Shiba inu was one of Friday’s biggest gainers, as the meme coin remained close to a recent three month high. The token has been in the green for the majority of today’s session, despite the global cryptocurrency market cap falling 1.28% at the time of writing. Polkadot was also higher, as it continued to trade above a key price ceiling.

Shiba inu (SHIB) was a notable mover on Friday, with prices remaining close to yesterday’s three month high.

SHIB/USD rose to a high of $0.00001291 on Thursday, which was its strongest point since November, however fell lower, as bulls moved to take profits.

As traders abandoned their positions, SHIB fell to a low of $0.00001196 yesterday, however prices have since recovered, and are currently sitting at $0.00001251.

Looking at the chart, Thursday’s decline pushed SHIB towards a floor at 61.00 on the relative strength index (RSI), however bulls rejected a breakout.

As of writing this, the index is tracking at 69.41, which is marginally below a resistance point at 70.00.

In order for SHIB to recapture yesterday’s peak, this ceiling at 70.00 will first need to be broken.

Polkadot (DOT) also maintained bullish momentum in today’s session, as the token continued to trade above a key resistance level.

After giving up a high of $6.84 on Thursday, DOT/USD dropped to a low of $6.53 later in the day.

The token has since rebounded, and as of writing this is currently trading at $6.79, which is marginally below a ceiling at $6.80.

Looking at the chart, the 14-day RSI indicator is at a reading of 66.53, and is fast approaching a ceiling of 68.00.

Similar to SHIB, DOT traders will need to race past this point in order for market momentum to remain bullish.

Should this happen, then it is possible that polkadot could move closer to the $7.00 mark.

Register your email here to get weekly price analysis updates sent to your inbox:

Could we see polkadot hit $7.00 before the end of the week? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis. He was previously a brokerage director and online trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX, whilst also a startup founder.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Shiba inu was one of Friday’s biggest gainers, as the meme coin remained close to a recent three month high. The token has been in the green for the majority of today’s session, despite the global cryptocurrency market cap falling 1.28% at the time of writing. Polkadot was also higher, as it continued to trade above a key price ceiling.

Shiba inu (SHIB) was a notable mover on Friday, with prices remaining close to yesterday’s three month high.

SHIB/USD rose to a high of $0.00001291 on Thursday, which was its strongest point since November, however fell lower, as bulls moved to take profits.

As traders abandoned their positions, SHIB fell to a low of $0.00001196 yesterday, however prices have since recovered, and are currently sitting at $0.00001251.

Looking at the chart, Thursday’s decline pushed SHIB towards a floor at 61.00 on the relative strength index (RSI), however bulls rejected a breakout.

As of writing this, the index is tracking at 69.41, which is marginally below a resistance point at 70.00.

In order for SHIB to recapture yesterday’s peak, this ceiling at 70.00 will first need to be broken.

Polkadot (DOT) also maintained bullish momentum in today’s session, as the token continued to trade above a key resistance level.

After giving up a high of $6.84 on Thursday, DOT/USD dropped to a low of $6.53 later in the day.

The token has since rebounded, and as of writing this is currently trading at $6.79, which is marginally below a ceiling at $6.80.

Looking at the chart, the 14-day RSI indicator is at a reading of 66.53, and is fast approaching a ceiling of 68.00.

Similar to SHIB, DOT traders will need to race past this point in order for market momentum to remain bullish.

Should this happen, then it is possible that polkadot could move closer to the $7.00 mark.

Register your email here to get weekly price analysis updates sent to your inbox:

Could we see polkadot hit $7.00 before the end of the week? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis. He was previously a brokerage director and online trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX, whilst also a startup founder.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

