Interest in the U.S. banking crisis has risen greatly over the past two weeks, as shown by Google Trends data. There has been a sharp increase in queries related to search terms such as “banking crisis,” “bank collapse,” and “bank failure.” On March 13, 2023, the search term “banking crisis” reached the top Google Trends score of 100. The related topics pertain to the financial troubles of Silicon Valley Bank, Signature Bank, and First Republic Bank.

Google Trends data reveals a significant increase in public interest in the U.S. banking crisis, with searches skyrocketing. A search using the term “banking crisis” shows that people are asking Google various related questions, including “What happens to my money if banks collapse?,” “What are the negative effects of a banking crisis?,” and “Which U.S. banks have collapsed?”

The surge in public interest is attributed to the collapse of three banks: Silvergate Bank, Signature Bank, and Silicon Valley Bank. Two out of the three banks are among the second and third largest bank failures in U.S. history, after Washington Mutual (Wamu) collapsed in 2008. People have also expressed concerns about other banks, including Pacwest Bancorp, First Republic Bank, and the Swiss banking giant Credit Suisse.

According to Google Trends, worldwide interest in the topic of “bank failure” reached a score of 100 on March 13. The increase began on March 9, 2023, and currently stands at 34 as of this writing. On March 13, search terms such as “banking crisis,” “bank collapse,” and “U.S. banks” all saw a significant increase in the number of searches. While a significant portion of the interest comes from the United States, there is also strong interest from countries such as Zimbabwe, Canada, China, Egypt, New Zealand, and Singapore.

Google Trends has also recorded other breakout searches, such as “banking crisis 2023,” “silicon valley banking crisis,” and “banking crisis in US.” In the past 14 days, search queries for banks of various sizes have increased, including banking giants, medium-sized financial institutions, and smaller banks. The last time searches for these terms peaked was during the Great Recession in 2008, specifically in the months of June, July, August, September, and October.

Banking-related terms, such as “deposits,” “insured deposits,” “uninsured deposits,” “bank run,” “FDIC,” “bailout,” “bailouts,” “Federal Reserve,” “Fed,” “interest rates,” “interest rate hikes,” and “rate hikes,” have also been trending upward over the last two weeks.

What do you think about Google searches and queries about the U.S. bank crisis increasing over the last month? Share your thoughts about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Google Trends on March 19, 2023,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

Interest in the U.S. banking crisis has risen greatly over the past two weeks, as shown by Google Trends data. There has been a sharp increase in queries related to search terms such as “banking crisis,” “bank collapse,” and “bank failure.” On March 13, 2023, the search term “banking crisis” reached the top Google Trends score of 100. The related topics pertain to the financial troubles of Silicon Valley Bank, Signature Bank, and First Republic Bank.

Google Trends data reveals a significant increase in public interest in the U.S. banking crisis, with searches skyrocketing. A search using the term “banking crisis” shows that people are asking Google various related questions, including “What happens to my money if banks collapse?,” “What are the negative effects of a banking crisis?,” and “Which U.S. banks have collapsed?”

The surge in public interest is attributed to the collapse of three banks: Silvergate Bank, Signature Bank, and Silicon Valley Bank. Two out of the three banks are among the second and third largest bank failures in U.S. history, after Washington Mutual (Wamu) collapsed in 2008. People have also expressed concerns about other banks, including Pacwest Bancorp, First Republic Bank, and the Swiss banking giant Credit Suisse.

According to Google Trends, worldwide interest in the topic of “bank failure” reached a score of 100 on March 13. The increase began on March 9, 2023, and currently stands at 34 as of this writing. On March 13, search terms such as “banking crisis,” “bank collapse,” and “U.S. banks” all saw a significant increase in the number of searches. While a significant portion of the interest comes from the United States, there is also strong interest from countries such as Zimbabwe, Canada, China, Egypt, New Zealand, and Singapore.

Google Trends has also recorded other breakout searches, such as “banking crisis 2023,” “silicon valley banking crisis,” and “banking crisis in US.” In the past 14 days, search queries for banks of various sizes have increased, including banking giants, medium-sized financial institutions, and smaller banks. The last time searches for these terms peaked was during the Great Recession in 2008, specifically in the months of June, July, August, September, and October.

Banking-related terms, such as “deposits,” “insured deposits,” “uninsured deposits,” “bank run,” “FDIC,” “bailout,” “bailouts,” “Federal Reserve,” “Fed,” “interest rates,” “interest rate hikes,” and “rate hikes,” have also been trending upward over the last two weeks.

What do you think about Google searches and queries about the U.S. bank crisis increasing over the last month? Share your thoughts about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Google Trends on March 19, 2023,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Ripple CEO: SEC Lawsuit Over XRP 'Has Gone Exceedingly Well'

The CEO of Ripple Labs says that the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against him and his company over XRP "has gone exceedingly well." He stressed: "This case is important, not just for Ripple, it’s ... read more.

