As bitcoin is coasting along under the $20K region, the network’s hashrate is still riding high at 250.04 exahash per second (EH/s) following the all-time high (ATH) the hashrate tapped on October 5. At the time of writing, the current speed at which blocks are processed is faster than the typical ten-minute average block intervals between the current block height (757,531) and the last difficulty adjustment. Statistics show that because block times have been much faster, the network could see the largest difficulty increase this year, as estimates show a possible jump between 9% to 13.2% higher.

Bitcoin mining is looking to become a whole lot more difficult on the next retarget date which will occur on October 10, 2022. Two days ago, on October 5, the network’s total hashrate reached an ATH at 321 EH/s at block height 757,214. While the price of BTC is lower and the difficulty is near the last ATH, miners are relentlessly dedicating computational power to the BTC chain. At the moment, the hashrate is coasting along at 250 EH/s after the ATH was reached on Wednesday.

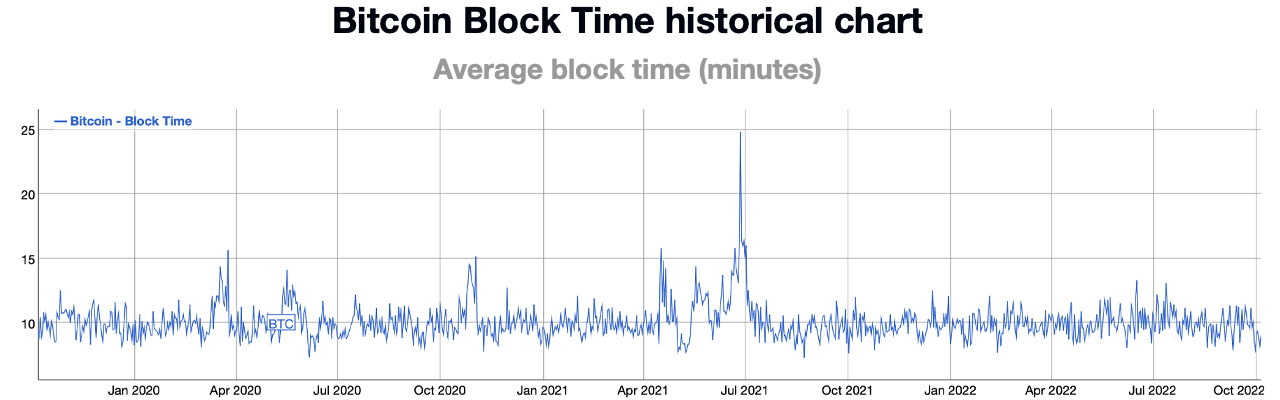

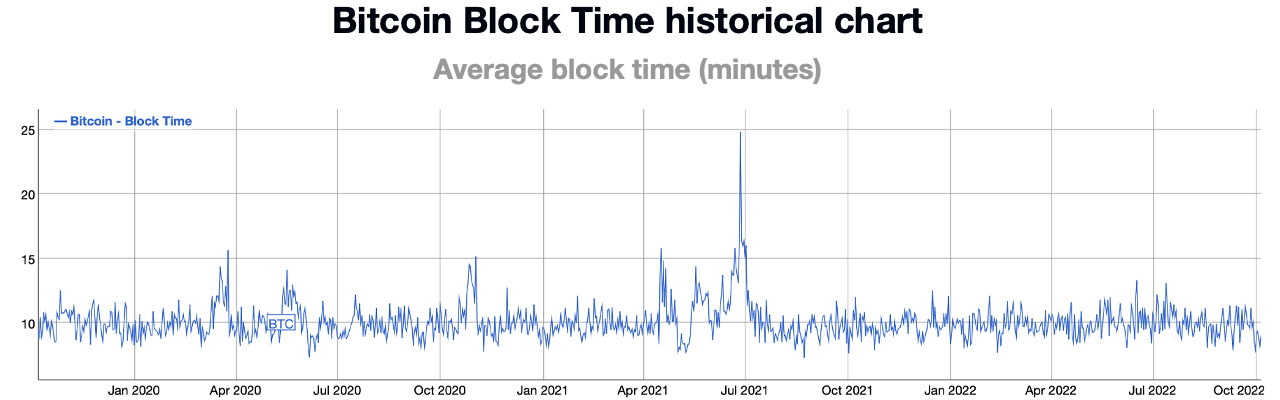

Currently, block times (the interval between each block mined) are faster than the ten-minute average, bitinfocharts.com data shows. Presently, at 9:00 a.m. (ET), metrics show block times are around 9:05 minutes but other dashboards show a much faster rate at 8:49 minutes. With the average bitcoin block interval between the current height (757,471) and the last difficulty epoch (756,000) at 8:49 minutes, it means BTC’s network difficulty is due for a notable rise. There’s a chance that the difficulty jump on October 10 could be the network’s highest difficulty rise this year.

Data from btc.com shows an increase of around 9.34%, which would surpass the network’s second-largest increase in 2022. If btc.com’s estimate is correct, BTC’s network difficulty will rise from 31.36 trillion to 34.29 trillion. Metrics from Clark Moody’s Bitcoin dashboard show the difficulty change could be a lot higher and at the time of writing, Moody’s dashboard indicates it could be around 13.2% higher than it is today. The Bitcoin network has roughly 400+ blocks to go until the next retarget.

It’s quite possible the hashrate will slow and block times increase back to the ten-minute range. If so the difficulty’s percentage increase could be a lot lower than even Btc.com’s 9% increase estimate. Every two weeks or when 2,016 blocks are discovered, the network’s difficulty adjusts to make it either harder or easier to find a BTC block depending on how fast the 2,016 blocks were discovered.

