Just as Bitcoin‘s valuation re-instilled the faith of investors, the derivatives market took a sniff of the same market optimism as well.

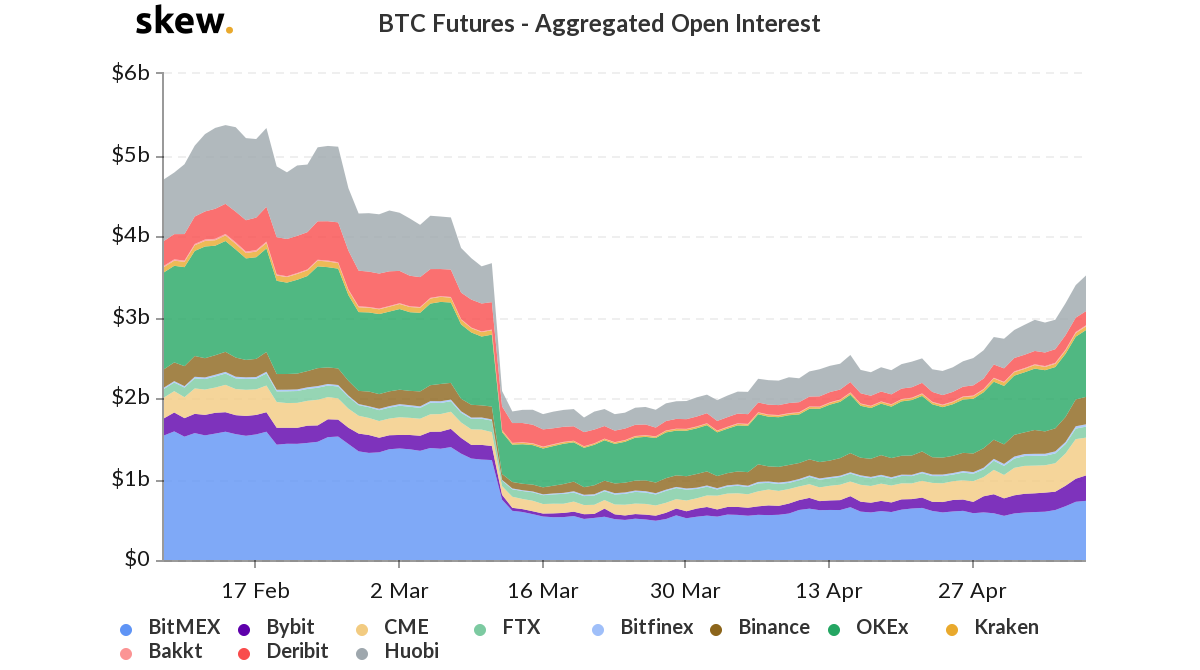

After a devastating drop in Open Interest collectively across all exchanges, Bitcoin‘s Futures contracts were maintaining decent interest, at the moment.

However, Arcane Research recently identified a major difference between the situation now and the one at the start of the year. The report highlighted that the Futures market is exhibiting a major structural difference as the entire market is in a state of contango.

Hence, Futures contracts are trading at a higher premium rate. Due to higher premiums, the volumes of spot market are trailing behind and frankly, it can be explained by the market activity in Q1 of 2020.

According to TokenInsight’s Q1 2020 report, Futures and Spot volumes were mostly on similar levels because of the economic collapse in mid-March. While the Futures market failed to engage investors in a certain type of trend for the future, spot market participants were able to use the Futures trading volume for position management.

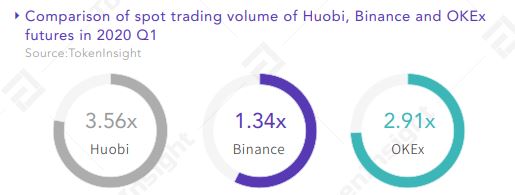

In spite of that, the total trading volume of cryptocurrency Futures is still on a steady incline. It was also revealed that Huobi, Binance, and OKEx, the exchanges with the highest BTC Futures trading in Q1 of 2020 had higher Futures trading volume than spot volume.

Source: TokenInsight

Huobi Futures’ trading volume ratio was about 3.56 times of spot; Binance was approximately 1.34 times; OKEx was about 2.91 times. Such a set of data indicated that the Futures market trading volume would only increase in 2020, with many in the community speculating that the industry is currently heading towards a shift in interest from spot trading to derivatives trading.

Current Market Dynamics only improve Futures trading

Now, even though, the wheels were in motion in Q1 of 2020 itself, the fruit of trading in Futures is unfolding at the moment. CME Bitcoin Futures recently registered its highest Open Interest of $400 million, since beginning its services back in late 2017.

Source: Skew

Analyzing the attached chart further gives a clear indication of the rise in OI across several Bitcoin Futures exchanges. As mentioned previously, the present state of contango is only going to increase Futures trading volume, but the radical shift had begun at the start of 2020.

Source From : Ambcrypto