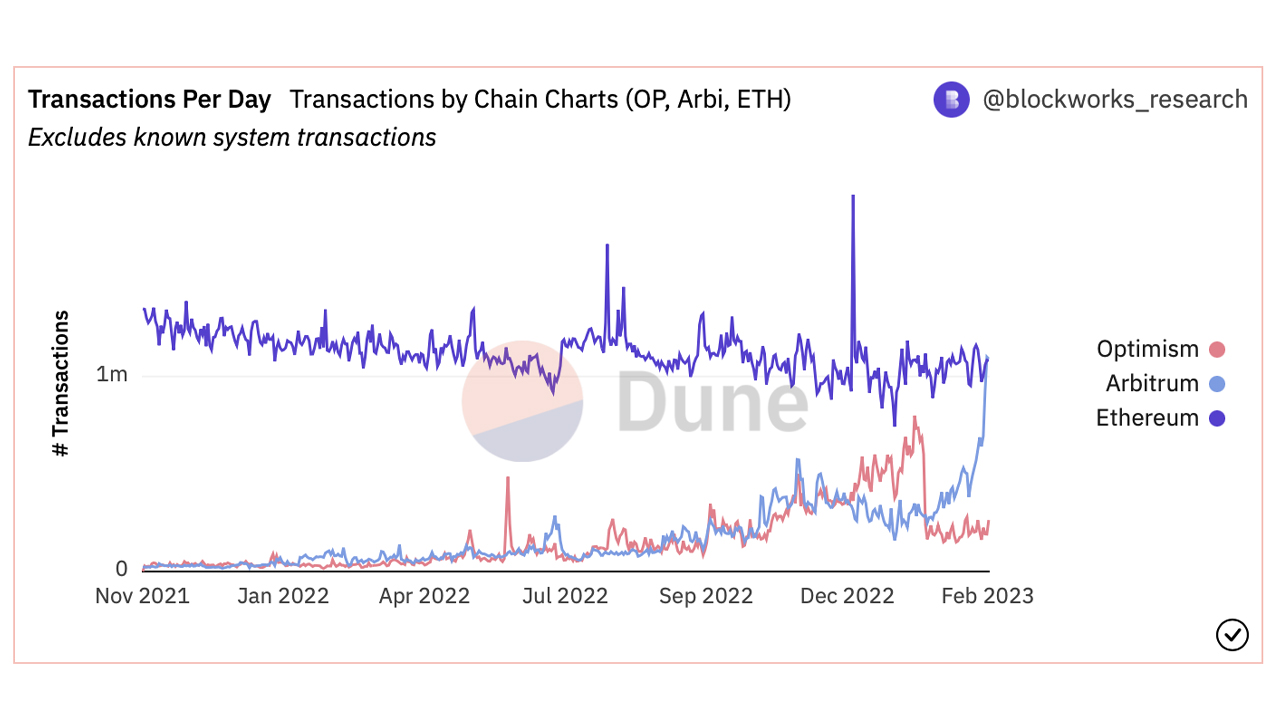

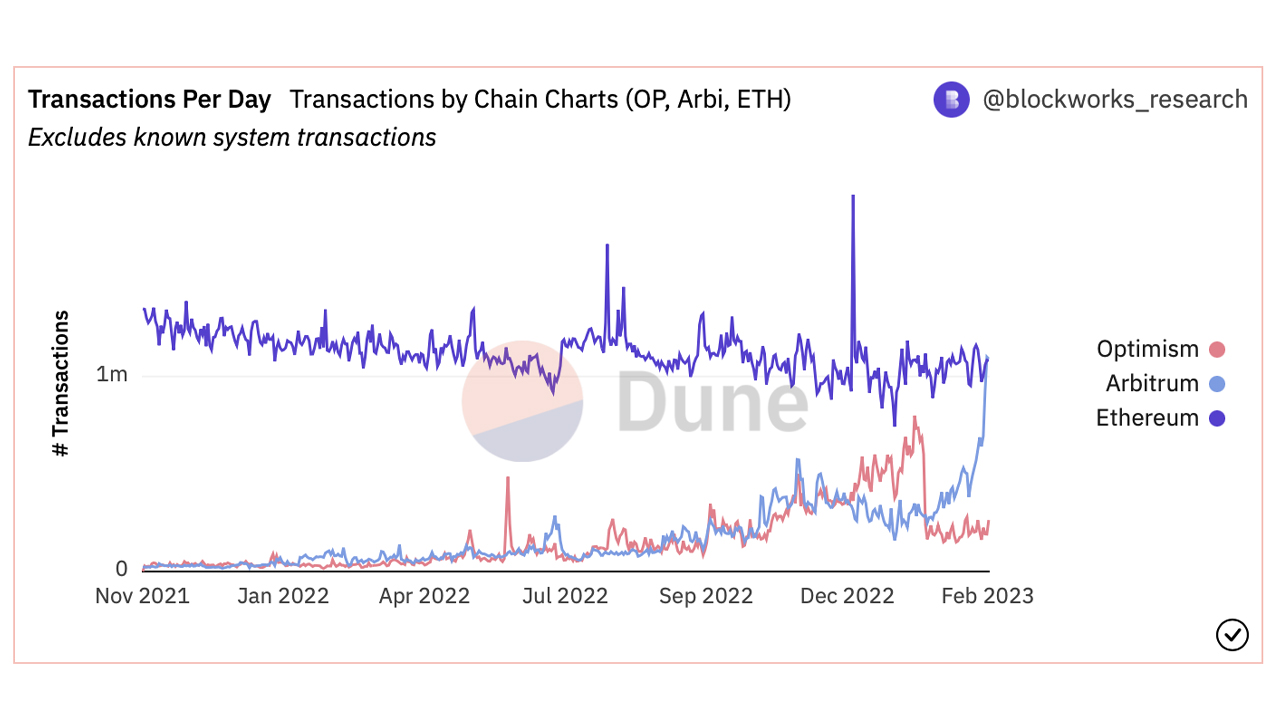

According to statistics recorded this week on Tuesday and Wednesday, the layer two scaling project Arbitrum’s transaction count has surpassed Ethereum’s. On Wednesday, Arbitrum processed 1,090,510 transactions, compared to Ethereum’s 1,080,839 transfer count.

