bitcoin Mining Devices Continue to Rake in Profits

As the crypto economy hovers just under $2 trillion in value, application-specific integrated circuit (ASIC) mining devices are making decent profits. While ASIC miners can still mine ethereum, a 1.5 gigahash (GH/s) Ethash mining device can rake in $51.58 per ... read more.

PRESS RELEASE. Stockholm, September 22nd: As the world moves into more digital environments, Swedish beauty-tech giant FOREO has taken the initiative to bring a whole new product to audiences everywhere – the beauty NFT. Blockchain technology has allowed FOREO to challenge traditional skincare protocol and unobtainable beauty standards by bringing its renowned beauty range LUNA into the 21st century with NFTs of its leading products before traditional launch.

Brands have the opportunity to bring their products to a whole new market, connecting younger generations with tailored, innovative skincare that promotes a better ethos for industry standards. This beauty-tech disruptor, led by Boris Trupcevic, FOREO CEO, is paving the way for both mental health and great skin by building a trusting, inclusive community. LUNA NFTs are promoting a healthy relationship between beauty, technology and overall well-being to highlight how their products are made and the benefits of great skincare routines for a more socially-conscious approach to audiences worldwide.

To further support their efforts, FOREO is donating the entire proceeds from NFT sales and trades to three deserving charities: Tjejzonen, Hope Givers and Scleroderma Research Foundation. These charities work to help people struggling with mental health issues and skin conditions to foster self-love and a happier, healthier mindset.

Those interested will be able to buy digital versions of their chosen LUNA 4 products before release – and there are 5 different NFTs to choose from. Each has 50 variations, so there are 250 limited edition NFTs to be enjoyed. Furthermore, there will be an exclusive launch of just one special edition NFT which will be sold at auction; FOREO worked with stand-out female designer Miriam to bring her own brand of stunning, stylistic artful concepts to the launch. Click here for more info.

Mental health can be impacted by how an individual’s skin looks and feels and that’s why the beauty industry has a responsibility to not only design and create products that cater to the needs of various skin types, but also to promote an accessible, safe, inclusive environment for audiences everywhere.

There has been a focus on unrealistic beauty standards for far too long and now is the time to change the direction of the industry and bring skincare to those who really need it. With this in mind, FOREO is forging forward with innovations in tech, their products and their business model to better connect with the ever-changing needs of consumers in the digital environment. Sitting firmly at the intersection of beauty and mental health, the brand is redefining how skincare is accessed, using NFTs, and bringing the spotlight on what it really means to feel happy in one’s own skin.

It’s these fundamental concepts driving FOREOs latest skin cleansing range LUNA 4.

The LUNA cleansing brush is the world’s most-sold facial brush – and the LUNA 4 has taken an already great design and made it even better. Users can now expect an even gentler feel with softer silicone touchpoints, alongside a deeper spa-like facial cleansing experience with five different massage modes for improved circulation and collagen production. The LUNA 4 is the first digital body brush to incorporate NIR LED light for heating and microcurrent capabilities that can tackle cellulite. All of these fantastic features combine for instant, visible results in three simple steps. First, start with the LUNA 3 and begin the 1 minute cleansing routine. Next, use the UFO 2 supercharged 2-minute facial to allow treatments to penetrate the deepest layers of skin. Finally, finish with the BEAR facial toning device – and that’s it!

FOREO is a beauty tech pioneer that’s bringing groundbreaking devices to the beauty industry and revolutionising the way users think about premium skincare. For an affordable way to promote skin health and a new approach to beauty treatments, fans can enjoy LED light therapy, T-Sonic pulsations, Thermotherapy, Cryotherapy, Microcurrents and more.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Today's Top Ethereum and Bitcoin Mining Devices Continue to Rake in Profits

As the crypto economy hovers just under $2 trillion in value, application-specific integrated circuit (ASIC) mining devices are making decent profits. While ASIC miners can still mine ethereum, a 1.5 gigahash (GH/s) Ethash mining device can rake in $51.58 per ... read more.

PRESS RELEASE. Unveiling multiple technological breakthroughs, SupraOracles is excited to announce its novel cross-chain oracle infrastructure enabling highly accurate, robust data porting across a multitude of blockchains and DLTs with only 3-5 second finality. Now, with over 550+ signed integration partners, they’re officially announcing the launch of their Alpha testnet as they progress towards mainnet in early 2023.