If the 2,016 blocks were found too fast, the network’s algorithm adjusts the difficulty higher and if the blocks are found at a much slower pace, the difficulty rating can decline. The last significantly large difficulty reduction took place on July 3, 2021, when the difficulty dropped by 27.94% at block height 689,472. That means it was 27% easier to find a BTC block subsidy than it was prior to block 689,472.

What do you think about the possibility that Bitcoin’s mining difficulty may see the largest jump this year? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Today's Top Ethereum and Bitcoin Mining Devices Continue to Rake in Profits

As the crypto economy hovers just under $2 trillion in value, application-specific integrated circuit (ASIC) mining devices are making decent profits. While ASIC miners can still mine ethereum, a 1.5 gigahash (GH/s) Ethash mining device can rake in $51.58 per ... read more.

As bitcoin is coasting along under the $20K region, the network’s hashrate is still riding high at 250.04 exahash per second (EH/s) following the all-time high (ATH) the hashrate tapped on October 5. At the time of writing, the current speed at which blocks are processed is faster than the typical ten-minute average block intervals between the current block height (757,531) and the last difficulty adjustment. Statistics show that because block times have been much faster, the network could see the largest difficulty increase this year, as estimates show a possible jump between 9% to 13.2% higher.

Bitcoin mining is looking to become a whole lot more difficult on the next retarget date which will occur on October 10, 2022. Two days ago, on October 5, the network’s total hashrate reached an ATH at 321 EH/s at block height 757,214. While the price of BTC is lower and the difficulty is near the last ATH, miners are relentlessly dedicating computational power to the BTC chain. At the moment, the hashrate is coasting along at 250 EH/s after the ATH was reached on Wednesday.

Currently, block times (the interval between each block mined) are faster than the ten-minute average, bitinfocharts.com data shows. Presently, at 9:00 a.m. (ET), metrics show block times are around 9:05 minutes but other dashboards show a much faster rate at 8:49 minutes. With the average bitcoin block interval between the current height (757,471) and the last difficulty epoch (756,000) at 8:49 minutes, it means BTC’s network difficulty is due for a notable rise. There’s a chance that the difficulty jump on October 10 could be the network’s highest difficulty rise this year.