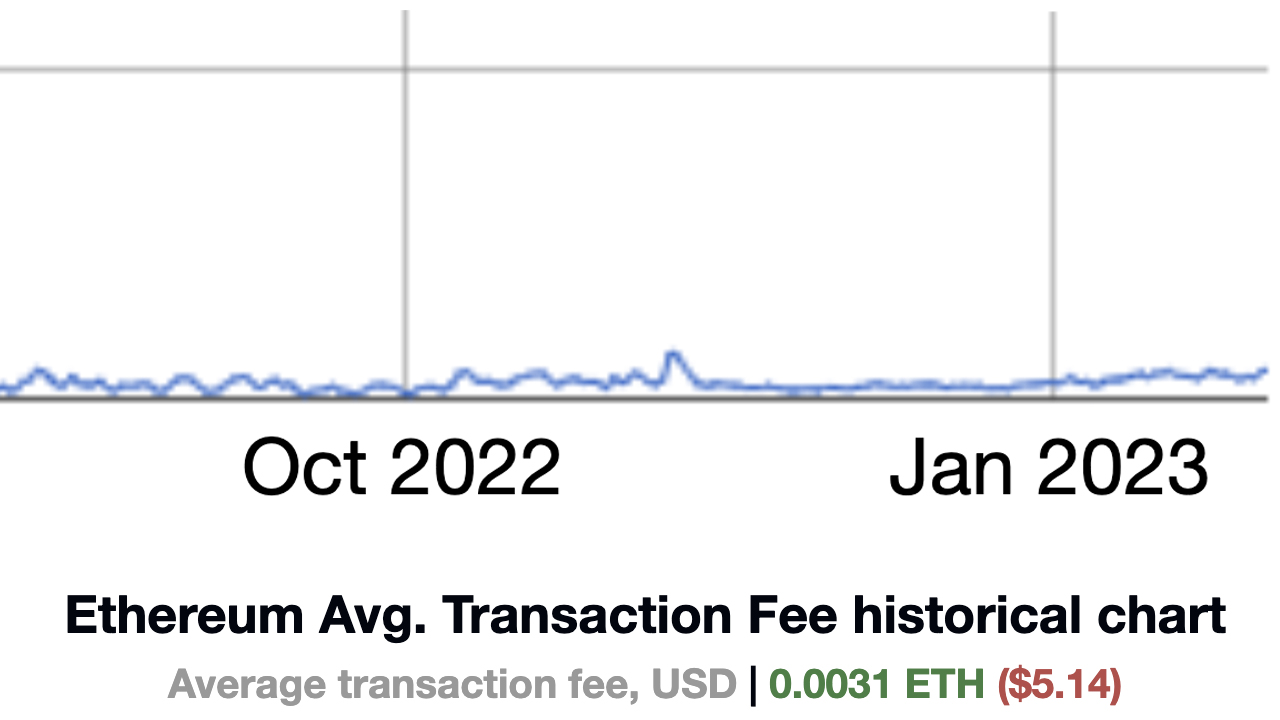

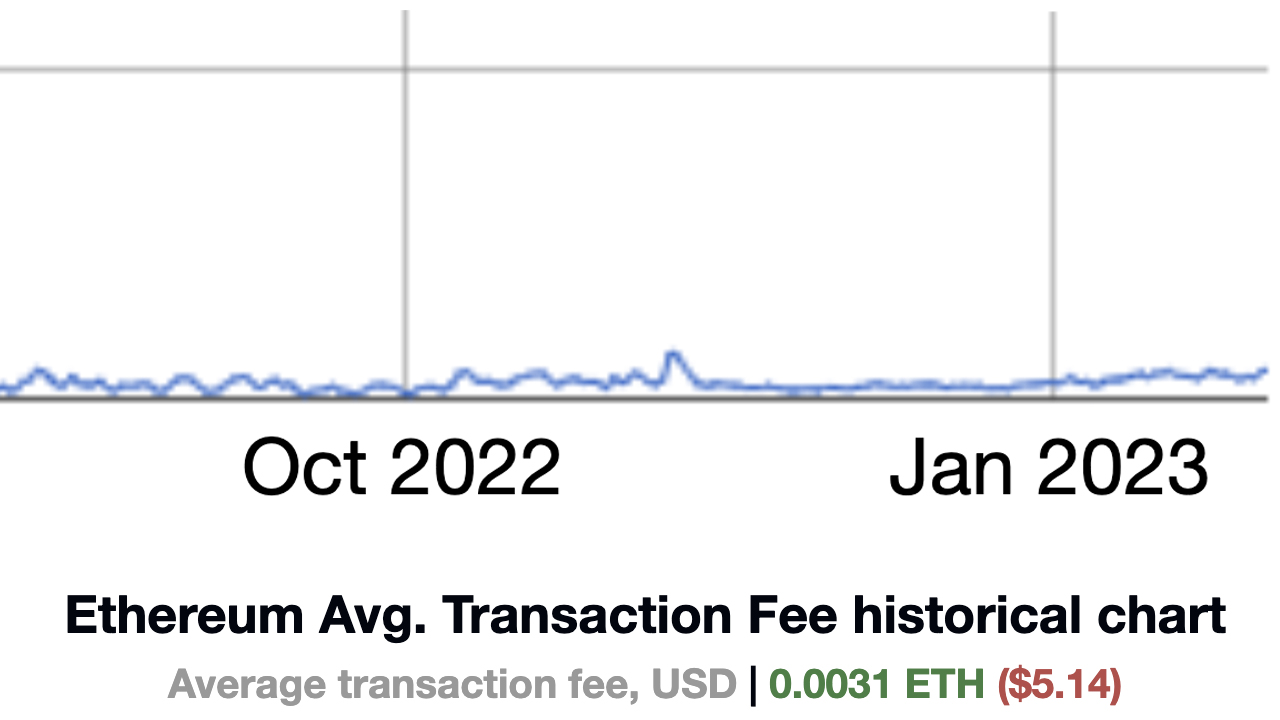

Ethereum gas fees have increased 13.71% in the last two weeks, with the average fee rising from $4.52 per transaction to $5.14 per transfer on Feb. 3, 2023. Despite ethereum’s price seeing significant growth this year, its network’s gas fees have also seen a similar increase. As the demand for Ethereum’s capabilities continues to soar, it remains to be seen if these rising fees will ultimately hinder its growth.

With a value of $1,701 per coin reached on Thursday, Feb. 2, 2023, ethereum (ETH) has reached new heights, soaring to its highest value this year. However, despite the increase in ethereum’s token value, the cost to send the cryptocurrency onchain has also risen.

On Jan. 18, 2023, data from bitinfocharts.com showed an average transfer fee of 0.0029 ETH or $4.52 per transaction. Just 15 days later, the transfer fee had risen to 0.0031 ETH or $5.14 per transaction.

The median fee for transactions was around $1.96 per transaction on Jan. 18, 2023, and jumped 20% to $2.36 per transaction on Feb. 3, 2023. The median fee to transfer ether is now 0.0014 ETH.

Transacting on Opensea currently costs around $3.89, while a decentralized exchange (dex) swap costs around $10.02 per transaction. On the Ethereum network, the cost to transact with an ERC20 token such as USDT or USDC is around $2.94 per transfer on Feb. 3.