Layer two (L2) scaling networks have become popular over the last two years as secondary chains allow users to transact faster and pay fewer fees. Thirty-nine days ago, in mid-January 2023, the combined daily transaction count from L2 networks Optimism and Arbitrum surpassed Ethereum’s daily transaction count. However, the transaction count subsided and ETH’s transfer count exceeded both networks’ counts until Feb. 21, 2023.

Statistics show that Arbitrum’s daily transaction count has surged this week and surpassed Ethereum’s for the first time ever on Tuesday. On Feb. 21, 2023, Arbitrum processed 1.1 million transactions, compared to Ethereum’s 1.08 million. The next day, on Wednesday, Arbitrum beat Ethereum again by processing 1.09 million, while Ethereum processed 1.08 million.

Abitrum tweeted about the watershed moment on social media. “For the first time ever, Arbitrum One processed more transactions than Ethereum,” the official Abitrum Twitter account said. This is a huge milestone achieved by our team and Arbinauts. We’ve come a long way as a community and we’re grateful to have you along with us. Our mission to scale Ethereum continues.”

The increase in Arbitrum transactions comes at a time when Ethereum network transactions have risen significantly. Statistics show that on Thursday, the average fee to transact on Ethereum’s blockchain is 0.0041 ETH, or $6.87 per transaction, while the median fee is 0.0017 ETH, or $2.84 per transfer. On the same day, the average fee to transact on Arbitrum is $0.307 per transfer, while Optimism costs $0.3601 per transaction.

What do you think about Arbitrum’s daily transfer count rising above Ethereum’s? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

According to statistics recorded this week on Tuesday and Wednesday, the layer two scaling project Arbitrum’s transaction count has surpassed Ethereum’s. On Wednesday, Arbitrum processed 1,090,510 transactions, compared to Ethereum’s 1,080,839 transfer count.

Layer two (L2) scaling networks have become popular over the last two years as secondary chains allow users to transact faster and pay fewer fees. Thirty-nine days ago, in mid-January 2023, the combined daily transaction count from L2 networks Optimism and Arbitrum surpassed Ethereum’s daily transaction count. However, the transaction count subsided and ETH’s transfer count exceeded both networks’ counts until Feb. 21, 2023.

Statistics show that Arbitrum’s daily transaction count has surged this week and surpassed Ethereum’s for the first time ever on Tuesday. On Feb. 21, 2023, Arbitrum processed 1.1 million transactions, compared to Ethereum’s 1.08 million. The next day, on Wednesday, Arbitrum beat Ethereum again by processing 1.09 million, while Ethereum processed 1.08 million.

Abitrum tweeted about the watershed moment on social media. “For the first time ever, Arbitrum One processed more transactions than Ethereum,” the official Abitrum Twitter account said. This is a huge milestone achieved by our team and Arbinauts. We’ve come a long way as a community and we’re grateful to have you along with us. Our mission to scale Ethereum continues.”

The increase in Arbitrum transactions comes at a time when Ethereum network transactions have risen significantly. Statistics show that on Thursday, the average fee to transact on Ethereum’s blockchain is 0.0041 ETH, or $6.87 per transaction, while the median fee is 0.0017 ETH, or $2.84 per transfer. On the same day, the average fee to transact on Arbitrum is $0.307 per transfer, while Optimism costs $0.3601 per transaction.

What do you think about Arbitrum’s daily transfer count rising above Ethereum’s? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Sam Bankman-Fried (SBF), the disgraced co-founder of FTX, faces four more charges after a new indictment was unsealed on Wednesday. The charges include operating an unlicensed money transfer business and conspiring to commit bank fraud.

The former CEO of FTX was originally indicted 72 days ago by a federal grand jury in Manhattan, and prosecutors charged the crypto exchange co-founder with eight different offenses. The charges include conspiracy to commit wire fraud, wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, and conspiracy to commit money laundering.

A new indictment was unsealed by the court on February 22, 2023, adding four new charges to SBF’s case. The charges include operating an unlicensed money transmitter and conspiracy to commit bank fraud. “Exploiting the trust that FTX customers placed in him and his exchange, Bankman-Fried stole FTX customer deposits and used billions of dollars in stolen funds for a variety of purposes,” the new indictment reads.

The newly revised indictment did not name any other defendants, and it alleges that SBF “corrupted the operations of the cryptocurrency companies he founded and controlled—including FTX.com and Alameda Research.” The revised indictment further adds that SBF “perpetrated this multibillion-dollar fraud through a series of systems and schemes that allowed him, through Alameda, to access and steal FTX customer deposits without detection.”

In addition to operating an unlicensed money transfer business and bank fraud, SBF is accused of defrauding customers in connection with the purchase and sale of derivatives. Furthermore, SBF faces a charge of making unlawful political contributions and defrauding the Federal Election Commission.

What impact do you think these new charges will have on SBF’s case? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

Source From : News