According to an analyst on Dec. 29, 2022, the disgraced co-founder of FTX, Sam Bankman-Fried (SBF), may have cashed out $684,000 in crypto assets while under house arrest. If the funds were spent by SBF, it goes against the court’s release conditions that note the former FTX executive is not allowed to spend more than $1,000 without permission from the court.

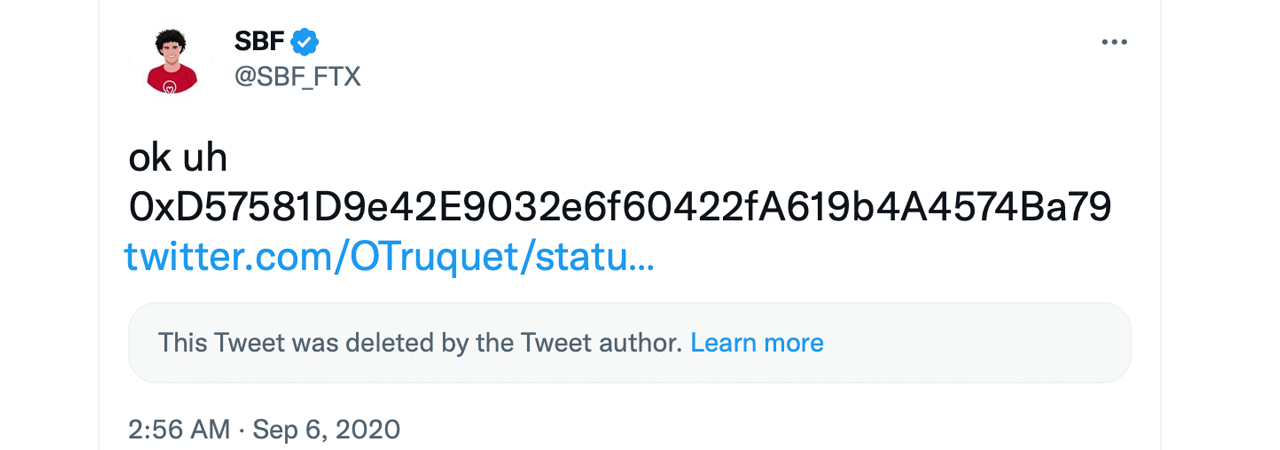

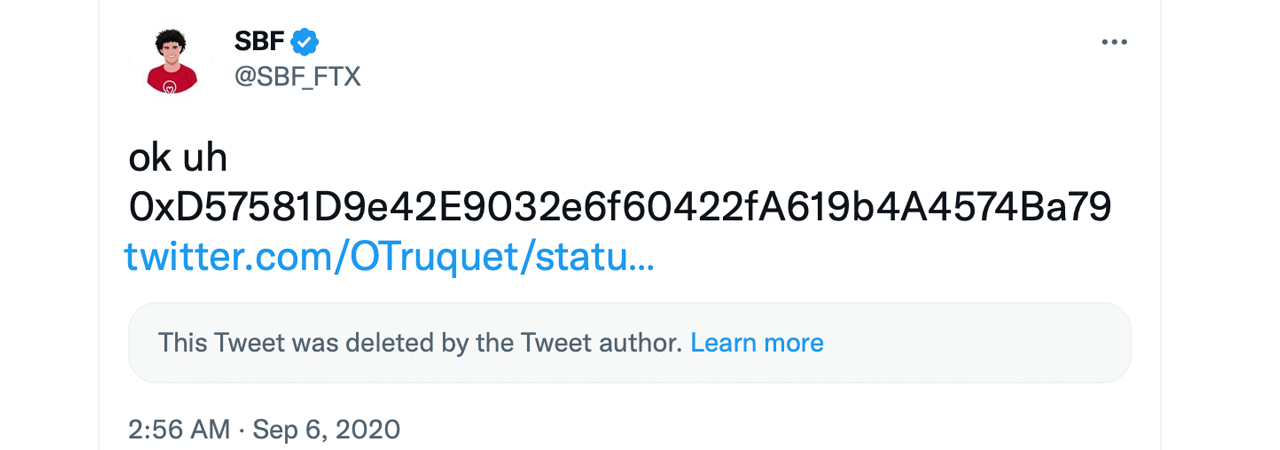

On Thursday, an analyst called “Bowtiediguana” published a Twitter thread that shows Sam Bankman-Fried may have spent $684K while he is on house arrest. According to Bowtiediguana, in August 2020, SBF agreed to temporarily take over the decentralized exchange (dex) Sushiswap, after the anonymous founder Chef Nomi decided to leave. When the deal was made, SBF shared a public Ethereum address and Chef Nomi transferred ownership of Sushiswap to SBF’s address.