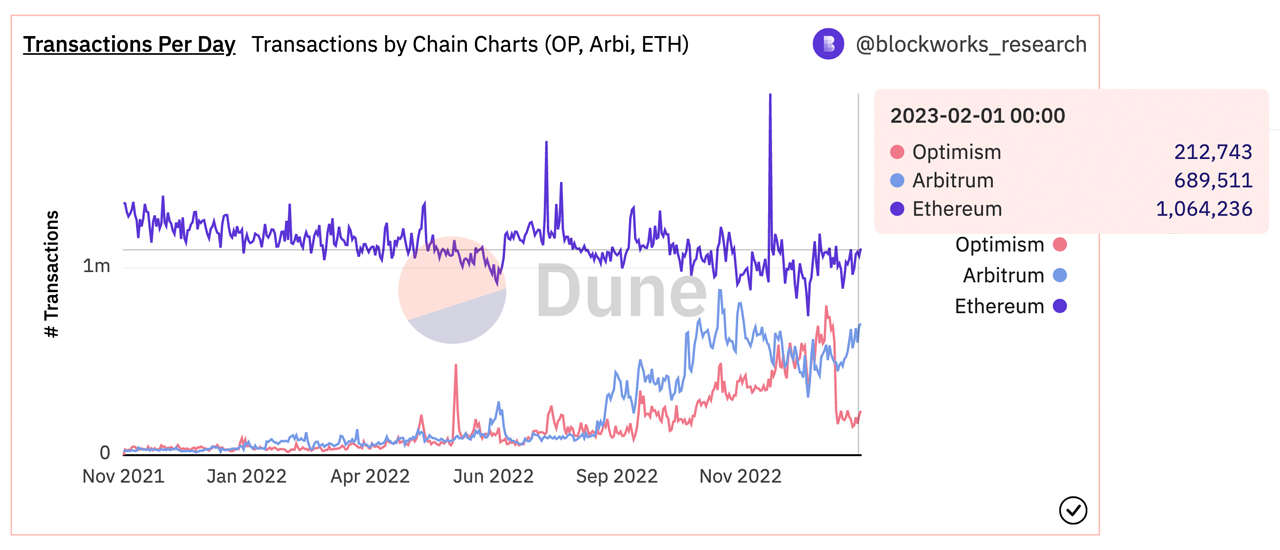

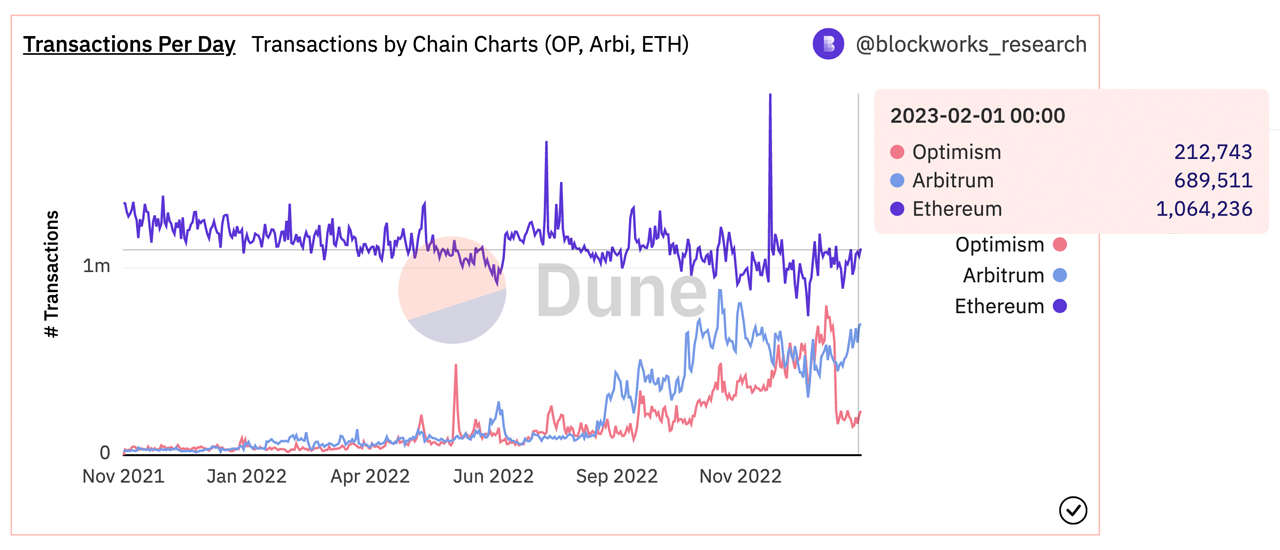

According to Dune Analytics data, the average cost to send transactions using the Ethereum scaling solution Optimism is approximately $0.288 per transaction, while the L2 scaling network Arbitrum is around $0.182 per transfer on Feb. 3.

The combined number of L2 transactions using Arbitrum and Optimism has decreased since Jan. 15, 2023. Two days ago, on Feb. 1, 2023, Ethereum recorded 1.06 million transactions, while the combined number of transactions using Arbitrum and Optimism was 902,254.

Data shows that the cost to transfer 1.06 million transactions on Ethereum at a median rate of $2.36 per transaction would be $2.49 million. However, if these same transactions were moved to Optimism at a rate of $0.288 per transaction, the fees would cost $307,680, which is 87.67% lower.

If the transactions were moved to Arbitrum at a fee rate of $0.182 per transfer, the cost would be $193,720, a 92.19% decrease compared to Ethereum. While Ethereum recorded 1.06 million transactions with a much higher cost, Optimism had 212,743 transfers and Arbitrum had 689,511 transactions.

What are your thoughts on the rise of Ethereum gas fees and the potential impact on its growth? Let us know your thoughts about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Following a Brief Fee Spike, Gas Prices to Move Ethereum Drop 76% in 12 Days

Transaction fees on the Ethereum network are dropping again after average fees saw a brief spike on April 5 jumping to $43 per transfer. 12 days later, average ether fees are close to dropping below $10 per transaction and median-sized ... read more.

Ethereum gas fees have increased 13.71% in the last two weeks, with the average fee rising from $4.52 per transaction to $5.14 per transfer on Feb. 3, 2023. Despite ethereum’s price seeing significant growth this year, its network’s gas fees have also seen a similar increase. As the demand for Ethereum’s capabilities continues to soar, it remains to be seen if these rising fees will ultimately hinder its growth.