To jumpstart momentum, Supra has partnered with Dorahacks, the host of BNB Grants and BNB Global Hackathons, by sponsoring and providing its oracle service to over 4,000-5,000 developers worldwide. Developers interested in adding this new, institutional grade oracle to their Web3 toolkit are invited to apply to the Supra Network Activate Program: https://join.supraoracles.com/network-activation-program

Oracles play a key role in Web3 projects. Developers need oracles to securely connect their decentralized applications (dApps) with timely, accurate data originating from other blockchains or real-world sources. This opens up a world of use cases such as exotic derivatives backed by real-world assets, options markets, multi-lateral clearing and settlement across public blockchains and DLT networks, that otherwise are simply not feasible with incumbent oracles today.

Supra’s PhD driven research team, led by the renowned Dr. Aniket Kate, has prioritized a number of novel principles in their design that brings a new gold standard to how oracles should perform. The most crucial being security of the core data, decentralization of nodes and consensus, auditability of data provenance, and cost efficient, predictable budgeting for consumers.

With these innovations, Supra has received recognition from Web3 incubators like Mastercard’s Start Path program, Berkeley Blockchain Xcelerator, and Silicon Valley’s Plug and Play, which recently named Supra among their top 10 up-and-coming Web3 projects.

Supra is drawing near to the launch of their incentivized testnet in Q4, with a roadmap that includes activities for developers to begin their testing:

Node Operators interested in learning about Supra’s block rewards and incentivization programs are invited to join the Discord community to know more: https://discord.io/supraoracles.

SupraOracles CEO, Joshua Tobkin commented, “We’ve built oracles that will undoubtedly exceed the typical expectations of cross-chain solutions, and we’re proud to bring forth a world-class product to the industry to help blockchains do even more incredible things.”

About SupraOracles

SupraOracles is supercharging oracles for a better, decentralized future. Blockchains need better, faster, accurate, and more secure off-chain data. SupraOracles provides a next-generation cross-chain oracle solution so smart contracts and blockchain apps work better.

After 5+ years of research, and thousands of hours of R&D and simulations, SupraOracles’ revolutionary technical breakthrough helps solve the Oracle Dilemma while improving performance across the board. The team’s academic mindset forms the bedrock of the organization and reinforces their commitment to deep research and a rigorous scientific process in everything they design and build.

Contact

Media contact

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Following a Brief Fee Spike, Gas Prices to Move Ethereum Drop 76% in 12 Days

Transaction fees on the Ethereum network are dropping again after average fees saw a brief spike on April 5 jumping to $43 per transfer. 12 days later, average ether fees are close to dropping below $10 per transaction and median-sized ... read more.

PRESS RELEASE. Unveiling multiple technological breakthroughs, SupraOracles is excited to announce its novel cross-chain oracle infrastructure enabling highly accurate, robust data porting across a multitude of blockchains and DLTs with only 3-5 second finality. Now, with over 550+ signed integration partners, they’re officially announcing the launch of their Alpha testnet as they progress towards mainnet in early 2023.

To jumpstart momentum, Supra has partnered with Dorahacks, the host of BNB Grants and BNB Global Hackathons, by sponsoring and providing its oracle service to over 4,000-5,000 developers worldwide. Developers interested in adding this new, institutional grade oracle to their Web3 toolkit are invited to apply to the Supra Network Activate Program: https://join.supraoracles.com/network-activation-program

Oracles play a key role in Web3 projects. Developers need oracles to securely connect their decentralized applications (dApps) with timely, accurate data originating from other blockchains or real-world sources. This opens up a world of use cases such as exotic derivatives backed by real-world assets, options markets, multi-lateral clearing and settlement across public blockchains and DLT networks, that otherwise are simply not feasible with incumbent oracles today.

Supra’s PhD driven research team, led by the renowned Dr. Aniket Kate, has prioritized a number of novel principles in their design that brings a new gold standard to how oracles should perform. The most crucial being security of the core data, decentralization of nodes and consensus, auditability of data provenance, and cost efficient, predictable budgeting for consumers.

