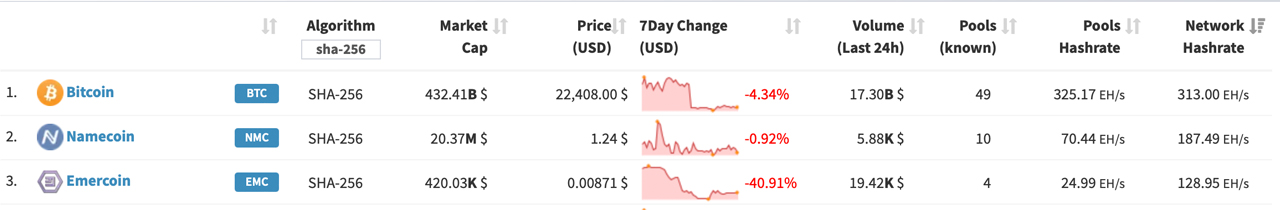

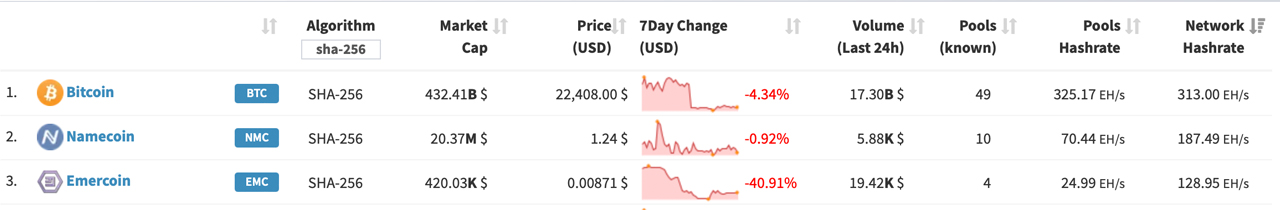

In recent times, Bitcoin’s hashrate has been consistently above 300 exahash per second (EH/s) as multiple mining pools dedicate significant hashpower to the Bitcoin blockchain today. Interestingly, some of the world’s top bitcoin mining pools are also using their hashrate to merge-mine other coins, and these networks have benefited from bitcoin’s increased hashrate.

Bitcoin’s hashrate secures the network and provides rewards for miners participating in the system, but mining pools also dedicate computational power to networks like Namecoin, Elastos, Emercoin, and Vcash. For example, Namecoin has a hashrate of around 187 EH/s today, and some of the top bitcoin mining pools merge-mine the network to acquire namecoin (NMC) rewards.

Merge mining is a process in which miners can mine various cryptocurrencies at the same time without any additional cost. Merged mining is similar to a person playing Pac-Man and Asteroids at the same time, using the same joystick and earning rewards for both games. Namecoin was the first cryptocurrency project to be merge-mined, as it shares the same SHA256 algorithm as Bitcoin, and the first merge-mined block on the network was mined on Sept. 19, 2011.

Bitcoin pools that dedicate hashrate to the Namecoin chain include F2pool, Viabtc, Poolin, and Mining Dutch. While F2pool is the fourth largest bitcoin mining pool over the last three days, it’s the largest namecoin miner as it dedicates its entire 44 EH/s to the Namecoin network. Viabtc dedicates 26.25 EH/s to the Namecoin chain, and Poolin points 5.10 EH/s toward Namecoin as well. At the time of writing, a single namecoin (NMC) is worth $1.24 per unit and 12.5 NMC plus fees are distributed in each block reward.

Namecoin has the second-largest hashrate among SHA256 blockchains, but the Emercoin (EMC) network is the third-largest under BTC and NMC. EMC has 93.38 EH/s dedicated to the network, and Mining Dutch and Viabtc are the top miners for the coin. Viabtc, which is BTC’s fifth-largest mining pool by hashrate, also dedicates 26.76 EH/s to EMC. The Emercoin network leverages a hybrid proof-of-work (PoW) and proof-of-stake (PoS) consensus mechanism. A single emercoin (EMC) is currently changing hands for $0.0088 per coin.

