Cardano climbed for a second consecutive session on Dec. 23, as the token surged to its highest point since Monday. Overall, crypto prices were marginally higher as of writing, with the global market cap currently up 0.49%. Xrp, formerly known as ripple, also rose, with prices nearing a key resistance level.

Cardano (ADA) was in the green on Friday, as prices surged for a second straight session.

ADA/USD raced to a high of $0.2623 in today’s session, which comes less than a day after the token was trading at $0.2482.

The move saw the token climb towards a resistance level of $0.2685, and it is currently trading at its highest point since Monday.

As can be seen from the chart, Friday’s gains come as the 14-day relative strength index (RSI) has moved closer to a ceiling of its own at 32.00.

The index is currently tracking at 30.18, with the price slipping from earlier highs, and trading at $0.2586 as of writing.

In order for bulls to hit the ceiling at the $0.2685 mark, this upcoming ceiling of 32.00 on the RSI must first be broken.

XRP, formerly ripple, also rose on Friday, as the token extended a recent bull run, in hopes of breaking out of a key resistance point.

Following a low of $0.3424, XRP/USD raced to an intraday peak of $0.3531 earlier in today’s session.

Today’s high is the strongest point that the token has traded at since Sunday, when it was at a top of $0.3555.

Despite this recent climb in price, sentiment in XRP still appears to be bearish, with the 10-day (red) moving average (MA) extending its downwards cross with the 25-day (blue) MA.

In addition to this, the 14-day RSI is currently tracking at 39.65, which is close to a ceiling of 41.00.

If bulls are unable to force a breakout of this level, we will likely see XRP once again move lower.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect xrp to break its current resistance of $0.3565 this weekend? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Cardano climbed for a second consecutive session on Dec. 23, as the token surged to its highest point since Monday. Overall, crypto prices were marginally higher as of writing, with the global market cap currently up 0.49%. Xrp, formerly known as ripple, also rose, with prices nearing a key resistance level.

Cardano (ADA) was in the green on Friday, as prices surged for a second straight session.

ADA/USD raced to a high of $0.2623 in today’s session, which comes less than a day after the token was trading at $0.2482.

The move saw the token climb towards a resistance level of $0.2685, and it is currently trading at its highest point since Monday.

As can be seen from the chart, Friday’s gains come as the 14-day relative strength index (RSI) has moved closer to a ceiling of its own at 32.00.

The index is currently tracking at 30.18, with the price slipping from earlier highs, and trading at $0.2586 as of writing.

In order for bulls to hit the ceiling at the $0.2685 mark, this upcoming ceiling of 32.00 on the RSI must first be broken.

XRP, formerly ripple, also rose on Friday, as the token extended a recent bull run, in hopes of breaking out of a key resistance point.

Following a low of $0.3424, XRP/USD raced to an intraday peak of $0.3531 earlier in today’s session.

Today’s high is the strongest point that the token has traded at since Sunday, when it was at a top of $0.3555.

Despite this recent climb in price, sentiment in XRP still appears to be bearish, with the 10-day (red) moving average (MA) extending its downwards cross with the 25-day (blue) MA.

In addition to this, the 14-day RSI is currently tracking at 39.65, which is close to a ceiling of 41.00.

If bulls are unable to force a breakout of this level, we will likely see XRP once again move lower.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you expect xrp to break its current resistance of $0.3565 this weekend? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis, he was previously a brokerage director and retail trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Draft Law Regulating Aspects of Crypto Taxation Submitted to Russian Parliament

A bill updating Russia’s tax law to incorporate provisions pertaining to cryptocurrencies has been filed with the State Duma, the lower house of parliament. The legislation is tailored to regulate the taxation of sales and profits in the country’s market ... read more.

