During a conversation with Binance CEO Changpeng Zhao (CZ) and the Milken Institute, the exchange executive called the former FTX CEO Sam Bankman-Fried (SBF) a “psychopath” for one of the tweets SBF wrote last week. CZ’s statements further follow the accusations stemming from Three Arrows Capital (3AC) co-founder Kyle Davies. The 3AC co-founder claimed that both FTX and Alameda Research “colluded to trade against clients.”

Crypto industry executives are not too pleased with the former FTX CEO Sam Bankman-Fried (SBF) and in recent times SBF has been getting a lot of criticism. Binance CEO Changpeng Zhao (CZ) talked about SBF with the Milken Institute on Nov. 17, 2022, and he explained that he did not know why SBF considered Binance a “sparring partner.”

CZ says that when SBF reached out to the Binance executive, CZ thought it was about an over-the-counter (OTC) deal to buy FTT tokens. Then CZ noted that when SBF called the former FTX CEO detailed that they were in “big trouble” and the company was “looking for a buyout.”

CZ was asked at the Milken Institute event why SBF would tweet and call the company Binance or CZ a “sparring partner.” The Binance CEO responded and said “I think only a psychopath can write that tweet.” In addition to calling SBF a psychopath, CZ further noted that he believes SBF should stop tweeting and noted that he should “put on a suit” to face the music in Washington D.C.

The Binance CEO is not the only person criticizing FTX and Alameda, as the co-founder of the now-defunct Three Arrows Capital (3AC) crypto hedge fund, Kyle Davies, accused FTX and Alameda of colluding against the firm.

Speaking with CNBC’s Kate Rooney, Davies alleges that “FTX [and] Alameda Research colluded to trade against clients” and further said: “We, [Three Arrows Capital], were hunted and our positions liquidated.” However, CNBC received a statement from SBF that said he was “shocked” about Davies’ allegations and said: “there’s no truth to their allegations here.”