“After SBF was released, his wallet sent all its remaining crypto tokens to a new Ethereum address created an hour earlier,” Bowtiediguana tweeted. “In 3 hours, over 100 new deposits were made to this wallet from various addresses, most having links to SBFs defunct hedge fund Alameda Research.” The analyst continued:

In less than [four] hours, 570 [ethereum] worth approximately $684,000 was transferred out of this new wallet, to various destinations. Funds were sent to a no-KYC exchange based in Seychelles and to the Bitcoin network via the [Ren Protocol], a bridge funded by Alameda. Perhaps the SEC attorneys would like notice of this?

The address in question is this ethereum address “which received a further $1M from 11 wallets labeled as Alameda Research,” Bowtiediguana said. “[Five] separate transactions of 51 ETH were used to move funds to newly created wallets [and] then onwards to a Seychelles-based exchange. [Three] tranches of 200K USDT were also sent from the SBF linked wallet to the Fixedfloat exchange,” the analyst added.

Bowtiediguana’s thread shows that an individual decided to email the information to the U.S. Securities and Exchange Commission (SEC) about the latest onchain movements. Others tagged the U.S. regulator in the Twitter thread and said: “@secgov u gave [SBF] 2 long of a leash sires. plz address this criminal.” It is unconfirmed at the moment as to who actually moved the funds, but many are speculating that it was SBF.

Since SBF’s arrest and his later release, FTX and Alameda-related funds have been moving, and transfers have been caught by onchain sleuths. Funds linked to Alameda were transferred two days ago and reportedly they were sent to Fixedfloat and Changenow and further converted into BTC. In another instance, an Alameda-labeled wallet sent 11.37 wrapped bitcoin (WBTC) to a wallet after removing it from Aave on Dec. 29.

The same day, another Alameda-labeled wallet sent 22,500 USDC on Dec. 29. Both of these transactions took place the day after a large swathe of ERC20 tokens linked to Alameda were moved on Wednesday, Dec. 28.

What do you think about the onchain movements caught by the analyst Bowtiediguana? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photo credit: Stephanie Keith / Getty Images

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

According to an analyst on Dec. 29, 2022, the disgraced co-founder of FTX, Sam Bankman-Fried (SBF), may have cashed out $684,000 in crypto assets while under house arrest. If the funds were spent by SBF, it goes against the court’s release conditions that note the former FTX executive is not allowed to spend more than $1,000 without permission from the court.

On Thursday, an analyst called “Bowtiediguana” published a Twitter thread that shows Sam Bankman-Fried may have spent $684K while he is on house arrest. According to Bowtiediguana, in August 2020, SBF agreed to temporarily take over the decentralized exchange (dex) Sushiswap, after the anonymous founder Chef Nomi decided to leave. When the deal was made, SBF shared a public Ethereum address and Chef Nomi transferred ownership of Sushiswap to SBF’s address.

“After SBF was released, his wallet sent all its remaining crypto tokens to a new Ethereum address created an hour earlier,” Bowtiediguana tweeted. “In 3 hours, over 100 new deposits were made to this wallet from various addresses, most having links to SBFs defunct hedge fund Alameda Research.” The analyst continued:

In less than [four] hours, 570 [ethereum] worth approximately $684,000 was transferred out of this new wallet, to various destinations. Funds were sent to a no-KYC exchange based in Seychelles and to the Bitcoin network via the [Ren Protocol], a bridge funded by Alameda. Perhaps the SEC attorneys would like notice of this?

The address in question is this ethereum address “which received a further $1M from 11 wallets labeled as Alameda Research,” Bowtiediguana said. “[Five] separate transactions of 51 ETH were used to move funds to newly created wallets [and] then onwards to a Seychelles-based exchange. [Three] tranches of 200K USDT were also sent from the SBF linked wallet to the Fixedfloat exchange,” the analyst added.