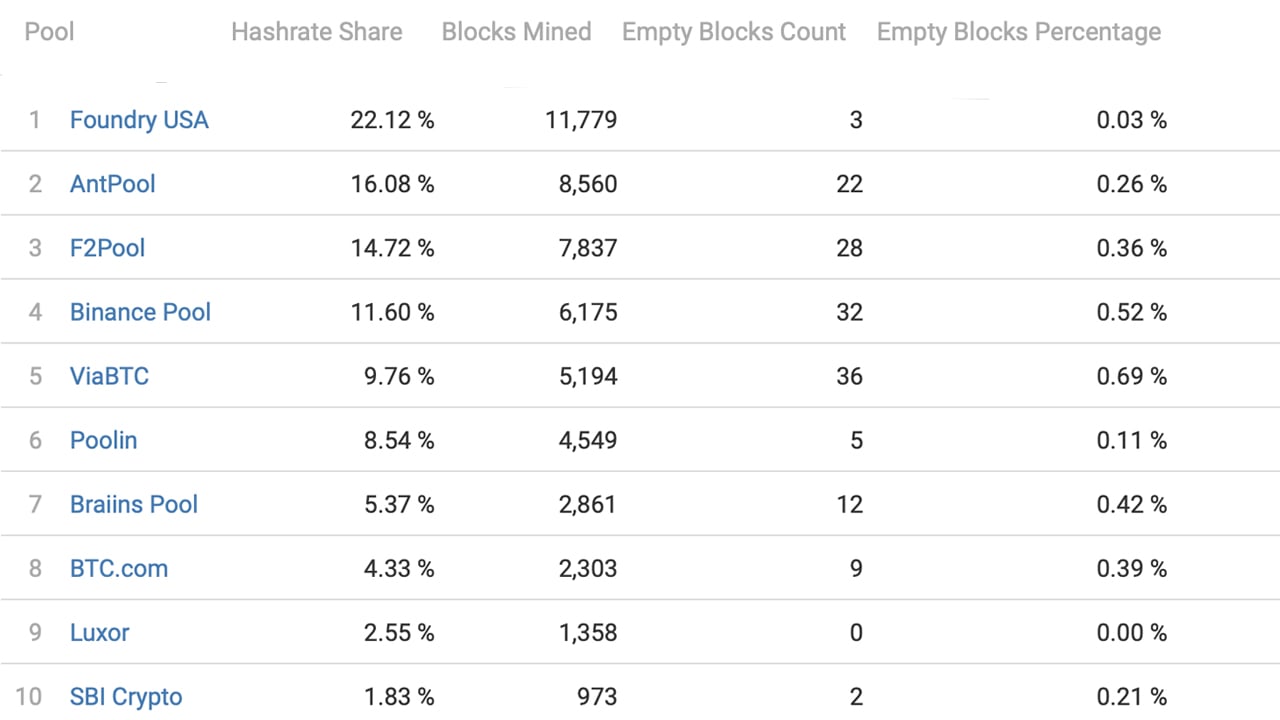

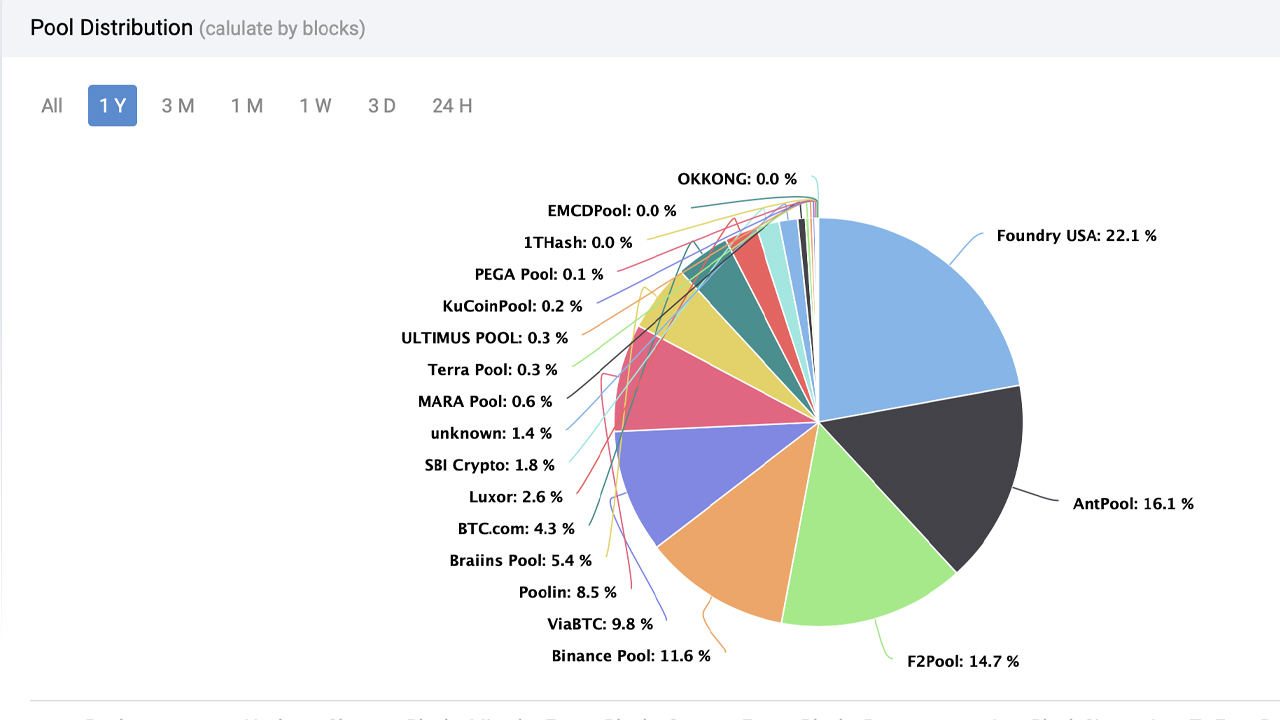

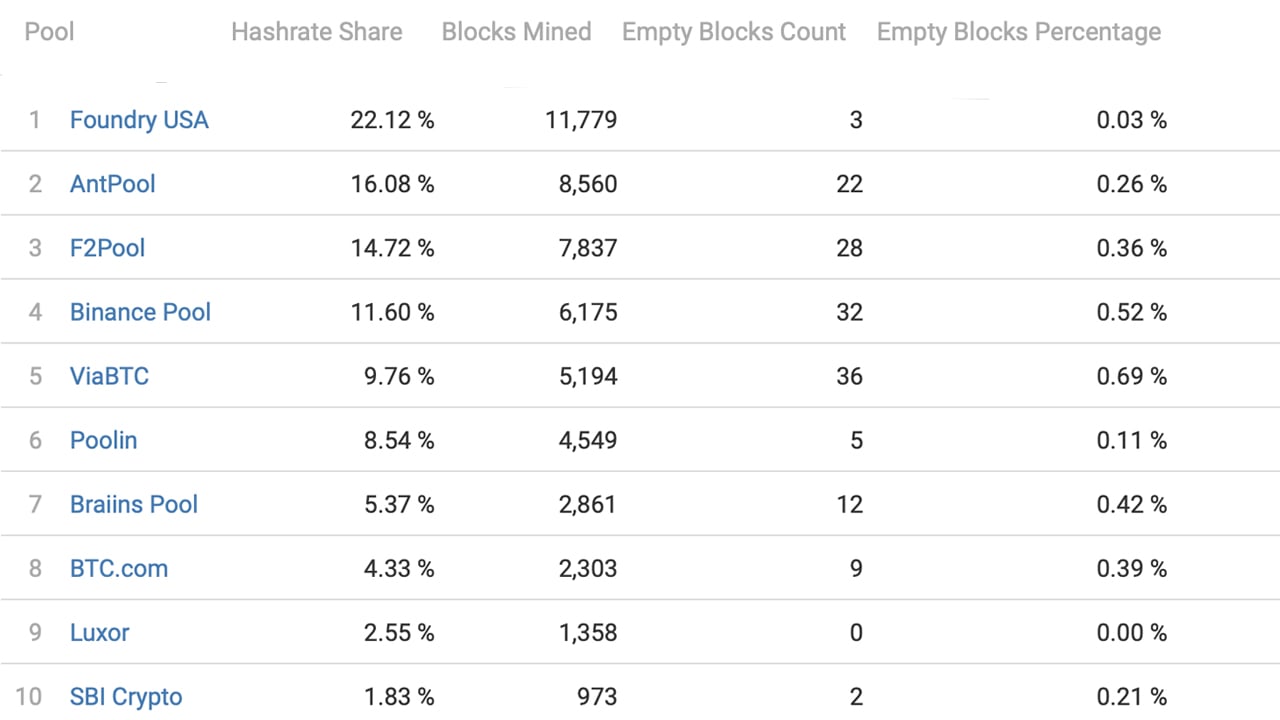

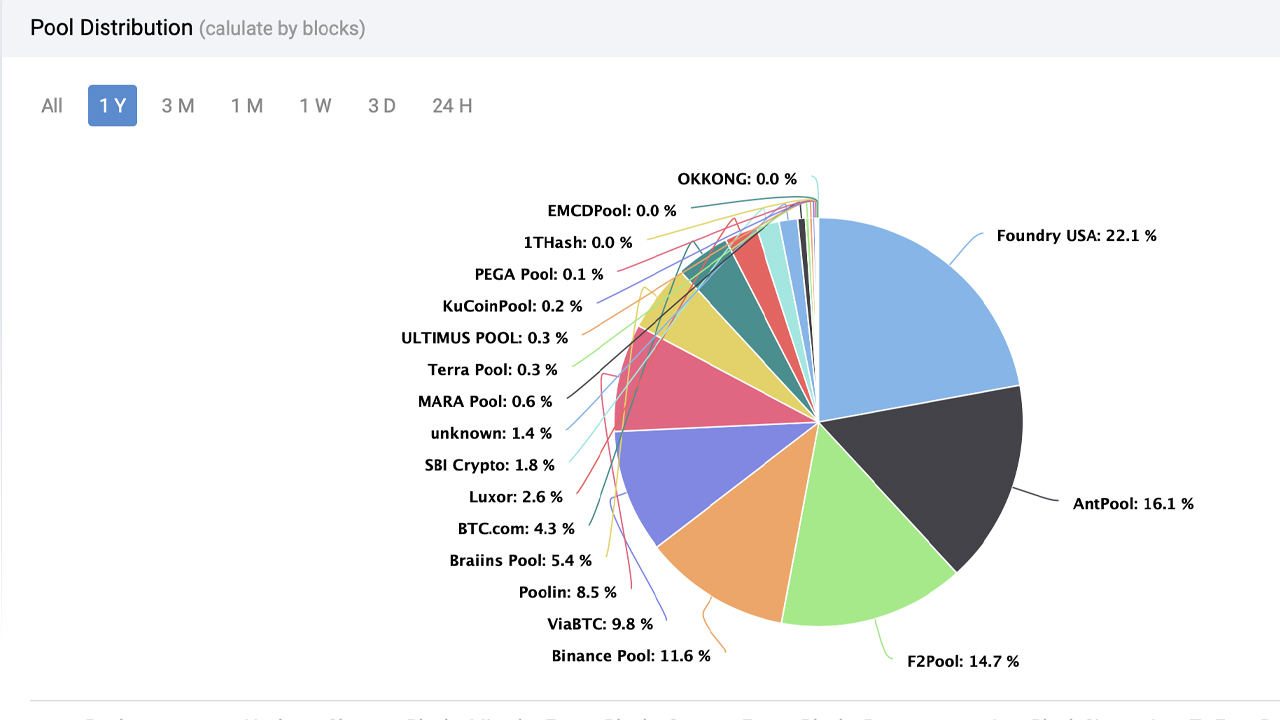

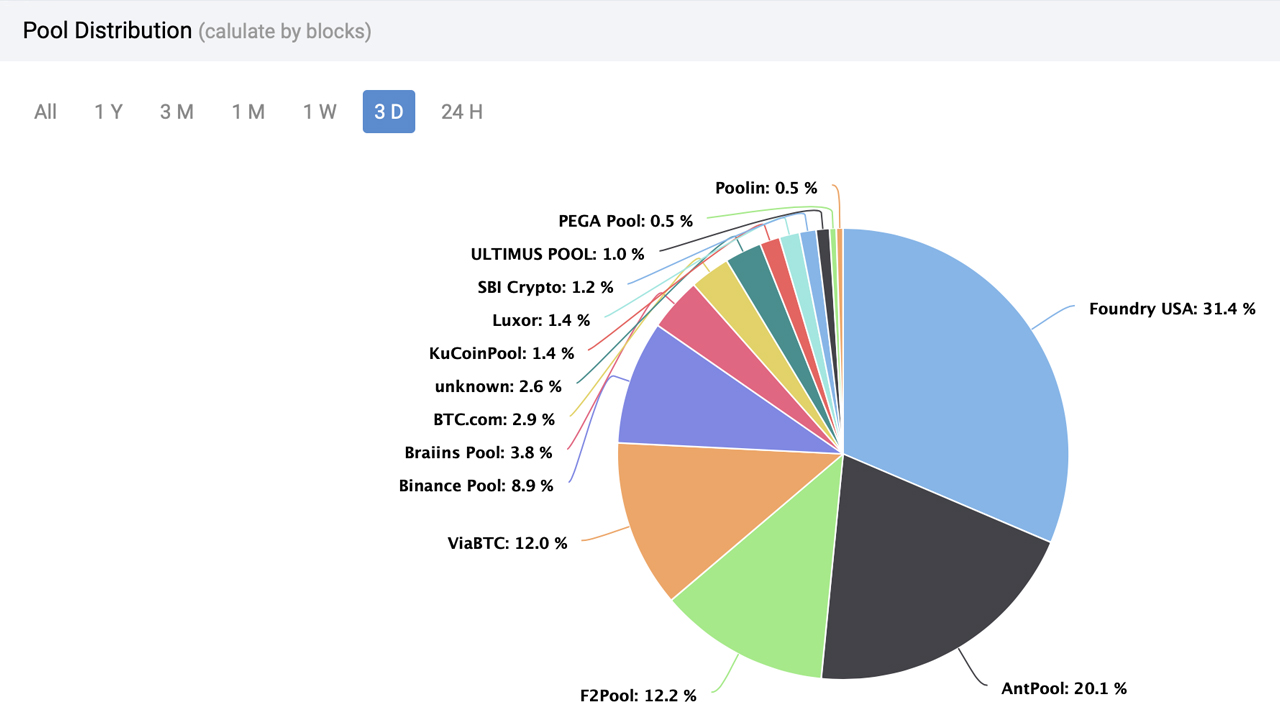

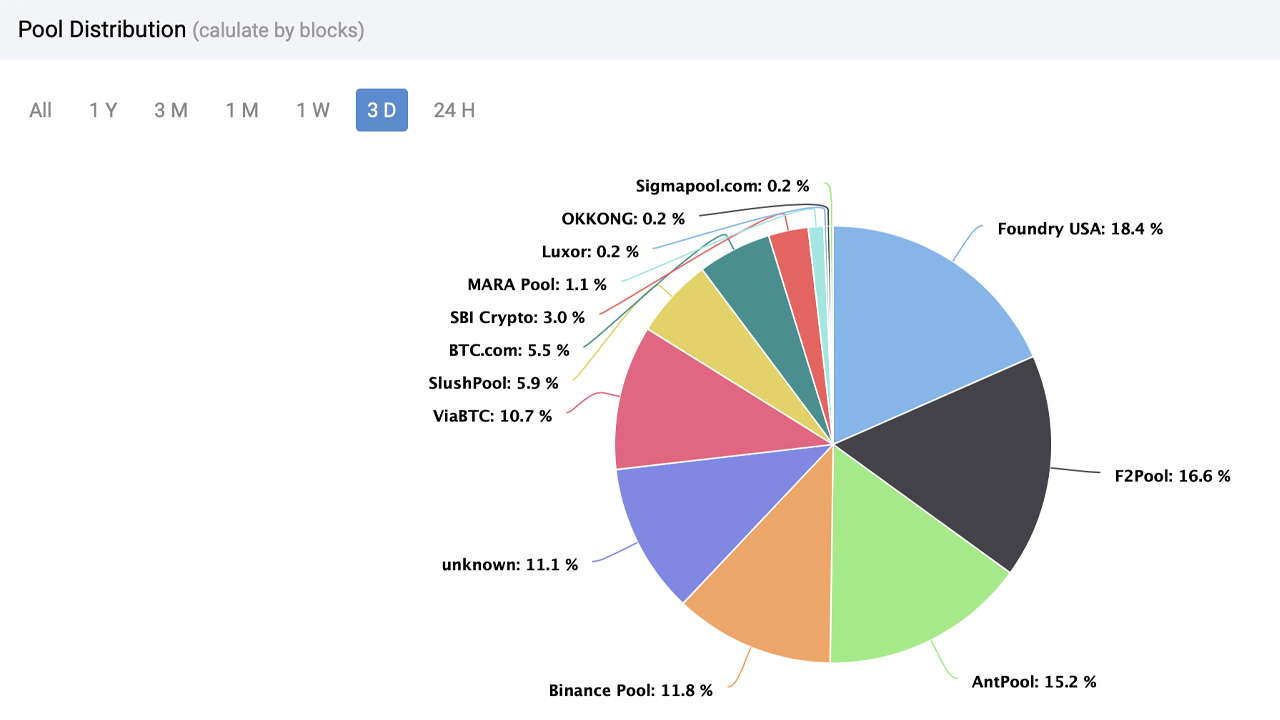

As the new year approaches, more than a dozen bitcoin mining pools still dedicate a total of 238 exahash per second (EH/s) toward the Bitcoin blockchain in order to secure the network and reap mining rewards. Statistics indicate that the mining pool Foundry USA discovered the most block rewards this year, as the operation found 11,779 bitcoin blocks out of the 53,240 rewards mined during the last 365 days.

On Thursday, Dec. 22, 2022, metrics show that 53,240 blocks were mined this year and a total of 23 known mining pools discovered the block subsidies. Presently, bitcoin’s price and high mining difficulty rating are making it awfully hard for miners to profit at the end of the year.

Data indicates that the average BTC mining cost according to metrics from macromicro.me is around $18,816 per unit, while BTC’s average spot market value in U.S. dollars is $16,800 per unit. The discrepancies between the cost of BTC production and BTC’s spot market value have been a tough reality for miners since mid-June 2022.