Data from btc.com shows an increase of around 9.34%, which would surpass the network’s second-largest increase in 2022. If btc.com’s estimate is correct, BTC’s network difficulty will rise from 31.36 trillion to 34.29 trillion. Metrics from Clark Moody’s Bitcoin dashboard show the difficulty change could be a lot higher and at the time of writing, Moody’s dashboard indicates it could be around 13.2% higher than it is today. The Bitcoin network has roughly 400+ blocks to go until the next retarget.

It’s quite possible the hashrate will slow and block times increase back to the ten-minute range. If so the difficulty’s percentage increase could be a lot lower than even Btc.com’s 9% increase estimate. Every two weeks or when 2,016 blocks are discovered, the network’s difficulty adjusts to make it either harder or easier to find a BTC block depending on how fast the 2,016 blocks were discovered.

If the 2,016 blocks were found too fast, the network’s algorithm adjusts the difficulty higher and if the blocks are found at a much slower pace, the difficulty rating can decline. The last significantly large difficulty reduction took place on July 3, 2021, when the difficulty dropped by 27.94% at block height 689,472. That means it was 27% easier to find a BTC block subsidy than it was prior to block 689,472.

What do you think about the possibility that Bitcoin’s mining difficulty may see the largest jump this year? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Today's Top Ethereum and Bitcoin Mining Devices Continue to Rake in Profits

As the crypto economy hovers just under $2 trillion in value, application-specific integrated circuit (ASIC) mining devices are making decent profits. While ASIC miners can still mine ethereum, a 1.5 gigahash (GH/s) Ethash mining device can rake in $51.58 per ... read more.

Meme coins were trading lower on Friday, as markets reacted to the latest U.S. nonfarm payrolls report. The data showed that 263,000 jobs were added to the United States economy in September, versus the 250,000 expected. Both dogecoin and shiba inu fell for a third consecutive session.

Dogecoin (DOGE) fell for a third consecutive session on Friday, as markets reacted to the latest nonfarm payrolls (NFP) report.

DOGE/USD slipped to an intraday low of $0.06201 in today’s session less than 24 hours after hitting a peak of $0.06511.

Today’s decline saw the token continue to fall below its resistance point of $0.0640, moving closer to a floor of $0.0590.

Looking at the chart, today’s drop in price comes as the 14-day relative strength index (RSI) fell below a floor of its own.

As of writing, the index is tracking at 50.63, which is marginally below its recent support point of 52.00.

The 10-day (red) moving average (MA) continues to hover above its 25-day (blue) counterpart, which remains a positive sign for bulls hopeful of a rebound.

Shiba Inu (SHIB) was also on day three of recent declines, with the token moving closer to a key support point.

Following a high of $0.00001138 on Thursday, SHIB/USD slipped to a bottom of $0.000011 earlier in the day.

This drop saw the meme coin move towards its floor of $0.00001080, which has mostly been in place since September 18.

Despite this recent sell-off, the 10-day moving average on shiba inu was set for an upwards cross with the 25-day MA.

Should this take place, we could potentially see SHIB move back towards a ceiling of $0.00001170.

As of writing, the RSI is now tracking at 44.91, which is just above a support point of 44.00.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect the token to continue to fall this weekend? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

Meme coins were trading lower on Friday, as markets reacted to the latest U.S. nonfarm payrolls report. The data showed that 263,000 jobs were added to the United States economy in September, versus the 250,000 expected. Both dogecoin and shiba inu fell for a third consecutive session.

Dogecoin (DOGE) fell for a third consecutive session on Friday, as markets reacted to the latest nonfarm payrolls (NFP) report.

DOGE/USD slipped to an intraday low of $0.06201 in today’s session less than 24 hours after hitting a peak of $0.06511.

Today’s decline saw the token continue to fall below its resistance point of $0.0640, moving closer to a floor of $0.0590.

Looking at the chart, today’s drop in price comes as the 14-day relative strength index (RSI) fell below a floor of its own.

As of writing, the index is tracking at 50.63, which is marginally below its recent support point of 52.00.

