According to a court document filed on March 31, 2023, regarding the sentencing of James Zhong, who stole over 50,000 bitcoin from the Silk Road marketplace, the U.S. government plans to liquidate 41,490 bitcoin “over the course of this calendar year.”

The U.S. government, one of the largest holders of bitcoin, plans to sell 41,490 BTC in 2023, according to a court filing submitted in the case of James Zhong’s sentencing. The government made the historic bitcoin seizure in November 2022 when it confiscated over 50,000 BTC from Zhong. The defendant pleaded guilty “to committing wire fraud in September 2012 when he unlawfully obtained over 50,000 bitcoin from the Silk Road dark web internet marketplace.”

Bitcoin.com News reported six days ago that, according to Dune Analytics data and public disclosures, the U.S. government holds 205,515 BTC. In the filing submitted on Friday, federal authorities plan to sell at least 41,490 BTC worth $1.17 billion at today’s exchange rates.

The court document notes, “With respect to the 51,351.89785803 bitcoin forfeited in the Ulbricht case before Judge Schofield, the government has begun liquidating (selling) it. On March 14, 2023, the government sold 9,861.1707894 BTC (of the 51,351.89785803 BTC) for a total of $215,738,154.98.”

According to onchain analytics firm Glassnode, the sale of 9,861 BTC was detected, or at least the period of time when it was sent to a major exchange prior to selling. “Of the bitcoin forfeited in the Ulbricht case, there remains approximately 41,490.72 BTC, which the government expects to be liquidated in four more batches over the course of this calendar year,” the filing adds.

Glassnode’s account of the onchain transfer explains that the funds were likely sent to Coinbase. If the funds were sold on Coinbase, it would be different from the U.S. government’s previous auction style of selling seized crypto assets. When the government sells the 41,490 BTC, it will still have 164,025 BTC, or $4.65 billion worth, remaining.

What do you think of the U.S. government’s decision to liquidate its seized bitcoin? Share your thoughts in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

According to a court document filed on March 31, 2023, regarding the sentencing of James Zhong, who stole over 50,000 bitcoin from the Silk Road marketplace, the U.S. government plans to liquidate 41,490 bitcoin “over the course of this calendar year.”

The U.S. government, one of the largest holders of bitcoin, plans to sell 41,490 BTC in 2023, according to a court filing submitted in the case of James Zhong’s sentencing. The government made the historic bitcoin seizure in November 2022 when it confiscated over 50,000 BTC from Zhong. The defendant pleaded guilty “to committing wire fraud in September 2012 when he unlawfully obtained over 50,000 bitcoin from the Silk Road dark web internet marketplace.”

Bitcoin.com News reported six days ago that, according to Dune Analytics data and public disclosures, the U.S. government holds 205,515 BTC. In the filing submitted on Friday, federal authorities plan to sell at least 41,490 BTC worth $1.17 billion at today’s exchange rates.

The court document notes, “With respect to the 51,351.89785803 bitcoin forfeited in the Ulbricht case before Judge Schofield, the government has begun liquidating (selling) it. On March 14, 2023, the government sold 9,861.1707894 BTC (of the 51,351.89785803 BTC) for a total of $215,738,154.98.”

According to onchain analytics firm Glassnode, the sale of 9,861 BTC was detected, or at least the period of time when it was sent to a major exchange prior to selling. “Of the bitcoin forfeited in the Ulbricht case, there remains approximately 41,490.72 BTC, which the government expects to be liquidated in four more batches over the course of this calendar year,” the filing adds.

Glassnode’s account of the onchain transfer explains that the funds were likely sent to Coinbase. If the funds were sold on Coinbase, it would be different from the U.S. government’s previous auction style of selling seized crypto assets. When the government sells the 41,490 BTC, it will still have 164,025 BTC, or $4.65 billion worth, remaining.

What do you think of the U.S. government’s decision to liquidate its seized bitcoin? Share your thoughts in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

According to statistics, 4,498 blocks have been mined in the last 30 days, creating 28,112 new bitcoins over the past month. Bitcoin’s network hashrate has been around 341 exahash per second (EH/s) during the last 2,016 blocks or the last two weeks. This month, the mining pools Foundry USA and Antpool dominated the pack, accounting for 52.87% of the global hashrate in March.

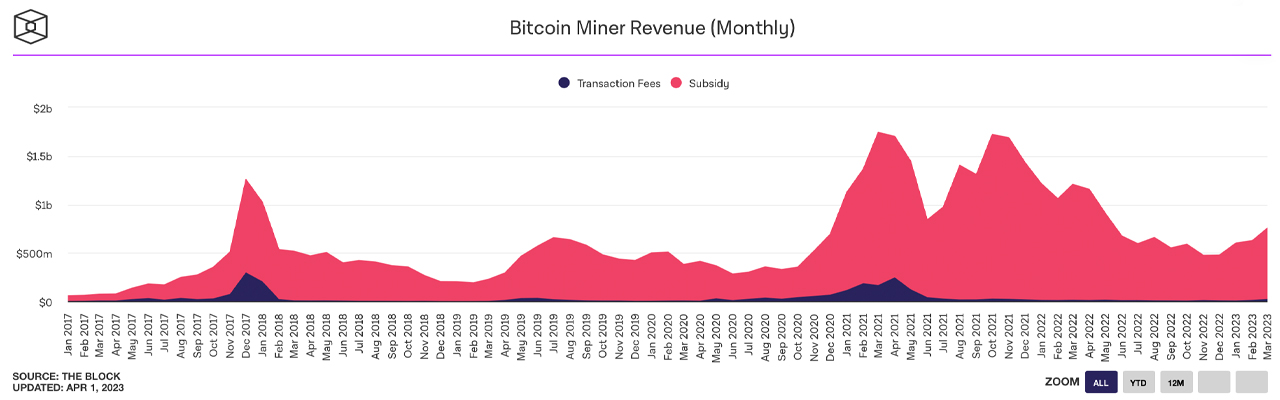

Bitcoin miners had a decent month in March with revenues not seen since before June 2022. During the last 30 days, 4,498 blocks were discovered, and bitcoin miners obtained $734.78 million in revenue.

Of that value, 28,112 freshly minted bitcoins were issued, accounting for $712.12 million. March statistics further show that bitcoin miners made approximately $22.66 million from transaction fees.

March’s total bitcoin mining revenue of $734 million also outpaced February’s $627 million, January’s $601 million, and December’s $477 million. Out of the 4,498 blocks, the largest mining pool by network hashrate, Foundry USA, discovered 1,468 blocks or 9,175 new bitcoins.

Foundry’s percentage of the hashrate in March was around 32.64%, and at press time, the pool has 105 EH/s of hashpower. Antpool found 910 blocks in March, which produced 5,687.50 BTC.

Foundry and Antpool are followed by F2Pool, Binance Pool, Viabtc, BTC.com, Luxor, and Braiins Pool. Last week, Bitcoin’s hashrate reached the 400 EH/s range, and on March 25, 2023, it hit an all-time high of 414.34 EH/s.

With the hashrate so high and block intervals below the ten-minute average, the next difficulty change is expected to occur on April 6, 2023. At present, the difficulty change estimates are roughly between 1.20% to 1.38% higher than the current difficulty of 46.84 trillion.

Three years ago, Bitcoin’s hashrate surpassed the 100 EH/s range, and today it is 240% higher than that period. At that time in April 2020, the total revenue obtained by Bitcoin miners was $412.42 million, with transaction fees accounting for $6.07 million of the aggregate.

What do you think the future holds for Bitcoin mining, given the current trend in revenue and hashrate? Share your thoughts about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

Source From : News