Prior to mid-June 2022, BTC’s spot market value was well above the average cost of production since mid-Nov. 2020. 12-month metrics show that in 2022, Foundry USA obtained the most blocks with 11,779 recorded.

Three of those blocks were empty blocks, and Foundry’s block discovery indicates that it represented 22.12% of the network’s hashrate this year. 2022 was a good year for Antpool in terms of finding BTC blocks over the last 12 months.

Antpool found 8,560 block rewards during the past 365 days and 22 of them were empty blocks. Antpool’s 12-month metrics show the pool’s hashrate this year represented 16.08% of the total network.

F2pool managed to hold down the third largest mining pool position in 2022 with 14.72% of the year’s total hashrate. F2pool gained a total of 7,837 out of the 53,240 blocks found and 28 were empty blocks.

Binance Pool found 6,175 BTC blocks in 2022 which equates to 11.60% of the year’s total hashrate. Viabtc clocked in at 9.76% of the hashrate as the pool attained 5,194 of this year’s blocks.

Calculations show that the top five mining pools mined a total of 39,545 of this year’s 53,240 blocks discovered, or 74.28% of the total hashrate. Other notable bitcoin mining pools in the top ten standings in 2022 include Poolin, Braiins Pool, Btc.com, Luxor, and SBI Crypto, respectively.

Those five pools accounted for 22.62% of the total hashrate over the last 365 days. Unknown hashrate, otherwise known as stealth miners, accounted for 1.45% of the hashrate during the last 12 months, discovering approximately 771 bitcoin block rewards.