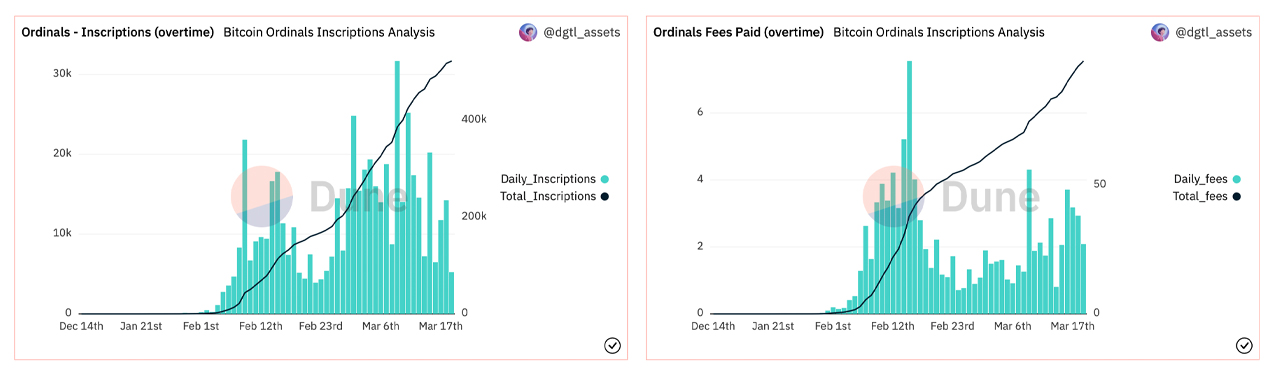

According to statistics, there are now more than 500,000 Ordinal inscriptions on the Bitcoin blockchain as the trend continues to gain significant traction. Onchain data also shows that since inscriptions started gaining popularity last month, Bitcoin miners have obtained 98 bitcoins worth $2.66 million in added fees.

Ordinal inscriptions have surpassed the 500,000 mark, and at the time of writing, there are approximately 522,243 inscriptions on the Bitcoin blockchain. Essentially, the technology behind Ordinal inscriptions allows people to embed all types of arbitrary data into the blockchain. Inscriptions include data such as text, images, audio, video, and applications.

The number of Ordinal inscriptions surpassed the 500,000 range on March 17, 2023, according to data hosted on Dune Analytics. Statistics show that 31.1% of inscriptions are in PNG format, or a total of 162,615 PNG-based inscriptions. Approximately 14% of Ordinal inscriptions are in WEBP format, and roughly 7% are in JPEG format.

A total of 212,827 inscriptions are text-based, accounting for more than 40% of all the Ordinal inscriptions today. Dune Analytics data further shows that at block height 780,895, approximately 1,870 inscriptions were minted in the block with Ordinal inscriptions. The block with the second-largest number of inscriptions is block height 780,037, with approximately 610 Ordinal inscriptions minted in a single block.

Block 780,895, with 1,870 inscriptions, was only 2.83 megabytes (MB) in size, and a total of 3,598 transactions were confirmed in the block mined on March 15. In addition to the number of Ordinal inscriptions rising above the 500K range, a few collections have amassed a great deal of sales. Yuga Labs sold its collection of inscriptions called Twelvefold for $16.6 million.

The project Bitcoin Punks has seen 454.9 BTC, or roughly $11.1 million in sales, and Ordinal Punks have raked in 225.5 BTC, or $5.5 million in sales. An Ordinal inscription collection called Tradfilines has accrued 100.4 BTC, or roughly $2.4 million in sales. The compilation Unordinals has recorded 95.4 BTC or $2.3 million.

Other top-selling inscription collections include Inscribed Pepes, Punks on Bitcoin, Pixel Pepes, Bitcoin Rocks, and the art compilation called Xcpinata. The trend of Ordinal inscriptions on Bitcoin continues, and while there are more than 500,000 inscriptions on the blockchain, there are also 213,583 LTC-based Ordinal inscriptions on the Litecoin network today.

The Litecoin blockchain also has a wide variety of onchain collections like Litecoin Punks, Litecoin Bulls, and Ordinal Doges. Many people have high hopes for the Ordinal inscription trend, especially on the Bitcoin blockchain. Galaxy Digital recently published a report that predicts Bitcoin-based non-fungible token (NFT) assets using Ordinal inscription technology could be a $4.5 billion market by 2025.

What do you think the future holds for Ordinal inscriptions on the Bitcoin blockchain and the NFT market? Share your thoughts in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Fidelity Investments Launches Crypto, Metaverse ETFs — Says 'We Continue to See Demand'

Fidelity Investments, one of the largest financial services firms with more than $11 trillion under administration, is launching exchange-traded funds (ETFs) focusing on the crypto ecosystem and the metaverse. "We continue to see demand, particularly from young investors, for access ... read more.

Source From : News