The 10-day (red) moving average (MA) continues to hover above its 25-day (blue) counterpart, which remains a positive sign for bulls hopeful of a rebound.

Shiba Inu (SHIB) was also on day three of recent declines, with the token moving closer to a key support point.

Following a high of $0.00001138 on Thursday, SHIB/USD slipped to a bottom of $0.000011 earlier in the day.

This drop saw the meme coin move towards its floor of $0.00001080, which has mostly been in place since September 18.

Despite this recent sell-off, the 10-day moving average on shiba inu was set for an upwards cross with the 25-day MA.

Should this take place, we could potentially see SHIB move back towards a ceiling of $0.00001170.

As of writing, the RSI is now tracking at 44.91, which is just above a support point of 44.00.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect the token to continue to fall this weekend? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

PRESS RELEASE. In light of the strengthened supervision of the cryptocurrency sector by Lithuania, Gofaizen & Sherle, an international legal and management consulting firm based in Europe, has taken the initiative to assist businesses in navigating these new regulations. According to Lithuanian regulators, these new laws will go into effect in November 2022. In addition, the country will prohibit anonymous accounts and establish more stringent requirements for customer identification.

Gofazen & Sherle, which has helped over 500 companies across 30 countries, has a physical presence in Estonia, Lithuania and Germany.

The New Lithuanian Regulations

According to the Lithuanian Ministry of Finance, the national government has approved changes to the country’s anti-money laundering (AML) and counter-terrorism financing regulations that affect the cryptocurrency sector. The newly approved laws will tighten user identification guidelines and prohibit anonymous accounts. The new regulations will also impose stricter requirements on exchange operators. For example, Crypto exchange operators will be required to register as a corporate body with a minimum capital of 125,000 euros beginning January 1, 2023. In addition, their top management must also be permanent residents of Lithuania.

According to Lithuania’s Finance Minister, Skaiste, the country decided to update its regulations in response to recent events in the region, particularly the ongoing military conflict in Ukraine.

Lithuania has seen a rapid increase in the number of crypto companies starting operations since Estonia tightened its crypto regulations. However, only eight such entities were established in 2020, whereas 188 new firms were registered in 2021, with another 40 added in the first months of this year. According to the finance ministry, over 400 crypto service providers are currently operating in Lithuania.

The Estonia Crypto Clamp-down

Estonia’s new regulations represented a sharp U-turn for a country with a population of just 1.3 million but which last year was home to more than half of the world’s registered virtual-asset service providers (VASPs).

The new rules, which went into effect on June 15, required Estonian crypto companies to meet new transparency requirements; they can no longer have anonymous accounts and must have at least €100,000-250,000 in capital.

Estonia has been a pioneer in regulating cryptocurrency-related services. However, until recently, the regulatory framework was very lax, and the entry barrier was low. This changed when existing laws were amended to provide greater clarity and regulation to the cryptocurrency industry. In short, the requirements for providing cryptocurrency-based exchange, trading, transfer, and wallet services will be more akin to those of European e-money institutions and other licensed financial service providers.

Since then the number of new licenses has dropped from 1305 in 2019 to just 81 in 2021. This represents a significant downtrend due to the new regulations.

Lithuania Will Not Be Like Estonia

As the new regulations are approved, many cryptocurrency enthusiasts are concerned that the once-global crypto hub will become another Estonia. Gofazen & Sherle lawyers, on the other hand, is providing businesses with a legal and convenient way to navigate the turbulent waters by receiving instructions from the FCIS in October and devising a strategy to help businesses thrive regardless.

About Gofaizen & Sherle

Gofaizen & Sherle is a leading legal & business consultancy for digital assets-oriented businesses, investment funds and financial organizations focused on EU markets while expanding globally. Its headquarter is located in Tallinn with representative offices in Lithuania, the Czech Republic, and Poland. The firm services scope features company registration, business strategy development, and financial licensing including crypto businesses, EMI, and other types of licenses.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

Source From : News