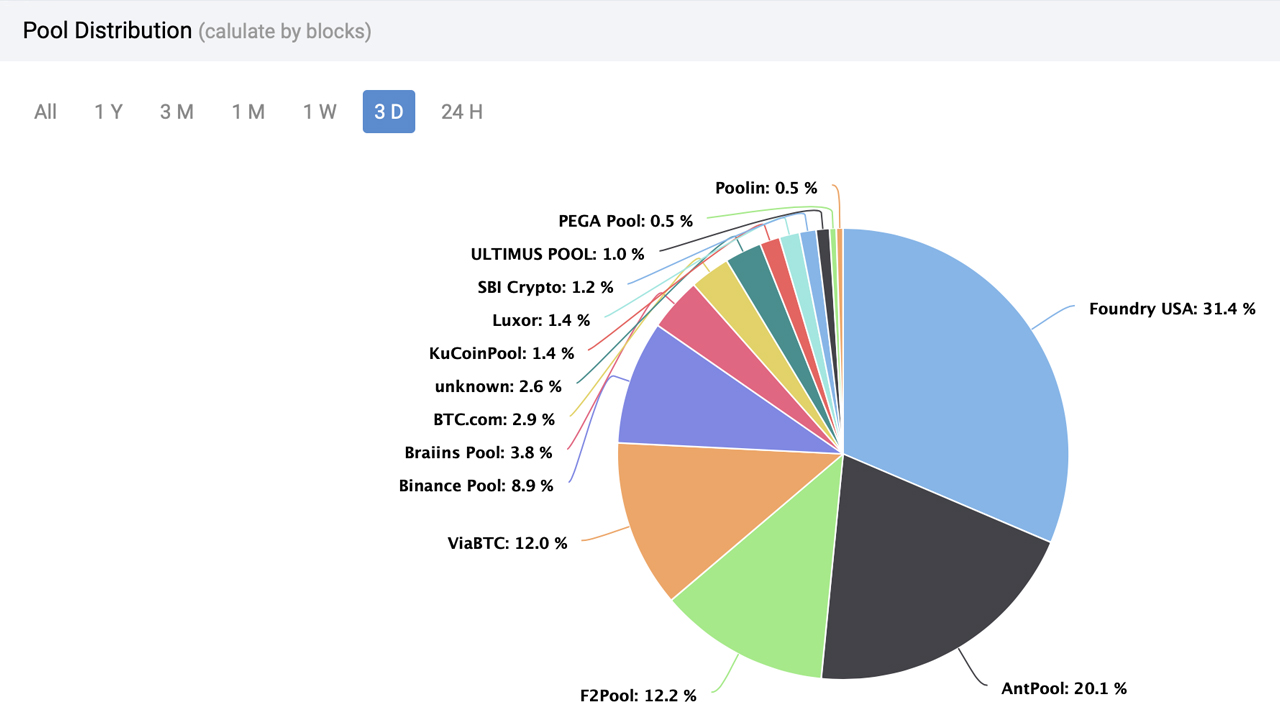

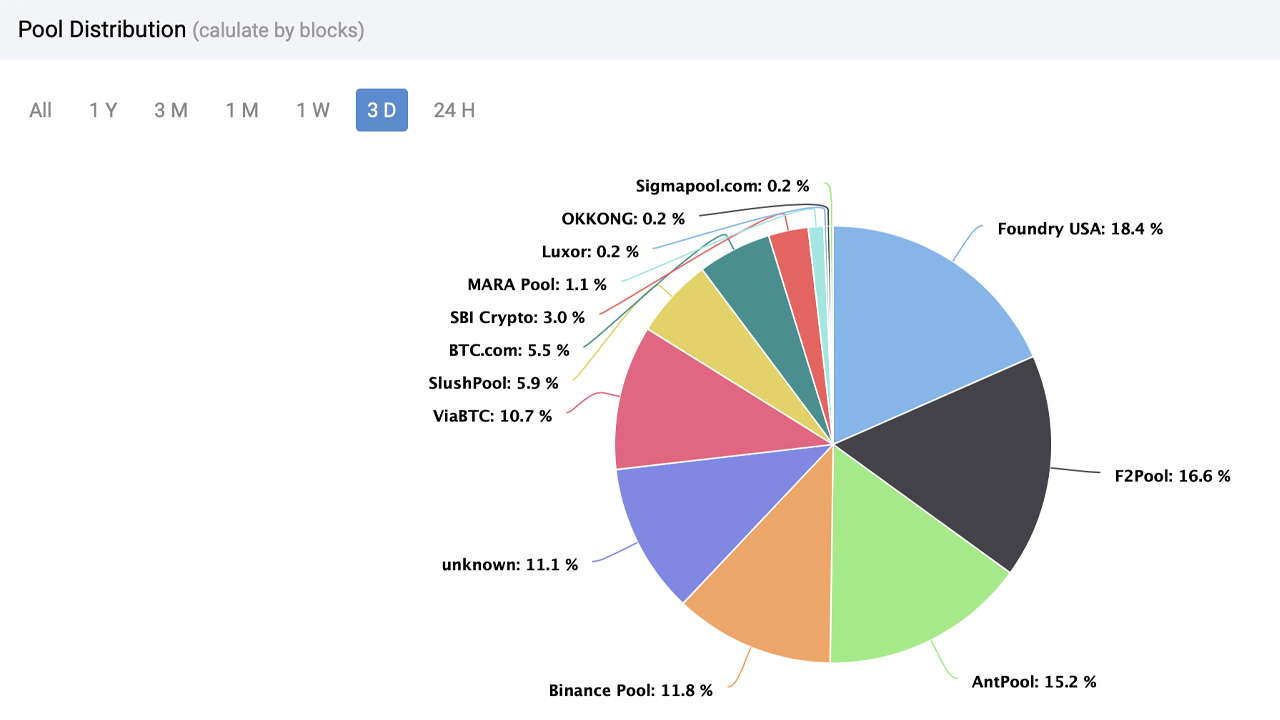

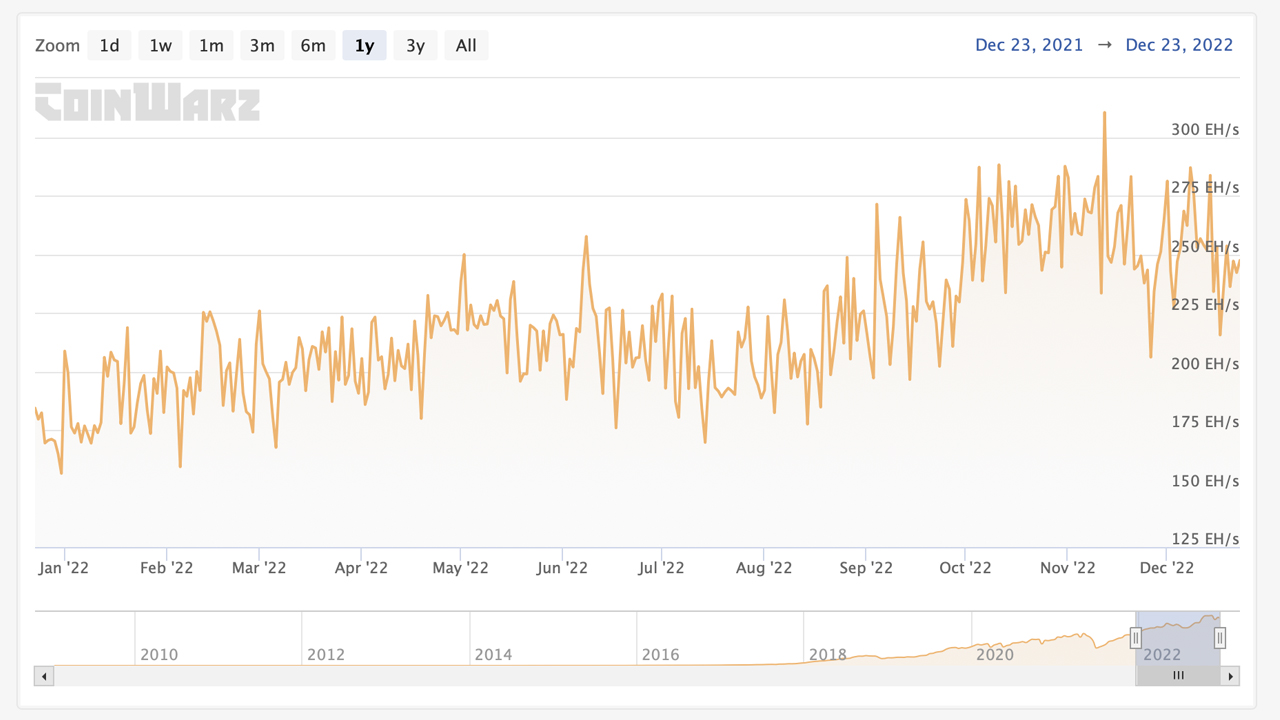

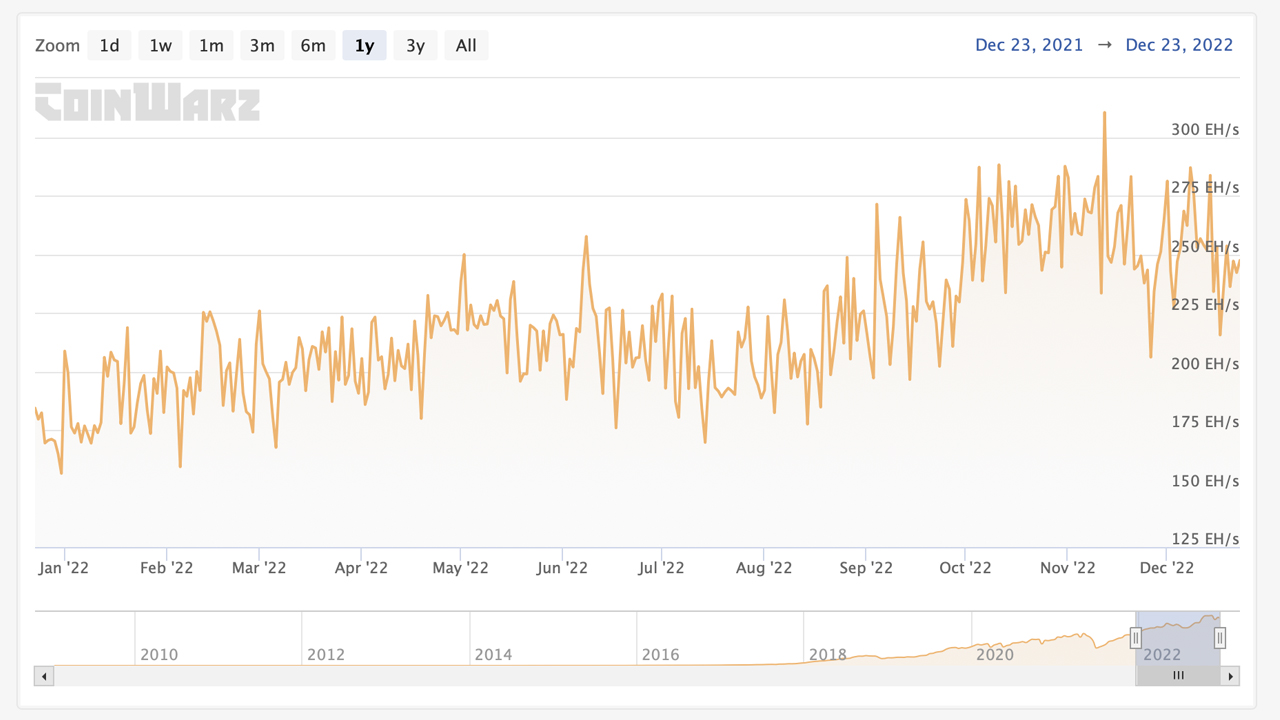

On Dec. 23, 2021, Bitcoin’s total hashrate was around 184 EH/s or 184,000 petahash per second (PH/s). Roughly around that time, within a three-day radius, Foundry had around 30.93 EH/s and today the pool has around 75 EH/s.

F2pool had around 27.88 EH/s and now has around 29.20 EH/s, while Antpool had 25.59 EH/s compared to today’s 48.09 EH/s. Besides the increase of around 29.35% from a year ago today in overall hashrate from 184 EH/s to 238 EH/s, the Bitcoin network also tapped a lifetime high in terms of total hashrate.

Statistics show that on Nov. 12, 2022, at block height 762,845, the total hashrate tapped a high of around 347.16 EH/s. The 347.16 EH/s lifetime record equates to 0.347 zettahash per second (ZH/s).

It also became a lot more difficult to find a bitcoin block this year, as the mining difficulty jumped from 24.37 trillion to today’s 35.36 trillion. The mining difficulty rating also tapped an all-time high this year at 36.84 trillion after block height 760,032 and the two weeks that followed.

The network recorded these feats despite the lower prices during the last 12 months compared to last year’s bitcoin bull run. 2022 saw a number of newly introduced bitcoin mining rigs that packed a whole lot more hashpower per watt.

Bitmain released the Antminer S19 XP Hyd., which boasts around 255 terahash per second (TH/s). The company also released the Antminer S19 XP with 140 TH/s. Canaan released the Avalon A1366 bitcoin mining device, which produces around 130 TH/s. There’s also the Microbt Whatsminer M50S bitcoin mining rig that produces around 126 TH/s.

What do you think about the last 12 months of bitcoin mining? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, editorial photo credit: Btc.com, coinwarz.com, macromicro.me,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

