As bitcoin is coasting along under the $20K region, the network’s hashrate is still riding high at 250.04 exahash per second (EH/s) following the all-time high (ATH) the hashrate tapped on October 5. At the time of writing, the current speed at which blocks are processed is faster than the typical ten-minute average block intervals between the current block height (757,531) and the last difficulty adjustment. Statistics show that because block times have been much faster, the network could see the largest difficulty increase this year, as estimates show a possible jump between 9% to 13.2% higher.

Bitcoin mining is looking to become a whole lot more difficult on the next retarget date which will occur on October 10, 2022. Two days ago, on October 5, the network’s total hashrate reached an ATH at 321 EH/s at block height 757,214. While the price of BTC is lower and the difficulty is near the last ATH, miners are relentlessly dedicating computational power to the BTC chain. At the moment, the hashrate is coasting along at 250 EH/s after the ATH was reached on Wednesday.

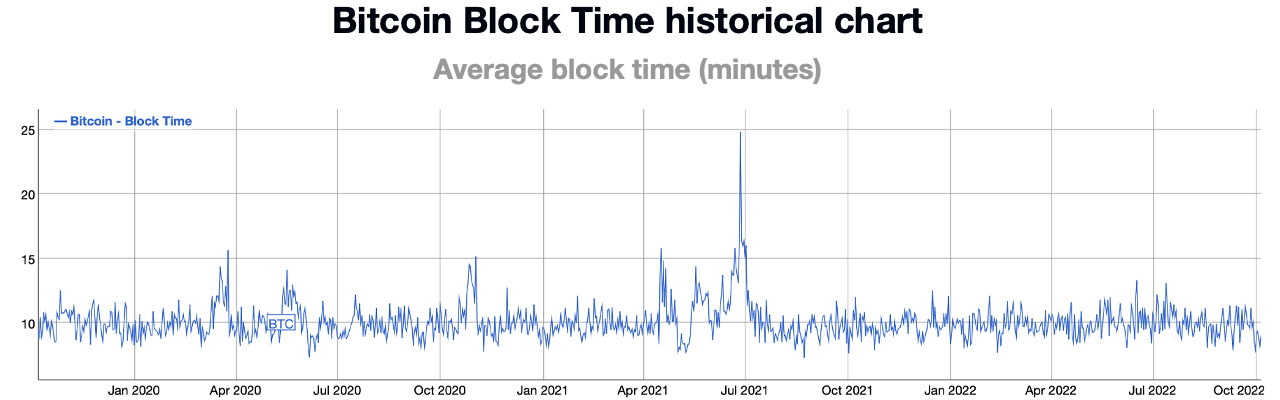

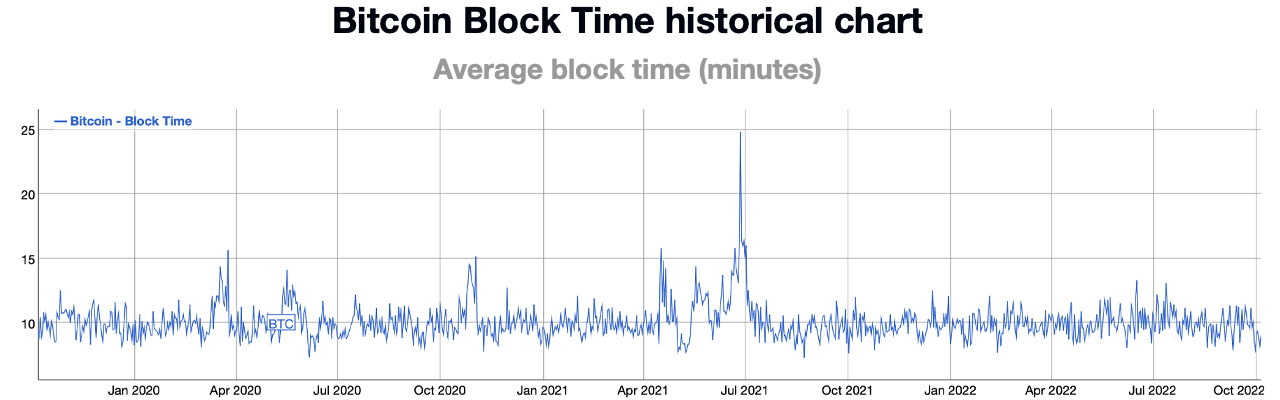

Currently, block times (the interval between each block mined) are faster than the ten-minute average, bitinfocharts.com data shows. Presently, at 9:00 a.m. (ET), metrics show block times are around 9:05 minutes but other dashboards show a much faster rate at 8:49 minutes. With the average bitcoin block interval between the current height (757,471) and the last difficulty epoch (756,000) at 8:49 minutes, it means BTC’s network difficulty is due for a notable rise. There’s a chance that the difficulty jump on October 10 could be the network’s highest difficulty rise this year.

Data from btc.com shows an increase of around 9.34%, which would surpass the network’s second-largest increase in 2022. If btc.com’s estimate is correct, BTC’s network difficulty will rise from 31.36 trillion to 34.29 trillion. Metrics from Clark Moody’s Bitcoin dashboard show the difficulty change could be a lot higher and at the time of writing, Moody’s dashboard indicates it could be around 13.2% higher than it is today. The Bitcoin network has roughly 400+ blocks to go until the next retarget.

It’s quite possible the hashrate will slow and block times increase back to the ten-minute range. If so the difficulty’s percentage increase could be a lot lower than even Btc.com’s 9% increase estimate. Every two weeks or when 2,016 blocks are discovered, the network’s difficulty adjusts to make it either harder or easier to find a BTC block depending on how fast the 2,016 blocks were discovered.

