Shiba inu moved to a five-week high during Tuesday’s session, despite cryptocurrency markets mostly consolidating. As of writing, the global crypto market cap is trading 0.20% lower, however the meme coin is up by nearly 5%. Apecoin also surged in today’s session, as it rose to its strongest point since November.

Shiba inu (SHIB) was one of Tuesday’s notable gainers, as prices of the token rose for a sixth straight session.

SHIB/USD surged to an high of $0.000009593 earlier in the day, which comes less than 24 hours after trading at a low of $0.000008603.

As a result of this latest surge in price, shiba inu climbed to its highest point since December 5.

From the chart, it appears as though today’s rally came following an upwards crossover of the 10-day (red) and 25-day (blue) moving averages.

In addition to this, the 14-day relative strength index (RSI) has risen above a recent ceiling at 65.50.

Currently, the index is tracking at 67.50, with the next visible ceiling at the 73.00 zone.

Apecoin (APE) was another big mover in today’s session, extending recent gains to a fifth consecutive day.

Following a low of $4.50 to start the week, APE/USD raced to an intraday peak of $4.98 earlier in the day.

The move pushed apecoin to its highest level since November 5, and came following a breakout of a price ceiling at $4.60.

As a result of today’s surge, the RSI on the APE chart is now at its strongest point on record, with a reading of 79.09.

This means that prices are now deep in overbought territory, which could mean that bears are preparing for reentry.

Despite this potential reversal, bulls are seemingly still targeting a ceiling at $5.30, which hasn’t been hit since October 11.

Register your email here to get weekly price analysis updates sent to your inbox:

Could apecoin rally to hit $5.30 during the month of January? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis. He was previously a brokerage director and online trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX, whilst also a startup founder.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Following a Brief Fee Spike, Gas Prices to Move Ethereum Drop 76% in 12 Days

Transaction fees on the Ethereum network are dropping again after average fees saw a brief spike on April 5 jumping to $43 per transfer. 12 days later, average ether fees are close to dropping below $10 per transaction and median-sized ... read more.

Shiba inu moved to a five-week high during Tuesday’s session, despite cryptocurrency markets mostly consolidating. As of writing, the global crypto market cap is trading 0.20% lower, however the meme coin is up by nearly 5%. Apecoin also surged in today’s session, as it rose to its strongest point since November.

Shiba inu (SHIB) was one of Tuesday’s notable gainers, as prices of the token rose for a sixth straight session.

SHIB/USD surged to an high of $0.000009593 earlier in the day, which comes less than 24 hours after trading at a low of $0.000008603.

As a result of this latest surge in price, shiba inu climbed to its highest point since December 5.

From the chart, it appears as though today’s rally came following an upwards crossover of the 10-day (red) and 25-day (blue) moving averages.

In addition to this, the 14-day relative strength index (RSI) has risen above a recent ceiling at 65.50.

Currently, the index is tracking at 67.50, with the next visible ceiling at the 73.00 zone.

Apecoin (APE) was another big mover in today’s session, extending recent gains to a fifth consecutive day.

Following a low of $4.50 to start the week, APE/USD raced to an intraday peak of $4.98 earlier in the day.

The move pushed apecoin to its highest level since November 5, and came following a breakout of a price ceiling at $4.60.

As a result of today’s surge, the RSI on the APE chart is now at its strongest point on record, with a reading of 79.09.

This means that prices are now deep in overbought territory, which could mean that bears are preparing for reentry.

Despite this potential reversal, bulls are seemingly still targeting a ceiling at $5.30, which hasn’t been hit since October 11.

Register your email here to get weekly price analysis updates sent to your inbox:

Could apecoin rally to hit $5.30 during the month of January? Let us know your thoughts in the comments.

Eliman brings an eclectic point of view to market analysis. He was previously a brokerage director and online trading educator. Currently, he acts as a commentator across various asset classes, including Crypto, Stocks and FX, whilst also a startup founder.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Following a Brief Fee Spike, Gas Prices to Move Ethereum Drop 76% in 12 Days

Transaction fees on the Ethereum network are dropping again after average fees saw a brief spike on April 5 jumping to $43 per transfer. 12 days later, average ether fees are close to dropping below $10 per transaction and median-sized ... read more.

According to the Jan. 5, 2023 All Core Devs (ACD) meeting, Ethereum developers are preparing to deploy a public testnet for the highly anticipated Shanghai hard fork in February 2023, with the mainnet implementation tentatively scheduled for March. Ethereum’s core developers emphasized that staked withdrawals are a priority and code related to EVM Object Format changes, or EOF, was removed from Shanghai to ensure that the focus remains on staked withdrawals.

During the first week of December 2022, Bitcoin.com News reported on the 151st Ethereum developers meeting, and the programmers recently finished the 152nd meeting on Jan. 5, 2023. The meeting mostly focused on the removal of EOF implementation from Shanghai, and developers decided not to review any Ethereum Improvement Proposals (EIPs) related to EOF until the Shanghai hard fork has completed.

Both Galaxy Digital’s research associate Christine Kim and Ethereum core developer Tim Beiko summarized the ACD meeting. “On the Shanghai front, a first devnet was set up with all client combinations right before Christmas,” Beiko said after the meeting. “While they are all running, some pairs have more issues than others.”