As the new year approaches, more than a dozen bitcoin mining pools still dedicate a total of 238 exahash per second (EH/s) toward the Bitcoin blockchain in order to secure the network and reap mining rewards. Statistics indicate that the mining pool Foundry USA discovered the most block rewards this year, as the operation found 11,779 bitcoin blocks out of the 53,240 rewards mined during the last 365 days.

On Thursday, Dec. 22, 2022, metrics show that 53,240 blocks were mined this year and a total of 23 known mining pools discovered the block subsidies. Presently, bitcoin’s price and high mining difficulty rating are making it awfully hard for miners to profit at the end of the year.

Data indicates that the average BTC mining cost according to metrics from macromicro.me is around $18,816 per unit, while BTC’s average spot market value in U.S. dollars is $16,800 per unit. The discrepancies between the cost of BTC production and BTC’s spot market value have been a tough reality for miners since mid-June 2022.

Prior to mid-June 2022, BTC’s spot market value was well above the average cost of production since mid-Nov. 2020. 12-month metrics show that in 2022, Foundry USA obtained the most blocks with 11,779 recorded.

Three of those blocks were empty blocks, and Foundry’s block discovery indicates that it represented 22.12% of the network’s hashrate this year. 2022 was a good year for Antpool in terms of finding BTC blocks over the last 12 months.

Antpool found 8,560 block rewards during the past 365 days and 22 of them were empty blocks. Antpool’s 12-month metrics show the pool’s hashrate this year represented 16.08% of the total network.

F2pool managed to hold down the third largest mining pool position in 2022 with 14.72% of the year’s total hashrate. F2pool gained a total of 7,837 out of the 53,240 blocks found and 28 were empty blocks.