Meanwhile, Viabtc dedicates the same amount of hashrate to the Syscoin (SYS) network, another hybrid PoW and PoS blockchain. Today, a single SYS trades for $0.167 against the U.S. dollar. In addition to the aforementioned PoW cryptocurrencies that leverage the SHA256 consensus algorithm, miners are also dedicating hashrate to networks such as Xaya, Veil, Hathor, Elastos, and Vcash. Older cryptocurrency networks like Terracoin (TRC) and Unobtanium (UNO) also see a small fraction of SHA256 hashrate.

F2pool dedicates 44.32 EH/s to Vcash, but the coin’s native asset has no listed value on any of the top coin market aggregation sites. Elastos has over 100 exahash dedicated to the chain, and top mining pools like Antpool, F2pool, Viabtc, and Mining Dutch are dedicating hashrate to the Elastos network. Current statistics further show that 100 exahash per second is also dedicated to the RSK smart contract network.

What do you think the future holds for merge mining and the relationships between different blockchain networks? Share your thoughts in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tari Labs University, miningpoolstats.stream

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Tony Hawk's Latest NFTs to Come With Signed Physical Skateboards

Last December, the renowned professional skateboarder Tony Hawk released his “Last Trick” non-fungible token (NFT) collection via the NFT marketplace Autograph. Next week, Hawk will be auctioning the skateboards he used during his last tricks, and each of the NFTs ... read more.

In recent times, Bitcoin’s hashrate has been consistently above 300 exahash per second (EH/s) as multiple mining pools dedicate significant hashpower to the Bitcoin blockchain today. Interestingly, some of the world’s top bitcoin mining pools are also using their hashrate to merge-mine other coins, and these networks have benefited from bitcoin’s increased hashrate.

Bitcoin’s hashrate secures the network and provides rewards for miners participating in the system, but mining pools also dedicate computational power to networks like Namecoin, Elastos, Emercoin, and Vcash. For example, Namecoin has a hashrate of around 187 EH/s today, and some of the top bitcoin mining pools merge-mine the network to acquire namecoin (NMC) rewards.

Merge mining is a process in which miners can mine various cryptocurrencies at the same time without any additional cost. Merged mining is similar to a person playing Pac-Man and Asteroids at the same time, using the same joystick and earning rewards for both games. Namecoin was the first cryptocurrency project to be merge-mined, as it shares the same SHA256 algorithm as Bitcoin, and the first merge-mined block on the network was mined on Sept. 19, 2011.

Bitcoin pools that dedicate hashrate to the Namecoin chain include F2pool, Viabtc, Poolin, and Mining Dutch. While F2pool is the fourth largest bitcoin mining pool over the last three days, it’s the largest namecoin miner as it dedicates its entire 44 EH/s to the Namecoin network. Viabtc dedicates 26.25 EH/s to the Namecoin chain, and Poolin points 5.10 EH/s toward Namecoin as well. At the time of writing, a single namecoin (NMC) is worth $1.24 per unit and 12.5 NMC plus fees are distributed in each block reward.

Namecoin has the second-largest hashrate among SHA256 blockchains, but the Emercoin (EMC) network is the third-largest under BTC and NMC. EMC has 93.38 EH/s dedicated to the network, and Mining Dutch and Viabtc are the top miners for the coin. Viabtc, which is BTC’s fifth-largest mining pool by hashrate, also dedicates 26.76 EH/s to EMC. The Emercoin network leverages a hybrid proof-of-work (PoW) and proof-of-stake (PoS) consensus mechanism. A single emercoin (EMC) is currently changing hands for $0.0088 per coin.