With these innovations, Supra has received recognition from Web3 incubators like Mastercard’s Start Path program, Berkeley Blockchain Xcelerator, and Silicon Valley’s Plug and Play, which recently named Supra among their top 10 up-and-coming Web3 projects.

Supra is drawing near to the launch of their incentivized testnet in Q4, with a roadmap that includes activities for developers to begin their testing:

Node Operators interested in learning about Supra’s block rewards and incentivization programs are invited to join the Discord community to know more: https://discord.io/supraoracles.

SupraOracles CEO, Joshua Tobkin commented, “We’ve built oracles that will undoubtedly exceed the typical expectations of cross-chain solutions, and we’re proud to bring forth a world-class product to the industry to help blockchains do even more incredible things.”

About SupraOracles

SupraOracles is supercharging oracles for a better, decentralized future. Blockchains need better, faster, accurate, and more secure off-chain data. SupraOracles provides a next-generation cross-chain oracle solution so smart contracts and blockchain apps work better.

After 5+ years of research, and thousands of hours of R&D and simulations, SupraOracles’ revolutionary technical breakthrough helps solve the Oracle Dilemma while improving performance across the board. The team’s academic mindset forms the bedrock of the organization and reinforces their commitment to deep research and a rigorous scientific process in everything they design and build.

Contact

Media contact

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Following a Brief Fee Spike, Gas Prices to Move Ethereum Drop 76% in 12 Days

Transaction fees on the Ethereum network are dropping again after average fees saw a brief spike on April 5 jumping to $43 per transfer. 12 days later, average ether fees are close to dropping below $10 per transaction and median-sized ... read more.

PRESS RELEASE. Utopia, a decentralized ecosystem specifically developed to combat online surveillance and ensure the privacy of financial transactions, has been integrated by over 1800 online stores. Shopping using Utopia, one of the most confidential online payment methods, is now available to the online community worldwide.

An unprecedented level of privacy offered by Utopia was made possible by a unique blockchain developed over 9 years and launched in 2019. Steady development and proven track record have led to Crypton (CRP) and Utopia USD (USSD) adoption by an increasing number of merchants. To take partnership to a new level, in June 2022, Utopia signed several agreements and now is widely accepted as a payment method. Customers can take advantage of low commissions and instant privacy-protected payments while paying for a wide array of goods and services.

The mechanism of payment confidentiality by Utopia is the following: absolutely no metadata, such as transferred amount, transaction date or account information. Utopia is the only decentralized blockchain where Transaction Explorer cannot be implemented. Network participants that are not the party to the transaction cannot see any transaction details.

By adding Utopia as a mean of payment merchants gains access to a privacy cautious target audience. Utopia’s explosive growth presents a unique opportunity for merchants to capitalize on what the most promising ecosystem has to offer.

Some of Utopia’s key benefits:

Other Utopia ecosystem components include a decentralized form of DNS (domain registry), multiplayer games, Tor alternative secure network, and Idyll browser created to surf deep sites hosted inside Utopia ecosystem. Utopia USD (UUSD) stablecoin and Crypton are built upon Utopia’s serverless, peer-to-peer blockсhain, which currently powers an all-in-one kit for secure instant messaging, encrypted email, voice communication and private web browsing.

Utopia’s desktop application is available for Windows, MacOS and Linux in 29 languages. The ecosystem has been developed by a group of networking technology enthusiasts. To eliminate any impact on the project, developers of Utopia will forever remain anonymous.

Utopia’s blockchain is based on Proof-of-Stake and Proof-of-Resources algorithms. Nodes are located around the globe and participate in packet routing and validation receiving a reward every 15 minutes (block generation time) by providing internet connectivity, RAM, and CPU resources. Each ecosystem user’s privacy is protected by utilizing a dynamic multi-link routing engine with MITM (man-in-the-middle) attack protection. Curve25519, XSalsa20 and Poly1305 algorithms are used to encrypt, sign and authenticate packets, objects, and connections between peers.

The high speed of transaction processing (less than 1 second) combined with outstanding privacy, anonymity, and security provides the ecosystem with bullet-proof financial transaction capabilities. Add Interest payments, Crypto Cards, Merchant Invoices, and uVouchers to this and you get the most advanced decentralized payment system.

Official Utopia website: https://u.is

Download Utopia: https://u.is/en/download.html

Crypton Exchange: https://crp.is

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

Source From : News