With a value of $1,701 per coin reached on Thursday, Feb. 2, 2023, ethereum (ETH) has reached new heights, soaring to its highest value this year. However, despite the increase in ethereum’s token value, the cost to send the cryptocurrency onchain has also risen.

On Jan. 18, 2023, data from bitinfocharts.com showed an average transfer fee of 0.0029 ETH or $4.52 per transaction. Just 15 days later, the transfer fee had risen to 0.0031 ETH or $5.14 per transaction.

The median fee for transactions was around $1.96 per transaction on Jan. 18, 2023, and jumped 20% to $2.36 per transaction on Feb. 3, 2023. The median fee to transfer ether is now 0.0014 ETH.

Transacting on Opensea currently costs around $3.89, while a decentralized exchange (dex) swap costs around $10.02 per transaction. On the Ethereum network, the cost to transact with an ERC20 token such as USDT or USDC is around $2.94 per transfer on Feb. 3.

According to Dune Analytics data, the average cost to send transactions using the Ethereum scaling solution Optimism is approximately $0.288 per transaction, while the L2 scaling network Arbitrum is around $0.182 per transfer on Feb. 3.

The combined number of L2 transactions using Arbitrum and Optimism has decreased since Jan. 15, 2023. Two days ago, on Feb. 1, 2023, Ethereum recorded 1.06 million transactions, while the combined number of transactions using Arbitrum and Optimism was 902,254.

Data shows that the cost to transfer 1.06 million transactions on Ethereum at a median rate of $2.36 per transaction would be $2.49 million. However, if these same transactions were moved to Optimism at a rate of $0.288 per transaction, the fees would cost $307,680, which is 87.67% lower.

If the transactions were moved to Arbitrum at a fee rate of $0.182 per transfer, the cost would be $193,720, a 92.19% decrease compared to Ethereum. While Ethereum recorded 1.06 million transactions with a much higher cost, Optimism had 212,743 transfers and Arbitrum had 689,511 transactions.

What are your thoughts on the rise of Ethereum gas fees and the potential impact on its growth? Let us know your thoughts about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Following a Brief Fee Spike, Gas Prices to Move Ethereum Drop 76% in 12 Days

Transaction fees on the Ethereum network are dropping again after average fees saw a brief spike on April 5 jumping to $43 per transfer. 12 days later, average ether fees are close to dropping below $10 per transaction and median-sized ... read more.

PRESS RELEASE. Foxify have just confirmed a brand partnership with Tyson Fury in an industry leading move. It comes following the hype of the brand reveal in January. The two-time world heavyweight champion is undefeated, with a legion of fans that follow his extraordinary career.

What is Foxify? From the founding team of MDB (Make DeFi Better) comes the next generation of peer-to-peer trading, a unique platform that is yet to be seen in the DeFi space: Foxify.

Following from previous successes, the team brings you their latest innovation, enter: Foxify. A first of its kind, decentralized peer-to-peer trading platform. Foxify will allow users to trade any pair or any token. The technology is built with the power to enable trading on pegged tokens that track currencies, commodities and assets beyond crypto. It’s 100% trustless, managed completely by smart contracts and is free to use. More details will be revealed as launch approaches, but it is set to be huge as it has the power to disrupt a $200 trillion dollar industry, and is scalable across global markets.

Foxify aims to put the power in users hands, traditional exchanges and decentralized trading platforms are still heavily weighted against the user being successful, Foxify levels the playing field and allows traders opportunities to trade against peers without the ‘house advantage’.

Foxify is a Diamond Sponsor at the Blockchain Economy London Summit in February, so you will be able to go and meet members of the team in person and find out more about the platform. Foxify founder and CEO Danny Winn will be a speaker there also, discussing the future of decentralized finances and trading. The team will also be exhibiting at the Blockchain Economy summits in Dubai, Texas and Istanbul later in the year, and will be attending numerous other industry events.

The team has a wealth of experience – including the 2022 bear market success story, Make DeFi Better. Make DeFi better has continued to buck the trend of the bear market with a consistent, upward trending chart and offering users sustainable passive income through their dApp.

Foxify will also run an affiliate programme, allowing you to earn a percentage of fees generated by those who sign up and trade via your referral link.

Launching June 2023, get early access to alpha, presale information and seed funding options and more by joining now.