Meanwhile, Viabtc dedicates the same amount of hashrate to the Syscoin (SYS) network, another hybrid PoW and PoS blockchain. Today, a single SYS trades for $0.167 against the U.S. dollar. In addition to the aforementioned PoW cryptocurrencies that leverage the SHA256 consensus algorithm, miners are also dedicating hashrate to networks such as Xaya, Veil, Hathor, Elastos, and Vcash. Older cryptocurrency networks like Terracoin (TRC) and Unobtanium (UNO) also see a small fraction of SHA256 hashrate.

F2pool dedicates 44.32 EH/s to Vcash, but the coin’s native asset has no listed value on any of the top coin market aggregation sites. Elastos has over 100 exahash dedicated to the chain, and top mining pools like Antpool, F2pool, Viabtc, and Mining Dutch are dedicating hashrate to the Elastos network. Current statistics further show that 100 exahash per second is also dedicated to the RSK smart contract network.

What do you think the future holds for merge mining and the relationships between different blockchain networks? Share your thoughts in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tari Labs University, miningpoolstats.stream

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Fidelity Investments Launches Crypto, Metaverse ETFs — Says 'We Continue to See Demand'

Fidelity Investments, one of the largest financial services firms with more than $11 trillion under administration, is launching exchange-traded funds (ETFs) focusing on the crypto ecosystem and the metaverse. "We continue to see demand, particularly from young investors, for access ... read more.

Ethereum classic remained near a two-month low on March 6, as a cloud of uncertainty continued to hover over markets. The global crypto market cap remained bearish to start the week, and is down 0.55% at the time of writing. Litecoin also moved lower on Monday.

Ethereum classic (ETC) started the week trading close to a two-month low, as volatility in crypto markets remained high.

ETC/USD slipped to an intraday low of $19.26 on Monday, a day after trading at a peak of $20.05.

The move has pushed ethereum classic towards Friday’s bottom at $18.89, which was its weakest point since January 6.

Overall, today’s drop has seen ETC fall for a fifth consecutive session, down by over 8% in that period.

Prices are marginally higher than earlier lows, which comes as the 14-day relative strength index (RSI) collided with a floor at 36.00

At the time of writing, the index is tracking at 36.19, with the next visible floor at the 30.00 mark, in the event of a breakout.

In addition to ethereum classic, litecoin (LTC) was another notable mover, as the token fell by as much as 4%.

Following a high of $91.27 on Sunday, LTC/USD dropped to a bottom at $87.15 during Monday’s session.

As a result of this move, litecoin moved closer to a floor at $86.00, which was last hit on Friday, and also a six-week low.

Recent declines in LTC have come following a downward crossover of the 10-day (red), and 25-day (blue) moving averages.

In addition to this, the RSI is now tracking at 40.47, which is marginally above support at 40.00.

Despite hovering beyond this floor, the index is at its weakest point since December 24 last year.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect litecoin to rebound in the coming days? Let us know your thoughts in the comments.

Eliman was previously a director of a London-based brokerage, whilst also an online trading educator. Currently, he commentates on various asset classes, including Crypto, Stocks and FX, whilst also a startup founder.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Bitcoin ATM Operator Indicted in New York Allegedly Running Illegal Business Attracting Criminals

A bitcoin ATM operator has been indicted in New York for running an illegal business "marketed towards individuals engaged in criminal activity." The district attorney in charge described: "Robert Taylor allegedly went to great lengths to keep his bitcoin kiosk ... read more.

Ethereum classic remained near a two-month low on March 6, as a cloud of uncertainty continued to hover over markets. The global crypto market cap remained bearish to start the week, and is down 0.55% at the time of writing. Litecoin also moved lower on Monday.

Ethereum classic (ETC) started the week trading close to a two-month low, as volatility in crypto markets remained high.

ETC/USD slipped to an intraday low of $19.26 on Monday, a day after trading at a peak of $20.05.

The move has pushed ethereum classic towards Friday’s bottom at $18.89, which was its weakest point since January 6.