If the 2,016 blocks were found too fast, the network’s algorithm adjusts the difficulty higher and if the blocks are found at a much slower pace, the difficulty rating can decline. The last significantly large difficulty reduction took place on July 3, 2021, when the difficulty dropped by 27.94% at block height 689,472. That means it was 27% easier to find a BTC block subsidy than it was prior to block 689,472.

What do you think about the possibility that Bitcoin’s mining difficulty may see the largest jump this year? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Today's Top Ethereum and Bitcoin Mining Devices Continue to Rake in Profits

As the crypto economy hovers just under $2 trillion in value, application-specific integrated circuit (ASIC) mining devices are making decent profits. While ASIC miners can still mine ethereum, a 1.5 gigahash (GH/s) Ethash mining device can rake in $51.58 per ... read more.

As bitcoin is coasting along under the $20K region, the network’s hashrate is still riding high at 250.04 exahash per second (EH/s) following the all-time high (ATH) the hashrate tapped on October 5. At the time of writing, the current speed at which blocks are processed is faster than the typical ten-minute average block intervals between the current block height (757,531) and the last difficulty adjustment. Statistics show that because block times have been much faster, the network could see the largest difficulty increase this year, as estimates show a possible jump between 9% to 13.2% higher.

Bitcoin mining is looking to become a whole lot more difficult on the next retarget date which will occur on October 10, 2022. Two days ago, on October 5, the network’s total hashrate reached an ATH at 321 EH/s at block height 757,214. While the price of BTC is lower and the difficulty is near the last ATH, miners are relentlessly dedicating computational power to the BTC chain. At the moment, the hashrate is coasting along at 250 EH/s after the ATH was reached on Wednesday.

Currently, block times (the interval between each block mined) are faster than the ten-minute average, bitinfocharts.com data shows. Presently, at 9:00 a.m. (ET), metrics show block times are around 9:05 minutes but other dashboards show a much faster rate at 8:49 minutes. With the average bitcoin block interval between the current height (757,471) and the last difficulty epoch (756,000) at 8:49 minutes, it means BTC’s network difficulty is due for a notable rise. There’s a chance that the difficulty jump on October 10 could be the network’s highest difficulty rise this year.

Data from btc.com shows an increase of around 9.34%, which would surpass the network’s second-largest increase in 2022. If btc.com’s estimate is correct, BTC’s network difficulty will rise from 31.36 trillion to 34.29 trillion. Metrics from Clark Moody’s Bitcoin dashboard show the difficulty change could be a lot higher and at the time of writing, Moody’s dashboard indicates it could be around 13.2% higher than it is today. The Bitcoin network has roughly 400+ blocks to go until the next retarget.

It’s quite possible the hashrate will slow and block times increase back to the ten-minute range. If so the difficulty’s percentage increase could be a lot lower than even Btc.com’s 9% increase estimate. Every two weeks or when 2,016 blocks are discovered, the network’s difficulty adjusts to make it either harder or easier to find a BTC block depending on how fast the 2,016 blocks were discovered.

If the 2,016 blocks were found too fast, the network’s algorithm adjusts the difficulty higher and if the blocks are found at a much slower pace, the difficulty rating can decline. The last significantly large difficulty reduction took place on July 3, 2021, when the difficulty dropped by 27.94% at block height 689,472. That means it was 27% easier to find a BTC block subsidy than it was prior to block 689,472.

What do you think about the possibility that Bitcoin’s mining difficulty may see the largest jump this year? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Today's Top Ethereum and Bitcoin Mining Devices Continue to Rake in Profits

As the crypto economy hovers just under $2 trillion in value, application-specific integrated circuit (ASIC) mining devices are making decent profits. While ASIC miners can still mine ethereum, a 1.5 gigahash (GH/s) Ethash mining device can rake in $51.58 per ... read more.

Meme coins were trading lower on Friday, as markets reacted to the latest U.S. nonfarm payrolls report. The data showed that 263,000 jobs were added to the United States economy in September, versus the 250,000 expected. Both dogecoin and shiba inu fell for a third consecutive session.

Dogecoin (DOGE) fell for a third consecutive session on Friday, as markets reacted to the latest nonfarm payrolls (NFP) report.

DOGE/USD slipped to an intraday low of $0.06201 in today’s session less than 24 hours after hitting a peak of $0.06511.

Today’s decline saw the token continue to fall below its resistance point of $0.0640, moving closer to a floor of $0.0590.

Looking at the chart, today’s drop in price comes as the 14-day relative strength index (RSI) fell below a floor of its own.

As of writing, the index is tracking at 50.63, which is marginally below its recent support point of 52.00.

The 10-day (red) moving average (MA) continues to hover above its 25-day (blue) counterpart, which remains a positive sign for bulls hopeful of a rebound.

Shiba Inu (SHIB) was also on day three of recent declines, with the token moving closer to a key support point.

Following a high of $0.00001138 on Thursday, SHIB/USD slipped to a bottom of $0.000011 earlier in the day.

This drop saw the meme coin move towards its floor of $0.00001080, which has mostly been in place since September 18.

Despite this recent sell-off, the 10-day moving average on shiba inu was set for an upwards cross with the 25-day MA.

Should this take place, we could potentially see SHIB move back towards a ceiling of $0.00001170.

As of writing, the RSI is now tracking at 44.91, which is just above a support point of 44.00.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect the token to continue to fall this weekend? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

Source From : News