Foxify: Your future, today.

Find out more: https://linktr.ee/foxifytrade

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

PRESS RELEASE. Foxify have just confirmed a brand partnership with Tyson Fury in an industry leading move. It comes following the hype of the brand reveal in January. The two-time world heavyweight champion is undefeated, with a legion of fans that follow his extraordinary career.

What is Foxify? From the founding team of MDB (Make DeFi Better) comes the next generation of peer-to-peer trading, a unique platform that is yet to be seen in the DeFi space: Foxify.

Following from previous successes, the team brings you their latest innovation, enter: Foxify. A first of its kind, decentralized peer-to-peer trading platform. Foxify will allow users to trade any pair or any token. The technology is built with the power to enable trading on pegged tokens that track currencies, commodities and assets beyond crypto. It’s 100% trustless, managed completely by smart contracts and is free to use. More details will be revealed as launch approaches, but it is set to be huge as it has the power to disrupt a $200 trillion dollar industry, and is scalable across global markets.

Foxify aims to put the power in users hands, traditional exchanges and decentralized trading platforms are still heavily weighted against the user being successful, Foxify levels the playing field and allows traders opportunities to trade against peers without the ‘house advantage’.

Foxify is a Diamond Sponsor at the Blockchain Economy London Summit in February, so you will be able to go and meet members of the team in person and find out more about the platform. Foxify founder and CEO Danny Winn will be a speaker there also, discussing the future of decentralized finances and trading. The team will also be exhibiting at the Blockchain Economy summits in Dubai, Texas and Istanbul later in the year, and will be attending numerous other industry events.

The team has a wealth of experience – including the 2022 bear market success story, Make DeFi Better. Make DeFi better has continued to buck the trend of the bear market with a consistent, upward trending chart and offering users sustainable passive income through their dApp.

Foxify will also run an affiliate programme, allowing you to earn a percentage of fees generated by those who sign up and trade via your referral link.

Launching June 2023, get early access to alpha, presale information and seed funding options and more by joining now.

Foxify: Your future, today.

Find out more: https://linktr.ee/foxifytrade

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

PRESS RELEASE.

KyotoSwap.io is the first decentralized exchange (DEX) on Binance Smart Chain that allows anybody to create a verifiable positive impact at little to no cost. As a result, decentralized finance (DeFi) users can passively contribute towards fighting climate change.

The first Regenerative Finance DEX on BSC to tackle climate change

The empowering movement of Regenerative Finance (ReFi) has created a thriving sub-sector within DeFi, which continues to snowball in popularity despite the recent crypto winter. In essence, Regenerative Finance incorporates an action that positively impacts circular or modular economies as well as tackle global warming and other issues related to climate change. The blossoming adoption of blockchain technology and DeFi has created a movement where WEB3 communities innovate unique approaches to fight climate change while simultaneously creating economic opportunity.

Become carbon neutral passively

As a secure automated market maker (AMM) on Binance Smart Chain, KyotoSwap.io allows users to trade in a permissionless yet secure environment. KyotoSwap.io is governed by the Kyoto Swap token ($KSWAP), which can be farmed by providing liquidity. KyotoSwap tokens accrued can be staked to earn a share of platform profits, or exchanged to plant trees real time. The trees are planted via Veritree and the impact is recorded on the Kyoto Swap impact leaderboard. Kyoto Swaps unique modular economy enables users to become carbon neutral passively.

KyotoProtocol.io has one of the largest ReFi communities on Binance Smart Chain

Kyoto Swap.io is founded and incubated by the Kyotoprotocol.io Foundation as its ReFi focused alternative to other decentralized exchanges out there. Initially launched as a DEX for Binance Smart Chain DeFi protocols, Kyoto Swap will become multi-chain, with its contract base held on the Kyoto blockchain — world’s first carbon-negative blockchain by design. Unlike most decentralized exchanges that rely on securing utility before the end of the farm tokens runway, $KSWAP holders can have peace of mind knowing that the utility for Kyoto Swap is secured.

Join the ReFi revolution- Kyotoprotocol.io

Trade and make a positive impact- Kyotoswap.io

About Kyoto Swap- Kyoto Swap.io is a decentralized exchange focused on creating a recordable and verifiable positive impact to our planet in an effort to fight climate changes and global warming. Incubated and supported by the Kyoto ecosystem and KyotoProtocol.io .

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

Source From : News