Overall, today’s drop has seen ETC fall for a fifth consecutive session, down by over 8% in that period.

Prices are marginally higher than earlier lows, which comes as the 14-day relative strength index (RSI) collided with a floor at 36.00

At the time of writing, the index is tracking at 36.19, with the next visible floor at the 30.00 mark, in the event of a breakout.

In addition to ethereum classic, litecoin (LTC) was another notable mover, as the token fell by as much as 4%.

Following a high of $91.27 on Sunday, LTC/USD dropped to a bottom at $87.15 during Monday’s session.

As a result of this move, litecoin moved closer to a floor at $86.00, which was last hit on Friday, and also a six-week low.

Recent declines in LTC have come following a downward crossover of the 10-day (red), and 25-day (blue) moving averages.

In addition to this, the RSI is now tracking at 40.47, which is marginally above support at 40.00.

Despite hovering beyond this floor, the index is at its weakest point since December 24 last year.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect litecoin to rebound in the coming days? Let us know your thoughts in the comments.

Eliman was previously a director of a London-based brokerage, whilst also an online trading educator. Currently, he commentates on various asset classes, including Crypto, Stocks and FX, whilst also a startup founder.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Bitcoin ATM Operator Indicted in New York Allegedly Running Illegal Business Attracting Criminals

A bitcoin ATM operator has been indicted in New York for running an illegal business "marketed towards individuals engaged in criminal activity." The district attorney in charge described: "Robert Taylor allegedly went to great lengths to keep his bitcoin kiosk ... read more.

PRESS RELEASE. London – Alvey Chain, a decentralized Layer 2 Blockchain built on Ethereum Chain, also a leading provider of blockchain technology solutions, is proud to announce the launch of its next-generation Virtual Reality Multiverse Exchange. The new platform offers a secure, reliable, and scalable solution for users. They can trade, open as many as 50 charts, use various indicators, manage their wallets all while having an immersive experience.

The Alvey Chain platform is built on a highly scalable architecture that can handle thousands of transactions per second, making it ideal for businesses of all sizes. The platform features a powerful consensus mechanism that ensures the integrity and security of transactions, as well as advanced smart contract functionality that enables businesses to automate complex processes and reduce costs.

https://youtu.be/ES55FXhoY5A

VR Exchange trailer

“We are thrilled to introduce our next-generation Virtual Reality Multiverse Exchange to the market,” said Naur, core member of Alvey Chain. “We believe that this technology has the potential to revolutionize the way businesses operate, and our platform offers a secure and scalable solution that can help users and businesses of all sizes harness this transformative technology.

In addition to its powerful platform, Alvey Chain offers a range of consulting and implementation services to help businesses integrate blockchain technology into their operations. The company’s team of experts has extensive experience working with businesses across a variety of industries, and can provide customized solutions to meet the unique needs of each client.

“We understand that implementing blockchain technology can be a complex process, which is why we offer a range of consulting and implementation services to help businesses navigate the process,” said Naur. “Our team of experts can provide guidance on everything from platform selection to smart contract development, ensuring that our clients get the most out of their blockchain investments.”

Alvey Chain’s new platform is available now, and the company is currently accepting inquiries from businesses interested in learning more about its blockchain solutions.

About Alvey Chain:

Alvey Chain has a metaverse called ‘Elve’s Forest’.The Elves Forest is an immersive Metaverse experience with a massive magical environment to get lost in and with many great castles to explore. They aspire to bring their value to the realm of possibility. Alvey Chain is also releasing products on a weekly basis. They have already released their own DEX, where people can trade projects built on their chain. They even launched an entertaining new game called “Alvey Casino” in collaboration with partners from Contract Checker.

Contact:

Naur

Core Team, Alvey Chain

Website: https://www.alveychain.com/

Twitter: https://twitter.com/AlveyChain

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Source From : News