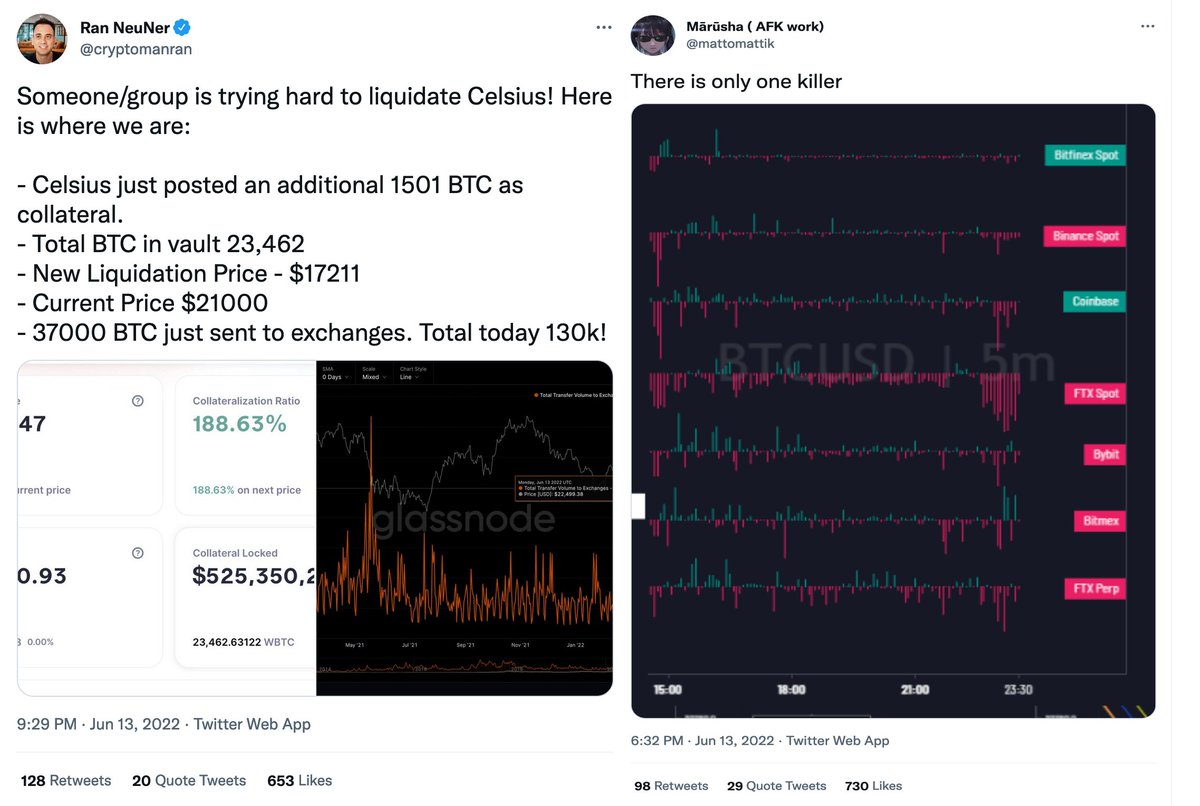

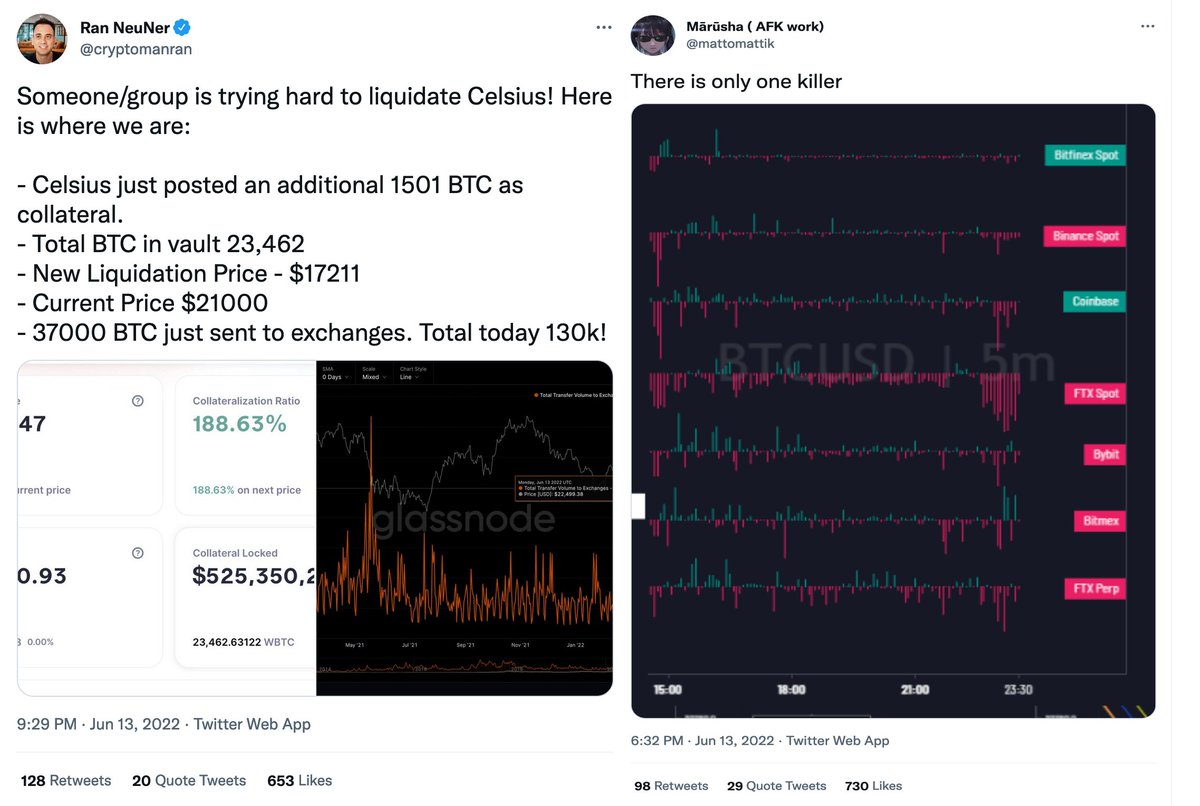

Although, FTX and Alameda have been accused of stop hunting in the past and one Twitter thread saved to archive.org claims Alameda and FTX were involved in Celsius going under. The Twitter account Plan C says that when Terra’s stablecoin UST collapsed, “Celsius got out the door first, suffered the lowest loses and didn’t want any part of the bailout.”

Dumb game woke westerns play

— Kyle Davies ? (@KyleLDavies) November 16, 2022

Plan C insisted that after Celsius fled, Alameda and FTX got stuck holding locked LUNA and UST bags. Alameda was also accused of manipulating the price of WAVES and selling lots of Lido’s staked ether called STETH. Just before FTX filed for bankruptcy protection, SBF told the public that Alameda would sunset trading operations. Davies’ accusations show FTX and Alameda may have had more than just Binance as a so-called ‘sparring partner.’

What do you think about Binance’s CZ calling SBF a “psychopath” and 3AC co-founder Kyle Davies accusing FTX/Alameda of stop hunting his hedge fund? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Tony Hawk's Latest NFTs to Come With Signed Physical Skateboards

Last December, the renowned professional skateboarder Tony Hawk released his “Last Trick” non-fungible token (NFT) collection via the NFT marketplace Autograph. Next week, Hawk will be auctioning the skateboards he used during his last tricks, and each of the NFTs ... read more.

During a conversation with Binance CEO Changpeng Zhao (CZ) and the Milken Institute, the exchange executive called the former FTX CEO Sam Bankman-Fried (SBF) a “psychopath” for one of the tweets SBF wrote last week. CZ’s statements further follow the accusations stemming from Three Arrows Capital (3AC) co-founder Kyle Davies. The 3AC co-founder claimed that both FTX and Alameda Research “colluded to trade against clients.”