Binance Pool found 6,175 BTC blocks in 2022 which equates to 11.60% of the year’s total hashrate. Viabtc clocked in at 9.76% of the hashrate as the pool attained 5,194 of this year’s blocks.

Calculations show that the top five mining pools mined a total of 39,545 of this year’s 53,240 blocks discovered, or 74.28% of the total hashrate. Other notable bitcoin mining pools in the top ten standings in 2022 include Poolin, Braiins Pool, Btc.com, Luxor, and SBI Crypto, respectively.

Those five pools accounted for 22.62% of the total hashrate over the last 365 days. Unknown hashrate, otherwise known as stealth miners, accounted for 1.45% of the hashrate during the last 12 months, discovering approximately 771 bitcoin block rewards.

On Dec. 23, 2021, Bitcoin’s total hashrate was around 184 EH/s or 184,000 petahash per second (PH/s). Roughly around that time, within a three-day radius, Foundry had around 30.93 EH/s and today the pool has around 75 EH/s.

F2pool had around 27.88 EH/s and now has around 29.20 EH/s, while Antpool had 25.59 EH/s compared to today’s 48.09 EH/s. Besides the increase of around 29.35% from a year ago today in overall hashrate from 184 EH/s to 238 EH/s, the Bitcoin network also tapped a lifetime high in terms of total hashrate.

Statistics show that on Nov. 12, 2022, at block height 762,845, the total hashrate tapped a high of around 347.16 EH/s. The 347.16 EH/s lifetime record equates to 0.347 zettahash per second (ZH/s).

It also became a lot more difficult to find a bitcoin block this year, as the mining difficulty jumped from 24.37 trillion to today’s 35.36 trillion. The mining difficulty rating also tapped an all-time high this year at 36.84 trillion after block height 760,032 and the two weeks that followed.

The network recorded these feats despite the lower prices during the last 12 months compared to last year’s bitcoin bull run. 2022 saw a number of newly introduced bitcoin mining rigs that packed a whole lot more hashpower per watt.

Bitmain released the Antminer S19 XP Hyd., which boasts around 255 terahash per second (TH/s). The company also released the Antminer S19 XP with 140 TH/s. Canaan released the Avalon A1366 bitcoin mining device, which produces around 130 TH/s. There’s also the Microbt Whatsminer M50S bitcoin mining rig that produces around 126 TH/s.

What do you think about the last 12 months of bitcoin mining? Let us know what you think about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, editorial photo credit: Btc.com, coinwarz.com, macromicro.me,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Central Bank of Brazil Confirms It Will Run a Pilot Test for Its CBDC This Year

The Central Bank of Brazil has confirmed that the institution will run a pilot test regarding the implementation of its proposed central bank digital currency (CBDC), the digital real. Roberto Campos Neto, president of the bank, also stated that this ... read more.

PRESS RELEASE. Victoria, Seychelles (December 23 2022) – Leading crypto exchange, Bitget, announces the conclusion of its biannual trading tournament, King’s Cup Global Invitation (“KCGI”): Football Edition with record-breaking participation. Hosted from November 21 to December 19, a total of 32,174 participants joined the tournament in a team battle, individual competition and invitational competition. The tournament recorded the highest participation this time since the event debuted, and all the winners took home a rewards pool of more than half a million USDT combined.

The KCGI tournament is a biannual futures trading tournament hosted by Bitget, and this season’s tournament was given a football theme because of the World Cup and the company’s partnership with the legendary Argentinian football star, Leo Messi. The company prepared various football-related prizes and activities to engage users in the World Cup football craze, including football fan tokens, Messi autographed jerseys, trophies, predicted World Cup winner games and giveaways.

Players were given the option to participate in KCGI in three competition modes. Here are the final results:

Gracy Chen, Managing Director of Bitget, comments, “KCGI is one of our major spotlights throughout the year. This time, the tournament is hosted during the FIFA World Cup Qatar 2022, where Argentina and our partner Leo Messi are crowned winners. Congratulations to all the winners in KCGI, Messi and Argentina team! We are glad to have the opportunity to engage Bitget users with the World Cup and stand with Messi throughout his journey to the Championship.”

“In the midst of a bear market and slow market sentiment, Bitget is also investing efforts into perfecting our product offerings. In line with the sense of community we all felt during the World Cup and KCGI, we have rolled out a few products recently to upgrade users’ social trading experience, including Shark Fin, Spot margin trading, DCA trading strategy, and so on, as well as announced measures to protect our users’ assets with the Bitget Protection Fund and our fully transparent Merkle tree Proof of Reserves information. We do these all to improve our internal strength and security while providing maximum transparency, hoping to rebuild the industry and set a good example.”

About KCGI

The King’s Cup Global Invitation (KCGI) is a biannual global crypto futures trading competition hosted by Bitget. KCGI 2022: Football Edition ran from November 21 to December 19, 2022, and consisted of three competing formats: Team Battle, Individual Competition, and Invitational Competition.

Debuted in 2021, the appeal of KCGI has drawn overwhelming responses as the last three competitions recorded over 44,000 participants worldwide, and stay tuned for the next tournament to be scheduled in mid-2023.

About Bitget

Bitget, established in 2018, is the world’s leading cryptocurrency exchange with innovative products and social trading services as its key features, currently serving over 8 million users in more than 100 countries worldwide.

The exchange is committed to providing users with a secure, one-stop trading solution. It aims to increase crypto adoption through collaborations with credible partners, including legendary Argentinian footballer Leo Messi, the leading Italian football team Juventus, and official eSports events organizer PGL.

To learn more about Bitget, please visit https://www.bitget.com.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Bitcoin.com is the premier source for everything crypto-related. Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)'s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real ... read more.

Source From : News