Bowtiediguana’s thread shows that an individual decided to email the information to the U.S. Securities and Exchange Commission (SEC) about the latest onchain movements. Others tagged the U.S. regulator in the Twitter thread and said: “@secgov u gave [SBF] 2 long of a leash sires. plz address this criminal.” It is unconfirmed at the moment as to who actually moved the funds, but many are speculating that it was SBF.

Since SBF’s arrest and his later release, FTX and Alameda-related funds have been moving, and transfers have been caught by onchain sleuths. Funds linked to Alameda were transferred two days ago and reportedly they were sent to Fixedfloat and Changenow and further converted into BTC. In another instance, an Alameda-labeled wallet sent 11.37 wrapped bitcoin (WBTC) to a wallet after removing it from Aave on Dec. 29.

The same day, another Alameda-labeled wallet sent 22,500 USDC on Dec. 29. Both of these transactions took place the day after a large swathe of ERC20 tokens linked to Alameda were moved on Wednesday, Dec. 28.

What do you think about the onchain movements caught by the analyst Bowtiediguana? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photo credit: Stephanie Keith / Getty Images

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

According to a myriad of reports, the People’s Republic of China has been buying hoards of gold during the last year. Consequently, World Gold Council (WGC) statistics show the demand for gold by central banks has risen at the fastest pace in 55 years. Meanwhile, Wells Fargo’s head of real asset strategy, John LaForge, contends that when silver starts outperforming gold, it usually signals it is “closer to a bull market in precious metals versus the other way.”

Precious metals like gold and silver are ending the year a lot higher in value than they were 56 days ago on Nov. 3, 2022. Close to two months ago, on that day, a troy ounce of .999 fine gold was trading for $1,629 per unit and today, prices are 11.48% higher at $1,816 per ounce. A troy ounce of .999 fine silver was trading for $19.45 per unit on Nov. 3, and it’s increased 23.29% higher against the U.S. dollar at $23.98 per ounce.

World Gold Council (WGC) data shows that while there’s been a rise in retail demand, central banks are hoarding gold at an extremely fast pace. A number of reports citing WGC data show that the central banks’ current demand for gold has risen at the fastest pace since 1967. China recently disclosed that the country purchased 1.03 million ounces of fine gold or the equivalent of 32 tons of the precious metal. China’s State Administration of Foreign Exchange detailed the purchase cost the country around $1.8 billion.

China has a reported 63.67 million ounces of gold, which is worth roughly $112 billion. Adrian Ash, the head of research at Bullionvault told Financial Times (FT) reporter Harry Dempsey that the central banks’ flight to gold may suggest “the geopolitical backdrop is one of mistrust, doubt, and uncertainty.” While China is among gold reserve giants like Germany, the U.S., Russia, Italy, and France, a number of smaller central banks have also been buying large quantities of gold. To single out a few specific examples, Turkey, Uzbekistan, and Qatar have accrued substantial sums of the precious metal in 2022.

Wells Fargo’s head of real asset strategy, John LaForge, is looking at silver ahead of gold according to his recent commentary with Kitco News on Dec. 29. “I am a little more positive on silver now that we are back to $23. It is the high-beta play. Silver is showing signs that whatever weakness we see in gold, it is probably short-lived,” LaForge told Kitco’s Anna Golubova.

“When silver starts beating gold, it is closer to a bull market in precious metals versus the other way,” the Wells Fargo executive added. LaForge believes gold prices will be anywhere between $1,900 to $2,000 in 2023, and he insists it’s quite possible silver could outperform the yellow precious metal.

“Over a supercycle, which is 10+ years, percentage-wise, silver does better than gold,” LaForge remarked. “That’s what happened during the last cycle between 1999 and 2011. That is typical … You can sense gold wants to go higher next year. Gold had a rough two and a half years,” the Wells Fargo executive further elaborated.

“In the last couple of months, with all the talk about the Fed pivoting, gold started to perk up. Next year, both gold and silver will do well. Silver might do even better,” LaForge concluded. So far, with a 23.29% increase compared to gold’s 11.48% jump since Nov. 3, silver is doing a lot better than gold against the greenback. Platinum, too, has jumped a great deal, rising from $915 per ounce 56 days ago to today’s $1,051 per ounce.

What do you think about the central banks’ demand for gold in 2022? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photo credit: VladKK / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

Source From : News