Crypto industry executives are not too pleased with the former FTX CEO Sam Bankman-Fried (SBF) and in recent times SBF has been getting a lot of criticism. Binance CEO Changpeng Zhao (CZ) talked about SBF with the Milken Institute on Nov. 17, 2022, and he explained that he did not know why SBF considered Binance a “sparring partner.”

CZ says that when SBF reached out to the Binance executive, CZ thought it was about an over-the-counter (OTC) deal to buy FTT tokens. Then CZ noted that when SBF called the former FTX CEO detailed that they were in “big trouble” and the company was “looking for a buyout.”

CZ was asked at the Milken Institute event why SBF would tweet and call the company Binance or CZ a “sparring partner.” The Binance CEO responded and said “I think only a psychopath can write that tweet.” In addition to calling SBF a psychopath, CZ further noted that he believes SBF should stop tweeting and noted that he should “put on a suit” to face the music in Washington D.C.

The Binance CEO is not the only person criticizing FTX and Alameda, as the co-founder of the now-defunct Three Arrows Capital (3AC) crypto hedge fund, Kyle Davies, accused FTX and Alameda of colluding against the firm.

Speaking with CNBC’s Kate Rooney, Davies alleges that “FTX [and] Alameda Research colluded to trade against clients” and further said: “We, [Three Arrows Capital], were hunted and our positions liquidated.” However, CNBC received a statement from SBF that said he was “shocked” about Davies’ allegations and said: “there’s no truth to their allegations here.”

Although, FTX and Alameda have been accused of stop hunting in the past and one Twitter thread saved to archive.org claims Alameda and FTX were involved in Celsius going under. The Twitter account Plan C says that when Terra’s stablecoin UST collapsed, “Celsius got out the door first, suffered the lowest loses and didn’t want any part of the bailout.”

Dumb game woke westerns play

— Kyle Davies ? (@KyleLDavies) November 16, 2022

Plan C insisted that after Celsius fled, Alameda and FTX got stuck holding locked LUNA and UST bags. Alameda was also accused of manipulating the price of WAVES and selling lots of Lido’s staked ether called STETH. Just before FTX filed for bankruptcy protection, SBF told the public that Alameda would sunset trading operations. Davies’ accusations show FTX and Alameda may have had more than just Binance as a so-called ‘sparring partner.’

What do you think about Binance’s CZ calling SBF a “psychopath” and 3AC co-founder Kyle Davies accusing FTX/Alameda of stop hunting his hedge fund? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Tony Hawk's Latest NFTs to Come With Signed Physical Skateboards

Last December, the renowned professional skateboarder Tony Hawk released his “Last Trick” non-fungible token (NFT) collection via the NFT marketplace Autograph. Next week, Hawk will be auctioning the skateboards he used during his last tricks, and each of the NFTs ... read more.

Unus sed leo was a notable gainer on Thursday, as the token surged towards a one-week high. The move comes as crypto markets seem to have settled, a week on from the turbulence caused by the FTX collapse. Monero also rallied, climbing above the $130 level.

Monero (XMR) was closing in on a one-week high on Thursday, as market volatility eased a week on from the FTX collapse.

XMR/USD raced to an intraday high of $132.97 in today’s session, which comes a day after trading at a low of $127.09.

Today’s move saw monero hit its highest point since last Friday, and it is now marginally below a ceiling of $133.50.

Looking at the chart, earlier gains have somewhat eased, as traders became nervous the closer price moved to this ceiling.

The 14-day relative strength index (RSI) also collided with a key resistance level of 43.00, and as of writing is tracking at 42.09.

Should bulls intend to move prices above $133.50, this ceiling of 43.00 will need to be broken first.

Unus Sed Leo (LEO) was another notable gainer in today’s session, as prices also neared a one-week high.

Following a low of $3.78, LEO/USD raced to an intraday peak of $4.04, hitting its strongest point since November 11.

Currently LEO is trading over 5% higher than yesterday’s bottom, and is nearing a breakout of a long-term resistance level.

LEO/USD is still hovering below this ceiling of $4.05, which comes as the RSI also sits below a resistance of its own.

As of writing, the index is tracking at 46.49, which is under its aforementioned resistance of 47.00.

In the event of a breakout, LEO bulls will likely attempt to move towards the next closest ceiling of $4.20.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect to see crypto markets begin to rally as the dust settles on the FTX saga? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Bill ‘On Digital Currency’ Caps Crypto Investments for Russians, Opens Door for Payments

Russia’s recently revised bill “On Digital Currency” limits crypto purchases for non-qualified investors while providing legal ground for some cryptocurrency payments, according to local media. The draft law, proposed by the Russian finance ministry, also introduces strict requirements for platforms ... read more.

Source From : News