Galaxy’s research associate explained that Devops programmer Barnabus Busa updated the team on the testing of staked ETH withdrawals. “He said that the current developer test network for Shanghai, which was launched just before Christmas, has already progressed to block 4,000,” Kim said. “All EL and CL client combinations are currently running on this testnet. A few client combinations such as Teku-Erigon and Lighthouse-Erigon are experiencing issues.”

Withdrawing staked ether has been a major concern for the community, and many want to know when it will happen. The Ethereum developers suggested that a new testnet will be deployed next month, with the Shanghai hard fork tentatively scheduled to go live by March.

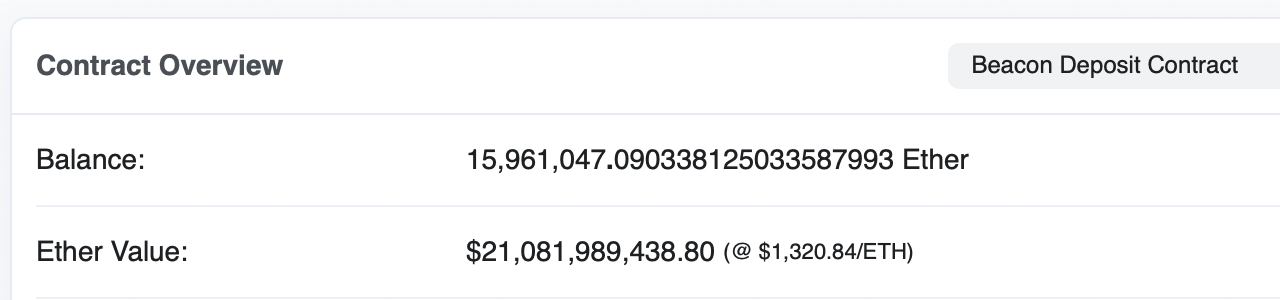

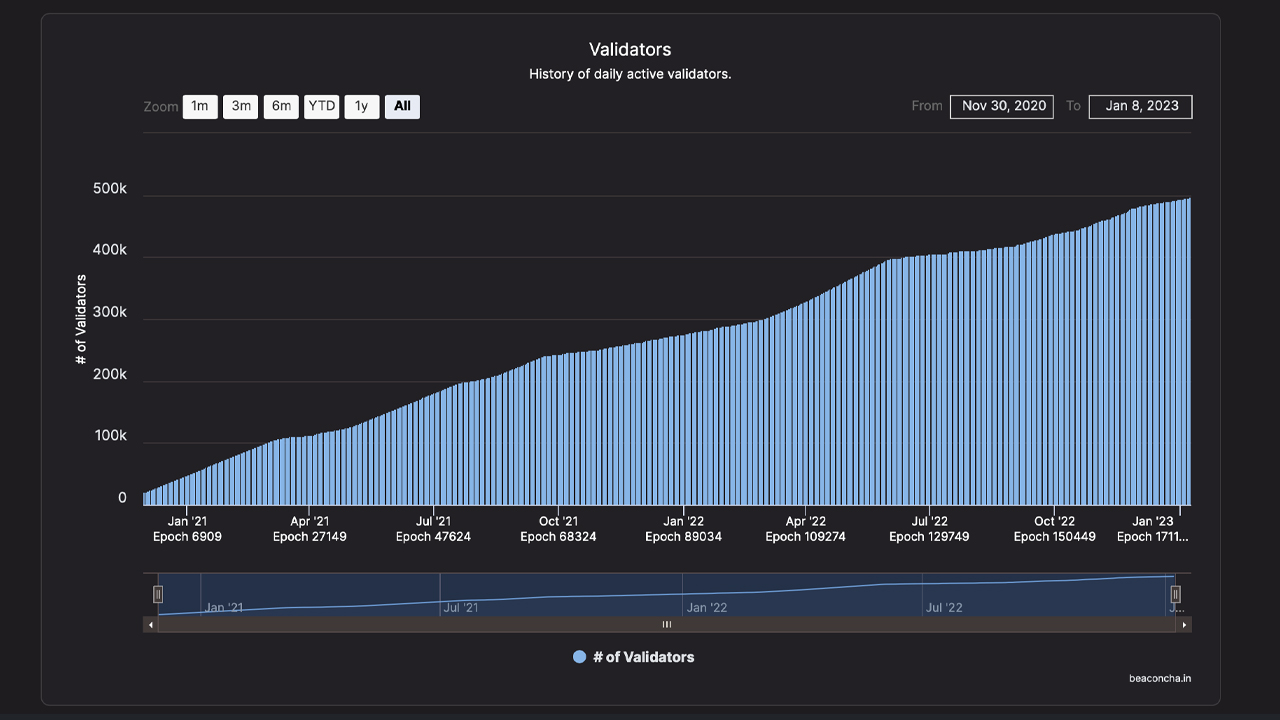

At the time of writing, there is 15.96 million ether locked into the Beacon deposit contract. Additionally, the network is just days away from reaching 500,000 validators. The Shanghai fork will be the next major upgrade for the Ethereum development team since The Merge.

What do you think about the latest Ethereum developer meeting and discussions revolving around the upcoming Shanghai fork? Let us know your thoughts about this subject in the comments section below.

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Following a Brief Fee Spike, Gas Prices to Move Ethereum Drop 76% in 12 Days

Transaction fees on the Ethereum network are dropping again after average fees saw a brief spike on April 5 jumping to $43 per transfer. 12 days later, average ether fees are close to dropping below $10 per transaction and median-sized ... read more.

Source From : News